Summary:

- Apple’s stock has been essentially stagnant for years, with minimal growth potential and a high valuation.

- iPhone sales, which account for a significant portion of Apple’s revenue, have peaked and are now declining.

- Sales in China, a major market for Apple, have dropped and there is no clear catalyst for improvement, while other Chinese smartphone makers continue to innovate.

- Apple’s stock may continue sideways or move lower due to multiple compression, as it is more of a value stock now than a growth name.

ozgurdonmaz

While Apple (NASDAQ:AAPL) was one of the most significant holdings in my portfolio several years ago, I’ve been neutral or negative on the stock more recently. And I’ve been right. While many high-quality tech stocks have surged to new all-time highs in this AI-driven bull market, Apple’s stock has been essentially dead money for years.

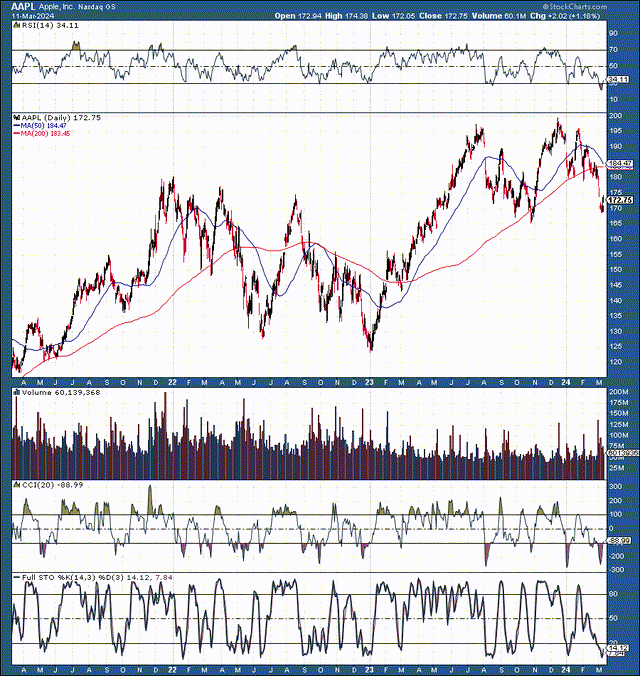

Apple 3-Year Chart

Apple’s stock has only increased by about 35% in the last three years and is now below its peak in 2021. Additionally, Apple is down by around 15% from its recent double-top, and there is no evidence that its share price will make a meaningful recovery any time soon.

Aside from Apple’s deteriorating technical image, its valuation remains high, and the company has minimal growth potential in the near term. Apple’s China sales are plunging, and Huawei and other Chinese smartphone makers seem intent on keeping their lead.

Apple is a value stock, trading at a growth stock’s valuation (27 forward P/E ratio). Additionally, Apple lacks clear catalysts that will enable considerable growth to return soon. Furthermore, Apple could face margin compression due to faltering iPhone, Mac, and other sales. Therefore, we could continue seeing multiple compressions and a lower stock price for Apple as the company churns through another stagnant phase.

iPhone Sales Are A Problem

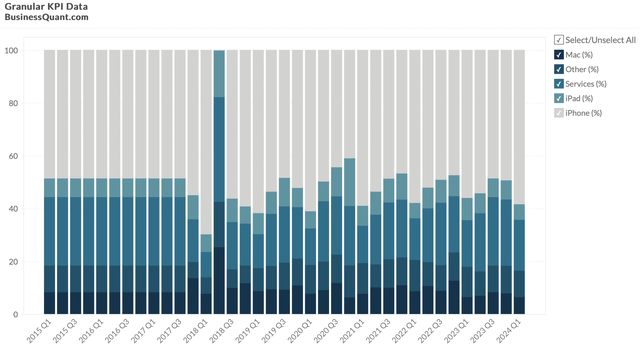

The problem with Apple is that the lion’s share of its revenues still comes from iPhone sales. In fact, last quarter, iPhone sales accounted for over 58% of Apple’s total revenues.

Apple Sales By Segment

Sales by segment (businessquant.com)

This figure represented the highest percentage of total sales since Q1 2021, three years ago. Another significant problem for Apple is that iPhone sales have peaked and are now declining.

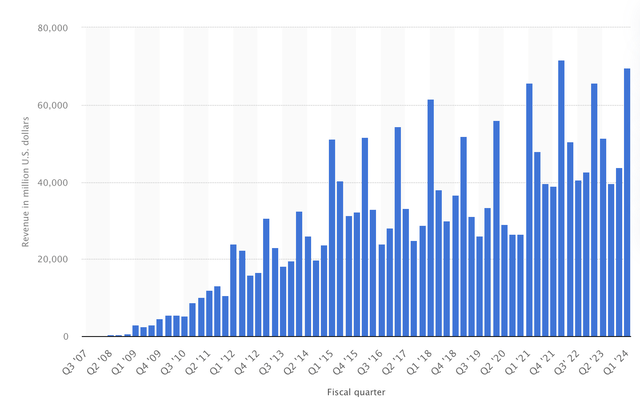

iPhone Sales By Quarter

In Q1 2022, iPhone sales were around $71.63 billion (registration required). In Q1 2024, iPhone sales were $69.7 billion, nearly 3% lower than two years ago. One major issue is that the iPhone has become stale, with its latest models still sporting a similar look as the iPhone 12. Why would I upgrade for incremental improvements I cannot distinguish from older models if I own the iPhone 12?

Do I need to get a slightly different black color variation? I don’t see a reason to upgrade. So, I am still using my iPhone 12 Pro Max. Likely, I am not alone, and more people may be using their iPhones for longer, three or maybe even four years, instead of the typical cycle of two years or less.

China Is A Big Issue

China is a massive market for Apple, with roughly 17.5% of its total sales coming from this one country alone. However, sales in China dropped by 13% YoY last quarter, and things could worsen. Due to the popularity of Huawei and other highly capable domestic smartphones, Apple’s sales crashed by 24% in the first six weeks of the new year. The weak demand has caused Apple to cut prices, a dynamic that will probably eat into its margins, negatively affecting Apple’s bottom line. Moreover, there is no clear catalyst for the trend to change, as Apple’s Chinese competitors continue innovating and appear to be winning the smartphone war in China.

Mac And iPad Sales Continue Slipping

Despite Apple’s progress with new in-house processors and new iPad/Mac models, the segments are not doing well (growth-wise).

Sales by segment (investor.apple.com)

The Mac space was essentially flat YoY, and iPad revenues crashed by over 25% YoY. Combined, the revenues of the two segments declined by 14% from last year. Apple’s wearables, home, and accessories segment, a formed bright spot, is also declining, with sales dropping by 11% from last year. Apple’s lonely growth engine, its services segment, which was putting up solid double-digit growth in recent years, also illustrates signs of a considerable slowdown, providing just 11% growth YoY.

The Vision Pro May Not Be A Blockbuster Product

There are “rumors” that Apple has sold around 200,000 units of its Vision Pro Headsets. However, at a nose bleeding $3,500 per unit, the headset could remain a relatively niche product instead of going mainstream (like the iPhone). Some analysts predict Apple will sell around 400,000 units this year and around one million Vision Pro Headsets in 2025. However, 400,000 units represent about $1.4 billion in sales, and one million units is just around $3.5 billion, which is minuscule relative to Apple’s $383 billion in revenues last year, and is hardly capable of delivering significant growth, in my view.

Apple Is Not A Growth Stock Anymore

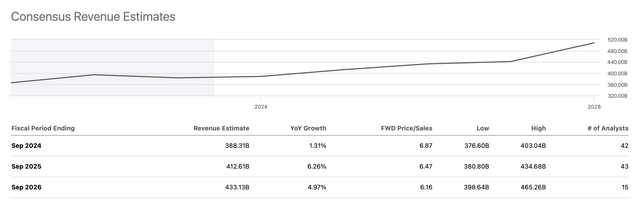

When Apple introduced the iPhone and brought other highly innovative products to the market, it was a growth stock. However, the market has become highly saturated with Apple products, and Apple is not a growth stock anymore.

Sales growth (seekingalpha.com )

In fact, Apple’s future growth appears exaggerated, as there are no clear catalysts to spark considerable growth. On the contrary, Apple’s sales declined by about 3% last year, and revenue growth projections for this year are under 2%. Therefore, Apple’s 2024 sales will likely be below 2022 levels, illustrating that Apple’s growth is stagnating without a comprehensive catalyst to improve.

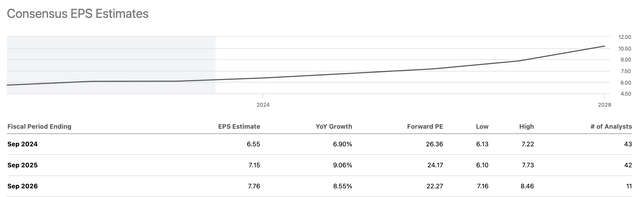

EPS Could Stagnate Or Decline

EPS projections (seekingalpha.com)

Apple’s EPS increased by just two cents year over year last year. Therefore, I am not sure where the projected 7-10% EPS growth will come from in future years. On the contrary, Apple faces margin compression issues due to increased competition in China and other areas. Therefore, we may see stagnant or declining EPS instead of the anticipated growth.

Apple could earn around $6 per share, toward the lower end of analysts’ EPS estimates this year and in 2025. This dynamic implies that Apple’s EPS could stagnate for 3-4 years, which doesn’t warrant a relatively high multiple of 25-30 times projected EPS.

Nonetheless, Apple continues to have a high valuation, which may continue to decline as multiple compressions occur. $6 in EPS implies that Apple trades around 29 times the forward P/E multiple, a very high valuation for a company in Apple’s place.

Therefore, we may see further multiple compression and a lower stock price for Apple in the near term, and the market may revalue Apple as a “standard” value stock as we advance. With EPS of around $6-7 and a P/E multiple of 18-20, Apple’s “fair value” may be around $110-$140. Thus, Apple remains a hold for me, with an initial buy-in target below $150.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!