Summary:

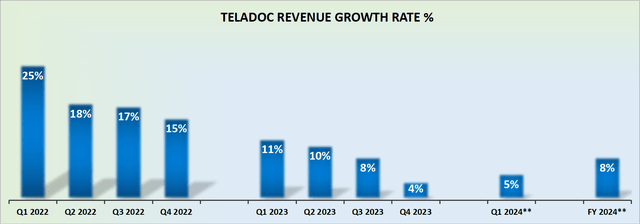

- Teladoc Health, Inc. growth has plateaued, with 2024 guidance pointing to a modest 8% CAGR at best.

- Despite a seemingly reasonable valuation at 13x forward free cash flow, the concern arises as the company transitions into an ex-growth phase.

- Challenges in BetterHelp and Integrated Care segments, coupled with a saturated virtual urgent care market, contribute to Teladoc’s growth hurdles.

Courtney Hale

Investment Thesis

Teladoc Health, Inc. (NYSE:TDOC) delivered unappetizing guidance in its Q4 earnings release. And yet, I want to be clear, that the problem with Teladoc is not that the stock is expensive. Indeed, I make it clear that paying 13x forward free cash flows is not expensive.

Rather, the problem here is that this business’ growth rates have petered out as Teladoc moves to the ex-growth part of its cycle.

Elements that were previously a vexing detraction, such as its elevated stock-based compensation will now gain a life of themselves.

I believe that in the next twelve months, investors will look back to $16 per share as a high price to aspire towards.

All in all, I recommend selling TDOC stock.

Rapid Recap

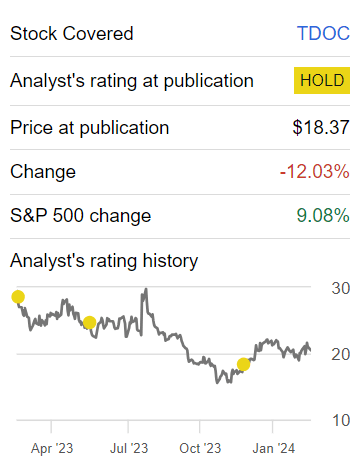

Back in November, I said in a neutral analysis:

There’s every reason possible to avoid this name. I know this. You know this. A management team that clearly was too aggressive and determined to grow at all costs.

But when I look ahead to 2024, this business is priced at somewhere around 7x to 10x EBITDA. It’s difficult to make the case that a lot of negativity hasn’t already surfaced and been priced into this stock.

Author’s work on TDOC

At the time, it was difficult to see a clear reason to be bearish on Teladoc. Yes, TDOC has been a hated stock for a while, but it was difficult to see a clear reason to be either bullish or bearish. But now, there are enough reasons to be bearish about this stock.

Teladoc’s Near-Term Prospects

Teladoc provides virtual healthcare services. They connect patients with healthcare professionals through online platforms, allowing people to consult with doctors remotely. Teladoc aims to make healthcare more accessible, offering consultations and eliminating the need for in-person visits.

Teladoc states on its earnings call that it has a robust product portfolio driving cross-selling opportunities, and that approximately 75% of Teladoc’s bookings involve upsells or expansions with existing clients, indicating a successful strategy to penetrate its large installed base of nearly 90 million virtual care members.

Also, that it strives to reach at least $425 million of adjusted EBITDA in 2025 by expanding into areas like weight management to service evolving healthcare needs.

On the other hand, Teladoc highlights concerns in the BetterHelp segment, where revenue was flat in the fourth quarter of 2023 and experienced a 3% sequential decline. The challenges primarily stem from lower yields on marketing spend, particularly in the second half of the year, affecting their ROIs from social media advertising spend.

On top of that, a delay in launching B2B consumer engagement efforts due to technical issues may have an estimated $20 million impact on 2024 revenue.

Further, its Integrated Care segment, while displaying positive results, is expected to witness lower growth going forward.

What’s more, Teladoc acknowledges that most U.S. healthcare consumers already have access to virtual urgent care, making it a replacement market with limited growth potential.

Here’s what management stated on the earnings call,

We’ve consistently taken share in this market and we expect to continue to do so. But it’s fairly well penetrated, and accordingly, we anticipate revenue growth from our U.S. virtual care products will be in the low single digits going forward.

This points to Teladoc’s need to diversify its growth drivers and explore avenues beyond the saturated virtual urgent care market.

Given this backdrop, let’s now turn our conversation to Teladoc’s fundamentals.

Teladoc, Now Post-Growth

Teladoc’s guidance for 2024 points to approximately 8% CAGR in the best-case scenario. In fact, the high end of its guidance points to 5%, but I’ve allowed room for 8% top-line growth, in the event that management is being conservative with its guidance.

SA Premium

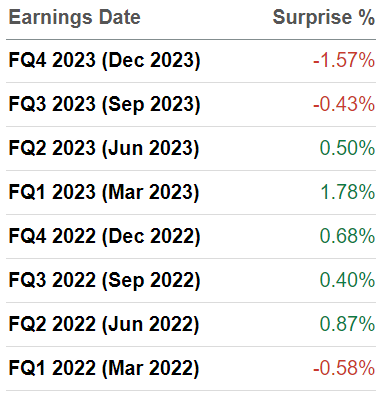

That being said, if we are objective about this, and look at Teladoc’s revenue beats over the past 8 quarters, not once have they beaten revenue estimates by more than 2% and only once by more than 1%.

Consequently, I’m confident in my contention that Teladoc’s growth in 2024 will be around 8%. Which is not even delivering double-digit growth rates.

Consequently, one way or another, if there was any doubt as we headed into Teladoc’s earnings results, that doubt has now been put to rest: Teladoc has now gone ex-growth. This implies that the multiple that investors will be willing to pay for its stock will be commensurate with its ex-growth status.

TDOC Stock Valuation — 13x Forward Free Cash Flow

Teladoc guides for approximately $240 million of free cash flow at the high end. For our discussion, let’s presume that Teladoc beats this figure and ultimately delivers $260 million of free cash flow in 2024, a 24% y/y increase relative to 2023.

This means that Teladoc is priced at 13x forward free cash flow, a figure that few investors would argue is a rich multiple on a tech stock, right? Well, that’s exactly where the plot thickens. Why?

Because investors are more than willing to give a stock ample room and price it at a high multiple provided that it’s rapidly growing. But once a business goes ex-growth, as Teladoc has, and investors understand that the best of its growth days is clearly in the rearview mirror, all of a sudden, investors start to put forth pesky considerations, that everyone was thinking about before, but now a lot more weight is put behind those assertions.

For instance, does it make sense for management to make $200 million of stock-based compensation, or SBC, when that essentially makes up all of the free cash flow it delivers each year? Or put another way, does it sound reasonable for approximately 14% of its revenues to translate into SBC?

I believe that investors will be increasingly skeptical of deploying their hard-earned capital into Teladoc.

The Bottom Line

Teladoc Health, Inc.’s near-term prospects are marked by a shift to the “ex-growth” phase, evident in its 2024 guidance of around 8% CAGR. Despite a seemingly reasonable valuation at 13x forward free cash flow, I doubt investors will be queuing up to buy this stock.

Furthermore, the significant stock-based compensation of $200 million, constituting about 14% of revenues, raises more questions about for whose benefit the company is being operated. As Teladoc faces these challenges, it prompts my skeptical outlook, and my recommendation leans toward selling the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.