Summary:

- The Goldman Sachs Group Inc. stock’s fantastic run since our latest coverage could come to an end.

- Revenues from pent-up demand in an equity and debt market recovery saved the bank in its fourth quarter. However, we doubt such demand is sustainable.

- Signs that corporate finance activities will pick up are absent.

- Goldman’s positive duration assets might increase in value with an interest rate pivot but the bank’s negative duration assets will be at risk.

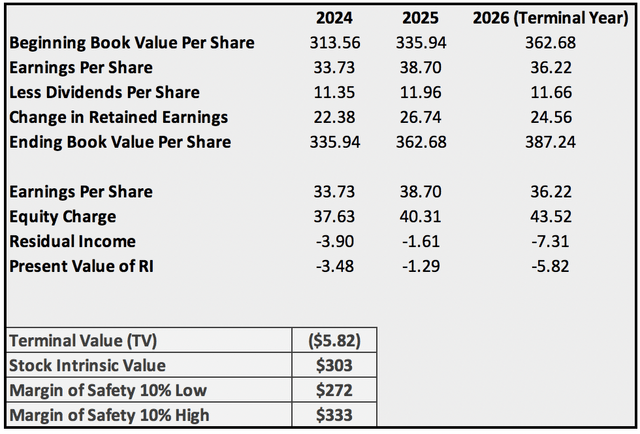

- Our residual income valuation model implies Goldman’s stock is overcooked.

Pgiam/iStock via Getty Images

It’s time for an update on The Goldman Sachs Group, Inc.’s (NYSE:GS) stock.

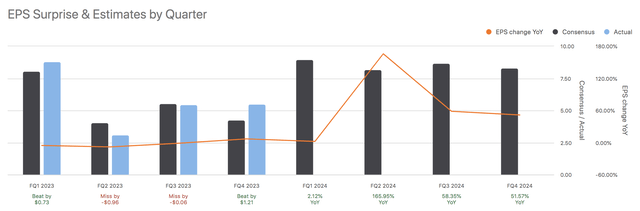

Our latest coverage of Goldman’s stock was before it released its third-quarter earnings, wherein we also stated the stock had a fair value of around $301. Since then, the stock has nearly reached the $400 level. Moreover, Goldman delivered two earnings reports whereby it fell short of its earnings target in Q3 but eclipsed its target in Q4, leading to a juxtaposed future earnings outlook.

Furthermore, Goldman had numerous idiosyncratic events occur since our latest coverage, lending to an interesting debate.

With all that being said, let’s get stuck into a few of our latest findings on Goldman Sachs.

Noteworthy Events

Private Credit Expansion

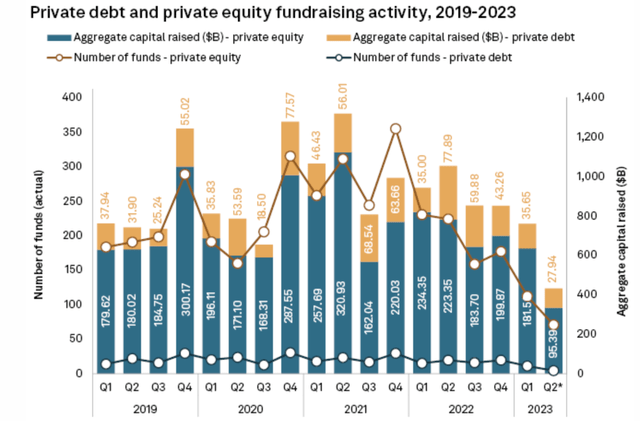

Private credit as an asset class shifted up a gear in 2023. Private Credit acquisitions have garnered immense popularity of late, given that globalization has opened up new avenues to debt in emerging and frontier markets. However, direct lending and bond market investing in such locations isn’t always possible for big banks. Thus, they acquire boutique lenders to garner their sought-after exposure.

Furthermore, limited partnerships are increasing their private credit representation as they’ve realized the benefits derived from diversification, illustrious returns, and scalable AUM growth.

Private Credit Uptake (S&P Global)

Goldman’s private credit exposure is over $180 billion, and it’s showing real conviction. In a telling move, Goldman decided to team up with Abu Dhabi’s sovereign wealth fund to invest $1 billion in Asian private credit.

The venture shows intent, and we think conviction in private credit ventures is likely regardless of Basel III tightening.

Penalties and David Solomon’s Pay Hike

Aside from headline activities, an overlooked event is Goldman’s trading division’s regulatory struggles. The company recently racked up another allegation of improperly charging futures trading fees. If found guilty, a fine would likely occur, which adds to the $50 million Goldman had to pay during 2023 for at least four separate trading fines.

I’m not saying that Goldman’s fines will dent its balance sheet all that much, but it shows that its commodity trading department’s internal controls need improvement before the bank loses more of its shareholders’ capital.

Furthermore, news broke upon Goldman’s fourth-quarter earnings report that its CEO, David Solomon, received a 24% pay hike to $31 million in annual compensation. Although $31 million in compensation isn’t much for a company with annual revenue of more than $46 billion, the timing of the raise is questionable given the uncertain economic outlook and the fact that no sign of outlying company earnings was achieved.

Fundamental Analysis

Goldman’s Q4 Results and Our Outlook

Goldman Sachs released its full-year and Q4 results a while back, revealing a few interesting talking points. The diagram below illustrates the firm’s Q4 results, with a discussion thereof beneath.

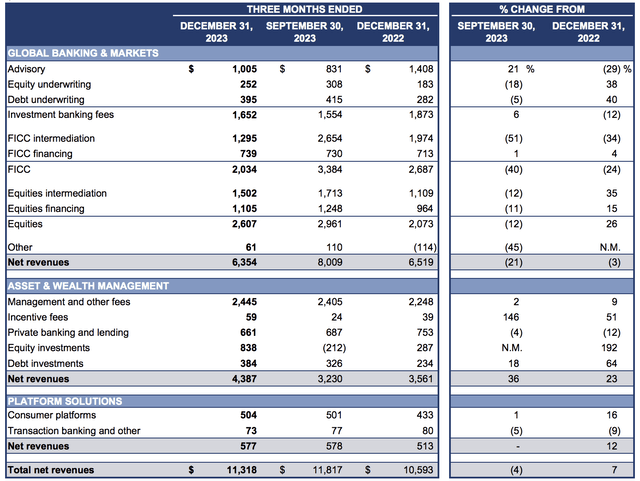

As illustrated in the diagram, Goldman’s results were quite divided. It’s clear from the diagram that certain corporate finance activities, such as advisory and investment banking, lagged due to suppressed M&A activity. However, divisions related to secondary equity and debt markets increased because of a broad-based increase in public market engagement during the latter stage of Q4, which in turn allowed Goldman to increase its AUM-linked base fees and intermediation.

According to the group’s quarterly results, investment banking fees settled at $1.65 billion, 12% lower year-over-year. We anticipate this trend to continue as the high costs of financing are restricting leveraged buyers. In addition, although some corporates might have significant cash positions, an economic downturn is highly possible, lending the argument that re-investment rates could slow.

Furthermore, we think stagnation in equity and debt investments could occur, also leading to lower incentive fees. Our basis here is that public markets surged in 2023. However, a disinflationary outlook paired with higher risk premiums (if interest rates pivot) presents Goldman with challenges. These factors could relay into its commercial real estate lending space, especially as real estate markets are highly cyclical.

Aside: Of course, we can be wrong about the aforementioned. I mean, economic debate is very subjective. So, keep that in mind.

One positive we gathered from Goldman’s latest results is its platform solutions segment. The segment experienced a broad-based increase of 12% year-on-year. This segment is highly scalable as we think its ETF accelerator program is aligned to benefit from an industry transition from mutual funds to ETFs. Moreover, its cloud-based customer solutions add valuable systematic growth and synergies. We definitely see this as a secular growth story.

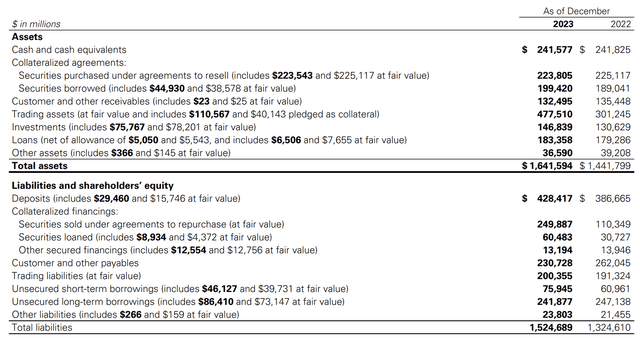

Balance Sheet Assessed

Goldman’s balance sheet shows that most of its assets (approximately 29%) are trading assets, of which more than two-thirds are held to maturity. In addition, the Group’s loan book comprises about 11% of its asset base, investments at fair value of about 9%, and collateralized agreements of about 25%.

Most of its assets are financed with deposits (about 28%) and other short-term sources such as collateralized financing and unsecured short-term borrowings. Borrowing short-term is highly beneficial because the low duration removes much of the interest rate risk. Moreover, the liabilities are cheaper by nature, allowing the bank-wide profit margins on its investments.

Consolidated Balance Sheet (Goldman Sachs 10-K)

Here’s our intermediate take on Goldman’s balance sheet.

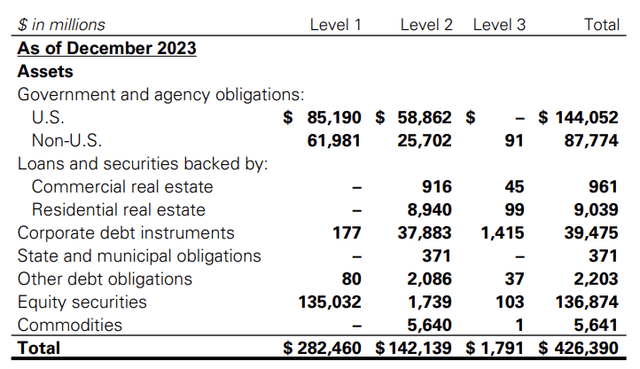

Looking at trading assets shows that most of Goldman’s debt holdings are sovereign. We couldn’t find any information on the terms, duration, or coupons. However, we assume that most of the securities are long-term option-free as Goldman generally holds HTM debt. These securities could perform well in 2024 as a pending interest rate pivot implied by the yield curve (link to yield curve here) has the latitude to send sovereign debt valuations higher.

Goldman’s trading equities are mostly public market assets (based on the fact that they’re labeled as level 1). No disclosure is provided on the specific equities held, but as mentioned before, we think the equity market faces headwinds, which could counteract momentum from sovereign debt valuation upgrades.

Trading Assets (Goldman Sachs 10-K)

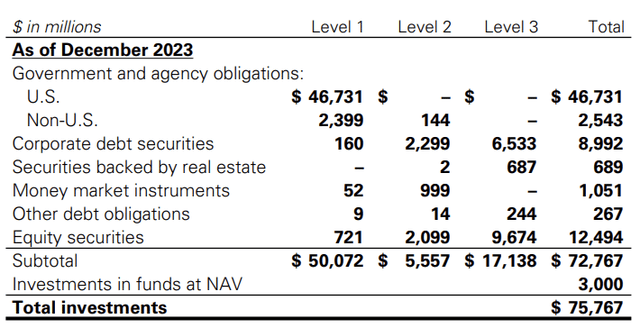

The following diagram shows Goldman’s investments. The exposure is much the same as trading assets, but lower exposure to equity is evident. We think this segment can proliferate for the rest of the year, given the aforementioned tailwinds we predict for sovereign debt. Sure, lower interest rates may introduce higher credit spreads, damaging corporate bond prices. However, the group’s investment portfolio has low exposure to corporate bonds relative to sovereigns.

Investment Assets (Goldman Sachs 10-K)

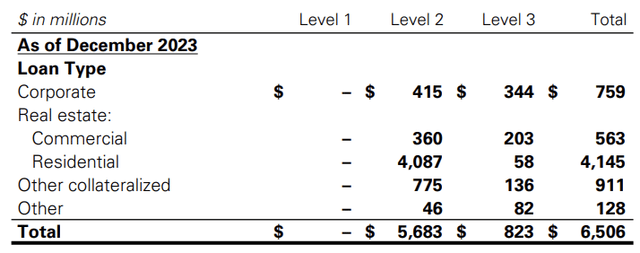

A look at the group’s loan book shows heavy exposure to residential loans, which is common for a bank. We think its residential loans could devalue when interest rates drop as mortgage securities usually possess negative duration, meaning their prices are positively correlated to interest rate levels.

Loans Book (Goldman Sachs 10-K)

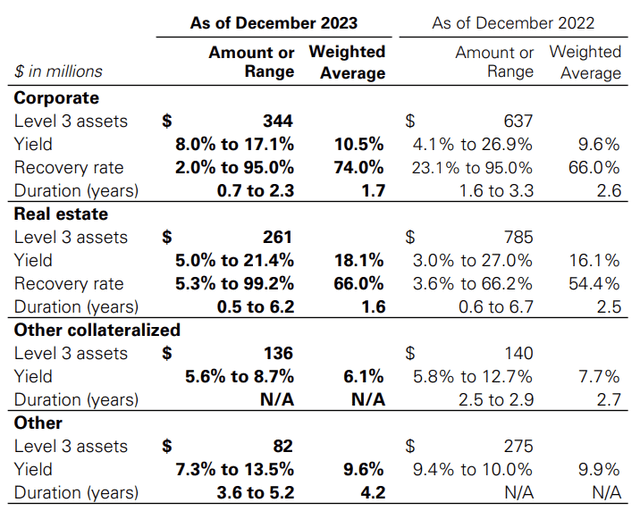

Following the above, Goldman’s risk assessment pertaining to level 3 assets (Illiquid assets that are difficult to value) illustrates higher recovery rates and longer duration occurred in 2023. This suggests that lower credit risk occurred in 2023 than in 2022, but duration grew and increased interest rate sensitivity. We don’t know how Goldman will adjust duration in 2024, but we think higher credit spreads will occur this year due to a drop in the yield curve, therefore worsening its recovery rates.

Risk Appraisal (Goldman Sachs 10-K)

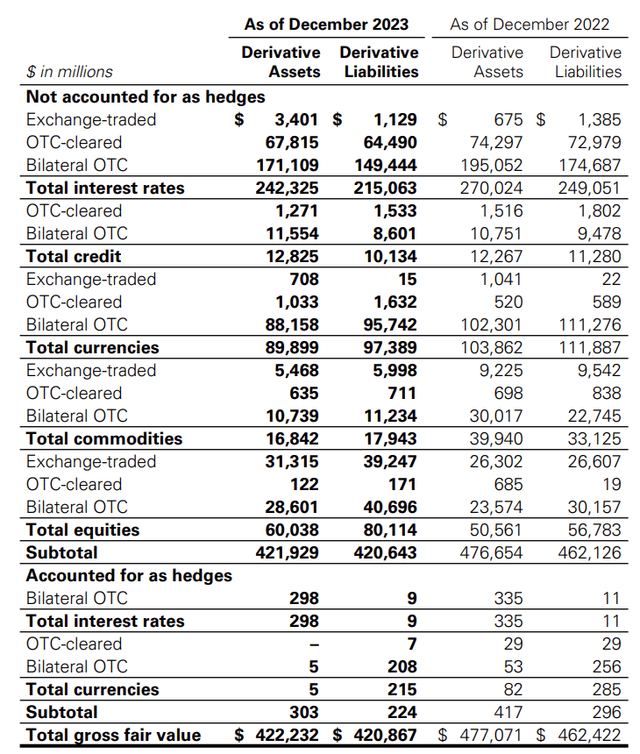

Lastly, a look at derivatives.

Based on the past two years, there’s been an even split between hedging and standalone derivatives on Goldman’s balance sheet. It’s difficult to determine the future composition of Goldman’s derivatives book because derivatives are dynamic, tactical, and often opaque instruments. All I can say here is that there are no signs of a mass amount of standalone derivatives that could unexpectedly hinder the company’s headline earnings. As shown later on, Goldman’s Basel III statistics are stellar, and derivatives soften to form a key part of managing capital adequacy ratios.

Derivatives (Goldman Sachs 10-K)

Risk Appraisal

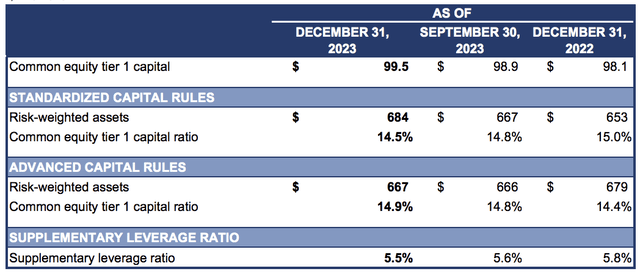

Capital Adequacy

I’m not going to spend much time here. It’s evident that Goldman’s Basel III data is above regulatory requirements if based on its CET 1 alone.

We still need to learn more about new Basel III addendums before forming a solid opinion on risk-weighted measures, but a few matters can be outlined.

- Retained earnings might be at higher risk in 2024 due to revenue uncertainty, which could lead to a diminished CET 1.

- As discussed in the next section, certain risk premiums look set to increase. As such, Goldman might have to lower its investment risk to balance the CET 1 number, potentially leading to lower profitability.

Again, as mentioned throughout the article, our outlook is our own and isn’t a guarantee of what will actually unfold in the future.

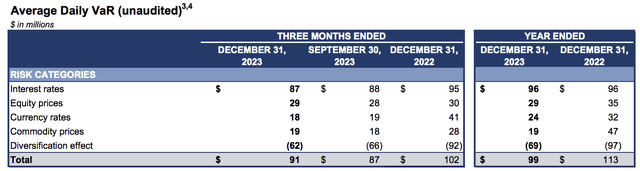

VAR

Goldman Sachs’ value-at-risk numbers declined across the board in 2023. We think it’s due to the “interest rate pivot” talk falling out of favor among investors amid sustained energy in corporate earnings stemming from robust nominal GDP growth in the United States. However, a few factors could change throughout 2024. See a discussion below the following exhibit for details.

Firstly, as displayed by the yield curve, interest rates could settle lower this year. Yes, I did just mention that the market phased out this narrative last year. However, we really believe lower rates are probable. If such an event occurs, we could see a higher interest rate VAR as Goldman’s high load on sovereign assets with positive duration (assuming positive duration) could result in higher beta sensitivity than in 2023.

Fortunately, Goldman holds quite a lot of mortgage debt on its balance sheet and has extensive access to the derivatives market. Thus, although we think interest rate VAR will spike, we think negative duration assets will phase out a portion of the risk.

As mentioned, we see headwinds for the equity market, which could spike VAR. However, the diversification effect might come into play here and phase out some of that risk.

In summary, we would not be surprised to see higher VAR numbers in 2024, but we don’t have a set-in-stone verdict.

Valuation and Dividends

Continuous Residual Income Model – Output

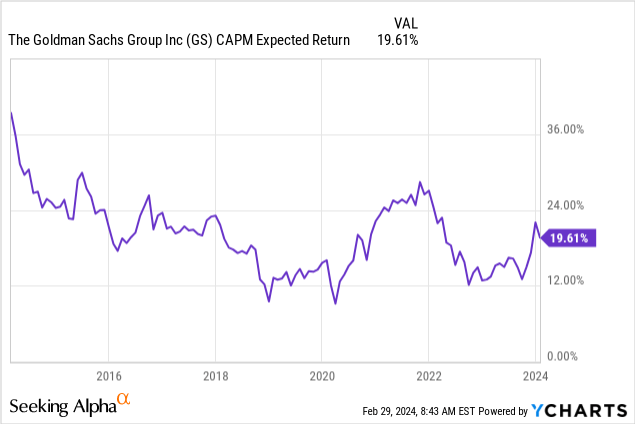

Based on Goldman’s FY 2023 results and its latest pre-market price, a simplified valuation shows that Goldman is more or less fairly valued with a price-to-book ratio of 1.25x. However, our residual income model suggests the stock is overvalued. Although it’s a theoretical model without guaranteed accuracy, the RI model holds validity and is often used in financial analysis.

Model Inputs

Herewith are the model inputs.

- The book value was drawn from Goldman’s latest earnings results.

- Estimates on earnings and dividends were drawn from Seeking Alpha’s database, with the 2026 figures averaged out to normalize a terminal value.

- The equity charge was generated by using the CAPM below. I compressed the CAPM to 12% as I thought the 19.61% was overcooked and reflective of turbulent times in COVID-19 and the post-COVID economic uncertainty.

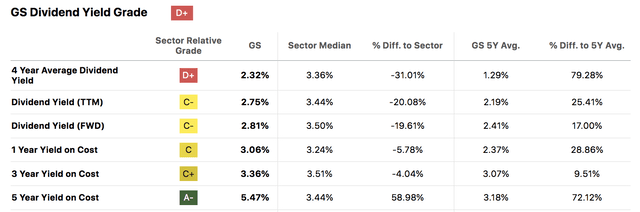

Dividends

Goldman’s forward dividend yield of 2.81% is respectable, but we don’t think it’s enough to add a floor to the stock or justify an income-driven investment opportunity. Goldman’s historical yield-on-cost figures are solid, but we think its latest stock surge has phased out much of its dividend prospects.

Final Word

Goldman Sachs stock’s fantastic run since our latest coverage is likely justified. However, we hold concerns regarding its medium-term future as our analysis tells us that the suppressed investment banking arena has caused the bank to be highly reliant on equity and debt market demand. Such demand will probably waiver in 2024, leading to a retracement in the bank’s revenues.

However, after assessing the bank’s asset base, we gathered that it holds plenty of securities that could benefit from a parallel downward shift in interest rates. Although Goldman holds many zero and negative-duration assets, such as stocks and mortgages, the net effect will likely be positive.

Having stated the above, our revenue outlook for Goldman and our valuation model combined indicate that the bank’s stock might be overvalued. Thus, we downgrade the stock to sell for the next quarter.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.