Summary:

- JPMorgan Chase is the largest bank in the US, with over $3.4 trillion in assets and a global market cap ranking of #1.

- The bank’s preferred stocks offer non-cumulative payments, but the Tangible Book Value and balance sheet of JPMorgan Chase support the safety of preferred stock investments.

- When compared against other banks and financial issuers, the JPM yields do not treat investors as well. Both only rate a Hold.

Michael M. Santiago

Introduction

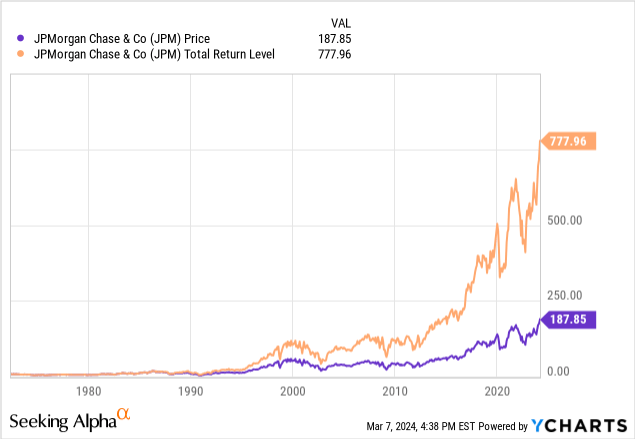

JPMorgan Chase (NYSE:JPM) is the largest bank in the country, holding over $3.4 trillion in assets. Globally, they rank #1 based on market-cap by a large margin. That should give comfort to preferred stockholders that their investments are safe from default on principal payments. The fact that common stock dividends have to stop if any of the many preferred stocks offered by JPM skips a payment, in my opinion, offsets the fact that payments are non-cumulative. While those are great pluses, investors can do better owning preferreds from other safe banks and financial issuers.

Here I review two of those preferred stocks that haven’t been covered since early 2023:

- JPMorgan Chase & Co. 5.75% SHS PFD DD (NYSE:JPM.PR.D)

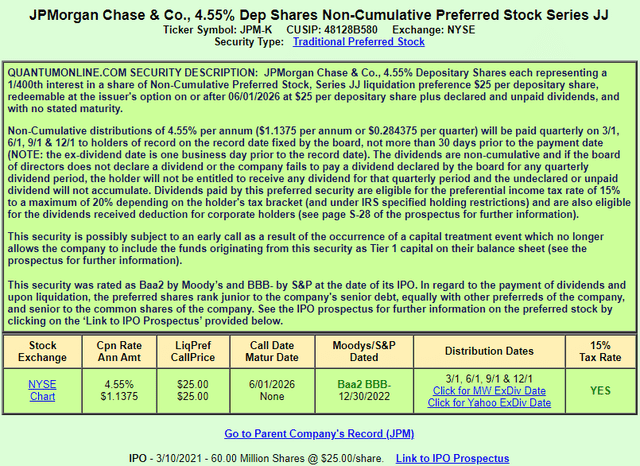

- JPMorgan Chase & Co. 4.55 DEP PFD JJ (NYSE:JPM.PR.K)

JPMorgan Chase reviewed

We are champions of banking’s essential role in a community – its potential for bringing people together for enabling companies and individuals to attain their goals and for being a source of strength in difficult times.

Jamie Dimon, Chairman and Chief Executive Officer

Source: 2022 Annual Report

Seeking Alpha provides this description of JPM (edited):

JPMorgan Chase & Co. operates as a financial services company worldwide. It operates through four segments: Consumer & Community Banking (CCB), Corporate & Investment Bank (CIB), Commercial Banking (CB), and Asset & Wealth Management (AWM). The CCB segment offers deposit, investment and lending products, cash management, and payments and services to consumers and small businesses. The CIB segment provides investment banking products and services, including corporate strategy and structure advisory, and equity and debt market capital-raising services, as well securities services, including custody, fund accounting and administration. The CB segment provides financial solutions, including lending, payments, investment banking, plus asset management. The AWM segment offers multi-asset investment management solutions to institutional clients and retail investors; and retirement products and services to high net worth clients. JPMorgan Chase & Co. was founded in 1799 and is headquartered in New York, New York.

Source: seekingalpha.com JPM

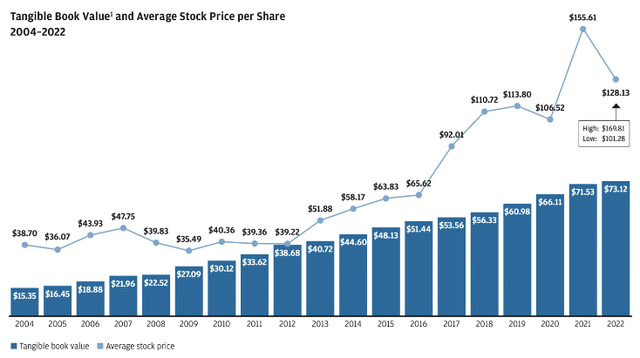

One value that backs preferred stocks is the Tangible Book Value, which has shown a 9% CAGR since 2004.

reports.jpmorganchase.com 2022 AR

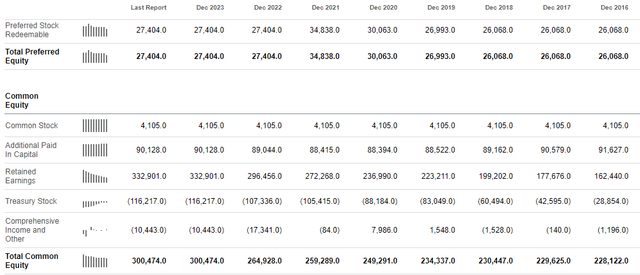

Despite my optimism about JPM, next I looked at the balance sheet to see if that is truly justified. Total Common equity is over 11X the value of all the preferred stock issued; one of the best ratios I have come across.

seekingalpha.com balance sheet

Another “comfort point” is if JPM defaults, investors have much bigger problems than the loss of one or two preferred stock issues!

JPM preferred stocks reviewed

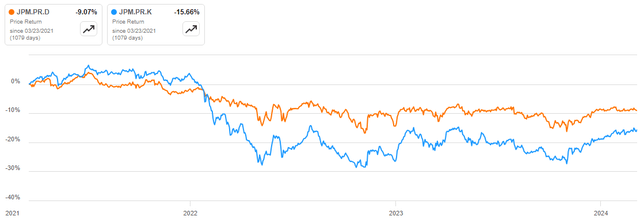

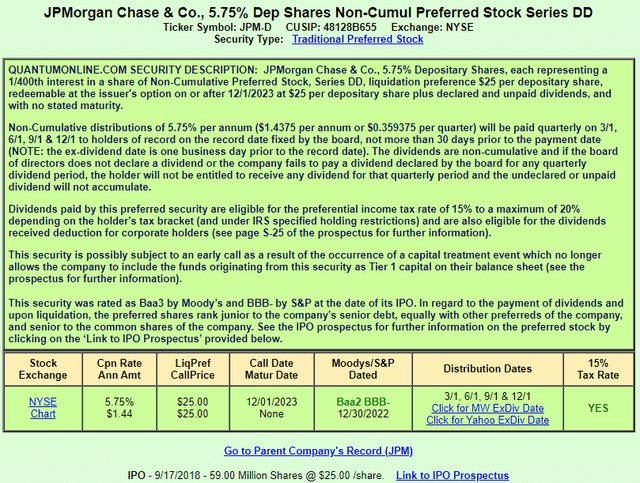

seekingalpha.com charting quantumonline.com JPM D

This issue just became eligible to be Called last December. That is important, as I found JPM called a 6.1% coupon preferred in the summer of 2021, which could explain why this issue hasn’t moved much above its $25 Par value. Citigroup (C) holders of their J Pfd were burned recently by it being called at when it was trading at $26.35: ouch! Investors in this issue should keep an open to whether the JPMorgan Chase & Co. 6 DEP NCM PFD EE (JPM.PR.C) issue is called as it becomes eligible on 3/21/24. It was the only callable issue with a higher coupon, but a fixed/floating one becomes eligible to float and be called, and I project it will be as the potential coupon will be over 8.5%! The good news there is JPM-D gains some call protection from both of those issues, which have a market-value close to $3b. Those pending call provide reasons why JPM-D wasn’t called once it was eligible, JPM is saving its cash for the two with higher coupons.

This issue still has just over two years before it can be Called, though there is an “early call” clause if the preferred stock can no longer be included as part of JPM’s Tier 1 capital. A Tier 1 requirement is the non-cumulative feature on the dividends. Payments are eligible for the 15% preferred tax rate (maximum of 20%). With rates set to decline later in 2024, their fixed-rate coupon should allow for better price returns than floating-rate issues.

As discussed above, JPM has several issues where the coupon cost to the bank is more than what JPM-K will have unless the 3-mo SOFR drops below; one of which I will be surprised if it isn’t called in April. (Author’s note: that Pfd has a $1000 face and isn’t listed on SA’s site) What makes this preferred “unique” within the JPM stable is its 4.55% fixed coupon, the second lowest of those I became aware of while researching this article.

Surprisingly, both issues reviewed here are rated at the lowest rung on the investment-grade scale: BBB-. The yields investors can get today from either issue do not reflect that low rating. I read that to mean the market believes the rating should be higher and that is important for it either was to downgrade one notch, investment-grade indices and ETFs that invest based on those indices would be required to sell their holdings, depressing the price until one of the “Angel” bond indices added them.

Portfolio strategy

I have recently reviewed preferred stocks from several banks: two global ones; two regional banks, plus one from another segment of the financial world. To evaluate the JPM issues, comparing features against some of those seemed appropriate. From each article, I picked one for this part, those being:

- Huntington Bancshares Incorporated 6.875% DEP PFD J (HBANL)

- Bank of America Corporation 4.250% DP PFD QQ (BAC.PR.Q)

- Citigroup Capital XIII – FXDFR PFS REDEEM 30/10/2040 USD 25 (C.PR.N)

- Banc of California, Inc. DEPOSITARY SHARE (BANC.PR.F)

- Stifel Financial Corp. 4.50% DEP PFD (SF.PR.D)

Clicking on the listed ticker will take you to the Seeking Alpha page, where you will find the article containing a review of that ticker. Here is how they compare. Including the coupon made the table too small to read, and I consider the current yield more important.

| Ticker | Price | Yield | Call date | YTC | 15% Tax | Rating |

| JPM D | $24.98 | 5.75% | Past | NA | Yes | BBB- |

| JPM K | $21.45 | 5.33% | 6/1/26 | 11.9% | Yes | BBB- |

| HBANL | $24.20 | 7.10% | 4/15/28 | 7.8% | Yes | BB+ |

| BAC Q | $19.72 | 5.40% | 11/17/26 | 13.8% | Yes | BBB- |

| C N | $29.25 | 10.17%* | Past | NA | No | BB+ |

| BANC F | $22.29 | 8.70%** | 9/1/27 | 11.6% | Yes | BB- |

| SF D | $18.00 | 6.25% | 8/15/26 | 19.1% | Yes | BB- |

* This is a TruPS security with a floating rate: 3-mo SOFR+26.16bps+637bps

** floating rate: 5-Yr UST rate + 482bps

Analysis

- Between the two JPM choices, I would give up some yield and own K over D for the Call protection and possible 11.9% YTC.

- The BAC-Q has both a better yield and YTC over both JPM issues and would be my choice between those three. Neither issuer will default.

- As holders of Citigroup PFD J (C.PR.J) experienced, it is dangerous holding a callable preferred selling above Par. While there must be reasons (accounting hit has been mentioned), I would avoid C-N with its price over $29.

- HBANL offers the best fixed-rate yield and longest Call protection. Offsetting those advantages is its low YTC. For investors thinking none will be Called, own this one.

- Between the two regional banks, BANC-F offers a better yield and YTC, assuming that happens. The rating difference doesn’t fully explain the better yield on BANC-F.

- With the SF-D having a 4.5% coupon, I see the 19.1% YTC as meaningless since this issue won’t be Called.

Conclusion

While I won’t go as far as giving either JPM preferred stock a Sell rating (Hold at best), the BAC is a better choice for global banks. Amongst the others, my favorite would be the BANC-F with its combination of in-the-middle values. I like that it uses the 5-Yr UST Note rate as its fixed-component.

Evaluating preferred stocks, in my humble opinion, boils down to a few factors:

- Do I believe in the issuer enough to not fear missing a dividend payout or its redemption value?

- If currently or soon-to-be callable, will it? If they think so, then does the YTC measure up well against other preferred I could hold instead?

- If the coupon floats, where do I see rates going if I am not a long-term holder where it is of less concern?

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SF.PR.D either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Alex Pettee is President and Director of Research and ETFs at Hoya Capital. Hoya manages institutional and individual portfolios of publicly traded real estate securities. Alex leads the investing group known as the Hoya Capital Income Builder, which uses the investment knowledge of several Seeking Alpha analysts provide members with insightful articles covering mostly individual stocks or funds. Occasionally an article cover will cover an investing strategy or other topic that investors need to be aware of, such as law changes that might effect their long-term strategy.

For more information about this Investors Group, click on this link: