Summary:

- fuboTV Inc. has filed a class action lawsuit against Disney, Fox, and Warner Bros. Discovery over a sports streaming joint venture, or JV, that poses a threat to its business.

- The JV plans to offer a bundle of sports content from various networks, potentially attracting sports-centric fans away from fuboTV.

- fuboTV’s weak financials, including large losses and limited subscriber growth, make it a risky investment.

grinvalds

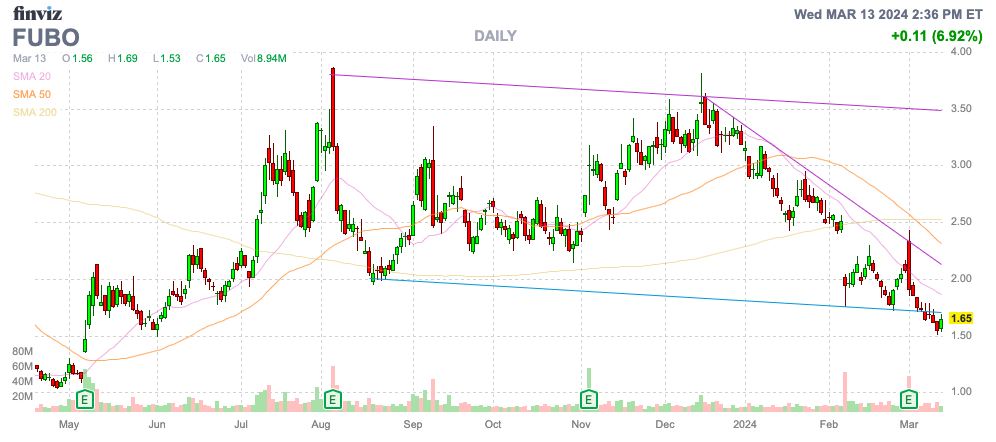

While fuboTV Inc. (NYSE:FUBO) has made some progress towards fixing the business, the media company still has cash flow issues to resolve. The large sports media partnership discussed below provides an existential threat to its whole business plan of providing a curated sports-centric entertainment offering. My investment thesis remains Neutral on the stock, even after the dip back below $2, due more to the ongoing weak financials.

Source: Finviz

Partnership Threat

The company has filed a class action lawsuit against The Walt Disney Company (DIS), Fox Corporation (FOX) and Warner Bros. Discovery, Inc. (WBD), who are forming a sports streaming joint venture (“JV”) expected to launch in the fall of 2024. The JV would be made directly available to consumers via an app and include the option to bundle the product with Disney+, Hulu and/or Max.

The service plans to include content from linear sports networks including ESPN, ESPN2, ESPNU, SECN, ACCN, ESPNEWS, ABC, FOX, FS1, FS2, BTN, TNT, TBS, truTV, as well as ESPN+. In essence, a large portion of sporting programs would be included in this bundle outside of regional sports networks and a few select programs on other streaming services, like the MLS on Apple Inc.’s (AAPL) Apple TV.

The JV would be equally owned by the 3 parties, but the economics would be split based on the programming. The sports content would be non-exclusive to the new JV, though the clear goal is to bypass a vMVPD service in order to save on the fees.

The major issue for fuboTV is whether the company has equal access to distribute the service. The content would apparently still be available to fuboTV subscribers via existing services, though the fear is that sports-centric fans might sign up for this bundle, with the CEO highlighting the issues on the recent Q4 ’23 earnings call:

We consider the defendant’s pernicious contractual terms and other anticompetitive practices borderline racketeering. As stated in our complaint, this Sports Cartel has levied content rates on us that are 30% to 50% plus higher than those of other distributors, forced us to license unwanted non-sports content to access their must-have sports programming, imposed above market penetration rates for this content and restricted our ability to offer certain features while permitting competitors and their own vertically integrated services to do so.

On the flip side, the JV could collapse before launch, if Warner Bros. doesn’t reacquire NBA rights, limiting what the media partner brings to the table. Not to mention, the JV will incur similar distribution costs by forming a new management team, building an app and other costs to form the partnership. Ultimately, the JV provides another collection of sports programming without a complete set and further media rights shifts towards tech giants would only make this JV less valuable in the future.

fuboTV recently signed a carriage deal with MASN Sports to stream Baltimore Orioles and Washington Nationals games to local subscribers in an MLB deal that clearly won’t be available on the JV. The sports-focused streaming service is definitely smart to push back on any streaming service blocking their access to content, but the JV just appears to be another ad-hoc service with incomplete access to sports content.

Limited Margin Of Safety

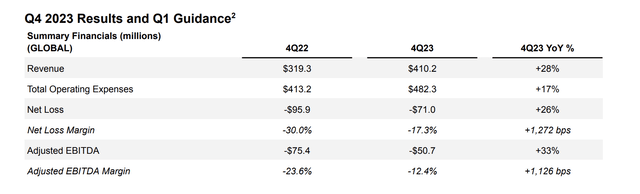

The biggest issue facing fuboTV is the limited margin of safety with the business still producing large losses. The sports streaming service recently reported Q4 ’23 revenues jumped 29% to $410 million, but the company still reported an adjusted EBITDA loss of over $50 million.

Source: fuboTV Q4’23 shareholder letter

Sure, the EBITDA loss improved nearly $25 million YoY, but the company still doesn’t plan to be adjusted EBITDA-profitable until sometime in 2025. The business only generates a 10% gross margin, leaving fuboTV susceptible to any small adjustment to the market like the above-discussed sports content partnership.

The key North American subscriber base is only forecast to reach 1.650 to 1.685 million in 2024 after reaching 1.618 million in Q4 ’23. The limited subscriber growth in a range of 4% doesn’t provide a lot of confidence in fuboTV cutting the large ongoing losses, though the company projects revenue growth rates up at 13% due to expanding ARPU.

The company only has a cash balance of $251 million, leaving the 2025 goal of reaching cash flow positive as a business requirement, much less a corporate goal. fuboTV burned $173 million in operating cash flows last year.

The stock has fallen back below $2, pushing the market cap to only $500 million. The company just has far too many hurdles in the content distribution business in order to warrant an investment considering so much can happen over the next 18 or so months before fuboTV becomes cash flow positive.

Takeaway

The key investor takeaway is that fuboTV Inc. stock remains a tough investment due to the weak financials, not so much the potential sports content partnership. Investors should avoid the stock until the prospects improve with signs of sustainable large cash flows, not just visibility to cash flows turning positive sometime over a year away.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.