Summary:

- KLA Corporation reports Q2 Fiscal 2024 earnings, with net income of $582.5 million and earnings per share of $4.28.

- Sales exceed expectations at $2.49 billion, but the net income decline is attributed to impairment charge.

- Company issues lower guidance for next quarter, citing challenging market conditions and limited visibility.

SweetBunFactory

KLA Corporation (NASDAQ:KLAC) has just published its quarterly earnings results. It reported GAAP net income of $582.5 million and GAAP earnings per diluted share of $4.28 on revenue of $2.49 billion. According to Rick Wallace, the results were well ahead of the expectations. However, the company’s indicators still seem to be lower compared to the previous periods. Let me cover this in some more detail in this article.

Recap of my previous article

In my previous article on KLA Corporation, I gave a bullish forecast on its stock. The company has been recording revenue and EPS growth for a while, whilst its valuations have been quite moderate in comparison to its peers in the semiconductors and artificial intelligence industries. The main risk was that of an economic slowdown. Moreover, the semiconductors industry is reliant on the political factors, including the US-China relations. But overall, the stock had good prospects, in my opinion. KLAC’s stock price has risen substantially since then. Now I am writing an update of this company.

Earnings press release and earnings history

At short, the results exceeded expectations.

- The total sales were $2.49 billion, above the midpoint of the guidance range.

- GAAP diluted EPS attributable to KLA was $4.28, whilst non-GAAP diluted EPS attributable to KLA was $6.16, near the upper end of the guidance range.

- The cash flows from operating activities for the quarter totaled $622.2 million, whilst for the last twelve months these were $3.48 billion. The free cash flow for the quarter was $545.4 million and $3.17 billion for the 12 months, respectively.

But let us have a look at these in the context of KLA’s earnings history.

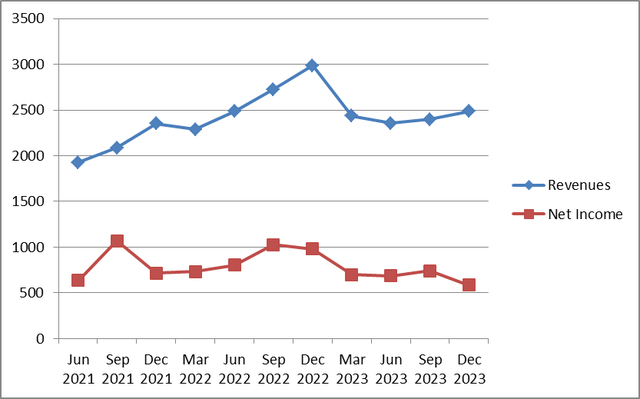

KLA Corporation – quarterly revenues and earnings

|

Quarter |

Jun 2021 |

Sep 2021 |

Dec 2021 |

Mar 2022 |

Jun 2022 |

Sep 2022 |

Dec 2022 |

Mar 2023 |

Jun 2023 |

Sep 2023 |

Dec 2023 |

| Revenues | 1926 | 2084 | 2353 | 2289 | 2487 | 2724 | 2984 | 2433 | 2355 | 2397 | 2487 |

| Net Income | 633 | 1068 | 717 | 731 | 805 | 1026 | 979 | 698 | 685 | 741 | 583 |

Source: Seeking Alpha

Compared to the previous quarters, the recently reported net income figure was not great, by all means. The sales, however, were reasonable and quite in line with the previous periods. At the same time, the net income decline can be explained by a $219.0 million impairment charge for goodwill and purchased intangible assets, or $1.59 per diluted share. So, overall, the quarterly earnings were good.

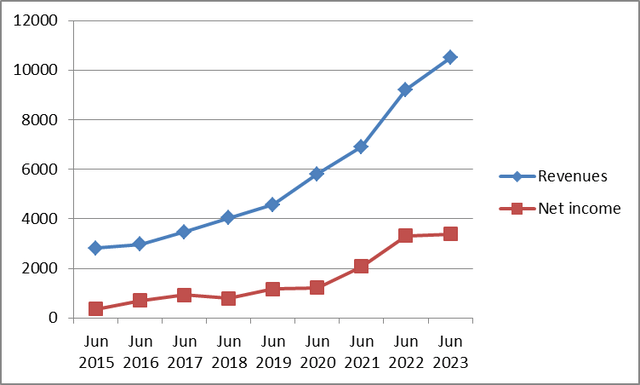

KLA Corporation – annual revenues and earnings

| Year |

Jun 2015 |

Jun 2016 |

Jun 2017 |

Jun 2018 |

Jun 2019 |

Jun 2020 |

Jun 2021 |

Jun 2022 |

Jun 2023 |

| Revenues | 2814 | 2985 | 3480 | 4037 | 4569 | 5806 | 6919 | 9212 | 10496 |

| Net income | 366 | 704 | 926 | 802 | 1176 | 1217 | 2078 | 3322 | 3387 |

Source: Seeking Alpha

Although my article is mostly centered around the recent quarterly earnings, I would briefly touch on the company’s annual results history. If we look at the table, the sales and net income picture looks almost impeccable. However, we can see there was a net income growth slowdown between 2022 and 2023.

Other news and developments

But what about other news and developments? Well, the management issued rather cautious guidance, whilst the stock price is down about 7% as I am writing this. Investors appeared to look poorly at the company’s near future and the next quarter’s results. The management expects the total revenue to range from $2.175 billion to $2.425 billion in the next quarter, which is below the analysts’ expectations of $2.46 billion. KLA expects the EPS to range from $4.66 to $5.86, versus the expectations of $5.86. According to the company’s CEO, the “market conditions remain challenging in the near term, with limited visibility regarding the timing of a resumption in sustainable demand“. However, Rick Wallace simultaneously believes the company “has stabilized around current revenue levels“.

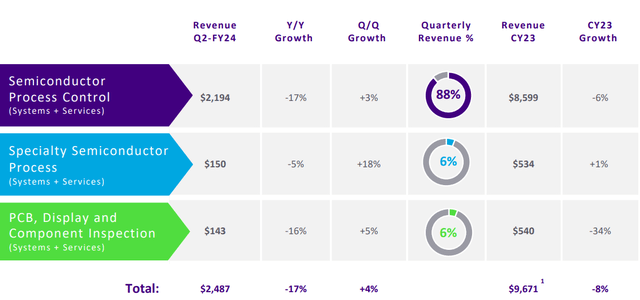

But it seems clear the growth rate has slowed down in the past quarter. Only the Specialty Semiconductor Process segment has shown positive revenue growth. However, the PCB, Display and Component Inspection and Semiconductor Process Control have shown negative growth number of (34%) and (6%) respectively.

Breakdown of Revenue by Reportable Segments and End Markets

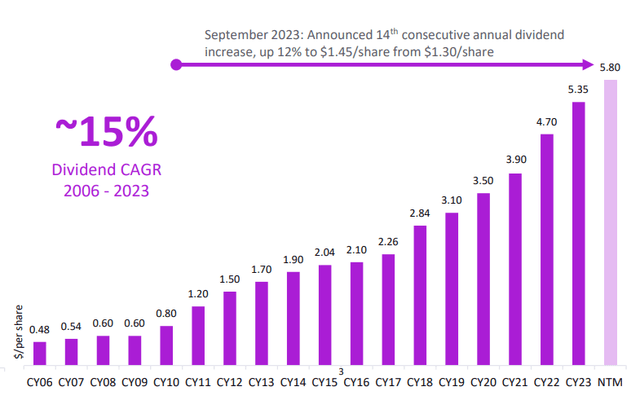

In spite of the rather poor revenue results, the company can still afford to pay dividends. In September 2023 KLA announced a 14th consecutive annual dividend increase, a rise of 12% to $1.45 per share from $1.30 per share. The total 2024 dividend is expected to be $5.80. This is quite a sign of stability. Few companies in the high-tech sector increase dividends for so many consecutive years.

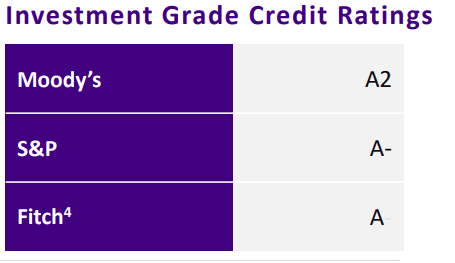

Other fundamentals

The company’s financial fundamentals are quite sound. In fact, KLA Corporation is rated A2 by Moody’s, A- by S&P and A by Fitch. The credit rating is somewhat below the US Treasurys’. But still, KLA’s bonds are well investment grade.

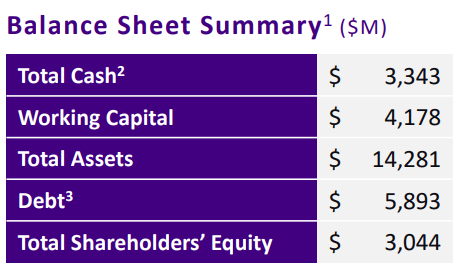

KLA Corporation

The net debt is quite low. The total cash is $3343 million, whilst the debt is $5893 million. This means the net debt is only $2 550 million, quite reasonable for a large and profitable company like KLA.

KLA Corporation

Interestingly, many semiconductors companies and businesses operating in the high-tech sector have negative shareholders’ equity. But this is not true of KLA. Its total shareholders’ equity is $3044 million, not brilliant but sound enough.

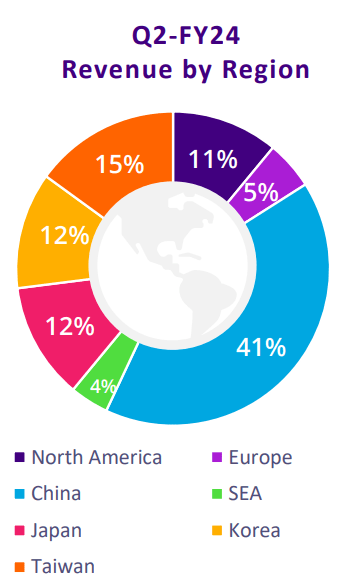

Risks

Apart from the economic slowdown and the semiconductors industry recording somewhat poorer results, KLA Corporation is vulnerable to some political risks. A lion’s share of its sales – a whopping 41% – is due to China. Obviously, this is subject to any problems arising from the US-China relations. Right now, tensions around Taiwan seem to escalate.

KLA Corporation

But the biggest problem with KLA is its own growth slowdown. However, the stock is still not expensive.

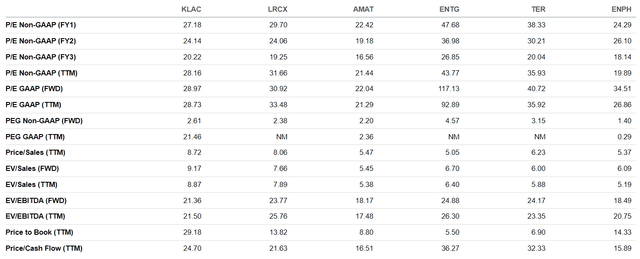

Valuations

Yes, KLA’s GAAP P/E of 28.73 is not very low compared to the S&P 500’s average of 23.27. However, compared to its peers, the company is fairly valued. The same is true of its other valuations ratios.

So, I would say that KLA’s valuations are not the key downside risk. The company’s stock is reasonably valued.

Conclusion

KLA Corporation is a financially sound business. Its revenue growth is slowing down somewhat. However, its debt position is sound, and the stock is not overvalued. The company has been raising its dividends for many years in a row and is still very profitable. However, the industry’s slowdown and the deteriorating US-China relations might negatively affect the company’s performance. So, I would rate the company’s stock as a “Hold”, a downgrade from my previous “Buy” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.