Summary:

- Nvidia Corporation stock experienced a significant price reversal following the February labor market report, which could signal a potential bubble burst.

- However, the Nvidia fundamental “hook” is still valid, and the macro situation still supports the speculative frenzy.

- The CPI report and the Fed’s meeting on March 21st could, however, validate the Friday’s blow-off top.

BING-JHEN HONG

Has the Nvidia bubble burst?

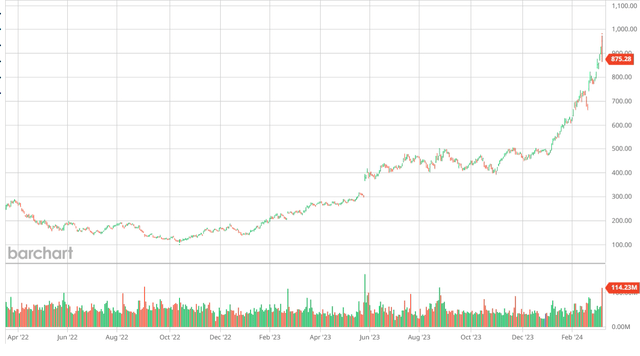

Nvidia Corporation (NASDAQ:NVDA) stock had a significant price reversal following the February labor market report. Initially after the “soft” labor market report, Nvidia rose by 4% and then sold-off by 6% by the end of the trading day, on a very heavy volume – for a nearly 10% top-to-bottom drop.

Leading up to the labor market report, and since the February 2023 Q4 earnings report, Nvidia has been rising sharply, continuing the parabolic move. The parabolic move started after the earnings report in April 2023, and really accelerated in the beginning of 2024, with the 500-level breakout, almost doubling in price in just over 9 weeks, adding almost a Trillion dollars in market capitalization.

Was this reversal a blow-off top and the burst in the NVDA bubble?

First of all, it is impossible to time the bubble top, it comes randomly, and I will further explain why later in this article. But even more importantly, we don’t even know if the asset price is in the bubble at the peak.

There are always fundamental arguments in favor of the bubble thesis and against the bubble thesis. The arguments in favor of the bubble thesis are usually based on valuation metrics. The arguments against the bubble thesis are usually based on some kind of fundamentals that justify the expectations embedded in the valuations.

The bubbles burst when those “bullish expectations” prove to be irrational. But bubbles also have the technical side with the trend-followers supporting the bubble, by extrapolating the trend. Thus, bubbles burst when the uptrend is broken, which is when the trend followers all try to get out at the same time – causing the crash.

NVDA fundamentals

Let’s first evaluate the NVDA fundamentals to determine: 1) what exactly is the fundamental hook; and 2) what are the expectations embedded in the valuation metrics.

Fundamental hook – GenAI

The NVDA story starts with Microsoft’s investment in OpenAI in January 2023, and the revelation of ChatGPT’s generative AI capabilities. ChatGPT is able to understand human language instructions, and generate content from the dataset. Nvidia is the market leader in the chips that make the genAI process possible.

This innovation triggered an immediate wave of investment. For example, Microsoft (MSFT) developed the Copilot – which essentially generates a text based on the instructions. Meta Platforms (META) invested heavily to develop the tools that content creators (on social media) can use to easily generate ads and other posts.

The GenAI trend was validated when Nvidia reported earnings in April of 2023 and revealed the significant demand for the chips that enable supercomputing and GenAI capabilities. Since, Nvidia has been beating the earnings expectations, and increasing the guidance, so the GenAI trend is possibly broadening to other industries.

Valuation and growth expectations

Nvidia is currently trading at 35x sales (P/S ttm is 35). Just for comparison AMD (AMD) has P/S ratio of 14, Microsoft P/S ratio is 13, Meta P/S ratio is 10, and Apple (AAPL) has P/S ratio of 7.

Thus, relative to each dollar of sales, Nvidia is very richly priced, which means that investors expect these sales to continue to increase, possibly double each year for a long time. If these expectations prove to be true, Nvidia is rationally priced. If not, and Nvidia’s sales growth starts to moderate, Nvidia is irrationally priced – it’s a bubble.

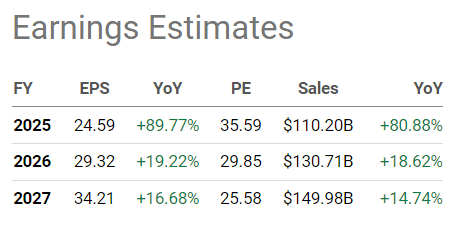

Based on the current earnings and sales estimates, Nvidia’s sales and earnings are expected to grow over 80% yoy in 2025, but then slow sharply in 2026 and 2027. Considering these estimates, Nvidia is a bubble – the current growth is temporary.

NVDA (Seeking Alpha)

In reality, even if the investment in genAI continues to broaden, the competition will eventually catch up as other chipmakers develop the genAI enabling chips, and there will likely be a glut of chips at that time.

Bubble burst based on fundamentals?

However, the NVDA fundamental hook is still valid, and the growth expectations are still current. Thus, nothing changed on Friday that would suggest that the NVDA bubble busted. The bubble burst will likely occur with the NVDA earnings miss or disappointing guidance, and we are not there yet.

Macro fundamentals

It’s likely that the NVDA stock performance in 2024 ytd is mostly due to the Fed’s premature dovish pivot in December, which fueled the speculative frenzy.

The Fed seems to be aiming for preventive interest rate cuts, to avoid a recession, possibly due to political pressure in the election year – and this is causing a significant loosening of the financial conditions. Many see the similarities with the 1995 soft landing scenario – which is when the dot-com bubble took off.

Thus, the NVDA bubble can also burst if: 1) the Fed takes a more hawkish stand due to stalling/rising inflation; or 2) we actually do get a recession (unlike in 1995).

The market still expects the Fed to cut interest rates 3-4 times in 2024, but the Fed might indicate that it’s still in a “higher-for-longer” mode when they meet in March – due to the recent rise in inflation.

Thus, the CPI report on Tuesday will be important – the “hot” reading could validate the blow-off top in Nvidia on Friday.

The market microstructure model

Market microstructure looks at who NVDA buyers and sellers are, and how they are behaving.

First, we have the insiders – and they have been selling lately, so that’s not a good sign.

Second, we have the rational speculators – these are the institutional investors who accumulated NVDA below the 500 price level, after the April 2023 earnings report. They have significant paper gains now, but they need to realize the profit by selling. Thus, they need the buyers – and they attract the buyers by promoting the “fundamental hook,” upgrading the stock price, and even promoting the stock split.

Third, we have the FOMO buyers that are “falling” for the fundamental hook, but ignoring the valuations, and the growth expectations beyond 2025, and even the macro situation.

Fourth, we have the trend followers who are buying only because the trend is up.

Based on the market microstructure model, the bubbles burst when there is nobody left to buy, and everybody is all-in.

So, what happened on Friday? In all likelihood, somebody tried to take profit after the “dovish” labor market report, expecting strong demand from the FOMO buyers. But it turns out, the buying power has dried out. It shows that the paper gains in NVDA stock will be hard to realize without crashing the price.

Implications – what happens next?

The key is now how trend-followers behave. They use technical analysis – and they see the big reversal on heavy volume. If they decide to take the profit, the price pattern will turn bearish – either double top, head-and-shoulders, or just a lower-lows breakdown. More importantly, the trend-followers could start to short in this situation – which could accelerate the crash.

The rational speculators, institutions promoting the stock, might also rush to sell, or possibly realize that they are unable to take profit and buy more to create a positive technical picture and induce more trend following – which could extend the bubble.

Overall, the Nvidia Corporation fundamental hook is still valid and as long as the uptrend holds, the NVDA bubble could continue. Furthermore, there is still no evidence that the Fed is willing to accept the tightening financial conditions, and thus, the broader speculative frenzy is still intact. Thus, at this point it’s premature to conclude that the NVDA had the blow-off top on Friday.

The CPI report on Tuesday and the Fed’s meeting on March 21st will influence the macro fundamentals, and could validate the Nvidia Corporation top on Friday. But let’s see what pattern develops in the NVDA price while processing all this information.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.