Summary:

- After explosive growth during the pandemic, Fiverr’s revenue grew 7% in 2023 and is expected to grow just 6% in 2024, based on company guidance.

- FVRR is facing transitionary headwinds as it transforms its customer base and service offerings while driving profitability in an uncertain economic environment.

- Despite all doubts, AI was a net positive for the Company in 2023 and will be an even bigger growth driver in the future.

- Fiverr has a strong balance sheet, turned profitable on a GAAP basis, and delivered an impressive $82 million free cash flow in 2023.

- With a fair value range of $27 to $50, FVRR presents an attractive opportunity for investors with a 3-to-5-year investment horizon.

Filmstax

Fiverr (NYSE:FVRR) is an online marketplace that connects freelancers offering digital services with clients seeking to outsource tasks or projects. Founded in 2010, the company has grown into a global platform facilitating transactions across various categories such as graphic design, writing, programming, digital marketing and more recently, AI-based services. With a user-friendly interface and a vast pool of talented freelancers from around the world, Fiverr provides businesses and individuals with access to affordable and high-quality services tailored to their needs.

Thesis

After seeing its sales explode in 2020 and 2021, FVRR stock was hyped to over $300, representing a market capitalization in excess of $11 billion at a time when the company was far away from making any profit. Investors assumed that growth rates in the mid-double-digit range could be maintained, and they were proven wrong after Covid ended, the Fed started tightening, and AI emerged as a potential threat.

Fast forward, FVRR now trades around $23, representing a market capitalization below $900 million and an enterprise value [EV] below $700 million, as the company built up a net cash position of about $200 million. Based on the $82 million free cash flow [FCF] it generated in 2023, FVRR trades at an EV/TTM FCF ratio of just 8x.

The main reason for the depressed valuation is the slow revenue growth of 7% in 2023, and the lackluster guidance of 6% growth in 2024. Interestingly, the street is not giving Fiverr any credit for turning profitable (on a GAAP basis) in 2023, nor for its impressive 23% FCF margin. In this article, I am unpacking the reasons for the slowdown, and I explain why I believe it is transitionary. I am also making the case that AI will be a tailwind for Fiverr in years to come, which may still be considered a contrarian view at this stage.

Based on my analysis, FVRR has a fair value of $37, with a range of $27 to $50. While the stock may struggle for catalysts in the coming 6-12 months, it is a buy for me with an investment horizon of 3 to 5 years.

Secular Tailwinds Vs. Near-Term Macro Headwinds

After COVID-19 drove huge growth in the “gig economy” in 2020 and 2021, massively benefiting online freelancing marketplaces like Upwork (UPWK) and Fiverr, growth slowed down significantly in 2022 and 2023 and is expected to remain subdued going into 2024. Meanwhile, the mid- to long-term outlook for the industry remains bright, according to about any market research report you can find out there.

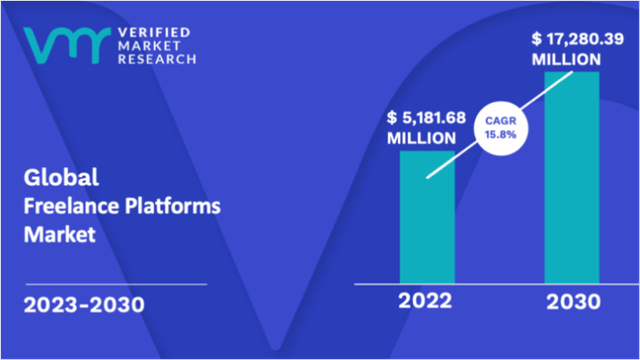

Here are a few growth projections for the freelance platform market:

- Grand View Research: 12.7% CAGR 2023-2030 (U.S. only)

- Mordor Intelligence: 16.7% CAGR 2024-2030 (global)

- Skyquest: 14.2% CAGR 2024-2030 (global)

- Verified Market Research: 15.8% CAGR 2022-2030 (global)

Global Freelance Platforms Market 2023-2030 (Verified Market Research)

While it is important to always take market research projections with a grain of salt, there are good arguments in favor of sustained growth in the online freelancing space over the decade ahead. Matthew Mottola published an article on Forbes, explaining why every enterprise needs a freelance strategy moving forward.

I have summarized below the author’s main arguments for a growing freelance economy:

- The freelance economy will continue to grow as more and more talents in younger generations prefer self-employment. The freelance workforce covers every skill and role and is on a path to becoming the larger part of the working population by 2030. Nearly 4 out of 5 employers report difficulties hiring the talent they need, according to research by the Manpower Group. Yet, a lot of this talent can be found in the freelance economy.

- Businesses need more flexibility than ever in today’s fast-changing environment. Companies not only need to cope with geopolitical and macroeconomic uncertainties. They are also facing stiff competition, fast innovation, and rapid technological change. All this requires more agile and cost-effective staffing strategies to continuously adapt to new demand trends and market conditions.

- The freelance economy has better unit economics. Using freelancers allows companies to pay for outcomes (or by the hour) while significantly reducing the overhead cost, also relative to other flexible hiring solutions (e.g., from temporary staffing firms or consultancies).

- The freelance economy consistently offers access to cutting-edge skills. As technology evolves fast, it has become increasingly difficult and costly for companies to continuously up-skill their workforce. Tapping into the (online) freelancer talent pool, companies get access to the latest skill set at much lower cost.

While I am aligned with the conclusion that these trends present secular tailwinds for the freelancing industry for years to come, it is clear that growth will not be linear, and that the speed of growth will depend on a number of other factors. COVID-19 was a unique factor that accelerated online freelancing for a 2-year period. The end of the pandemic did not undo this shift, but as a share of “COVID-19 freelancers” returned to other jobs, it certainly slowed down growth significantly.

Another important factor is economic conditions. The freelancing industry, like other forms of temporary labor, is generally more exposed in periods of economic slowdown. Companies will tend to reduce their discretionary expenses and flexible workforce first, before paying large sums on a restructuring program. And as we know, 2023 started and finished with many companies, including the likes of Meta or Google, announcing massive layoffs. On the other hand, when the economy rebounds, flexible labor solutions can benefit earlier as companies avoid adding back fixed costs right away. But that will likely not happen in 2024 yet.

To make a long story short, the good news is that Fiverr operates in an industry that is directionally bound to grow faster than the broader economy in years to come. The caveat is that this growth will be cyclical rather than linear, which will create volatility – both in the company’s results and in its valuation.

Aside from broader economic factors, the recent surge of AI-based tools has raised additional questions marks on the future of certain services and professions. Let’s take a closer look at how AI might impact Fiverr’s business moving forward.

AI: Threat, Or Opportunity?

Looking at the economic impact of breakthrough innovations in human history, all of them were disruptive for some while creating new opportunities for others, the net of both always being vastly positive (at least economically speaking, I will avoid any social or ethical considerations here).

AI will be no different, and actually first studies already provide proof points of the disruptive effects of the new technology on many professions, including those of freelancers offering their service on online freelance portals like Fiverr’s. Translators, writers, video editors, you name it. If you are providing basic services in any of these professions, no doubt your job security is in danger. And true, by extension, this means less gigs and thus less commissions for Fiverr from such basic services.

Yet, to conclude from such studies that AI is a threat to Fiverr’s business model is a mistake. Actually, quite the opposite may be true. Fiverr’s business is to provide a trusted platform to connect people in search of a service (buyers) with experts able to provide such service (sellers). It does not really matter what service that is, as long as it can be completed remotely and delivered digitally. It also does not matter who the sellers are, as long as they are good at what they do and their services are in demand. And actually, Fiverr’s business model naturally benefits from a shift from simple to more complex (AI-based) services, as these tend to sell at higher prices. In 2023, Fiverr reported that the average transaction size for complex services was 30% higher than for simple services.

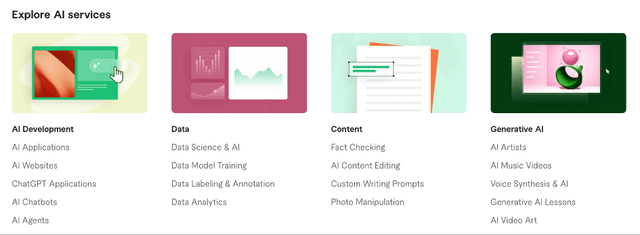

Let’s take a look at how AI impacted Fiverr in 2023. In January, Fiverr was the first platform to market to launch a dedicated AI service vertical, which currently looks like this:

Fiverr’s AI-based Services (Fiverr website)

While AI development services are a totally new field providing services around the AI technology itself, the data, content and generative AI services are making use of artificial intelligence to deliver existing service types faster or in new ways. Those are the types of services that will most likely sooner or later replace their non-AI based counterparts.

The number of gigs completed by top sellers across the AI services range is still very low relative to other categories. Nonetheless, management estimates that AI already contributed a net positive 4% to the business in 2023. There is certainly some art to this number, notably surrounding the assumption about how much of the “double-digit decline in simple services” (that Micha Kaufman, the CEO, called out in Q&A) is attributable to AI.

According to my napkin math, revenue from AI must have been between $13 million (that is 4% of 2022 revenues) and $27 million (as the total revenue decline in simple services was about $14 million), depending on the assumed AI-related erosion in the simple services segment. That is about 4 to 8% of total revenue in year 1 of launching the AI service range.

We are only at the very beginning of discovering what AI can do for businesses in everyday life, and what matters is that Fiverr is well positioned to capitalize on future AI-related services on its platform, many of which none of us could even imagine today. And while simple services may be entirely displaced by AI over time and won’t likely need much human support at all, many more complex, higher value service opportunities will arise to drive sustainable and profitable growth.

So, to conclude: AI is definitely more an opportunity than a threat for Fiverr. Even if the short-term net growth contribution is muted as AI-based services cannibalize other simple services on the platform, I am convinced that AI will most be a sizable net positive opportunity for Fiverr in the mid- to long-term.

But before we take a look further into the future, let us address the elephant in the room: Fiverr’s lackluster growth in the near term.

Why Near-Term Growth Trends Are Disappointing

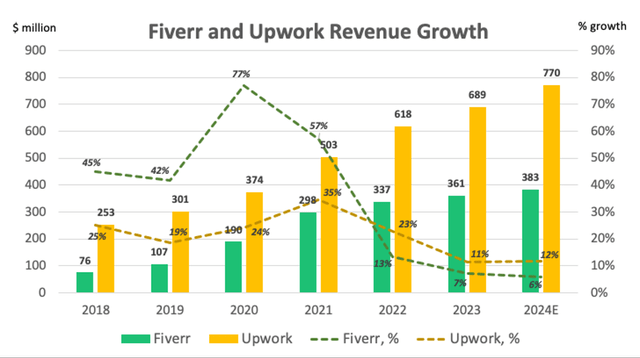

Fiverr revenues only grew 7% in 2023, and management guided it to just 6% growth in 2024 (at mid-point). Micha Kaufman is calling out the challenging macro-environment, which I alluded to earlier, as the main culprit. But that seems to be only part of the story. When comparing Fiverr’s growth trajectory to Upwork’s (the largest online freelancing platform, and one of Fiverr’s main competitors), it becomes difficult to blame lackluster performance on industry headwinds alone.

Fiverr vs. Upwork Revenue & Growth (Stock Research Platform)

Fiverr’s slower growth in 2022 (13%, vs. 23% for Upwork) can be explained as a normalization from a much more pronounced COVID-19 boost. Indeed, Fiverr massively outgrew Upwork in 2020 and 2021. From being just 35% of Upwork’s revenue size in 2019, Fiverr jumped up to 60% of Upwork’s size in 2021 and looked poised to become the #1 player in the online freelancing market a couple of years down the road.

Now it looks like that is not going to happen anytime soon, as Fiverr’s growth fell to the mid-single digits in 2023 and management expects to repeat this performance in 2024. Meanwhile, Upwork sustained low double-digit growth in 2023 and expects to even see a slight acceleration in 2024.

So why is Fiverr losing out to Upwork, at least when it comes to revenue growth? Here is my take on it.

While both Fiverr and Upwork offer a platform with the purpose of matching buyers (“employers”) and sellers (“freelancers”), their approach to the market is actually quite different. If interested, you can read the comprehensive comparison of both companies by Hostinger, while I will focus here on the key differences which in my view explain Fiverr’s relative underperformance in the current market environment.

The most fundamental difference goes back to Fiverr’s roots. The company name literally comes from a $5 bill, also called a “fiver”. This is how the company started out, offering services starting at $5, and while Fiverr has expanded its service offerings upstream in recent years, cheap services are still a core part of Fiverr’s business. A lot of them are what the company now calls simple services, which have quick turnaround times and do not require a lot of skill. In contrast, Upwork’s business model is centered around larger, more complex projects, often with longer-standing relationships between buyers and sellers. This has a number of ramifications in the context of both the emergence of AI and a slowing economy in 2023/2024.

First, we already discussed how AI has started and will continue to displace basic gigs (translation, voice-over, etc.), while it will create opportunities for more and more complex service offerings in the future. Even if AI is a net positive for Fiverr as the company transitions to new service categories, the cannibalization of revenues from simple services will be inherently much higher than for competitor Upwork, which did not rely much on revenue from such services in the first place.

Second, Fiverr’s revenues, which still predominantly come from one-time gigs, are much more sensitive to fluctuations in the broader economy compared to Upwork’s revenues from larger projects, which are often based on more durable relationships between companies and freelancers. This effect is magnified by the fact that Fiverr’s customer base is mostly composed of freelancers (who seek help from other freelancers) and smaller companies, compared to a larger average client base for Upwork. Those smaller customers are also much more exposed to economic cycles than their larger counterparts.

Let’s now take a closer look at how these factors translated into only 1% growth in gross merchandise value [GMV] in 2023.

Why Slow GMV Growth Is Likely Transitionary

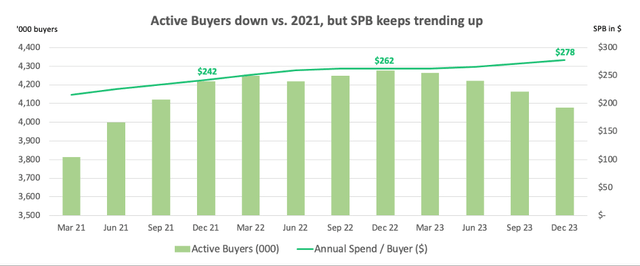

The AI shift and slowing economy translated into a “dramatic” drop in the number of active buyers for Fiverr in 2023, down 5% vs. prior year, from 4.2 to 4.1 million. This contrasts with a 5% growth of active clients reported by Upwork, up to an all-time high of 851 thousand. Interestingly, however, Fiverr calls out that buyers with an annual spend above $500 grew 4% year-over-year.

While the downward trend in Fiverr’s total active buyers is clearly not sustainable long-term, it is a (logical) consequence of the company’s transition from a business model that grew massively from a large number of small customers to a business model that focuses more and more on larger buyers and longer-standing relationships. Next to the aforementioned growth in higher-spend customers, this transition is also positively reflected in the continued increase of overall average spend per buyer [SPB], up 6% to $278 in 2023, vs. $262 in 2022.

Fiverr Active Buyers & Spend per Buyer (Stock Research Platform)

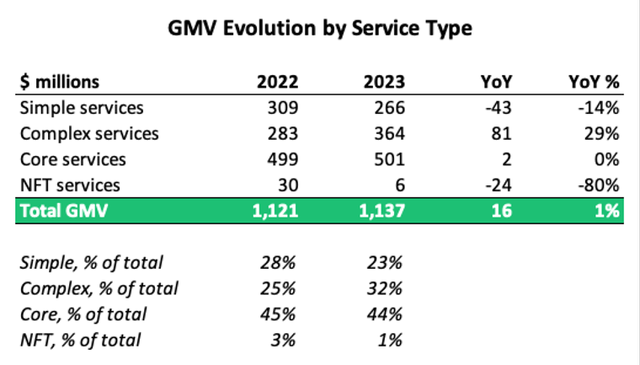

Unpacking the total GMV growth using the comments provided in the business update section of the Q4-2023 letter to shareholders, the change in service mix becomes very evident.

2022-2023 GMV estimates by type of service (Stock Research Platform)

A couple of comments. First, let’s briefly highlight that NFT-related services, which became “a thing” during the COVID-19 bubble, no longer spur any interest from buyers. Assuming directionally similar take-rates across the different service categories, NFTs caused a -210bps headwind to both total GMV and total revenue growth. This is a clear one-time effect, as there is (almost) nothing left to lose.

Second, simple services dropped -14% year-over-year, a -380bps headwind to total growth. As discussed earlier, this decline is driven by a combination of AI cannibalization and an unfavorable macro-environment. At the average take-rate of 31.8%, the $43 million drop in GMV translates to a $14 million drop in revenue for Fiverr. This trend is likely to continue into 2024, assuming a subdued economic growth and the continued advancement of AI-based services.

Third, complex services, defined as services requiring human skills to deliver the desired outcome even when AI helps with productivity, grew 29% in 2023 (vs. 12% in 2022). Since Fiverr launched its AI-based services in 2023, it is likely that AI was the primary driver for the growth acceleration. Complex services contributed +720bps to total growth, and I believe this growth is sustainable or may even accelerate, given the company’s targeted investments in this area and the continued tailwinds to be expected from emerging AI services.

Finally, what I call core services designates all other services, which according to Fiverr are unlikely to be impacted by AI based on their nature. Those were flat on a GMV basis, which I expect to be largely the result of lower promotional efforts as the company focused on improving profitability in an unfavorable macro-environment.

To sum up, the 1% growth in GMV was driven primarily by the strong growth in complex services, which was largely offset by the significant decline in simple services and the quasi disappearance of NFT-related services. This mix shift resulted in a 5% reduction in active buying customers, while the average SPB grew 6%.

Fiverr’s 2024 GMV growth guidance of 1-2% indicates that management expects the two main headwinds to continue, if not to accelerate. Indeed, the reduced NFT headwind should add about 200bps to GMV growth relative to 2023. Expecting only a 0-100bps acceleration means that Fiverr must expect a less favorable balance between the decline in simple services and the growth in complex services, and/or a decline in its core service offerings. Frankly, this seems a bit conservative to me.

Either way, from a longer-term perspective, GMV growth will accelerate meaningfully when the economy (including small businesses) re-accelerates, and when AI services hit their “tipping point”. This is the time when additional revenues from new complex services will materially outweigh the erosion of simple services, as the share of the latter becomes less and less material to Fiverr’s total revenues.

Why Fiverr Can “Afford” Industry-Leading Take-Rates

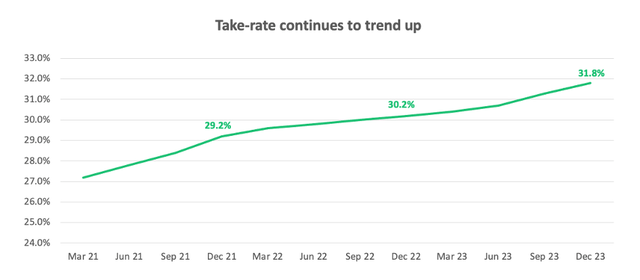

Meanwhile, the reason Fiverr delivered 7% revenue growth in 2023 despite only 1% GMV growth is that the company was able to continue expanding its take-rate, which increased by 160bps up to 31.8%.

Fiverr’s take rate evolution 2021-2023 (Stock Research Platform)

This continued increase is quite impressive, as Fiverr’s take-rate is already industry leading. For reference, Upwork’s take-rate sits at just over 17%. A valid question to ask is how sustainable a rate above 30% can be. Management already said that they expect the take-rate to stabilize in 2024, with potential modest upside.

Compared to Upwork, the higher take-rate is also a consequence of the difference in the business model: many small gigs allow for a higher take-rate compared to fewer large gigs. According to their investor presentation, Fiverr charges a 5.5% service fee to buyers, plus an additional $2.50 small order fee for orders below $75. When you do the math on a $10 gig, the total service fee alone represents $3.05 (or 30.5% of GMV). On top, Fiverr keeps 20% of the gig value as commission, with freelancers keeping 80%. So that’s an additional $2 for Fiverr on a $10 gig, leading to a total revenue of $5.05, a mind-blowing take-rate of 50.5%.

Of course, for any gig above $75, the take-rate is fixed at 25.5% (=5.5% + 20%). This means that if Fiverr’s upstream transition involves a higher value per gig, the average take-rate should go down, purely driven by mix. As such, unless there are other elements influencing the take-rate (e.g., in the enterprise space), the continued expansion we see in the take-rate so far points to the increase in average spend per buyer coming from a larger number of cheap (below $75) gigs per buyer, as opposed to more expensive gigs. Either way, mix should cause average take-rates to come down in the future, while remaining at industry-leading levels.

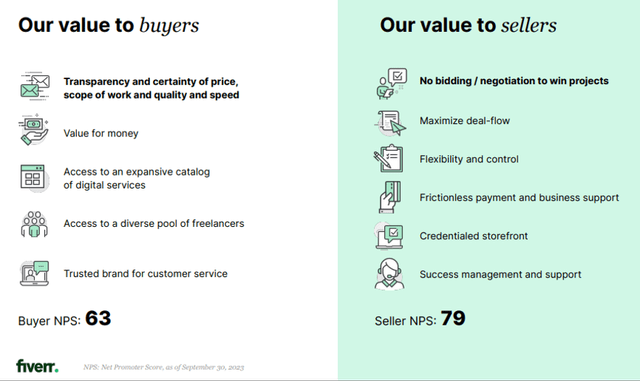

Bears may argue that regardless of the effects of mix, the 20% cut will alienate freelancers. Well, let’s take a look at what value Fiverr offers to buyers and sellers, and how they think about the value they are getting.

Fiverr’s value proposition to buyers and sellers (Fiverr Investor Presentation)

I will not go into the details of the different value drivers, but just cut right to the verdict, which is reflected in the respective buyer and seller Net Promoter Scores [NPS]. In case you are not familiar with what this score means, Retently does a good job of explaining it. In a nutshell, the score is calculated by asking buyers and sellers how likely they are to recommend Fiverr to a friend or colleague on a scale of 0 to 10. The score is obtained by subtracting the % of individuals scoring 6 or less (detractors) from the % of individuals giving 9 or 10 (promoters). For reference, the creators of the NPS metric, Bain & Company, say that an NPS above 50 is amazing.

In other words, I think it is fair to say that buyers and sellers generally believe that they are getting good value from Fiverr, despite a supposedly elevated take-rate.

Let’s move to what this all could mean for Fiverr’s future growth.

Longer-Term Revenue Growth Scenarios

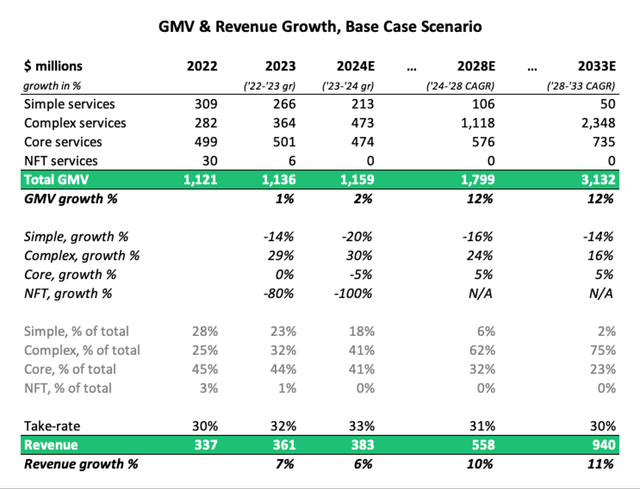

Based on the trends discussed above, I have modeled the growth trajectory by service type to determine total GMV growth. For 2024, I forced my assumptions to match company guidance of 2% growth in GMV and 6% growth in revenue, which implies a 33% take-rate (which may be flat to slightly up from where Fiverr landed Q4-2023 to average 31.8% on a TTM basis). My personal bias is that GMV may grow faster while the take-rate may stagnate, but either way, I believe the guidance is very achievable.

Over the coming decade, my model assumes a steady shift away from simple services to complex services. This will entail continued mid-single digit erosion in active buyer count and mid- to high-single digit growth in SPB in the near term. Over time, I am expecting the number of active buyers to hit a tipping point and resume growth from a lower base. This will happen once there are more new buyers joining the platform for complex services than existing simple services buyers leaving. Overall, I am expecting GMV to grow at a CAGR of 11% between 2023 and 2033, the majority of which will be driven by an increase in SPB due to the shift to larger customers and complex services.

The market research projections presented at the beginning of this article predict a GMV CAGR between 12 and 16%. I like to take these with a grain of salt, but on the other hand, I believe that Fiverr is well positioned to grow, at least in the market. Therefore, I feel that an 11% GMV CAGR is a reasonable projection.

Fiverr GMV & Revenue Growth Projection, Base Case (Stock Research Platform)

As mentioned earlier, I believe that the take-rate will come down over time, while remaining industry-leading for the reasons mentioned earlier. For modeling purposes, I will assume a 30% take rate by 2033 as a base case assumption. This gets me to a base case annual revenue of $940 million by 2033, a 10% CAGR from $361 million in 2023.

For valuation purposes, I will use a revenue CAGR range of 9 to 11%, to accommodate upside/downside scenarios on either GMV growth or the take-rate.

Fiverr’s Fair Value

Now that we have determined a plausible range for revenue growth, let’s take a look at profitability, an area where Fiverr has made significant improvements over the past 24 months.

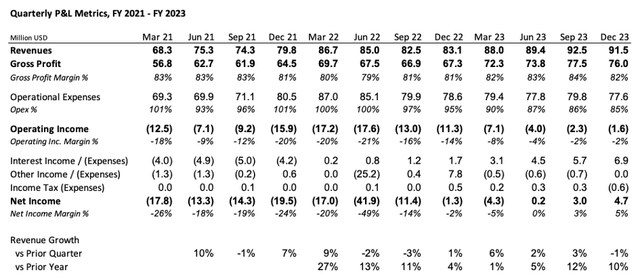

Fiverr Quarterly P&L Trend (Stock Research Platform)

While gross margins have remained consistently above 80%, operating expenses have been continuously reduced as a percentage of revenue, reaching 85% in Q4-2023. With that, operating income is almost at breakeven on a GAAP basis. Net income already turned green for 3 consecutive quarters thanks to Fiverr’s interest income on its net cash balance of over $200 million.

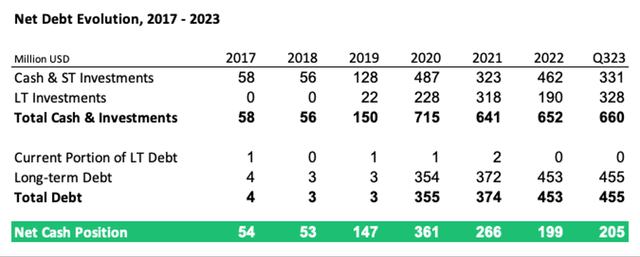

Fiverr Cash & Debt Evolution (Stock Research Platform)

Looking at free cash flows, they consistently increased throughout the year, reaching $27.4 million in Q4-2023, and $82.1 million for FY-2023. That is an impressive 23% FCF margin, while Fiverr still has a lot of room for operating leverage as the business scales. On a side note, Upwork generated $26.5 million FCF in FY 2023 on revenue of $689.1 million. That’s a FCF margin of less than 4%. While Upwork’s margins are also trending upward, this just shows how effective Fiverr has been at optimizing its business for cash generation.

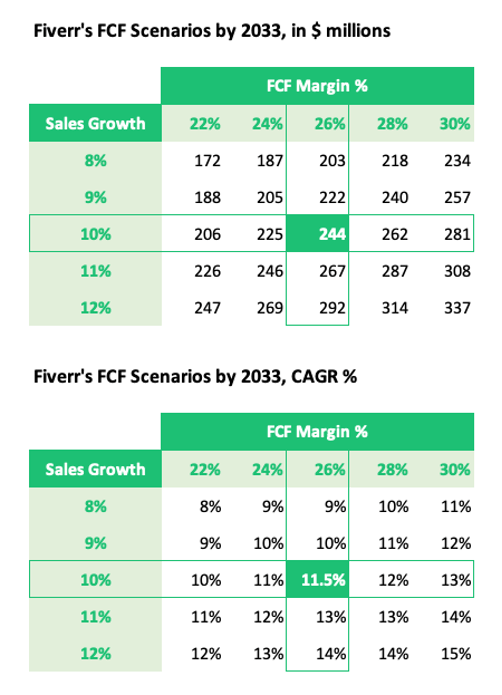

The table below shows what Fiverr’s FCF could look like by 2033, depending on revenue growth and FCF margin. For my base case, I will assume the 10% revenue we previously discussed, and a 26% FCF margin, reflecting a 300bps improvement vs. 2023 from future operating leverage. This gives us a FCF growth CAGR of 11.5%.

Fiverr FCF Growth Scenarios (Stock Research Platform)

Consistent with a revenue growth CAGR range of 9 to 11% and a FCF margin range from 24 to 28%, I am using a FCF growth range of 10% (low case) to 13% (high case) for valuation.

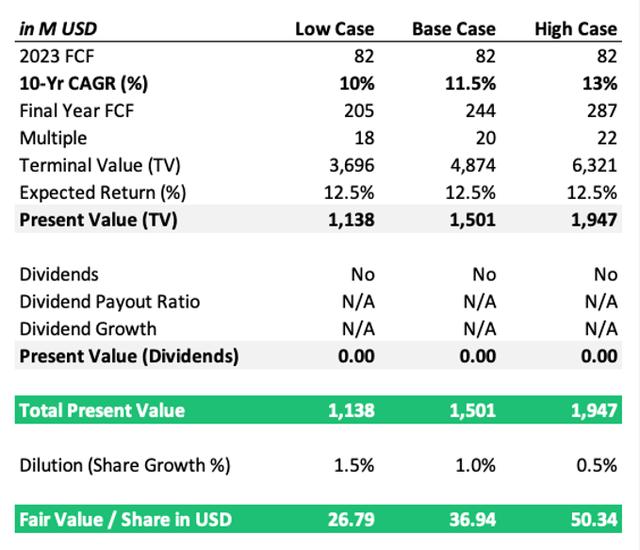

Given the growth profile and FCF margin quality, I will assume a terminal FCF multiple in the range of 18 to 22, and discount back at an expected return rate of 12.5%. Given Fiverr’s focus on growth, I will not assume any dividends to be paid out, but I am assuming that future share buy-back programs will partially offset the dilutive effect of stock-based compensation. To be conservative, I am still assuming a net increase in stock count by 0.5% to 1.5%, depending on the scenario.

Fiverr Valuation Scenarios (Stock Research Platform)

With that, I obtain a fair value for FVRR of $37, with a range from $27 to $50. This means that as of today, Fiverr trades about 15% below the low end of its fair value range, making it an attractive long-term risk-reward investment. That said, like with any investment, there are also some risks to consider.

Key Risks

First of all, there is a timing risk. While Fiverr may be able to beat its rather conservative 2024 guidance, growth is likely to remain below investor expectations in the near term, as the company transforms its customer base and drives profitability in the midst of an uncertain economic environment. This means that while FVRR may be a market-beating opportunity for an investor with a 3-to-5-year horizon, it may not perform that well in the next 6 to 12 months.

The other, more fundamental risk relates to Fiverr’s ability to continue providing value to buyers and sellers over time, in order to remain competitive and to sustain its industry-leading take-rates. While fears of rate compression are not new, so far, Fiverr has been able to consistently expand its share of GMV to even higher levels. Meanwhile, buyer and seller net promoter scores are very high. Therefore, while take-rates should come down somewhat as the mix shifts toward higher value services, I could not find a compelling reason why they would plummet. The argument that take-rates must fall because they are so much higher than the industry average does not hold for me, as there are good reasons for that (which were discussed above).

Finally, I could be wrong with my assumption that AI will end up being a significant net benefit to Fiverr. That would imply that while revenues from simple services erode, Fiverr would be unable to capture the upside from the new services that AI will create. To be honest, I have a difficult time finding a good reason why they should not benefit significantly from AI-based services. After all, AI is a service category that lends itself perfectly to online freelancing. Fiverr is the second-largest platform out there, with a clear differentiation from Upwork, which should allow both companies to co-exist and grow.

Conclusion

On the Stock Research Platform, I am looking for asymmetric low-risk, high reward opportunities. Fiverr is a well-positioned company with an attractive valuation, considering both secular industry tailwinds and mid- to long-term growth prospects from AI-related services. However, the AI transition paired with a near-term economic slowdown continues to be short-term headwinds to growth.

At the current price, FVRR has a potential 60% upside to its fair value of $37, and currently trades below the low end of its fair value range of $27 to $50. This is why I am giving the stock a buy rating with an investment horizon of 3 to 5 years.

The reason I am not giving FVRR a strong buy at this time is that I believe it will take time for Fiverr to prove it can reaccelerate growth, making it potentially “dead money” in 2024. To address this risk, one way to open the position is by selling puts in the low-$20s range. This way, you can build a position with an extra margin of safety and/or earn premium while waiting for a stronger buy signal.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FVRR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.