Summary:

- Last week, struggling fuel cell systems, electrolyzer solutions, and green hydrogen provider Plug Power released another set of abysmal financial results.

- Consolidated gross margin eclipsed negative 100% after auditors required the company to increase inventory provisions substantially.

- Free cash flow for the full year was negative $1.8 billion thus resulting in year-end liquidity decreasing to just $135 million.

- Since January 17, PLUG has raised more than $300 million in gross proceeds from open-market sales. The resulting shareholder dilution calculates to 11.5%.

- Considering sufficient access to capital, a new focus on cash burn reduction as well as vastly improved market sentiment, I am upgrading Plug Power’s shares from “Sell” to “Hold”.

audioundwerbung

Note:

I have covered Plug Power Inc. (PLUG) previously, so investors should view this as an update to my earlier articles on the company.

Last week, struggling fuel cell systems, electrolyzer solutions, and green hydrogen provider Plug Power Inc. or “Plug Power” was scheduled to report fourth quarter and full-year 2023 financial results.

But similar to last year, management decided against breaking out the company’s fourth quarter results in detail and simply filed its annual report on form 10-K with the SEC, thus leaving investors and analysts with the difficult and time-consuming task of extracting Q4 numbers from the 10-K.

Moreover, in contrast to the company’s long-standing practice of releasing a long-winded quarterly shareholder letter, Plug Power instead limited itself to a very short press release.

Clearly, management wasn’t eager to discuss the worst quarterly performance in the company’s history, as consolidated gross margin eclipsed the negative 100% mark:

However, most of the sequential deterioration was the result of auditors requiring Plug Power to materially increase inventory reserves after discovering another material weakness in the company’s internal control system:

The following material weaknesses have been identified and included in management’s assessment: the Company did not design and maintain effective controls at an appropriate level of precision over the review of the calculation of the carrying value of the asset groupings and the projections used as a basis for performing their impairment assessments of certain asset groups and the Company did not maintain effective controls related to the accounting for the valuation of inventory reserves, specifically surrounding the calculation of excess and obsolete inventory and the lower of cost or net realizable value adjustments of inventory.

As a result, the company had to increase its inventory provision by almost 200% quarter-over-quarter to a new all-time high of $85.2 million, or approximately 8% of total inventory.

Regulatory Filings

But even after adjusting for the issue, Plug Power’s product gross margins would have remained in firmly negative territory.

Revenues for the quarter came in at $222.2 million, thus bringing full-year revenues to $891.3 million, a far cry from management’s initial $1.4 billion expectation:

The majority of the miss was caused by ongoing problems in the company’s electrolyzer division, with segment revenues of $82.6 million coming in at a tiny fraction of management’s $400+ million guidance at the beginning of the year.

Even more disappointing, electrolyzer backlog was down from the end of last year as customer demand has been well below management’s original expectations:

In addition, the company’s core material handling business continued to deteriorate, with GenDrive unit deliveries down for a second consecutive year and essentially back to 2019 levels:

Regulatory Filings

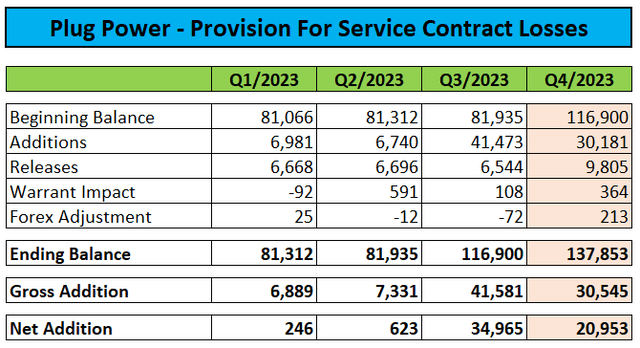

Moreover, Plug Power had to increase its provision for underwater service contracts by another $21 million on a net basis in Q4:

Please note that without the quarterly releases to service cost of goods sold, Q4 service gross margin would have been negative 163.5% rather than the negative 81.1% reported by the company:

Remember also that US-GAAP precludes the company from recording similar provisions for service contracts related to its leasing (“PPA”) business. As a result, segment results will continue to be impacted by elevated service contract losses for the time being.

During the quarter, cash usage continued unabatedly. Free cash flow in Q4 was negative $428.7 million:

As a result, available liquidity was down to just $135.0 million at year-end:

In order to keep the lights on and address going concern language in the company’s third quarter report on Form 10-Q, Plug Power entered into an up to $1 billion at-the-market offering agreement (“ATM-Agreement”) with a division of B. Riley Financial (RILY).

As of February 23, the company had sold 77.4 million new shares into the open market for gross proceeds of $302.1 million, which calculates to an average of just below 3 million shares on a daily basis since establishing the ATM-Agreement on January 17. Dilution for existing shareholders has been approximately 11.5% so far.

Last week, Plug Power amended the ATM-Agreement in order to raise more funds at an even faster pace:

On February 23, 2024, the Company and B. Riley entered into Amendment No. 1 to the Original ATM Agreement (…) to increase the aggregate offering price of shares of the Company’s common stock available for future issuance under the Original ATM Agreement to $1.0 billion.

Under the ATM Agreement, for a period of 18 months, the Company has the right at its sole discretion to direct B. Riley to act on a principal basis and purchase directly from the Company up to $11.0 million of shares of its common stock on any trading day (…) and up to $55.0 million of shares in any calendar week (…).

On the conference call, management reiterated expectations for cash usage to decrease by more than 70% year-over-year due to a substantial reduction in capital expenditures and anticipated working capital releases.

However, the company still has to catch up on payments for last year’s equipment purchases, as admitted to by CFO Paul Middleton on the conference call (emphasis added by author):

(…) the hydrogen investment that we have in the current plan is predominantly the retention and finalization of the Georgia plant that we’ve completed. It’s the funding for the Louisiana program we have with Olin that we’re developing, building, rolling out. And it’s kind of residual projects that we had open at the end of last year that we’re paying now for, given extended terms on some of the vendor programs.

In addition to lowering capital expenditures, the company is looking to generate cash from reducing its electrolyzer inventory while putting less focus on adding new business.

So, this year, (…) it’s really about executing on the backlog. (…) this year is not about optimizing the capacity utilization or the labor overhead per se. It’s really more about using what we’ve already bought.

Moreover, Plug Power has essentially stopped providing lease financing to customers, which should result in a substantial reduction of its massive restricted cash position over time:

Based on the numbers provided by management, full-year cash usage is expected to be approximately $500 million. That said, even when assuming a whopping $1 billion in lower cash usage from capex reductions, working capital swings and restricted cash releases, the company would still have to improve losses from operations by another $300 million to arrive at Plug Power’s stated target which management expects to achieve by a combination of lower hydrogen fueling costs and price increases across the board.

However, raising prices and reducing financing options is likely to result in further deterioration in the company’s material handling business.

Consequently, management expects Plug Power’s new business segments like electrolyzers and liquefaction technology to contribute the majority of revenues this year. Despite anticipated headwinds from the former core business, management still guided for year-over-year revenue growth.

Analysts on average expect Plug Power to increase sales by approximately 35% this year, which I consider way too optimistic again.

On the conference call, management even projected Plug Power “to achieve a positive cash flow rate in the next 12 months” but, quite frankly, I have no idea how this should work out without adding the proceeds from ongoing open market sales or other financing activities to the equation.

Management also stated expectations for conditional approval of a $1.6 billion DOE loan guarantee by the end of this month, with closing anticipated by the end of Q3.

Once again, I consider this timeline overly aggressive given the amount at stake and complexity involved here, but with ongoing open market sales likely to provide more than sufficient funds to bridge any potential gap, I do not expect further delays to become a major issue.

Bottom Line

Plug Power’s fourth quarter results represented a new all-time low in the company’s history, with consolidated gross margin eclipsing negative 100%.

As usual, full-year results missed management’s stated targets by a mile and the company burned $1.8 billion in cash, thus resulting in liquidity deteriorating to just $135 million at year-end.

In addition, auditors have discovered a new weakness in Plug Power’s internal controls, which resulted in the requirement to increase the company’s inventory provision materially.

On the flip side, the successful implementation of a $1 billion ATM program has addressed the recent going concern language in the Q3 report and management expects conditional approval of a $1.6 billion DOE loan guarantee by the end of this month.

In 2024, the company will focus on reducing cash burn by more than 70% through a combination of capex reductions, working capital benefits and margin improvements.

While some of these measures will impact the company’s short-term growth prospects, management still anticipates sales to increase on a year-over-basis due to improved contributions from new business segments like electrolyzers and liquefaction technology.

With highly speculative stocks experiencing strong demand again, funding the business with additional open market sales should not be an issue for Plug Power in the near-term.

Should the company come even close to management’s stated cash burn reduction target for this year without major revenue contraction, I would expect market participants to regain some confidence in Plug Power’s long-term prospects after more than a decade of overpromising and underdelivering.

In addition, a near-term conditional loan guarantee approval by the DOE could provide a strong catalyst for the stock.

Consequently, I am upgrading Plug Power’s shares from “Sell” to “Hold“.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.