Summary:

- Devon Energy has seen a bounce in its stock following solid earnings, but the stock is still cheap due to strong cash flows.

- The energy company has improved efficiency by cutting capital spending plans for 2024 and focusing on maintaining oil volumes rather than aggressively chasing market share.

- Devon Energy’s low breakeven level allows it to generate substantial free cash flow, offering a nearly 10% yield at the current market cap with WTI prices around $80/bbl.

GlobalStock

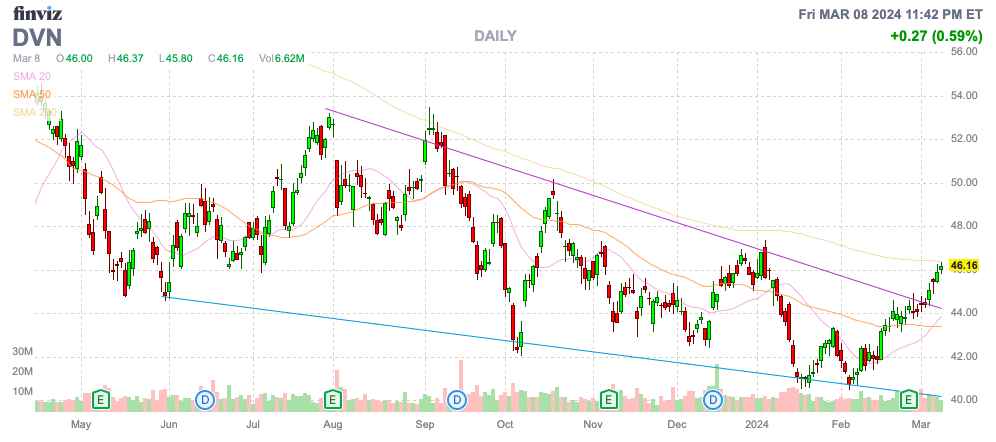

After a brutal start to the year, Devon Energy (NYSE:DVN) has finally bounced following solid earnings. The domestic energy company has become a cash flow machine returning lots of capital to shareholders, making the stock appealing to buy on weakness considering the volatile energy sector. My investment thesis is ultra Bullish on the energy company at this valuation.

Source: Finviz

Improved Efficiency

While Devon Energy grew oil volumes 8% in 2023 to 317 m/bod, the company actually cut capital spending plans for 2024 by 10%. The goal is to keep oil volumes at 315 m/bod with capital spending dipping to $3.45 billion.

The company isn’t chasing the market with aggressive spending in order to capture more market share even with OPEC+ maintaining production cuts of 2 m/bod. Devon Energy will allow production volumes to possibly even dip in 2024 to only 650,000 m/boed compared to the 662,000 m/boed produced last year.

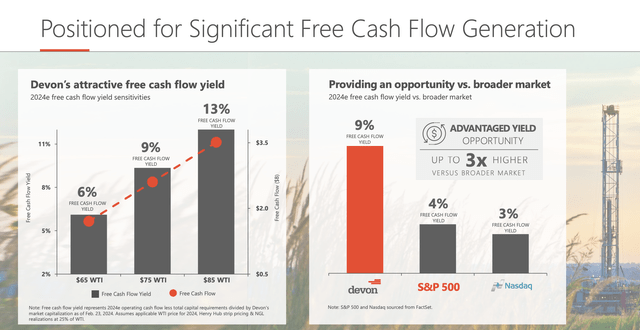

Devon Energy suggests breakeven funding at ~$40 per barrel of oil at WTI prices. Due to this low breakeven level, the company is able to generate substantial free cash flow, offering a nearly 10% yield at the current market cap with WTI prices around $80/bbl.

Source: Devon Energy Q4’23 presentation

Due to the consistent cash flows from the higher capital efficiency from focusing on the Delaware Basin while generating better results in the Williston Basin and Eagle Ford, the company just hiked the fixed dividend by 10% to $0.22. The total Q1’24 dividend payout will be $0.44 for an annual payout of $1.76. Devon Energy only guarantees the fixed dividend with a yield of 1.9%, but investors are virtually guaranteed higher payouts on current oil prices along with stock buybacks.

The hiked fixed dividend only amounts to ~$600 million in annual payouts. Devon Energy produced $2.7 billion in free cash flow in 2023 and lower capital spending should boost cash flows in 2024 while the company forecast returning 70% of capital to shareholders.

The stock could definitely fall back to the lows at $40, but Devon produced strong results back in Q4’23 when oil prices were lower. The energy company had realized oil prices of nearly $77/bbl in Q4, while the company survived only $72/bbl back in Q2’23 when natural gas prices were $1.66/mcf.

Devon was still able to generated $1.4 billion in operating cash flows back in the June quarter. The company could still absorb far lower energy prices, though natural gas prices couldn’t sustain lower prices and WTI isn’t likely to stay below $70/bbl for long with OPEC+ cuts.

The stock only has a market cap of $29 billion for a company with $6+ billion in operating cash flows and a $5+ EPS. By every metric, Devon Energy is cheap and energy prices are closer to the lows than a premium level where risks to the downside are excessive.

An investor can build a solid position at the current cheap levels and get a dividend normally running at double the current fixed rate. Back after the weaker Q2 results due to lower oil prices, Devon Energy actually paid a variable dividend of $0.29 on top of the fixed rate of $0.20.

The combined $0.49 quarterly dividend would equate to a 4.2% dividend yield. Recently, management has proclaimed a desire to prioritize the share buybacks program at the current stock valuation.

Devon Energy bought 5.2 million shares for $234 million during the December quarter. The company has reduced the diluted share count from 677 million at the end of Q3’21 to only 636 million at the end of 2023. Devon has reduced the share count by 6% during a period where the company was more focused on dividend payouts, offering insight to the potential for a larger reduction in the outstanding share count.

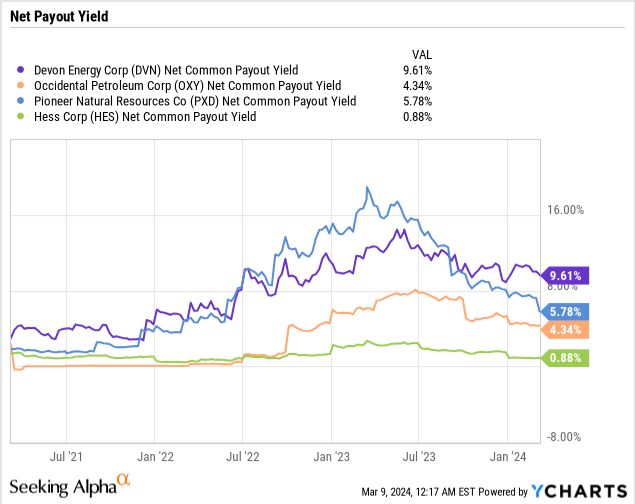

Yielding The Most

Over the last few years, Devon Energy has consistently offered shareholders one of the best net payout yields. The current yield is nearly 10% while Occidental Petroleum (OXY), Pioneer Natural Resources (PXD) and Hess Corp. (HES) all became acquisition targets with lower yields of the combined net buyback yield and the dividend yield.

The market is clearly missing the opportunity to own a premier energy company on the cheap. While oil could definitely trade lower, the odds are that natural gas rallies eventually and oil is likely split on whether the next move is higher or lower.

Warren Buffett and Berkshire Hathaway (BRK.B) continues loading up on Occidental, though Devon Energy offers the better net payout yield and the cheaper stock.

Takeaway

The key investor takeaway is that investors should continue loading up on Devon Energy, trading near multi-year lows while offering investors strong capital returns from positive cash flows via disciplined capital investments. At these prices, the stock offers some protection from lower oil prices, though the upside potential occurs with a rally in both oil or natural gas prices.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.