Summary:

- Visa’s strong financial performance is overshadowed by potential disruptions to its revenue model due to global regulatory changes, particularly around interchange fees.

- Regulatory adjustments in the US and Europe, such as proposed caps on interchange fees, could negatively impact Visa’s revenue derived from interchange fees.

- Visa’s 10-K filings highlight the significant influence of regulations on its business, including the Interchange Fee Regulation in Europe and the Dodd-Frank Act in the US.

Arturo Holmes

Investment Thesis

With potentially impeding interchange regulations on the horizon, I believe Visa (NYSE:V) stands at a crossroads, characterized by its strong financial performance but dealing with the global regulatory changes, particularly around interchange fees.

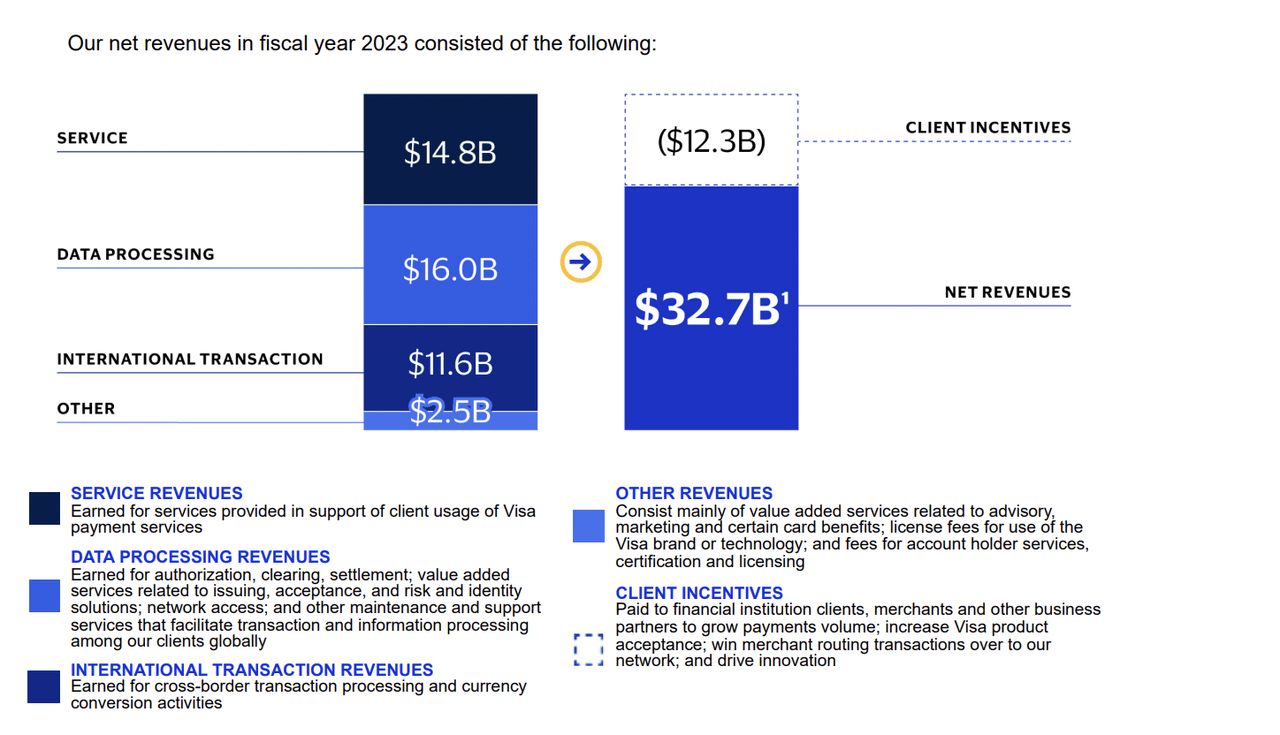

On the one hand, the company’s recent annual earnings report showcases healthy performance, with net revenues growing to $32.653 billion in fiscal year 2023, up 11% from 2022. However, the undercurrents of regulatory adjustments in key markets, notably the U.S. and Europe, hint at potential disruptions to Visa’s revenue model.

As regulators globally scrutinize payment processing fees, aiming to cap interchange fees to alleviate merchant burdens, I think investors need to warrant caution. In the US, one example is the Federal Reserve revising the debit interchange fee cap (and potentially expanding this) and the UK Payment Systems Regulator proposing a cap on cross-border interchange fees. I believe these regulatory shifts could hurt Visa’s interchange fee-derived revenues.

While I think Visa’s current business is robust, the unpredictable regulatory landscape gives me pause, making me warrant a ‘hold’ position on Visa until we can be more certain that the regulatory climate will stabilize.

Background

Interchange fees are crucial to Visa’s revenue stream, representing a significant portion of the cost merchants incur when accepting Visa payments, which subsequently influences the consumer pricing model. Interchange fees are the credit card company’s cut of the fees that a merchant pays to accept your credit card at their store as a form of purchase.

For fiscal year 2023, Visa brought in $32.653 billion in revenue, marking an 11% increase from the previous fiscal year’s $29.31 billion (Visa 2023 10-K). This growth is attributable to a surge in nominal cross-border volume, processed transactions, and nominal payments volume. The credit card company’s operating expenses also increased 11% to $11.653 billion.

Internationally, Visa’s reach and impact continue to grow. I think this is key as regulatory risks are just as much international as they are domestic in the US.

Revenue continued to grow in FY 2024 as well. For instance, for the three months ending December 31, 2023, net revenues grew 8.8% compared to the same quarter in FY 2023. This expansion, however, comes with its set of regulatory hurdles.

In the US, the Federal Reserve’s expansion of the debit interchange fee cap use cases to include online payments and require at least two unaffiliated payment card networks to be available for use, creates more competition risk for Visa.

In the UK, the Payment Systems Regulator’s proposal for a cap on cross-border interchange fees underlines the shifting regulatory landscape Visa navigates and could impact their profitability.

Visa’s Perspective In Their Filings

In my opinion, the best place to view a company’s risk profile is to look at their 10K. In the US, 10K’s have to follow a standard order and format meaning you can better compare corporate risks apples to apples.

With this, Visa’s perspective on regulatory risks is well outlined in its 10K filings. Visa specifically notes the significant influence of regulations like the Interchange Fee Regulation (IFR) in Europe, which directly competes with Visa by allowing processing of Visa transactions by third parties, potentially affecting its market position.

Similarly, the company acknowledges the global trend towards regulating or influencing interchange fees, pointing out legislative actions such as the Dodd-Frank Act in the U.S., which limits interchange reimbursement rates for certain debit card transactions.

Additionally, regulatory scrutiny and potential caps on interchange fees in the UK and EU, as well as other regions like Australia and Brazil, add to this trend and can compound their effects to Visa’s business elsewhere (cross border payments appear to be subject to these new restrictions as well). Cross border payments represented $11.6 billion in revenue in FY 2023.

Visa FY 2023 Revenue Breakdown (Visa 2023 10K)

More specifically, the company identifies the main regulatory risks by the following 3 regions (Directly from the FY 2023 10K):

United States:

June 2023, legislation was reintroduced in the U.S. House of Representatives and Senate, which among other things, would require large issuing banks to offer a choice of at least two unaffiliated networks over which electronic credit transactions may be processed. Similar legislation was introduced in the previous Congress in 2022 but failed to advance and become law. The current legislation has additional bipartisan support, and while the ultimate outcome of the legislation remains unclear, its sponsors continue to strongly advocate for its passage.

In Europe:

The EU’s IFR places an effective cap on consumer credit and consumer debit interchange fees for both domestic and cross border transactions within the EEA (30 basis points and 20 basis points, respectively). EU member states have the ability to further reduce these interchange levels within their territories. The European Commission has announced its intention to conduct another impact assessment of the IFR, which could result in even lower caps on interchange rates and the expansion of regulation to other types of products, services and fees.

Other Regions:

Several countries in Latin America continue to explore regulatory measures against payments networks and have either adopted or are exploring interchange caps, including Argentina, Brazil, Chile and Costa Rica. In Asia Pacific, the Reserve Bank of Australia (RBA) completed its review of the country’s payment system regulations and adopted a series of measures, which include lower interchange rates for debit transactions. The RBA also continues to assess the potential merits of mandating co-badging and merchant routing choice on dual network debit cards.

In addition, the New Zealand Parliament passed legislation capping domestic interchange rates for debit and credit products. Finally, many governments, including but not limited to governments in India, Costa Rica, and Turkey, are using regulation to further drive down MDR, which could negatively affect the economics of our transactions. While the focus of interchange and MDR regulation has primarily been on domestic rates historically, there is increasing focus on cross-border rates in recent years.

For example, in 2019, we settled certain cross-border interchange rates with the European Commission. In 2020, Costa Rica became the first country to formally regulate cross-border interchange rates by direct regulation. Cross-border MDR is also regulated in Costa Rica and Turkey. Finally, in June 2022, the UK’s PSR initiated two market reviews: one focusing on post-Brexit increases in interchange rates for transactions between the UK and Europe, and another focusing on increases in the UK in what are referred to as scheme and processing fees.

Quantifying the Interchange Fee Reduction

While quantifying the potential impacts of proposed regulation on Visa is by no means an exact science, Visa’s SEC filings and regulatory developments suggest that the company is facing a pivotal moment and again why I believe the stock is a hold until more clarity comes out about the proposed regulations.

With this, we can look, however, at history to see what the impact has been of previous regulatory change and see what is reasonable for us to assume today.

In 2010, Congress passed the Dodd-Frank Act with the Durbin Amendment which reduced the amount that can be charged to merchants in interchange fees for debit cards. Before this amendment was passed, the average fee was 44 cents. After, this average fee to merchants for a debit card transaction was 21 cents + 0.05%. While these fees were assessed by the banks that issued the debit cards (so not Visa in this case) it shows how much Congress is willing to cut fee revenue to financial institutions when they think fees are becoming excessive.

According to a research report by Bank of New York Mellon on current credit card fees, “These fees and percentages can vary based on the type of [credit] card anywhere from 0.5% -3.5%.”

This is much higher than the interchange fees charged on debit cards.

All together:

In 2021, U.S. retailers paid an astounding $138 billion to accept electronic payments, a significant increase from 2015 when merchants paid $83 billion, and this past year’s number is more than double what the retail community paid in 2011, $64 billion. -Bank Of New York Mellon Report

In my opinion, this seems like something that stands a high risk of being regulated.

Assuming a conservative 5% reduction in overall net revenue received by Visa due to these regulatory pressures, and based on Visa’s reported net revenues of $32.653 billion for the fiscal year 2023, this scenario could lead to a significant revenue impact exceeding $1.6 billion. This would likely flow (almost entirely) down to the bottom line, meaning net income would drop by a similar figure to $1.6 billion.

At a forward non-GAAP P/E of 28.24, this could cause a ~$45 billion impact to the market cap. This also assumes that the company could continue to trade at such a high forward P/E ratio (the sector median forward P/E is 10.50). I am not sure a company facing new, unknown regulatory risks will be rewarded by the market with a forward valuation that is much higher than other financial institutions. My current assumption is that Visa trades at a higher P/E due to a slightly lower current regulatory profile compared to traditional financial institutions. I’m not sure this would continue with higher regulations, hence my opinion that the stock is a hold.

I’m not attempting to estimate a full fair value here since I do not know how these regulations will evolve, but this math is here to show how vulnerable their stock could be to even a slight change in their business model due to regulatory risk.

Bull Case

I think the biggest opportunity for the stock to rerate for a buy is if these regulatory risks globally dissipate. For example, the current U.S. political scenario, marked by a divided Congress, introduces some uncertainty that could indirectly benefit Visa. Congress is at a record level of polarization and a multi decade low for productivity. There is a real chance this legislation does not get passed.

In addition, to offset this, Visa has focused on accelerating revenue growth through consumer payments, new flows, and value-added services, alongside fortifying its foundational business model. There’s no guarantee that these efforts will be successful, and in some cases puts them in more direct competition with directly consumer facing companies like Apple’s (AAPL) Apple Pay, and Paypal (PYPL).

Takeaway

I believe Visa presents a cautious investment narrative. Despite demonstrating formidable financial strength with a notable 11% increase in net revenues for fiscal year 2023, the shadow of global regulatory shifts, particularly concerning interchange fees, I believe casts a significant uncertainty on its future revenue pathways.

While the company is attempting to navigate the regulatory risks, I think the opaque regulatory environment does not match the crystal quantitative premium that Visa stock trades at above other financial sector peers.

Given this, I think the stock is a ‘hold’ until we observe more of the unfolding regulatory environment and its impact on Visa’s operational and financial performance.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the Managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.