Summary:

- Altria Group stands out as a company with a high dividend yield of over 9% and a history of increasing dividend payments.

- Concerns arise due to the company’s high payout ratio of 80%.

- Despite being in a “dying industry,” Altria has maintained solid free cash flow growth rates and aims to deliver consistent dividend growth.

krblokhin

Introduction

It’s hard not to love big dividend payments. But the vast majority of companies that have 8%+ dividend yields typically have a hard time sustainably growing those dividend payments over time, and most never grow their dividends at all. In fact, it’s pretty common to see high-yielding stocks reduce their dividend payments over time, as it can be difficult for companies to generate enough free cash flow to cover their dividend payments.

But there is one company that has been the exception to this, and that is Altria Group (NYSE:MO). Altria is one of the rare companies with a starting yield sitting at over 9%, that also has a phenomenal history of increasing dividend payments over time. The company has now been increasing the amount they pay out in dividends for 54 consecutive years. And if that’s not impressive enough, they also have a 10-year dividend compounded annual growth rate of 7.63%. That easily beats the rate of inflation over the past decade.

And while the valuation looks attractive for this dividend king, the decision as whether or not buy completely depends on the goals of the investor. For someone looking to maximize immediate dividend income, this could potentially be an opportunity. As someone who is already a shareholder of Altria, I currently plan on holding my shares.

Dividend Investors Concern

But here is what has dividend investors concerned:

Altria is currently sitting on a payout ratio of 77.58%, and a free cash flow payout ratio of 79.70%. Anytime I see a payout ratio that high, I become pretty hesitant. So while they pay out big dividends and their history is impressive, can dividend investors rely on the payments from a company that is using 80% of their free cash flow to pay out dividends? And if so, can we count on them to sustainably raise their dividend payments at a rate above inflation like they have for the past decade?

To address this, let’s take a deeper dive into their key dividend metrics.

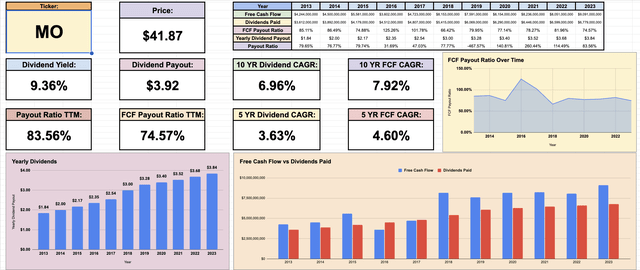

Altria Dividend Metrics (Tickerdata.com)

Looking at the spreadsheet above, there is one key chart that really paints the picture for Altria, and that’s the free cash flow earned vs dividends paid out chart. At a basic level, Altria has to maintain free cash flow growth in order to sustainably grow their dividend payments. And over the past decade, their free cash flow has gone from 4.2 billion, to 9.1 billion. This gives them a 10-year free cash flow compounded annual growth rate of 7.92%.

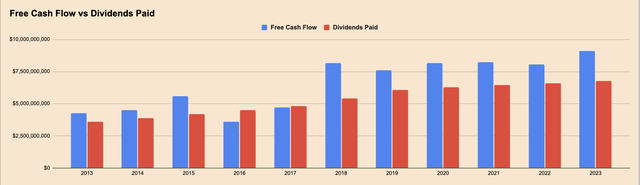

Altria free cash flow vs dividends (Tickerdata.com)

While some are concerned about Altria operating in a ‘dying industry’, the company has been able to maintain solid free cash flow growth rates. This is in part due to the strong pricing power that companies in the tobacco industry maintain. It’s also worth noting that the projected forward EPS growth for the next 3 – 5 years is expected to come in at close to 4%. And while that is by no means an impressive growth rate compared to most companies in the S&P 500, it should be enough to sustain the slight dividend growth moving forward.

With that being said, the 80% payout ratio is still something to be addressed, and that is exactly what Sal Mancuso (the chief financial officer for Altria) did in a recent open letter to Altria shareholders.

Since 2010, our objective has been a dividend payout ratio target of approximately 80% of adjusted diluted EPS. Under this objective, potential earnings variability would also affect the dividend. Therefore, to provide investors with confidence in consistent dividend growth, we are establishing a new progressive dividend goal that targets mid-single digits dividend growth annually.

A strong and consistently growing dividend remains a top priority for us. Our dividend has been the primary vehicle to return cash to shareholders throughout our history, and we do not expect that objective to change. Today’s announcement reflects our commitment to consistent future dividend growth and shareholder returns.

With this in mind, it becomes more clear that the 80% payout ratio is not necessarily a result of poor financial health for Altria, but an acknowledgment from management that the best way to drive returns to shareholders is currently in the form of dividends. This is something potential investors must understand when considering Altria. While EPS projections are low and it’s unlikely you’ll see much share price appreciation, the management team has a clear focus on providing shareholders with returns in the form of dividends. This becomes evident when considering the fact Altria has a price return of 15.52% over the past decade, but a 108.57% total return of the past decade.

Altria Price return vs Total return (Seeking Alpha)

It’s also worth pointing out that Altria recently stated their enterprise goals through 2028 in a press release on their website:

Deliver a mid-single digits adjusted diluted EPS compounded annual growth rate in 2028 from a $4.84 base in 2022.

A progressive dividend goal targeting mid-single digits dividend per share growth annually* through 2028.

With Altria’s projected EPS growth through 2028, they are able to target low to mid-single digit dividend growth through that same time period. In the company’s most recent earnings report released in late February, they stated that they continue to expect earnings of $5.00 to $5.15 per share in 2024, representing a growth rate of 1%-4% from a base of $4.95 in 2023. This falls in line with the previous estimates we discussed from Altria management, which gives more reason to have confidence in these projections. Altria’s most recent dividend hike was around 4.3%, which was on the higher side of management’s guidance that was given to us over a year ago.

Valuation

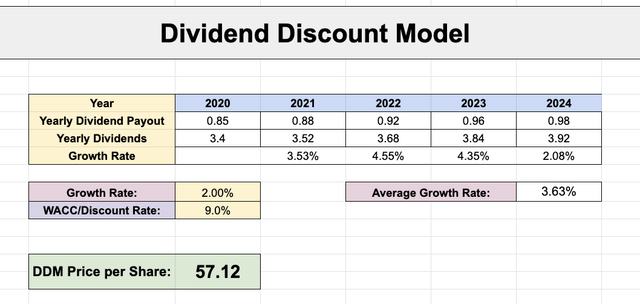

If we look at our dividend discount model and assume a 2% dividend growth rate (which is in line with estimates), and a 9% discount rate, we come to an intrinsic value of $57.12.

Altria Dividend Discount Model (Tickerdata)

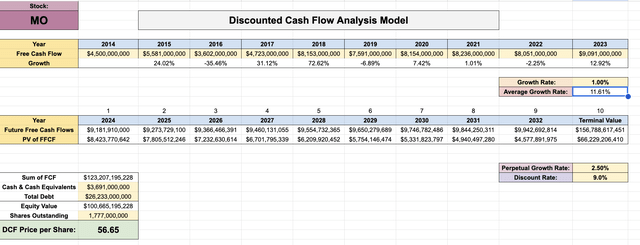

If we look at a discounted cash flow analysis for Altria, assuming just a 1% free cash flow rate and a 9% discount rate, we come to an intrinsic value of $56.65.

Altria Discounted cash flow analysis (Tickerdata)

So with a dividend discount model valuation of $57.12 and a discounted cash flow analysis valuation of $56.65, it appears that Altria is currently trading at a discount.

Risks

Altria also recently filed their form 10-k in late February, which is a great place to assess the major risks the business is currently facing. As a current shareholder in Altria, here are the areas of risk I most closely watching:

- Significant changes in price, availability or quality of tobacco would be detrimental

- Altria relies on a few significant facilities and a small number of key suppliers, so issues with these facilities could lead to supply chain disruptions

- Significant federal, state and local governmental actions could be difficult and costly for Altria to manage

- Tobacco products are subject to substantial taxation, and potential increases in taxes could reduce Altria’s profitability

Conclusion

While Altria has a high payout ratio and low projected earnings growth, it does still appear that the company’s status as a dividend king is not in jeopardy at this time. Management has been strategically targeting an 80% payout ratio moving forward, and even expects to continue to grow the dividend at mid-single digits through 2028. It is important to realize that the company faces significant risks from the industry that operates in as a whole, but the valuation appears to be attractive.

The decision as to whether to consider Altria as a potential investment heavily depends on the goals, time frame, and risk tolerance of the investor. Altria will likely see low levels of price appreciation, but should be able to maintain their massive dividend payments moving forward. For someone looking to maximize immediate dividend income, this could potentially be an opportunity. As someone who is already a shareholder of Altria, I currently plan on holding my shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.