Summary:

- Tesla, Inc. has seen its share price decline more than 50% from its peaks, and we don’t see that changing.

- The company’s growth rate and margins declined substantially year-over-year, and the company expects that to continue.

- Lack of additional full self-driving purchases as the company remains behind could hurt margins even more.

SimonSkafar

Tesla, Inc. (NASDAQ:TSLA) is down more than 50% from its late-2021 peak, but continues to have an almost $600 billion market cap. As the electric vehicle (“EV”) company’s growth continues to collapse, as we’ll see throughout this article, Tesla stock remains heavily overvalued. That means now is still a great time to bet against the company.

Tesla Results Summary

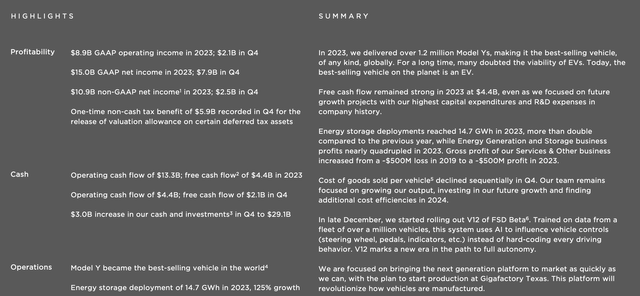

The company is now consistently profitable; however, those profits still need to be contrasted to an almost $600 billion market cap.

The company in 2023 had just under $9 billion in GAAP operating income and just under $11 billion in non-GAAP net income. The growth through the year wasn’t incredibly strong, with Q4 performance across the board one of the company’s weaker quarters. The company’s free cash flow, or FCF, was a mere $4.4 billion in the year, although it finished the year strong.

It’s worth noting the company’s FCF yield is only 1.5%. The company’s energy storage business is the strongest in its portfolio, but still small in relation to its business. 2023 was a year of major price cuts for the company, despite continued cost reductions, which has put pressure on prices.

Tesla Financial Performance

The details of the company’s financial performance and slowing growth are below.

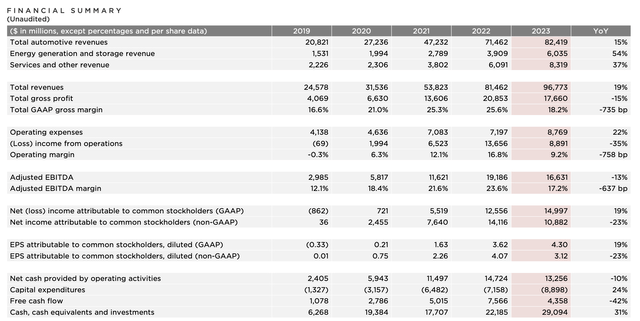

The company had $82.4 billion in revenue growth, or 15% YoY growth, its slowest growth by % in revenue in many years. The company’s energy generation and services revenue businesses were stronger, but are still an incredibly small performance of the company’s businesses. The company’s gross profit decreased 15% YoY.

That shows how the company’s businesses have peaked from a profit perspective from pandemic demand. Margins declined by more than 6% despite its focus on lowering prices, another sign of this, and non-GAAP EPS declined by more than 20%. Given the decline in margins as the company chased price declines, we expect weakness to continue.

Tesla Operational Performance

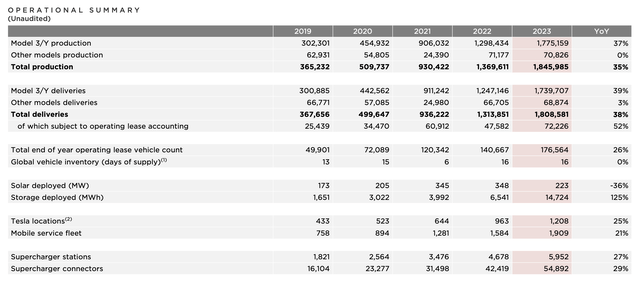

Operationally, it’s becoming more evident that demand for the company’s vehicles has peaked. That’s evidenced through both the company’s slowing down of revenue growth along with the lead time for vehicles on its website. Lead times on the company’s vehicles dropped 50% just a few months ago.

The company produced 1.85 million vehicles and sold 1.77 million for 37% growth. The company’s other models remained roughly flat. The company’s deliveries were also strong, but leasing for the company has grown quicker than deliveries. That’s concerning because leasing price is much more modifiable.

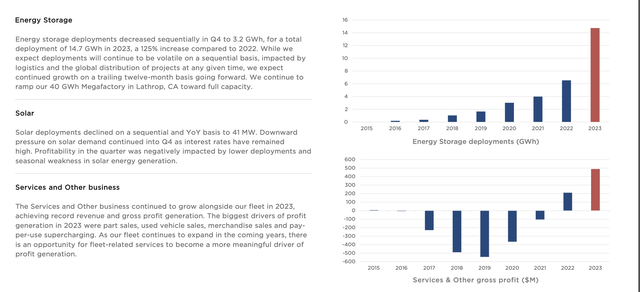

The company’s inventory has remained high versus the high demand of 2021. At this point, we view the company’s solar deployment business as worthless effectively as it continues to wither, but the company’s storage deployment business has remained incredibly strong. This is a bright spot, but a dramatically smaller part of the company’s portfolio.

Tesla Other Businesses

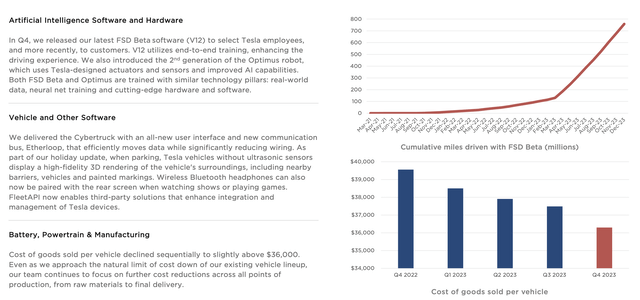

The company’s other businesses – artificial intelligence, battery manufacturing, energy storage, and solar – have a lot of variance in their strength. The company’s battery manufacturing business helps lower production costs. Its energy storage is a strong independent business. The company’s solar business is in decline. Artificial intelligence adds strong earnings to the company’s vehicles, but with a promise of future self-driving (“FSD”).

The company keeps discussing artificial intelligence and hardware associated, charging as much as $12k per vehicle to include it. However, the company still does not have full self-driving without a driver running, which is something that other companies such as Waymo are actively managing to do. The fact that the company does not have that testing indicates it’s actually behind.

Waymo (private) has recently received permission to operate its full self-driving system with no driver on highways. Mercedes-Benz Group (OTCPK:MBGAF) has beaten Tesla to achieving Level 3 self-driving. There have been setbacks with competitors, like Google’s (GOOG) Cruise stopping self-driving, but the key takeaway is that multiple competitors are ahead of Tesla, whose vehicles still need a driver and is charging massively for its FSD services.

In our view, this is a risk to the company’s earnings. When the company had more excitement, more customers were buying this feature. We expect that % to go down, costing the company additional margins. This slowdown is also evidenced through the fixed rate of cumulative mile growth, showing that customers are using it less per vehicle.

The company managed to reduce the cost of goods sold per vehicle, but margins still declined as selling prices had to decline. The company admits in its earnings slide above that “we approach the natural limit of cost down on our existing vehicle lineup,” meaning any further price decreases could hurt its margins even more.

The company’s megapack business is the one bright spot in its other businesses. The company increased deployments to 14.7 GWh for the year but had some weakness QoQ. It’s working to build a 40 GWh factory that it’s ramping, and selling prices are ~$500 million / GWh. That means that it’s $20 billion in annual revenue even at peak volume, 20% of its current automotive revenues.

That’s not bad, but it’s not enough to justify a $600 billion valuation or anywhere remotely close. We don’t know megapack margins, but we know it’s lower than vehicles given that the company delayed batteries from megapacks to keep them for vehicles. That means that margins here are less than 20%.

Tesla Outlook

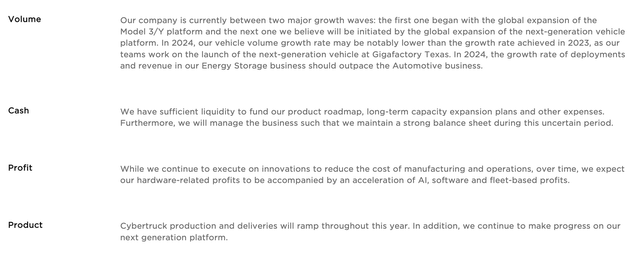

The outlook for the company is weak by the company’s own admission.

The company is impacted by China rapidly ramping up vehicle exports. The country became the number one vehicle exporter in the world in 2023 and dominates EVs. Local manufacturer BYD Company (OTCPK:BYDDF) overtook Tesla as the largest EV company in 2023, with more than 1.5x the market share of Tesla. BYD is not currently planning to come to the U.S., but in international growth markets remains a major competitor.

Numerous governments are concerned about China EV manufacturers’ low-margin vehicles and their impact.

Tesla had to cut prices substantially in 2023 and we expect price cuts to continue. Substantial car demand is coming from low-income countries modernizing, which are focused on lower cost vehicles. The company is focused on maintaining a strong balance sheet and profit, but in our view, it doesn’t have a strong path to getting the 5x / profits it needs to justify its valuation.

Tesla Changing Brand

Tesla’s earnings were more than a month ago, so the question becomes, what’s happening now that makes the update noteworthy today.

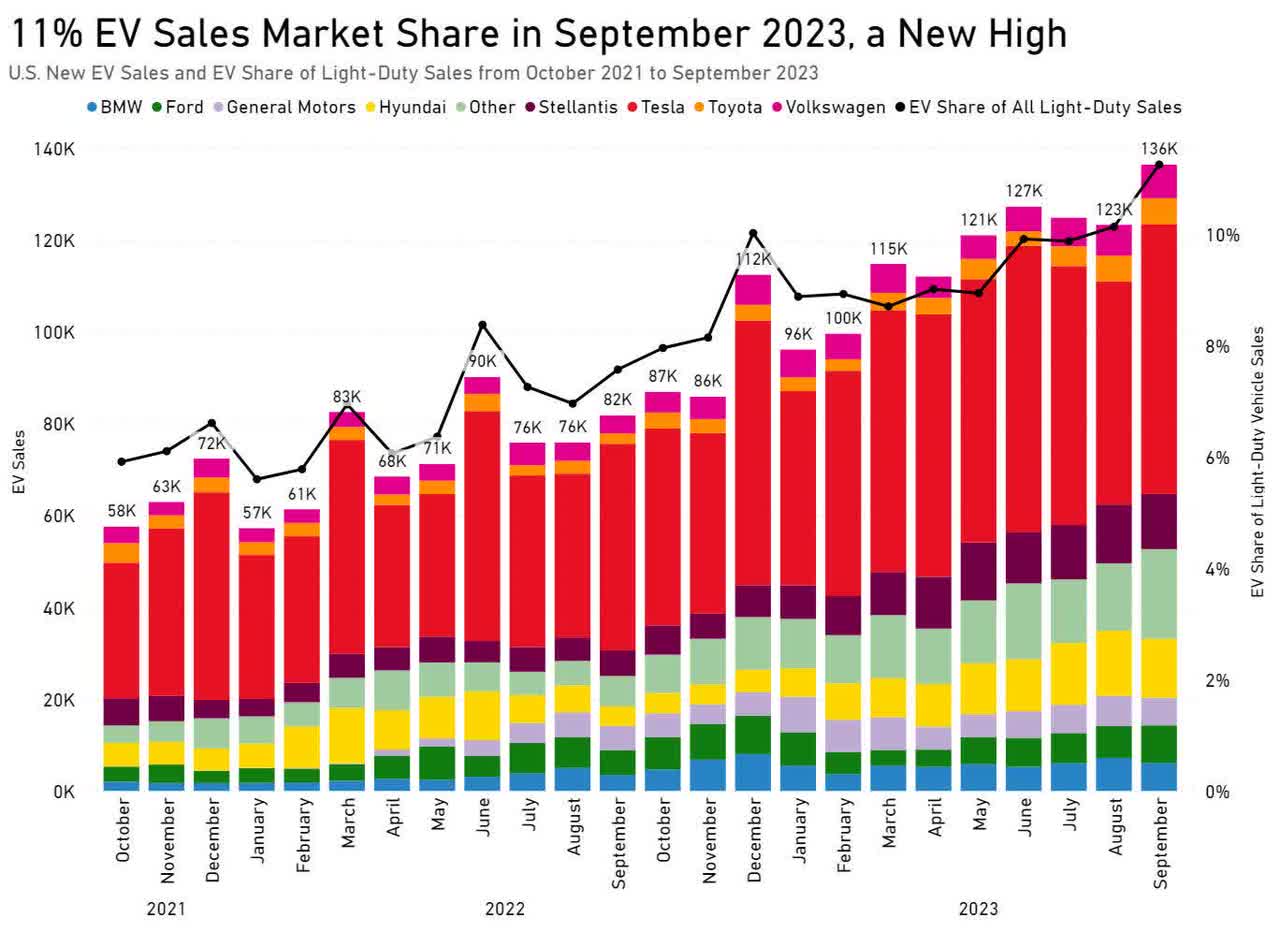

The catalyst in our view is increasing news coming out about dramatic increases in competition. Ford (F) in its most recent earnings reported more volume growth (by unit count) in hybrids than EVs. Over the past year, the % of customers who say they prefer PHEVs or Hybrid EVs over BHEVs has actually increased.

In the pure-play EV space, competition is increasing dramatically. China has had abandoned electric vehicles pile up after a production boom. China now is the world leader in EV production, while also having the largest EV fleet and charging infrastructure. That’s all sponsored by the government supporting local companies, and Tesla is clearly a victim in one of the largest car markets.

China’s EV exports continue to soar and many are priced much cheaper now than Teslas. The largest EV company in China, BYD, sells more EVs than Tesla now. This combined news of weakness in the company’s core markets and competition in export markets is a catalyst that can dramatically impact future growth and returns.

One Million EVs Sold Through September 2023 – Atlas EV Hub

The above chart shows how even in the core U.S. market for Tesla, while volumes have grown, its share of the market has dropped dramatically. The company in October 2021 a more than 60% market share, and towards the end of 2023, that’s dropped towards 50%. That weakness shows how other brands are becoming more competitive.

Due to the pressure from China, the so-called “flooding the market” has the White House concerned. It is based on state support and low costs. BYD has hit its highest vehicle export ratio, with continued price reductions. BYD might not be interested in the U.S. market right now, but Tesla is expanding internationally and needs to face international competition.

Tesla’s vehicle registration in China has become virtually flat mapping to last week, YoY, despite the company’s large bet in China, which hosts its second largest plant outside of the U.S. China represents more than 20% of the company’s revenue and is seeing virtually no growth. Indications are that Tesla’s incentives no longer help sales.

Thesis Risk

The largest risk to our thesis is the exuberance surrounding Tesla as an investment as the company makes new claims. Claims like self-driving, Tesla being taken private, a roadster with rocket boosters, etc. can all influence the share price, but right now, none of them exist in a full legal way for customers. That volatility is worth paying closing attention to.

Another risk for Tesla is new vehicles. The Cybertruck still has a massive number of reservations, and the Redwood project could be a $25k mass market EV. However, the company’s estimate is mid-2025, coming in after a more than 2-year-delayed Cybertruck. The company expects to sell 10k vehicles / week, meaning even if it meets all estimates, it’d see $12 billion in additional annual revenue (13%) for a very low margin vehicle.

Conclusion

Tesla is dead money. The vehicle growth counts and improving margins that drove true financial growth for the company have gone. By the company’s own admission, it expects vehicle growth rates to decrease dramatically. At the same time, it thinks it’s hitting the limit of cost reductions. Any price reductions will impact margins even further.

China EV manufacturers are ramping up scale and flooding the market. Protectionist measures might come into play but they’re not there. The company’s full self-driving business is far away from making any noticeable profit. The company’s energy storage business is exciting but remains weak and we know margins are below vehicles.

As a result, we expect Tesla’s share price to continue stagnating if not going down.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.