Summary:

- DVN continues to be undervalued compared to its peers, with a prospective market re-rating likely to bring forth excellent upside potential.

- The management’s raised fixed dividends also brought forth expanded forward yields, further demonstrating its shareholder friendly policies, aided by the sustained share retirement.

- We may see DVN offer higher variable dividends in 2024, due to the improved balance sheet and efficient working capital plans, further boosted by the elevated crude oil prices.

- With the stock appearing to be well-supported at $41, we may see a floor materialize here, supporting its intermediate-term investment thesis.

DNY59

We previously covered Devon Energy (NYSE:DVN) in December 2023, discussing why its inherent undervaluation might be a gift for investors with a long-term investing trajectory, with the potential recovery in the macroeconomic outlook likely to trigger the eventual normalization in its stock valuations and prices.

Most importantly, the management continued to execute brilliantly, further demonstrating why it did not deserve to be beaten down and unappreciated as it had thus far.

In this article, we shall discuss why DVN’s investment thesis remains attractive, warranting our reiterated Buy rating, with the elevated crude oil prices likely here to stay.

With the management competently executing balance sheet deleveraging, shareholder returns, and improved working capital efficiency, it is apparent that the oil/ gas producer remains highly attractive here, further aided by the inherent undervaluation compared to its peers.

The DVN Investment Thesis Remains Attractive Here, Further Aided By The Healthier Balance Sheet

For now, DVN has reported a bottom-line beat in the FQ4’23 earnings call, with adj EPS of $1.41 (-14.5% QoQ/ -15% YoY) and Operating Cash Flow of $1.7B (inline QoQ/ -10.5% YoY).

Readers must note that the QoQ/ YoY volatility are mostly attributed to the fluctuating fuel spot prices and volatile realized prices, including oil at $76.98 (-3.5% QoQ/ -0.5% YoY), Natural Gas Liquids at $19.67 (-5% QoQ/ -19.1% YoY), and Gas at $2.02 (+0.4% QoQ/ -49.6% YoY).

However, this headwind has also been well balanced by DVN’s increased total oil production at 662 MBoe/d (-0.4% QoQ/ +4% YoY) by the latest quarter, with the management already reaffirming a similar production level in 2024.

In addition, readers must note that these realized prices are already much improved compared to FQ4’19 realized oil prices of $56.89, Natural Gas Liquids prices of $17.54, and Gas prices of $1.83, further aided by the producer’s lower WTI break even price of $40.

Thanks to the excellent profitability, we are not surprised by the sustained improvement in DVN’s balance sheet, with long-term debts of $5.67B (-8.2% YoY/ -19.4% from FQ1’21 levels of $7.04B) and moderating net-debt-to-EBITDA ratio of 0.7x (inline QoQ/ +0.2x from FQ4’22 levels of 0.5x/ -0.7x from FQ1’21 levels of 1.4x).

At the same time, the producer has been consistently repurchasing shares, with 17M shares already retired over the LTM, and 41M since FQ2’21. This is on top of the excellent 5Y dividend growth rate of +21.67%, compared to Exxon Mobil (XOM) at 2.55%, Chevron Corporation (CVX) at 6.25%, and the sector median of +5.04%.

From these numbers, it is apparent that DVN has been putting much of the hyper-pandemic cash flow to great use, both in deleveraging and shareholder returns, thanks to the strategic fixed-variable dividends.

As a testament to its improved profitability and healthier balance sheet, the management has also approved a +10% increased in its fixed dividends to $0.22 per share, further demonstrating its commitment to be shareholder centric.

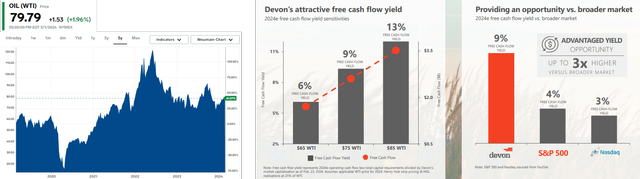

WTI Crude Oil Prices

Readers must also note that we may see DVN’s Free Cash Flow generation exceed expectations in 2024, as the WTI crude oil spot prices recover to near $80 at the time of writing.

Based on the management’s FY2024 guidance, we may see the producer offer an expanded Free Cash Flow yield of nearly 11% if WTI stabilizes at current levels, or near 13% if WTI hits $85, further aided by the tightened projected capex of $3.45B (-6.7% YoY) at the midpoint

With the OPEC+ expected to extend their previous production cuts into Q2’24, attributed to the uncertain geopolitical climate, we may see the WTI crude oil sustain its upward momentum in the near-term, further aided by the Fed’s supposed pivot in H1’24 and Chinese’s growing demand.

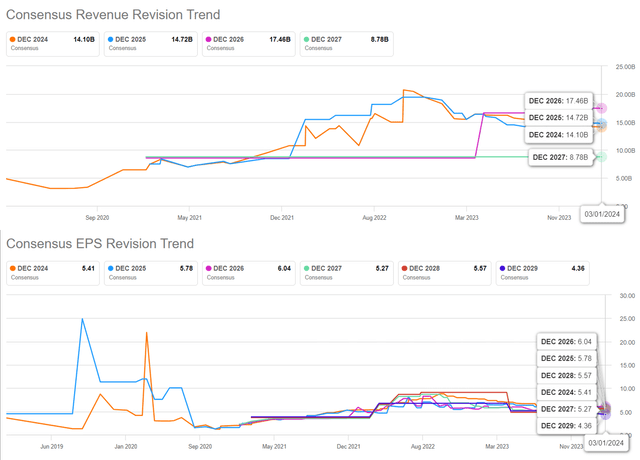

The Consensus Forward Estimates

The same optimism has also been embedded in the consensus forward estimates, with DVN expected to generate an expanded top/ bottom line CAGR of +4.6%/ +1.9% through FY2026.

This is compared to the previous estimates of -10.3%/ -8.7% and historical growth at +1.5%/ +20.8% between FY2017 and FY2023, respectively, with the revision likely attributed to the EIA’s projections of crude oil prices staying elevated at $79.48 through 2025, compared to the $60 recorded in 2019.

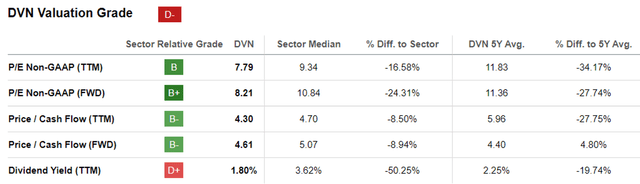

DVN Valuations

As a result of the intermediate-term tailwinds, we can understand why the market has temporarily upgraded DVN’s valuations, with FWD P/E of 8.21x and FWD Price/ Cash Flow of 4.61x, higher than its 1Y mean of 7.72x/ 4.01x and nearer to the sector median of 10.84x/ 5.07x, respectively.

Most importantly, DVN remains inherently undervalued with an Enterprise Value to Proven Reserve ratio of 18.75x, based on its Enterprise Value of $33.95B at the time of writing and the 2023 proved reserves of 1.81M BOE.

This is compared to XOM at 26.2x, CVX at 27.2x, and Occidental Petroleum (OXY) at 20.5x, based on their Enterprise Value/ 2023 proved reserves of $443.86B/ 16.92M BOE, $302.62B/ 11.1M BOE, and $81.83B/ 3.98M BOE, respectively.

So, Is DVN Stock A Buy, Sell, or Hold?

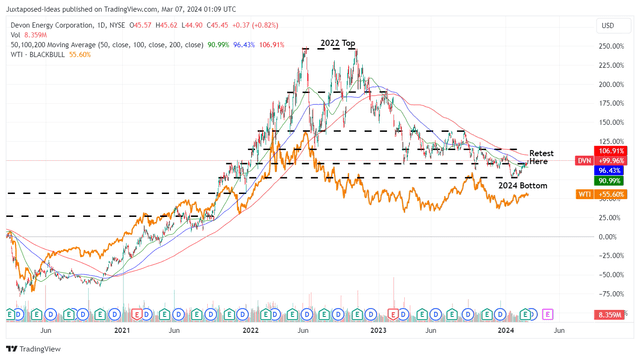

DVN 2Y Stock Price

For now, DVN has successfully bounced from its 2024 bottom, while retesting its previous resistance levels of $45s at the time of writing.

The stock’s correlation to the WTI spot prices also suggests that the 2024 bottom of $41 may hold, assuming that the OPEC+ is able to establish the $80 floor for crude oil.

Based on the last announced quarterly dividends of $0.44 per share, DVN investors may also look forward to an expanded dividend yield of 3.9% based on the current stock prices, compared to the sector median of 3.66%.

We may also see a moderate upside potential of ~10% to our intermediate price target of $49.50, based on the consensus FY2026 adj EPS estimates of $6.04 and the FWD P/E valuation of 8.21x.

Opportunistic investors may also look forward to a speculative re-rating in its FWD P/E valuations nearer to its 3Y pre-pandemic means of 18x, implying an extremely bullish long-term price target of $108.70.

As a result of the attractive risk/ reward ratio at current levels and its inherent undervaluation, we maintain our Buy rating for the DVN stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.