Summary:

- Altria Group stock has slightly trailed the S&P 500 but remained resilient. MO attracts investors with its cheap valuation and robust dividend yields.

- Altria faces a structural decline in its legacy tobacco portfolio and must improve its portfolio transition to sustain a valuation re-rating.

- Despite challenges, Altria management is confident in its 2024 outlook and sees more robust growth in the second half of the year.

- A less hawkish Fed in 2024 should provide robust valuation support for MO.

- With MO still valued at a forward dividend yield of nearly 9.6%, it’s still very cheap and has a substantial margin of safety.

Mario Tama

In my previous update on Altria Group (NYSE:MO), I articulated that MO was working hard to establish a bottom. Over the past two months, MO’s performance has slightly trailed the S&P 500 (SP500) but remained resilient. As a result, I assessed that buying momentum on MO has strengthened as investors returned to the well-battered stock, taking advantage of its cheap valuation and robust forward dividend yields.

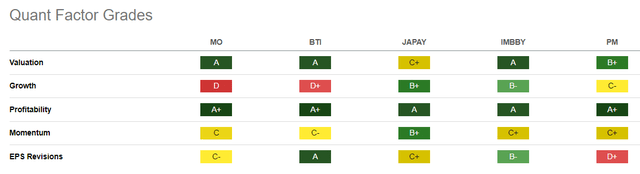

MO Quant Grades Vs. Peers (Seeking Alpha)

MO is assigned a best-in-class “A” valuation grade compared to its consumer staples (XLP) sector peers. However, tobacco leaders like Altria face a structural decline in their legacy portfolio, even as they restructure and move toward a “smokeless” future. Therefore, investors must be careful about anticipating a substantial valuation re-rating of MO in the near term.

A glance at MO against its peers in the table above should afford vital clues into their relative valuation grades. Consequently, I believe investors must consider the market’s perception of whether Altria can improve its growth opportunities in its core markets. I think a more robust improvement in its reduced-risk portfolio could drive a more sustained re-rating moving ahead.

Altria reported its fourth-quarter earnings release in early February 2024. There were concerns over the volume decline suffered by the company on its legacy tobacco portfolio relative to industry-wide domestic cigarette volume metrics. Accordingly, Altria suffered an adjusted decrease of 9% in Q4, above the 8% decline suffered by the industry. Notwithstanding its premium positioning, it suggests that macroeconomic headwinds, including inflation dynamics, have continued to hamper Altria’s recovery. Furthermore, the industry decline was way above the mid-single-digit average, indicating a cause for concern. With the recent CPI release showing that inflation headwinds have remained stubborn in 2024, Altria might need to move its discount segment more aggressively, mitigating the volume challenges.

I believe there are valid concerns about the extent of pricing actions to mitigate the headwinds observed in its legacy portfolio. Observant Altria investors should have observed that “higher pricing” helped withstand the “lower shipment volume and higher promotional investments” that affected its Q4 net revenues. Despite that, Altria’s ability to increase its adjusted OCI margin to 59% underscores its robust pricing power. Despite that, the market could remain worried about Altria’s ability to continue raising prices, given the observed structural volume decline.

Notwithstanding these challenges, Altria management is confident in its 2024 outlook. Accordingly, Altria reaffirmed its adjusted EPS of between $5 and $5.15 this year. The company sees a stronger H2, with “growth to be weighted towards the second half of the year.”

I believe MO’s headwinds in its legacy portfolio aren’t new. Income investors buying into MO’s attractive forward dividend yield of 9.6% (10Y average: 6.1%) could argue that significant pessimism is reflected in its valuation. Altria has also telegraphed that it assessed more robust opportunities with Altria’s reduced-risk portfolio to target ex-US markets, expanding its TAM. As a result, Altria has the potential to chart a stronger-than-expected growth trajectory. However, with arch-rival Philip Morris (PM) executing well with its newer portfolio across Philip Morris’s global base, Altria might need to focus on generating domestic market share gains through NJOY in the near term. With PM keen to expand Philip Morris’s US market influence through IQOS this year, Altria’s execution risks are expected to intensify.

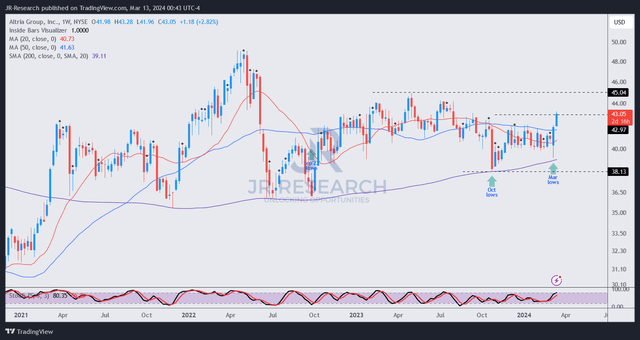

MO price chart (weekly, medium-term, adjusted for dividends) (TradingView)

As seen above, MO buyers haven’t been unduly concerned with headwinds attributed to weaker volumes. I adjusted the chart for dividends to better account for its performance, given its focus on income investors.

It seems increasingly clear that MO saw robust support above the $40 level, suggesting the worst is likely over. This week’s re-test against the $43 level could open up a further recovery toward the $45 level before finding more robust selling resistance.

I’m confident that MO’s well-battered thesis is positioned for a medium-term recovery, even as investors assess the execution risks from its portfolio transition to reduced-risk products. Its attractive valuation and robust dividend yield should also find stronger valuation support as the Fed potentially lowers rates in June.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!