Summary:

- A. O. Smith Corporation is a dominant company in its sector with a proven business model, almost guaranteeing dividend increases despite economic cycles.

- The company has a strong balance sheet, good growth prospects and an excellent capital allocation strategy for the long-term dividend growth investor.

- AOS has reported record sales and FCF in FY 2023, which allows them to invest into further growth and reward shareholders in the form of dividends and share repurchases.

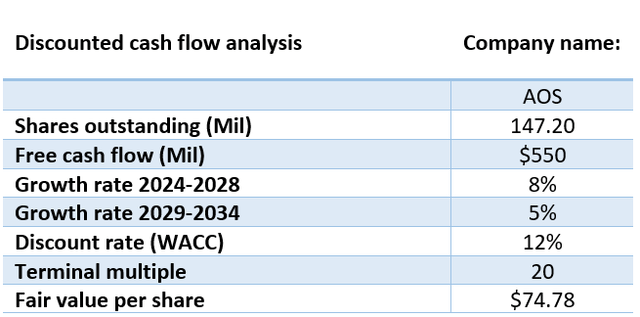

- Based on discounted cash flow analysis, the fair value of AOS stock is $74.78 per share, which means it is 14.7% overvalued compared to the current share price.

onurdongel

Investment thesis

There is nothing better than having a number of stocks in your portfolio that increase their dividend like clockwork. There are plenty of people who don’t invest in boring stocks, while I think we should embrace boring sometimes. Companies that are dominant in their sector and have a proven business model. These companies keep growing earnings and can almost guarantee dividend increases despite the influence of the economic cycle.

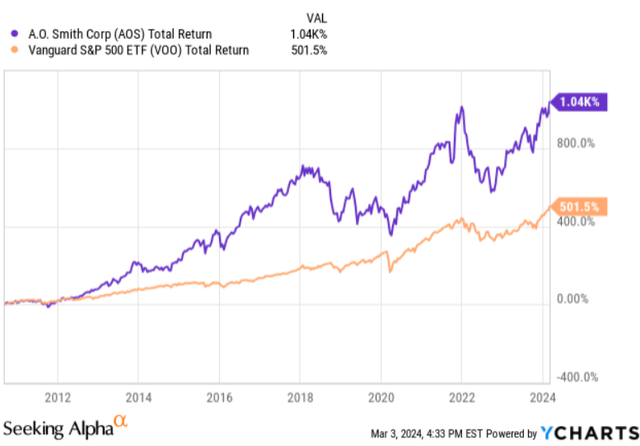

One of my own top 5 holdings is A. O. Smith Corporation (NYSE:AOS). The company doesn’t get the attention it deserves. In my view this is unjustified, because the long-term results are exciting.

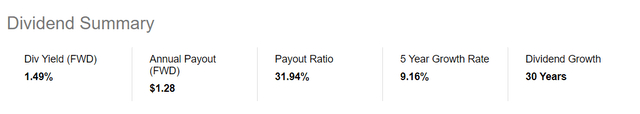

For the dividend growth investors who have a lot of time on their side, there is a lot to like as well. The dividend yield is “just” 1.49% at the moment but that’s just because of its share price appreciation.

AOS dividend summary (Seeking Alpha)

With a 5Y dividend growth CAGR of 9% and a healthy pay-out ratio of 31.9% there is no sign of weakness. I even think the company has serious dividend king potential.

Today I want to update my investment thesis for the company using the latest information.

Why AOS?

Why invest in AOS? I will give you a summary of why you should take a look at the company. For people who are interested in additional information about AOS, you can read my previous article via this link.

- The company has a stable business model and they are very profitable in the US. What is nice to see is that 80-85% of sales are derived from the replacement of existing products which creates a solid foundation.

- AOS can profit from several trends, since they can continue to benefit from the transition to higher energy-efficient products. Commercial parties will also participate in this to reduce their carbon footprint. They are also expanding into new markets with their water treatment products. Although AOS is very profitable, especially in America, they are active in various growing markets, including China and in particular India.

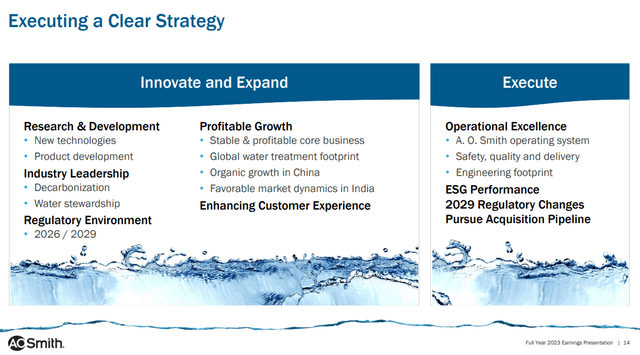

AOS strategy (AOS investor day presentation)

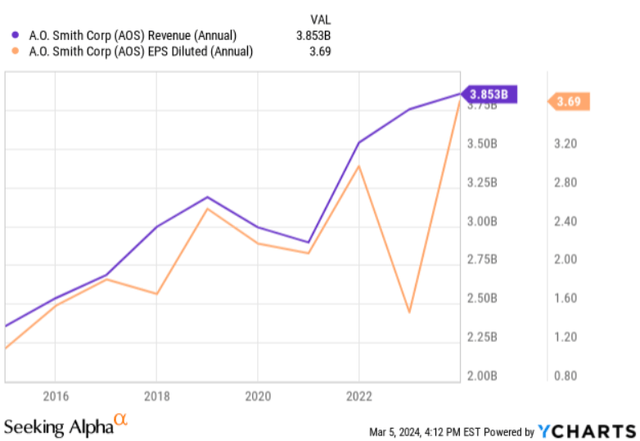

- Their long-term growth numbers are solid. According to the Seeking Alpha data for growth numbers they achieved a 10Y revenue CAGR of 5.99%, and with a 10Y EPS CAGR of 14.89% they are really showing their compounding capacity.

Revenue and EPS development (YCharts)

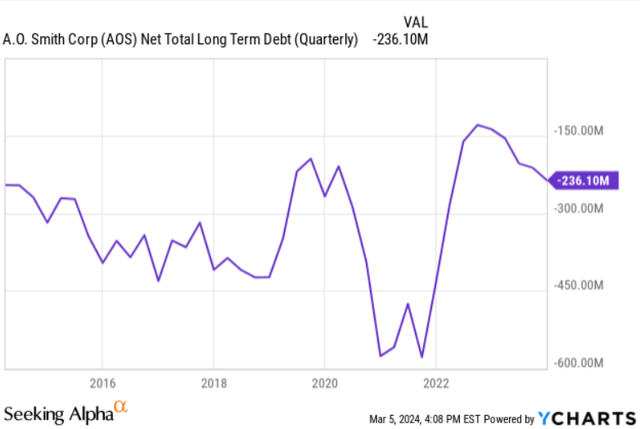

- The company has a top-notch balance sheet, they have more cash on hand than debt and they’ve been in this situation for long periods of time. This puts the company in a good position to strike when opportunity arises when it comes to M&A.

AOS net debt development (YCharts)

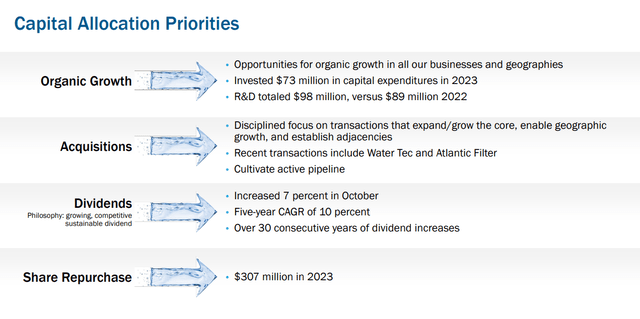

- Their capital allocation strategy is ideal for dividend growth investors, since the focus in mainly on growth. This should lead to growing earnings and of course to sustainable growing dividends and a healthy amount of share buybacks.

AOS capital allocation (Investor day presentation)

Full year fiscal results

AOS has managed to deliver excellent full year results.

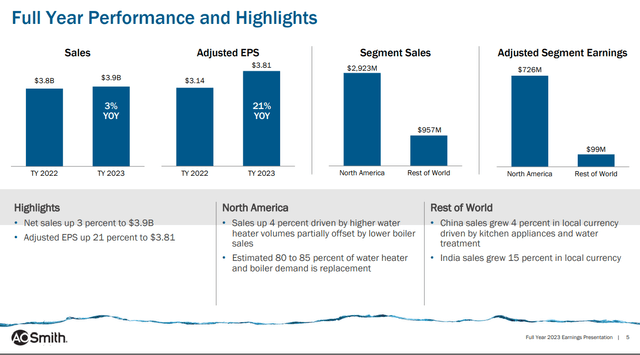

AOS FY 2023 performance (Q4 2023 presentation)

In FY 2023 the total sales increased 3% and their margins increased as well due to an improved price cost relationship. The North America segment increased 4% YOY, because of higher volumes in water heaters. The “Rest of the world segment” went down 1% due to currency headwinds, this was mostly China-related. Despite a weak economy in China, AOS is growing sales again with 4% in local currency. New kitchen products in China were received very well. Sales in India are growing fast, 15% in local currency. This growth is equivalent to 3x the market.

EPS is also growing rapidly, the adjusted EPS was a whopping 21% higher compared to FY 2022.

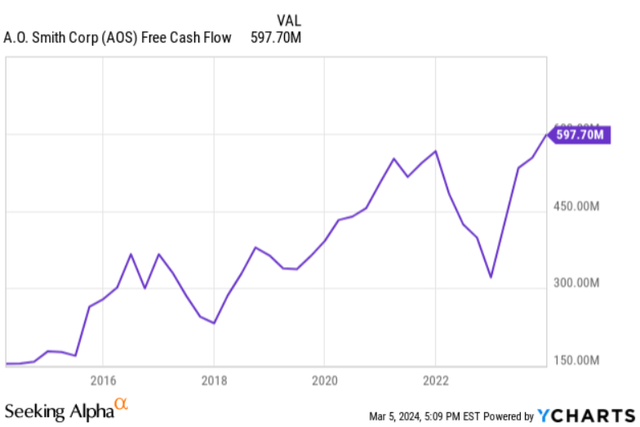

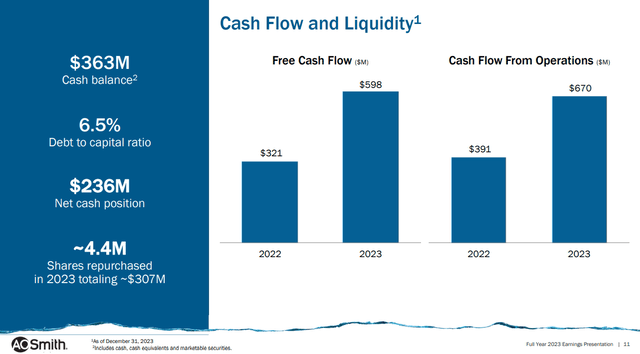

What is also remarkable is AOS’s FCF growth, which is significantly higher compared to FY 2022 due to higher profitability.

Free cash flow (Q4 2023 investor presentation)

This allows them to continue what they do so well, namely investing in further growth, buying back shares and growing their dividend in a sustainable way.

FY 2024 outlook

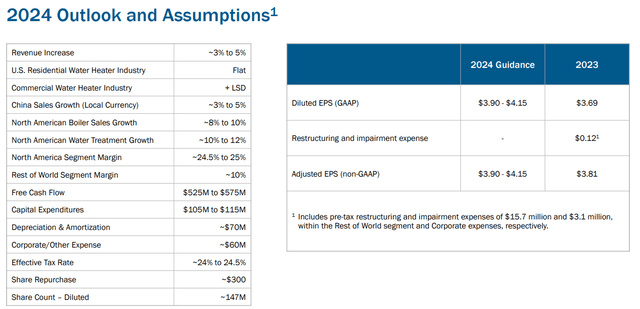

For FY 2024, AOS predicts sales growth of North America water treatment products to increase approximately 10% to 12%. They are planning to do some price increases in water heaters. This is around 8% and will be effective in Q1. AOS is also expecting new growth in their North America boiler business of 8-10%.

They also expect 3-5% growth in China, due to resilient replacement demand and their success in their water treatment- and kitchen products. Growth in India remains good and growth of 15% is expected for the coming year.

However, they expect a lower amount of FCF compared to FY 2023 ($598 million vs $525-$575 million). This is based on the fact that steel prices are likely to be higher in FY 2024. Also CapEx will be higher compared to FY 2023, which impacts FCF as well ($65 million vs $105-115 million).

AOS does expect to repurchase $300 million of its own shares and it is expected that the dividend will be increased again.

FY 2024 outlook (Q4 2023 presentation)

In other words, next year will be looking very similar compared to FY 2023. From an FCF point of view, things are looking a little bit less attractive.

What consequences does this have when it comes to the valuation of AOS?

Valuation

To calculate the intrinsic value of AOS, I used discounted cash flow analysis. The expected FCF for FY 2024 should be in the $525-$575 million range. I have confidence in management, and I used $550 million for my calculations.

As you can see from the chart, AOS’s growth in FCF is lumpy, but over the long term, they show healthy growth. The company achieved a 5Y FCF per share CAGR of 10.9% and 10Y CAGR of 14.9%. FCF will drop a bit next year but growth prospects are still strong. I think a 5Y free cash flow growth assumption of 8% is reasonable and 5% for the 5 years thereafter, because it is more difficult to make assumptions further into the future.

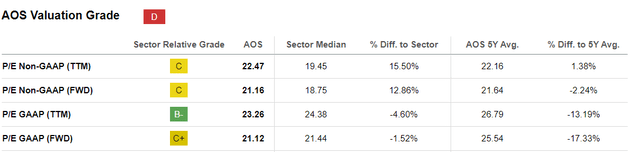

At the moment, AOS has a PE non-GAAP of 22.47, which is still a bit above its 5Y average of 22.16. From a PE GAAP point of view, the company trades below its 5Y average.

Valuation metrics (Seeking Alpha)

I used a PE of 20 as a terminal multiple, because AOS is a high-quality business where I think this multiple can be justified. Finally, I used a discount rate of 12% as a minimum rate of return.

If we do the math, this comes to a fair value of $74.78 per share. Comparing it to the current share price of $85.82 it is 14.7% overvalued.

Conclusion / investment risks

AOS is a quality company and continues to do what they have been doing for decades. The company has done well over the past year and its free cash flow is currently at a record high. They will continue to invest in new growth, but will have sufficient capital to continue to buy back shares and increase the dividend. The last dividend increase of 7% was on the conservative side, but from a dividend growth investment point of view, this is in my opinion a SWAN stock. Free cash flow isn’t likely to grow much in FY 2024, but with a long-term mindset, there are plenty of opportunities for AOS to continue to grow.

In my opinion, the stock is currently overvalued, but it’s definitely worth putting the company on your watchlist. It is always possible that market sentiment may change or AOS may disappoint in the short term. AOS has shown in the past that it can be very volatile. In 2022, it already stood at $80, but has since fallen below $50 dollars per share.

AOS Share price volatility (Seeking Alpha)

It is therefore possible that AOS could fall significantly below my calculated fair value. These are usually opportunities to add these types of stocks to your portfolio.

Of course, there are also several investment risks to mention. AOS needs to keep innovating and investing to maintain its dominant position. Competition that can possibly make better use of the most up-to-date technology can have a negative impact on the position of AOS. When it comes to profitability, AOS is dependent on the steel price. If this rises sharply, this could have a significant impact on profits. Doing business in China can be both an opportunity and a threat. Geopolitical tension between America and China can complicate activities and impact profitability. In addition to this, AOS has a goal of achieving margins of 14-15% in the “rest of the world” segment, which is currently 10-11%. China has the biggest impact on this (22% of total sales in FY 2023), but the current economic condition is disappointing to say the least. There is still turmoil in the Chinese real estate sector, which could mean that people might invest less in AOS’s products or choose other, more cheap alternatives. The company is therefore really dependent on economic recovery, and this could make the margin expansion too ambitious.

At this point in time, I give AOS a “HOLD”, but it wouldn’t surprise me if AOS falls closer to or below my calculated fair value in the event of a setback. This would be an excellent time for the dividend growth investor with a long-time horizon to add to his position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.