Summary:

- Tesla’s stock price has declined significantly in recent months, losing over half of its market cap since its peak.

- Weak quarterly results and tempered growth outlook for 2024 are the main factors behind the stock price decline.

- However, we believe these factors are temporary and that Tesla’s long-term growth potential remains intact.

- Even with conservative growth and valuation assumptions, I see good odds for Tesla to regain a $1T market cap in the next few years.

Justin Sullivan

Thesis

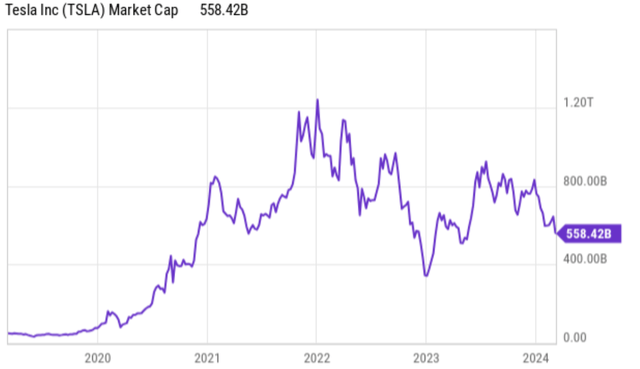

Share prices of Tesla, Inc. (NASDAQ:TSLA) have lost much ground in the past few months (see the next chart below). To wit, it has shed more than half of its market cap (“MC”) since its peak price about 2 years ago, when its MC exceeded more than $1.2T. In the remainder of this article, I will analyze the possible reasons for such a large retreat and argue why these reasons are only temporary. I see the stock’s long-term potential intact and will elaborate on its growth scenario to regain $1T MC.

In my analyses, the leading factors for Tesla’s recent stock price declines are twofold. First, it posted weaker-than-expected results in the past 1 or 2 quarters. For example, it reported 2023 Q4 earnings of $2.27 per share, on a 3% top-line increase, to $25.17 billion. The numbers look encouraging on the surface, although the growth is largely due to a one-time tax benefit. Excluding this factor, adjusted earnings were $0.57 a share, well below the $1.07 EPS from the previous year and many analysts’ expectations. Secondly, management also tempered its growth outlook for 2024. Specifically, they indicated that vehicle volume growth “may be notably lower” than last year, as it works on the launch of its next-generation vehicle.

Next, I will argue that these factors are both temporary and TSLA’s long-term growth potential remains.

Long-term potential remains unchanged

First of all, I view the above quarterly results as merely speed bumps. Second, my view is that TSLA’s “tempered growth” is only in relative terms. For instance, Counterpoint Research projects the sales to grow by about 20% to 25% YOY in 2024 on delivery of around 2.2~2.3 million vehicles (see the quote below). To me, these are still remarkable growth rates in absolute terms and will be more than sufficient to deliver outsized shareholder returns at the current price levels (more on this in the next sections below).

TSLA management did not specify any target for total vehicle sales in 2024 but has indicated a lower growth compared to 2023. Considering the prevailing market conditions, it is anticipated that Tesla’s sales could grow 20% YoY to 25% YoY in 2024 to reach 2.2 million to 2.3 million units.

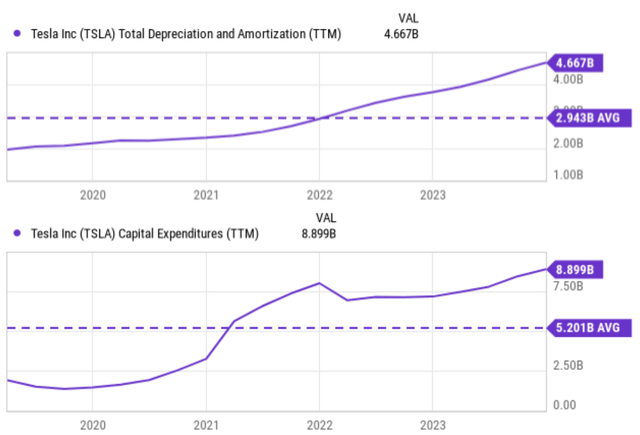

Third, TSLA is still the dominant leader in a market with years, if not decades, of secular growth to come. It continues to focus on future growth projects and technological lead. As a demonstration, its capital expenditures and R&D expenses both reached company records in 2023 (see the next chart below).

I share the management’s view that these investments will bear fruit and its next-generation platform will revolutionize how vehicles are built. As an example, the top panel of the next chart shows its total depreciation and amortization (“TDA”) in recent years (with an average of $2.94B per year). Its CAPEX expenditure reached $8.9B last year and averaged $5.2B per year in the past 5 years. If we use the TDA to approximate its maintenance CAPEX (see my earlier article here for more details), then its CAPEX is largely targeted toward growth.

TSLA’s path back to $1T

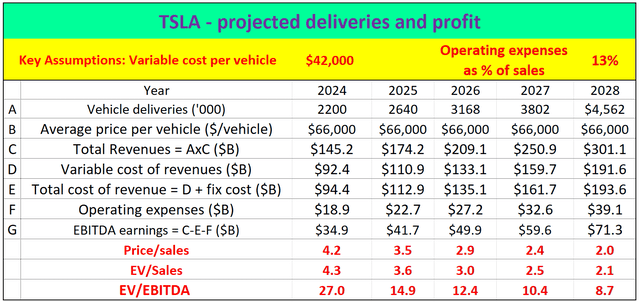

As aforementioned, the “tempered growth rate” ahead can already drive sufficient shareholder returns at the current price levels in my view. And the next table elaborates on a growth scenario based on such rates in the next few years.

The essence of the table is a projection of TSLA’s delivery and revenue growth based on a delineation of its production costs into fixed and variable costs. The details of the delineation can be found in my earlier article. Here, I will just directly quote the end results, which are the key assumptions used to build this table:

The key results are the variable cost per vehicle is $42,000, a fixed cost of $2B, the operating expenses to be 13% of total sales, it can maintain the current average vehicle price tag of $66,000.

For growth rate, I took the lower end of the range (i.e., 20%) quoted from Counterpoint Research above. Based on these parameters, my calculation shows that TSLA’s total sales can exceed $300B in about 4 years. At today’s price (and also assuming share counts remain fixed), the P/S ratios would only be 2.0x by 2028. My calculations also show that its EBITDA earnings can reach $71B by then. Now add a further assumption that its total debt remains unchanged (which is a very minor part of its total EV anyway), its EV/Sales ratios would be only 2.1x in 2028 in this scenario.

To better contextualize these multiples, the overall market’s P/S ratio exceeded 3x in early 2022 and currently hovers around 2.8x. Thus, to put it in a different way, even if TSLA’s sales are valued at the same multiple as the overall market (which is a very conservative assumption in my view), its MC can still be close to $1T.

Other risks and final thoughts

Before closing, there are some other risks, in both the upward and downward directions, that I want to mention. My above analyses only included TSLA’s electric vehicles, and other nonlinear growth catalysts can further drive the return higher. Tesla’s Powerwall home battery storage system and Solar Roof system are the top ones that come to my mind. This area could see significant growth as homeowners look to reduce their reliance on the grid and generate their own clean energy. Tesla’s Autopilot driver-assistance system and its plans for fully autonomous vehicles could be another major growth driver. This technology, when compared with tailored car insurance offerings, could create another nonlinear growth area, not only in the EV space but also in the insurance space. Looking further out, Tesla’s humanoid robot (aka, Optimus) could be a game-changer in the automation industry and, in CEO Elon Musk’s words, worth more than its EV business by itself.

In terms of downward risks, TSLA faces all the generic risks that other EV makers are facing, such as macroeconomic risks, sensitivity to government subsidies, competition intensification, etc. Here I will focus on some of the risks that are more particular to Tesla but not to other EV manufacturers.

First, TSLA currently relies heavily on Elon Musk. Musk’s celebrity status and pronouncements can significantly impact the company’s stock price and public perception. This dependence makes Tesla vulnerable to any missteps or controversies surrounding Musk. Other EV makers have a more traditional leadership structure that spreads out the risks and impacts decisions.

Second, unlike most traditional automakers, Tesla embraces a vertically integrated model. It designs, develops, and manufactures many of its own components and systems, including batteries. This vertical integration can give Tesla more control over its products and potentially improve efficiency. However, it also makes Tesla more vulnerable to supply chain disruptions or delays in its own production processes. Other EV makers may be able to source components from a wider range of suppliers, giving them more flexibility.

All told, my overall conclusion is that under the current prices, the upside potential far outweighs the downside risks. The large price corrections in the past few months have presented a compelling entry point in my view. Even with conservative growth and valuation assumptions, I see good odds for TSLA to reenter the $1T club in the next few years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.