Summary:

- Verizon’s management demonstrates exceptional capital allocation amid challenging conditions of high indebtedness.

- The company’s cash flow before financing activities is expected to improve in 2024, ensuring dividend safety and notable deleveraging.

- Verizon is undervalued and as deleveraging continues, the stock price is likely to move closer to its fair value.

Justin Sullivan

Investment thesis

My previous bullish thesis about Verizon (NYSE:VZ) aged well with almost 9% total return over the last three months, slightly behind the broader U.S. market. VZ is interesting for investors who are seeking for a high dividend yield, which will likely be safe and the stock price has little downside potential. Therefore, in my updated thesis I am emphasizing on the management’s exceptional capital allocation. The operating cash flow for 2024 looks predictable and the CAPEX will likely continue decreasing as the peak 5G buildout is in the past. Verizon’s operating cash flow less CAPEX is expected to continue improving in 2024, which adds optimism regarding the dividend safety and likely protection from inflation. Moreover, the stock is massively undervalued and as Verizon continues deleveraging there will be less reasons for the share price to stay significantly below the fair value. All in all, I reiterate my “Strong Buy” rating for VZ.

Recent developments

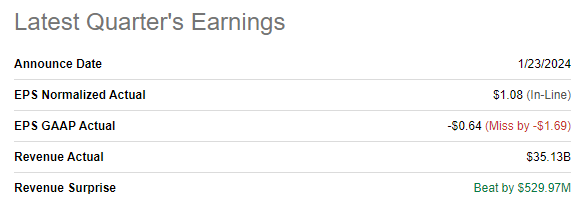

Verizon delivered a decent quarterly report on January 23, when the company topped revenue consensus estimates and was in line with the non-GAAP EPS projections. Revenue was flat on a YoY basis and the adjusted EPS shrank from $1.19 to $1.08. According to the “management’s discussion” section from the latest 10-K report, the decrease in profitability is explained by a non-cash $5.8 billion charge to P&L related to the Verizon Business Group Impairment.

Seeking Alpha

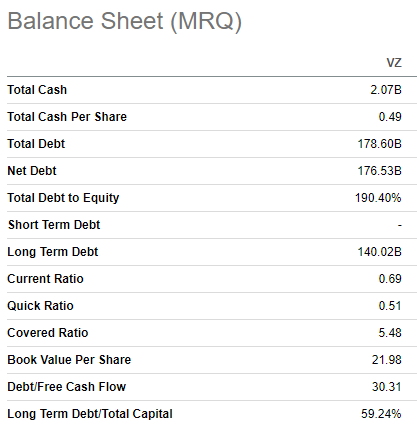

The level of debt is still substantial and the leverage ratio is sky-high. But static numbers do not convey much information and it is better to examine trends. Verizon ended FY 2022 with a $183.9 billion net debt position, which improved by around $7 billion by the end of FY 2023. The management deserves credit for successfully balancing between aggressive deleveraging, meeting substantial CAPEX business needs and increasing dividends in 2023 for the 17th consecutive year. Therefore, I reiterate my opinion that Verizon’s management demonstrates exceptional capital allocation which is crucial in the reality of substantial indebtedness. During the latest earnings call, the management shared expectations that the aggressive deleveraging will continue in 2024.

Seeking Alpha

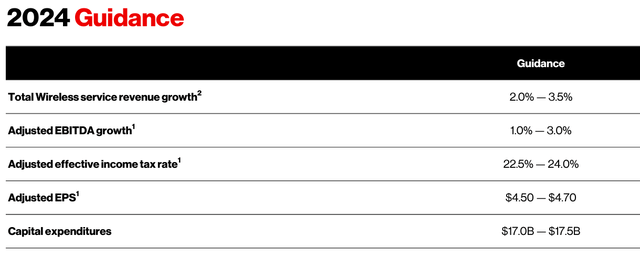

The management’s guidance for 2024 looks good. Revenue and EBITDA are expected to expand at a modest pace, which is natural given industry specifics. The non-GAAP EPS 2024 guidance is $4.6 at the midpoint of the provided range, which will be approximately in line with FY 2023. Therefore, I expect operating cash flows to remain solid. High leverage is the key problem that is the real obstacle for the stock price to rally. Therefore, I want to emphasize that CAPEX is expected by the management to decrease by around $1.5 billion, which is good for deleveraging opportunities.

Verizon’s latest earnings presentation

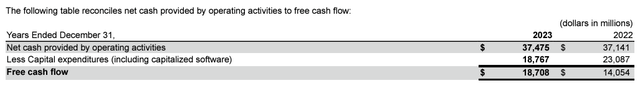

Since the FY 2024 operating cash flow looks predictable and will highly likely be in line with FY 2023 levels and I have CAPEX guidance, I think I can project approximately the company’s cash flow which will be available financing activities [dividend payouts and deleveraging]. The FY 2023 operating cash flow was at $37.5 million and the FY 2024 CAPEX guidance is $17.3 at the midpoint of the provided range. That said, VZ will likely have $20.2 billion to allocate to its financing activities in 2024, which looks much better than the company had in 2022-2023.

Verizon’s latest 10-K report

Given the fact that the 5G buildout peaks are in the rearview mirror, I believe that Verizon’s improving cash flow before financing activities [as you can see, the company calls it “free cash flow’ in the 10-K report] is a good indication that the dividend is safe and will likely continue growing in line with historical long-term inflation levels.

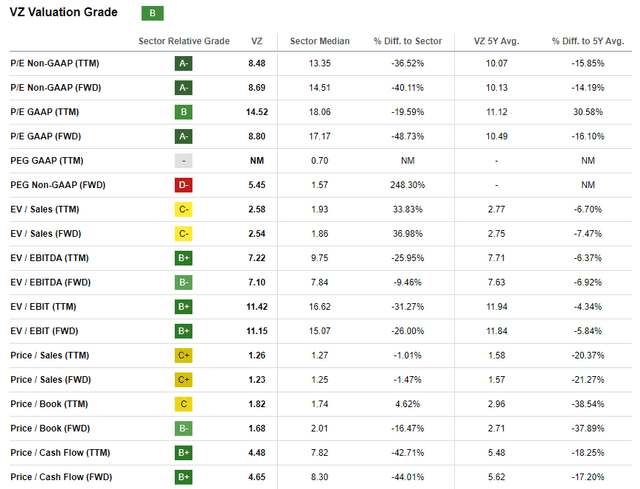

Valuation update

VZ had a good start in 2024 with almost 6% rally. Valuation ratios look good with a “B” Seeking Alpha Quant valuation grade. Most multiples are lower than historical averages, which indicates undervaluation in my opinion, especially considering the recent positive developments.

Seeking Alpha

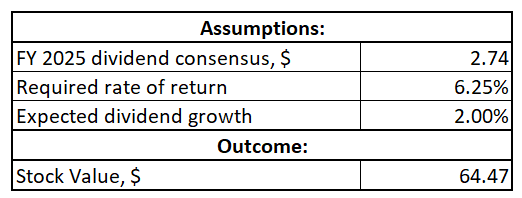

For dividend superstars like Verizon the best way to proceed with is a dividend discount model [DDM] valuation approach. I am using a 6.25% WACC, which is the previous 7% WACC minus three expected rate cuts in 2024, each by 25 basis points. Since I am figuring out my 12-months target price, I am using an FY 2025 dividend consensus estimate, which is $2.74. I am reiterating a 2% long-term dividend growth rate, which is the last five years’ CAGR.

Author’s calculations

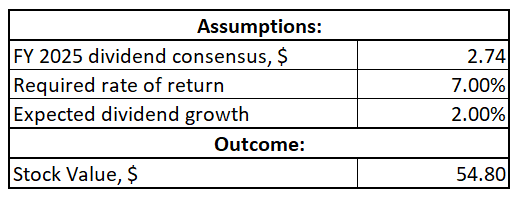

With the assumptions mentioned above, Verizon’s fair share price is $64. This is around 64% higher than the last close. The upside potential looks very attractive, but I want to simulate a DDM with a 7% WACC to understand how the fair value will look like in case Fed decides not to cut rates in 2024.

Author’s calculations

Even with a notably higher required rate of return the fair price is substantially higher than the last close. The second scenario suggests that the fair share price is around $55, which represents a 39% upside potential. To be more conservative, I will choose $55 as my target price because Jerome Powell describes the macroeconomic outlook as uncertain, which likely does not help the Fed to make decisions regarding rate cuts.

Risks update

While semiconductor stocks like NVIDIA (NVDA) and Super Micro Computer (SMCI) enjoy massive momentum and soar by hundreds of percent within just several months, the sentiment around dividend stocks is not the same. I am covering Verizon since June 2023 and the upside potential suggested by my DDM has always been significant. Nevertheless, the gap between the market share price and the fair value is closing slowly. Therefore, Verizon might not be an optimal choice for investors who are seeking rapid capital gains. Instead it will be good for investors who expect high and safe dividend yield together with low volatility and little probability of a big drawdown.

To adapt to the evolving technological landscape of recent years, i.e. transition from 4G to 5G, Verizon had to raise massive amounts of debt finance to invest it in capex and equipment upgrades. Since we are currently evidencing a rapid shift to generative AI, there is a risk that even faster telecom will be required within the next couple of years and 5G might become obsolete before the investment in its buildout pays back

Bottom line

To conclude, I reiterate “Strong Buy” for Verizon. The free cash flow is poised to improve and the management is allocating spare cash wisely. The deleveraging trend is likely to accelerate in 2024, which looks realistic with the predictable operating cash flow and decreasing CAPEX. Deleveraging will not only protect a high 6.7% forward dividend yield but also highly likely will help the stock to climb closer to the fair value.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.