Summary:

- Algonquin Power & Utilities had a stronger Q4-2023 than expected, beating earnings estimates and adjusted EBITDA by 10%.

- AQN did not provide guidance for 2024 due to its focus on selling its renewable business.

- We look at how this is likely to play out for Algonquin and the related company, Atlantica Sustainable.

yangna

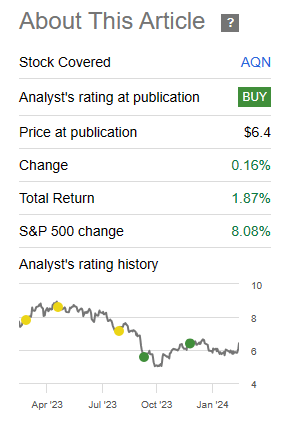

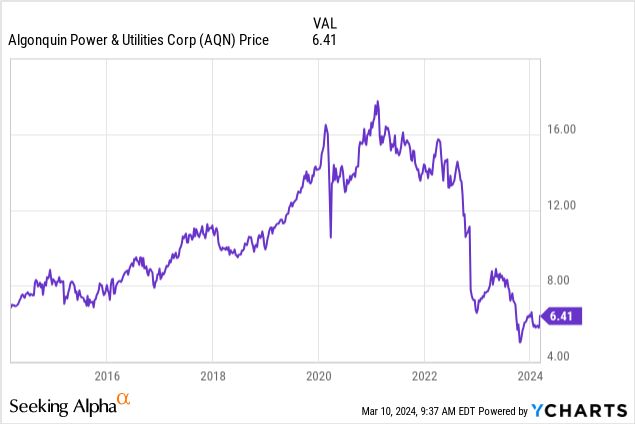

In our last coverage of Algonquin Power & Utilities Corp. (NYSE:AQN), (TSX:AQN:CA), we remained optimistic while the bulk of the income-chasing crowd had thrown in the towel. That said, we did not have high hopes for our total return prospects.

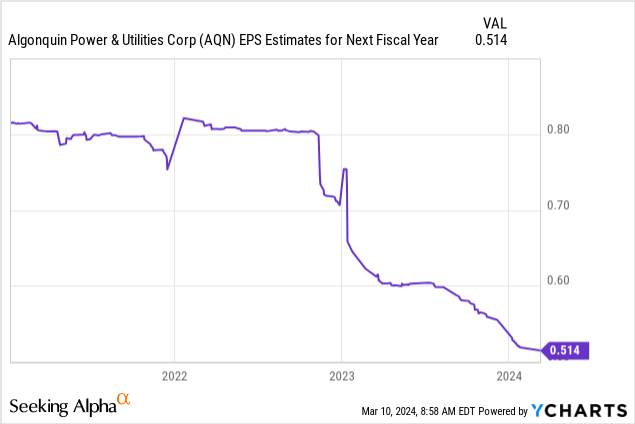

Valuation push can only go so far when earnings estimates keep falling. We maintain our buy rating from the original $5.60 and suggest investors keep an eye on the exits. We will move to a “hold” if $7.00 is hit at any point. Our personal position here is in Atlantica Sustainable (AY) where AQN has a controlling stake. We think that one offers a slightly better setup at this point.

Source: Seeking Alpha

We never did get the $7.00 number since then (only reached $6.65) and the stock has provided flat returns since then.

Seeking Alpha

We examine the Q4-2023 numbers and see if the bull case can still be made.

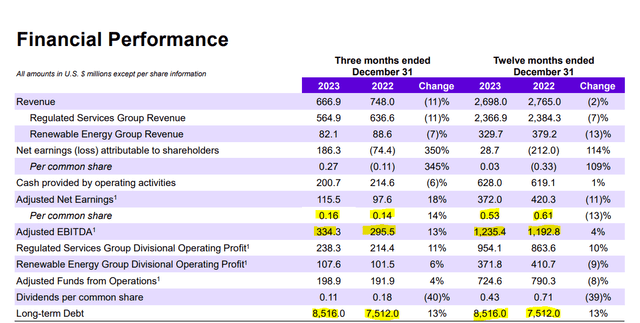

Q4-2023

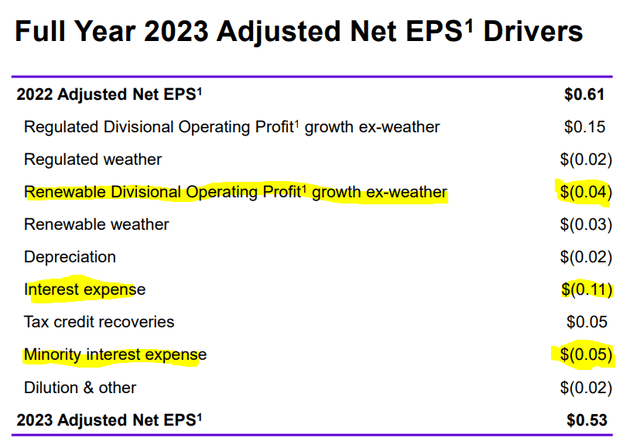

AQN had a stronger quarter than what the average analyst estimated. The earnings per share were well above the $0.14 estimate (came in at $0.16), but the bigger and more important number was the adjusted EBITDA, which beat by 10%. The main beat was in the utilities segment, which had a strong Q4, and it helped drive the results, despite weaker numbers in the power segment. That all said, the business still showed a substantial decline relative to 2022 as earnings for the full year were 13% lower, and this is despite long-term debt levels rising 13%.

The breakdown of the delta from 2022 showed that interest expense was a major detractor. Not exactly a shocker considering that AQN was one of the worst amongst the serial acquirers during ZIRP and are now paying the price for their bloated balance sheet.

But at the core level, it was good to see the regulated segment deliver and save the earnings from complete embarrassment.

Outlook

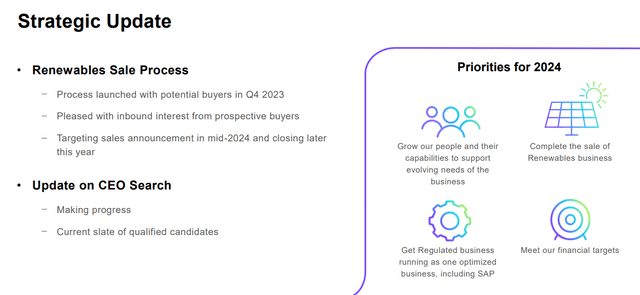

AQN did not provide guidance for 2024. While that may seem like an unusual move, it is understandable as their major thrust remains for the sale of the renewable business and that sale timing and price, will alter pretty much everything. The exchange below did suggest to us that there was definitely a high level of interest in the renewable asset business, and AQN would not be saying such things if they had extremely poor bids so far.

Nelson Ng

Great. Thanks and good morning, everyone. Maybe I’ll try to have another go at the renewal sales process question. So Chris, you mentioned that you’ll be making a sales announcement and/or you expect to make a sales announcement in mid-2024. So, just to clarify, are you essentially saying that the renewables sales — like, do you expect to announce the sale of the renewables division in mid-2024? Or are you saying that an announcement will be made in mid-2024 regardless of whether there is a sale or not?

Chris Huskilson

What you just described is our target is to announce a sale at ’24, that’s our target.

Nelson Ng

Okay, okay and things are tracking well it sounds like.

Chris Huskilson

No news is good news.

Source: Seeking Alpha

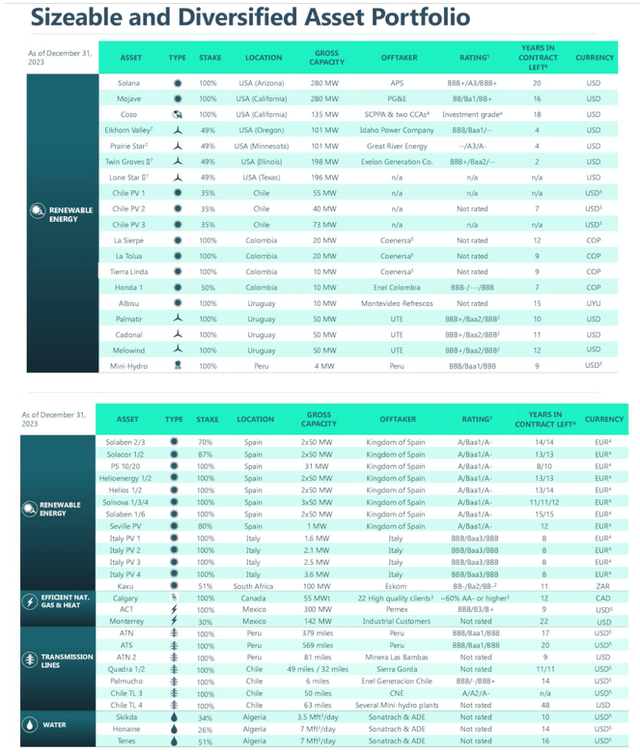

Mind you, things can still get derailed. AQN has its own renewable assets and also has a large position in AY. AY is doing its own strategic review in conjunction with AQN, so whether something works out for everyone concerned, remains to be seen. AQN management was again tight-lipped on the exact course of action, but it appears that this complexity is not a hindrance to the asset sales planned.

Mark Jarvi

Yes, good morning everyone. Maybe Chris, coming back to your comments about maximizing the value of AY and like you said in your prepared remarks you’re actively working with them to support them. Can you elaborate on that what that means what that could mean in terms of your relationship going forward and middle pause for that my answer?

Chris Huskilson

Yes, I mean, I think just fundamentally we’re supporting the activities that they’re going through right now. You know, the transaction that I noted in my comments, we sold some of our assets in Spain to them, giving them some development opportunities. And we’re looking at how we can be helpful in that kind of respect.

Mark Jarvi

But in terms of how you think about maximizing your value in it, is there anything beyond that aside from making sure that they’re unencumbered and can optimize their own business? Or is there something else that we should read into your comments?

Chris Huskilson

No, I think that’s appropriate the way you’ve described it.

Source: Seeking Alpha

The AQN bull case largely hinges on this asset sale and the multiply it fetches. 1-2X EBITDA multiple differential could be the difference between a $5.00 stock price and a $8.00 stock price. The reason is that there is a lot of associated debt load with the renewable area and the equity value gets a big bump for every EBITDA multiple turn.

In other news, the company said that it was making progress on finding a new CEO, but did not add much to that.

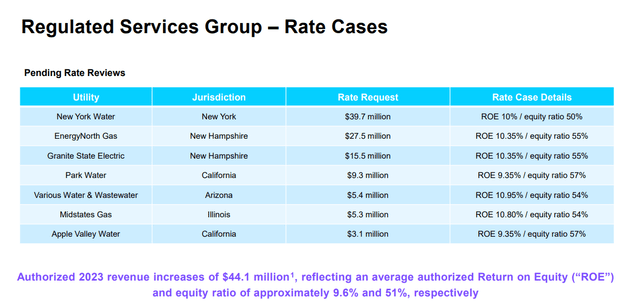

For 2024, there are several rate cases pending, and the larger ones are in generally favorable jurisdictions.

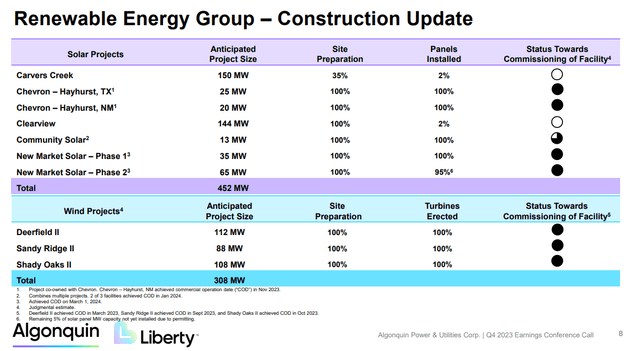

AQN also is continuing with the renewable projects it started sometime back, even though it is planning to unload the whole thing in 2024.

Verdict

If you bought AQN or mandatory convertible units, Algonquin Power & Utilities Corp Units. (AQNU) at the highs, there is really no hope of you breaking even any time soon. That may sound like a pessimistic take, but the whole recovery case has been shredded by these earnings.

Multiple expansions may happen in the next bull cycle, but even if you get back to 60 cents and throw a 17X multiple on it, that gets you to about $10.00. So that $16.00 plus price is more of a hope and a dream here.

That said, you can make some money on AQN, if the renewable asset sale goes well. In our last update, things were looking up and as we examine things here, the credit conditions improve the odds of a good sale price. In fact, we would be certain about it today, if not for the fact that AQN has the added complexity associated with AY trying to do its own strategic review. One final leg of this is that AY’s assets are all over the world.

There are very few firms that would be ready to take this on outside of Brookfield Renewable Partners L.P. (BEP). So the risk remains that AQN loses this sale window, and we go into the next recession without the assets being sold. At present, we think this gets done and AQN escapes with the skin of its teeth. We are maintaining our Buy Rating with the $7.00 price target and will reassess if the sale does occur. We currently do not have a position here but do have one in AY, which we see as the lower risk play on a relative valuation basis. A sale for AY likely happens at a $25 plus price, and we think that is the better play here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AY, BEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

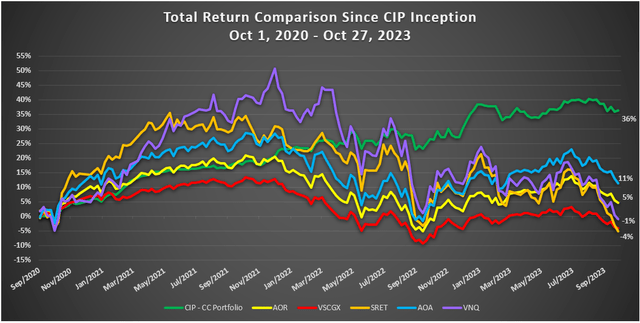

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with an 11-month money guarantee, for first time members.