Summary:

- Plug Power investors saw a glimmer of hope in January 2024 as it staged a remarkable recovery.

- However, PLUG has given back most of its January gains, reminding investors of the perils of betting on a further recovery.

- Plug Power has an unenviable record of overpromising and underdelivering.

- Hoping that management can somehow find a way out of its troubles isn’t a viable investment strategy.

Giselleflissak/E+ via Getty Images

Plug Power Inc. (NASDAQ:PLUG) stock has been an absolute train wreck as it fell into penny stock territory in November 2023, as investors were concerned about Plug Power’s going concern warning. Since then, PLUG has failed to recover from its massive battering, still down more than 96% from its early 2021 highs. As a result, I believe investors who had wanted to flee have likely bailed out. Therefore, those left are likely holding steadfastly to arguably misplaced optimism that Plug management could somehow dig their way out of its troubles. I also cautioned investors into buying into PLUG’s recovery thesis in November, given its weak execution record.

Plug Power’s business update in January 2023 led to a sharp revival, as the company highlighted that it has concluded its negotiations with the Department of Energy or DOE for a $1.6B loan facility. As a result, it likely assuaged justifiable concerns that Plug Power might not need to leverage its $1B ATM offering that would have diluted existing shareholders massively. With PLUG last valued at a market cap of $2.06B, I assessed it doesn’t make sense that the market has not attempted to price in the worst. Therefore, some bearish investors could have been stunned by the reversal in late January 2024.

However, the recovery momentum proved unsustainable, as PLUG has given up most of the gains from its January lows. PLUG’s short interest as a percentage of its float also increased to nearly 34% at the end of January. As a result, I gleaned that the market is taking a pessimistic view again as we head into Plug Power’s upcoming fourth-quarter earnings release on March 1.

Given the recent business update, it should have been reasonable for investors to assume they wouldn’t be surprised by unexpected downward revisions. However, I’ve also presented previously that Plug Power has an unenviable track record of overpromising and underdelivering, behooving caution. Notwithstanding the recent positive developments on the commencement of operations of Plug Power’s liquid green hydrogen plant in Georgia, things could look downcast in the first half. Accordingly, management indicated it sees more significant business momentum in the second half. Therefore, investors must expect “initial high inventory costs and early underpriced deals may impact gross margin in the first half of the year.”

I must highlight that PLUG’s January 2024 bottom suggests that the worst could be over from the price action perspective. Although the February 2024 pullback indicates that the market remains tentative over its progress, selling pressure on PLUG could have peaked last month. Therefore, if management can improve its execution over the next four quarters, we could see a glimmer of hope for a further recovery. Plug Power has also committed to additional operating costs and CapEx cuts in response to the markedly lower demand dynamics affected by the high interest rate environment. Despite that, I assessed that the market is likely still pricing in uncertainties over its DOE loan, which is expected to be pivotal toward its ability to sustain its medium-term outlook. Consequently, I believe that too much is at stake even to consider PLUG as a speculative buy, even though PLUG’s price action suggests a viable long-term bottom.

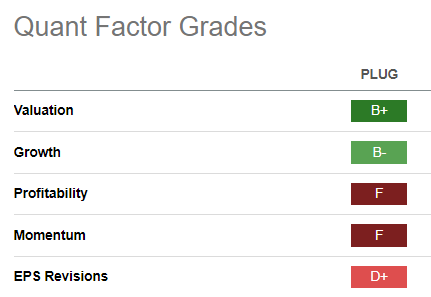

PLUG Quant Grades (TradingView)

Given PLUG’s “B+” valuation grade, I assessed a possible valuation dislocation relative to its “B-” growth grade. In other words, the market seems to have de-rated PLUG significantly, attributed to its weak execution (“D+” earnings revisions grade) and highly uncertain financing dynamics.

Furthermore, being a fundamentally weak company (“F” profitability grade), I don’t expect investors to be confident about its medium- to long-term prospects.

With the recent pullback digesting most of its January recovery, I see PLUG’s risk/reward as more balanced. However, I could lean toward a more bullish view if management doesn’t disappoint with another stunning downward revision at its upcoming earnings conference.

Therefore, high-conviction PLUG investors could use the pullback as another opportunity to add exposure. Despite that, I continue to hold the view that Plug’s high-risk profile, weak fundamentals, and long-duration business model aren’t convincing enough for me to recommend it as a Buy.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!