Summary:

- Rivian unveiled its new R2 SUV, starting at $45,000, but additional features can be costly, and it won’t be here for at least two years.

- Rivian’s R2 is entering a very competitive market with other electric SUVs available at similar price points, such as the Tesla Model Y and Chevy Blazer EV.

- Rivian could use another capital raise as losses and cash burn will continue for several quarters, despite two debt offerings already in 2023.

Phillip Faraone/Getty Images Entertainment

Back in February, I discussed why I would not be a buyer of Rivian Automotive, Inc. (NASDAQ:RIVN) shares after the company’s mixed Q4 report. With production guidance implying little volume growth this year, and losses and cash burn remaining quite high, I thought there might be some additional pain to come. Last week, the company unveiled its second-generation vehicle to a tremendous amount of hype, but the recent rally in shares now has me turning negative on the name.

Last Thursday was the highly awaited event where Rivian showed off its new R2 SUV. The vehicle will start at $45,000, but that appears to be a “base” version that will not have over 300 miles of range. Like the company’s current R1 platform, you can get bigger batteries to allow for more range, but these add-ons can be very costly. It’s not clear at this point if the R2 will be able to receive the full $7,500 EV tax credit. That credit also assumes the US political situation remains the same, as the election this fall could swing things that result in the credit potentially being eliminated by the time the R2 is available. As we’ve seen with many electric vehicles, the lowest announced priced model doesn’t come right at the beginning of availability and can take several years to get depending on the company’s situation.

After the R2 unveil, I saw a lot of people calling this the “Model 3 moment” for Rivian, referring to when Tesla, Inc. (TSLA) launched its mass-market vehicle in 2016 after selling two luxury vehicles to that point. While that is the path that Rivian seems to be following, it’s not as comparable as you might think. Tesla was calling for a $35,000 vehicle with a $7,500 tax credit, which even adjusting for the inflation we’ve seen since would only equate to about $36,000 today. If Rivian only gets half of the EV credit, the cheapest variant of the R2 would come in at more than $41,000. Elon Musk reported 180,000 orders for the Model 3 in the first 24 hours, with each requiring a $1,000 deposit, whereas Rivian had over 68,000 deposits down at $100 each as of Friday morning.

Rivian is entering a vastly different competitive situation here as well. Tesla was basically only competing with the Nissan Leaf at the time it launched the Model 3. Currently, you can get a base Tesla Model Y for $36,490 after the Federal tax credit, and it will have similar performance specs to the base R2 that is at least two years away. Last Friday, Chevy announced sales were starting again for its Blazer EV, which is quite comparable to the R2 as well, and other players like Kia, Honda, Hyundai, etc. have electric SUVs available now or coming soon.

Rivian also announced another model last week, the R3, which will be smaller and come after the R2. No pricing, specs, or an availability timeline were given, but this unexpected reveal was nothing more than pure hype for now. I say this because perhaps the biggest news that came out of last week was that Rivian is pausing its plans for its new Georgia factory, instead launching the R2 out of its Illinois factory in the first half of 2026. This move will save an estimated $2.25 billion between capital expenditures and operating expenses according to management. The Georgia factory will eventually come and produce the R2 and then the R3, meaning the smaller vehicle is a 2027 item at the earliest, which is why I wouldn’t put much focus on it currently.

Rivian certainly did a 180 here, and I think it speaks to some desperation from the company as well as the financial situation being weaker than it seems. It was just a year ago at the Q4 2022 conference call that management believed it had enough cash to get through the end of 2025. Yet, Rivian went out twice last year and hit the debt markets, raising $2.8 billion in convertible debt. Unlike the Tesla Model 3 deposit surge, which brought in hundreds of millions of dollars in cash in a week or two, Rivian’s R2 deposits are likely to only bring in tens of millions at best. Tesla didn’t have the cash pile that Rivian currently does back in 2016, but it wasn’t burning as much, and it did produce almost 84,000 vehicles that year, as compared to Rivian’s guidance for 57,000 in production in 2024.

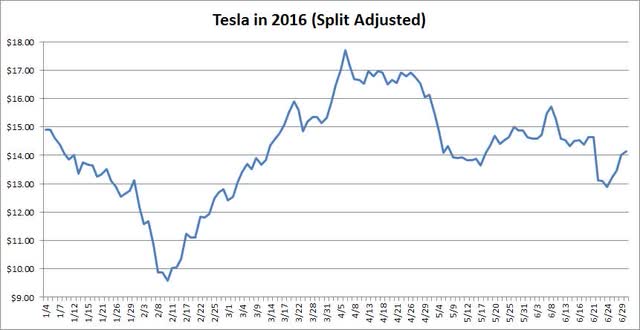

Interestingly enough, Rivian shares so far this year have shown some similar trends to Tesla in 2016. As the chart below shows, Tesla shares tanked to begin the year, which Rivian has done, before rebounding into the new model reveal. Tesla unveiled the Model 3 on March 31st, and interestingly enough, shares hit their peak for the year the next week, before falling again. Rivian has seen its shares bounce 27% from their recent low, and those gains would have been even higher if not for the overall market rally on Friday getting wiped out and then some.

Tesla 2016 First Half (Yahoo! Finance)

Rivian shares have jumped about 17% since my prior article, with the S&P 500 being roughly flat over that time. The price-to-sales valuation here has ticked up slightly to 2.56 times this year’s expected revenue, mostly a function of analyst estimates coming down, and was over 2.70 times at Friday’s high. However, when I talked about the major discount to Tesla in my last article, Tesla was at nearly 5.6 times its expected sales. Since then, we’ve seen a bunch of bad news regarding Tesla, including weak China sales and its Berlin factory shut down due to an arson attack on the power grid. Tesla now only goes for about 5.1 times its expected 2024 revenue, so the valuation gap has certainly narrowed.

Rivian finished 2022 with total cash of more than $11.5 billion against debt of just $1.2 billion. However, due to large losses and cash burn, the company finished 2023 with cash of about $9.4 billion, but debt was also up to more than $4.4 billion. The other thing that differentiates Rivian from Tesla here is that when the Model 3 was unveiled, Tesla had a market cap of more than $30.75 billion. Even after last week’s rally, Rivian’s market cap stands at just $12.5 billion, meaning any capital raises are a bit more painful to swallow.

Given everything that happened last week, I am now downgrading Rivian to a sell. The valuation increase isn’t justified given Tesla’s valuation decrease. The R2 won’t be here for at least two years, and there’s a lot more competition now than when Tesla launched its mass-market Model 3. I believe another capital raise will come, and it’s possible that last week’s unveil was set up just to prepare for that. The pausing of the Georgia factory does ding the growth story in the medium term, even while saving some money, and the R3 will be several years off. Investors are now going to focus on the current business, and Rivian is about to shut down its plant for upgrades that will pressure revenues in the near term. It remains to be seen if last week’s reveal will thus pressure sales of the current lineup as consumers wait for the R2, and how the addition of leasing options for the R1 line will impact the financials.

For me to bring my rating back to a hold, I need to see a couple of things happen. First, I need to see Rivian get through this plant upgrade period and show that it has resulted in the cost savings that management expects. Getting to gross profits in Q4 will be tough given the company hasn’t had gross margins better than negative 36% in any quarter recently. Second, I need to see the company raise more capital to de-risk the balance sheet through the start of the R2 launch and to get the Georgia factory plans back on track. Finally, I need to see the valuation improve a bit, given all the weakness we’ve seen in EV stocks in recent months. Should the price-to-sales figure come down to around 2 times this year’s expected revenues, I would consider looking at my rating again.

In conclusion, the hype and rally in Rivian shares surrounding last week’s R2 unveil is not warranted in my opinion. The company’s cheaper SUV won’t be here for at least two years and enters a much tougher EV landscape than when Tesla launched the Model 3. Tesla shares peaked the week after its major reveal, falling back to reality as investors went back to scrutinizing how the actual business was doing. With Rivian’s valuation rising ahead of a potential capital raise, I think investors should step aside here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.