Summary:

- GoDaddy’s stock has reached an all-time high of $113 after a considerable run-up since November 2023.

- The company’s fundamentals are solid, with consistent cash flow generation and profitability improvements.

- The Applications and Commerce (A&C) segment is expected to drive revenue growth and margin expansions in 2024, supported by initiatives like Airo, in my view.

Morsa Images

A leading provider of domain registration, web hosting, and online marketing solutions, GoDaddy (NYSE:GDDY) has become a household name for businesses and individuals venturing online.

Since its IPO in 2015 at $26.5, the stock saw an outperformance that helped it reach $80 in 2018. However, shares had been mostly trading sideways until last November. Since November 2023, GDDY has had a considerable run up that sees the stock trading at $113 today. At that level, GDDY now trades at its all-time high.

I initiate my coverage with a buy rating. My 1-year price target of $128 presents an 13% upside for the stock, highlighting an attractive buy opportunity.

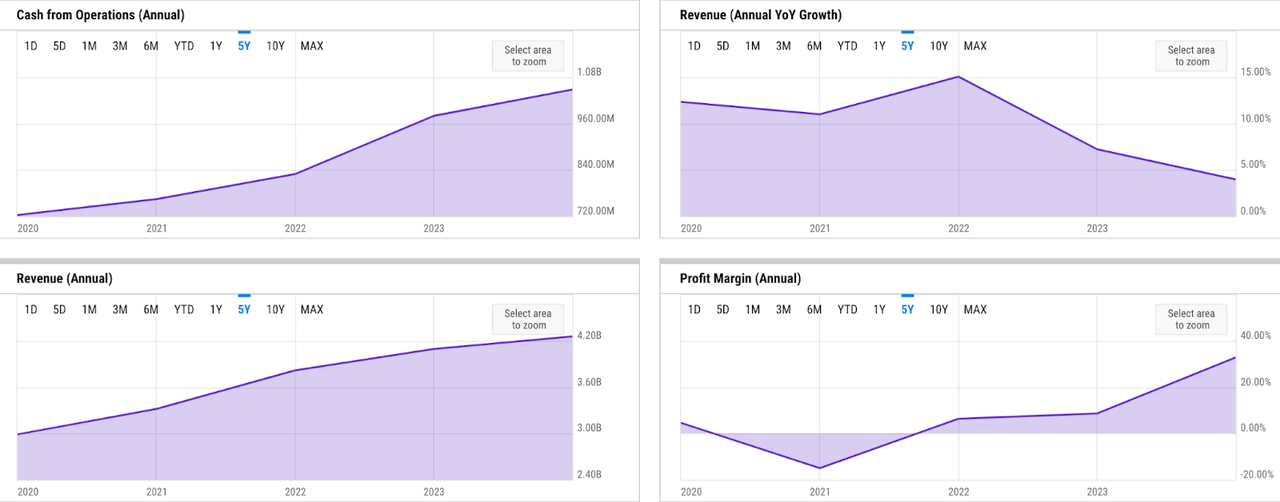

Financial Reviews

Fundamentals are relatively solid. Though annual revenue growth has declined from over 10% – 15% to 4% as of FY 2023, cash flow generation and profitability have consistently improved. GDDY finished FY 2023 with over a billion dollars of cash from operations / OCF, 44% more than what it delivered five years ago in 2019.

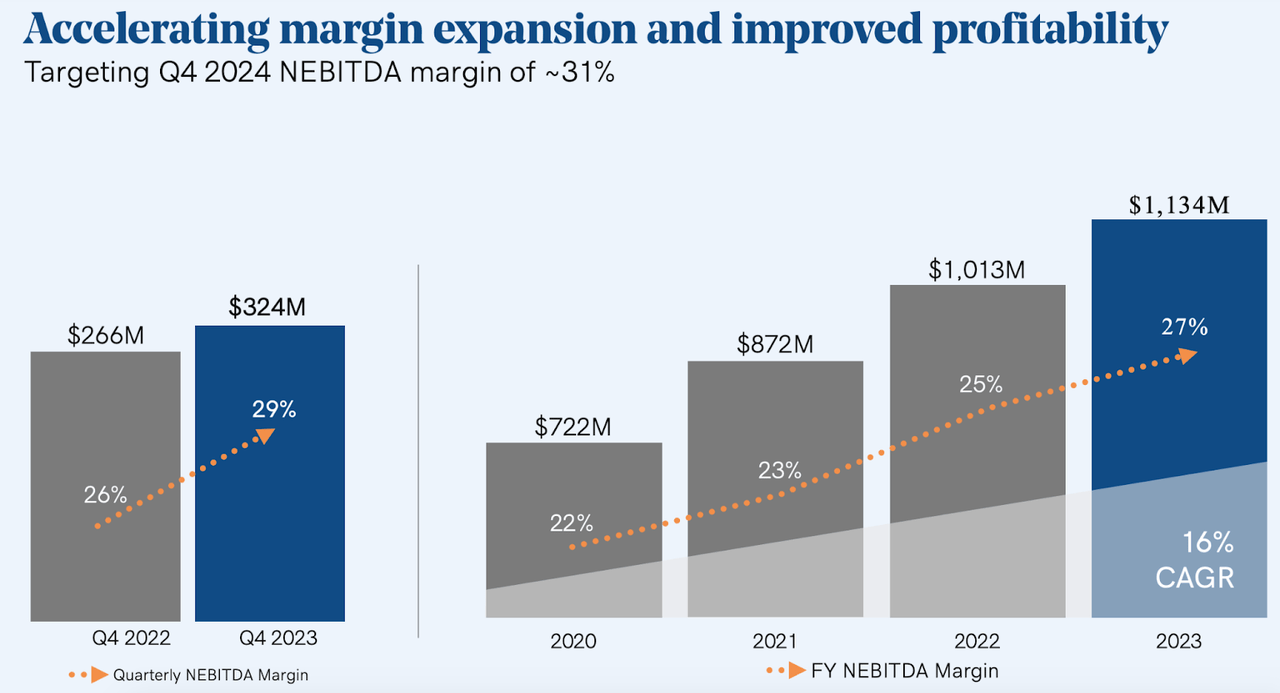

NEBITDA (company presentation)

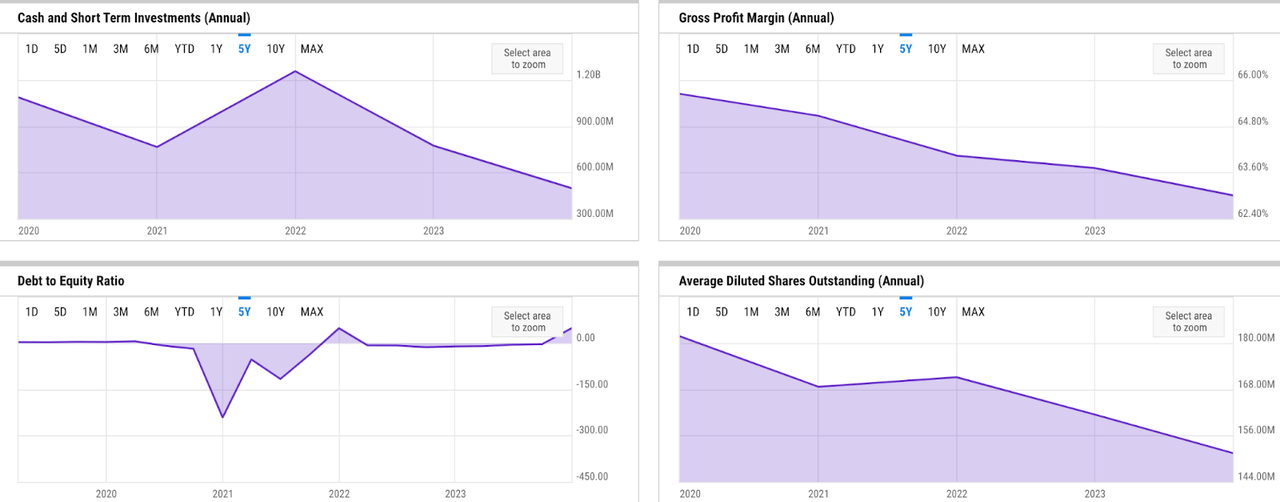

GAAP net margin was over 30% in FY 2023, which was a significant expansion from the 8% level the prior year. This seemingly abnormal spike was caused by a non-operational, one-time tax benefit provision of $990 million. However, when we look at the normalized earnings figure, using normalized EBITDA / NEBITDA as a proxy, GDDY has also seen consistent margin expansions of over 500 bps since 2020. In my opinion, this suggests that the margin expansion is sustainable and driven by strong operations.

Having made share repurchases over the past five years, liquidity has gone down from $700 – $1.2 billion to almost $500 million in FY 2023. I believe this should not be a key concern for investors, since GDDY should be able to support its liquidity position with the consistently strong OCF generation. In addition, $500 million of cash is still a relatively decent figure. GDDY had $3.4 billion of net debt as of FY 2023, but it has managed its leverage and coverage ratio well, in my opinion. As of FY 2023, 87% of its debt issuance has a fixed interest rate, while the leverage ratio is at 2.7x, sitting comfortably within its target range of 2x to 4x.

Catalyst

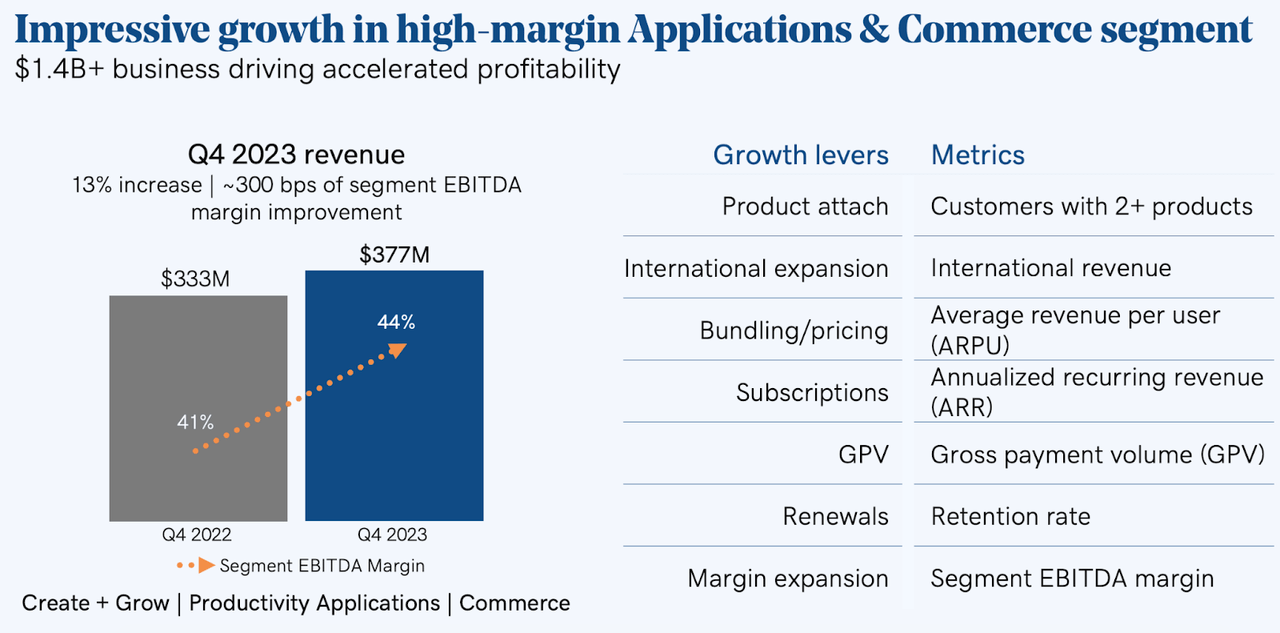

In 2024, I believe GDDY will continue to see stronger uptake of its Applications and Commerce (A&C) offerings, which should open up opportunities to expand margins and sustain revenue growth.

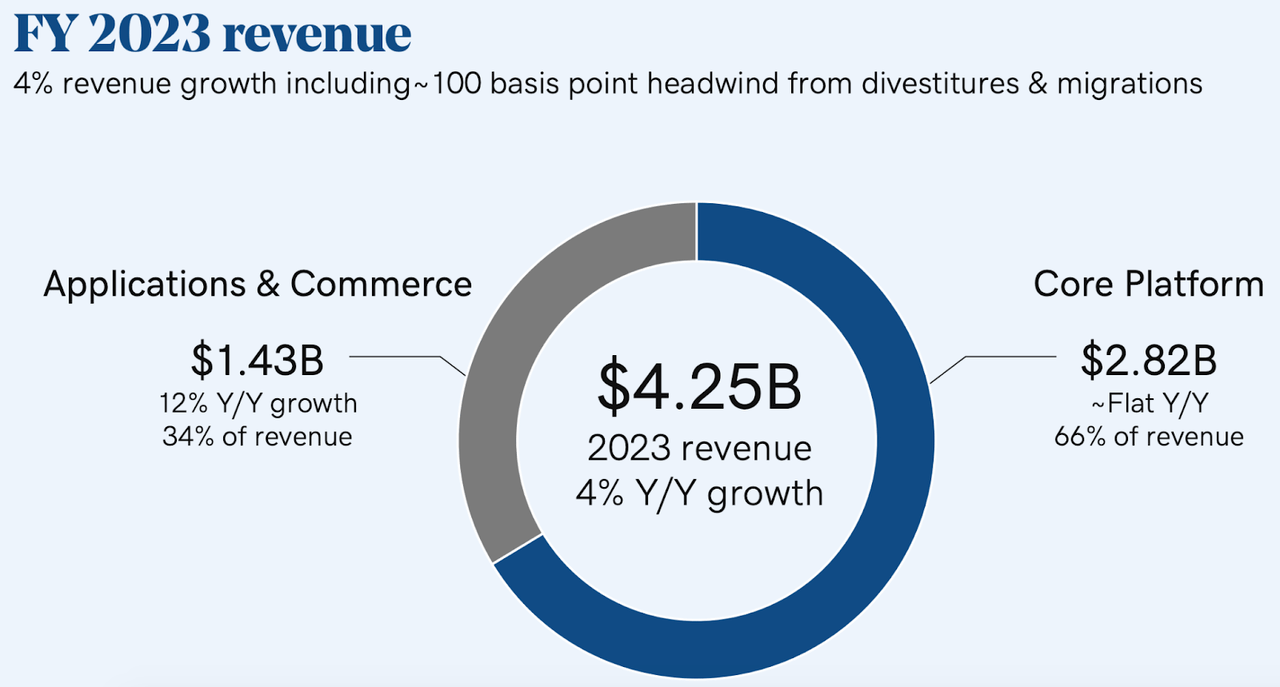

fy 2023 revenue (company presentation)

A&C has consistently made up over 30% of GDDY’s business while delivering higher NEBITDA margins than the core platform business. Today, A&C is already a significantly faster-growing business than the core platform, given its 12% YoY revenue growth in FY 2023. In my opinion, A&C is well-positioned to see an increasing share in the total revenue mix in 2024 and beyond, effectively driving overall growth and margin expansions. So far, the share of revenue from A&C has already grown from 31% in 2022 to 34% in 2023.

In my opinion, initiatives like bundling and the GoDaddy Airo platform further bolster this focus. Airo, a platform that helps small businesses use AI to help build their online presence (e.g. website, content), shows early promise in increasing attach rates. Increased attach rates should help improve margin expansions through higher ARPU:

Yeah. So, anything we plan on doing pricing wise, just so you know, is built into our guide as we sit here today. We’re excited about the bundling and the attach that’s happening within Airo, within our software platform all together.

Source: Q4 earnings call.

I also see two external factors that should help A&C, driven by Airo, to continue driving revenue growth in 2024 and beyond. First off, GDDY has not yet rolled out Airo nationwide and internationally, implying future revenue growth upsides – internationally, rising internet penetration, shifting consumer preferences, and the mobile commerce surge are fueling global e-commerce growth, directly aligning with the solutions offered by GDDY’s A&C segment.

Secondly, I believe Airo will continue benefiting from the powerful confluence of AI and e-commerce secular trends:

About a quarter of small businesses owners (26%) currently use AI, per data cited in the press release, though it is predicted that users can save $4,000 and 300 hours of work this year using generative AI.

Source: MarketingDive’s Airo coverage.

Risk

I believe risk remains minimal to moderate, and mainly concerns A&C and Airo. While early results from the Airo soft launch are promising, successfully implementing and scaling the Airo platform across other geographies could encounter unexpected challenges. Learning from Netflix’s strategy, one of these challenges could be pricing. Before rolling out to international markets, it’s crucial for GDDY to develop pricing strategies that cater to markets with different ARPU potentials and competitive landscapes. Without the right strategy, I believe Airo may see limited growth potential.

Moreover, Airo’s success still hinges on navigating intense competition in the crowded AI-driven SMB tooling space, in my opinion. I believe established players like Wix and Squarespace already offer similar user experiences and design features, while new entrants like Webflow, Mailchimp, or Canva, will continue to provide competition.

Valuation / Pricing

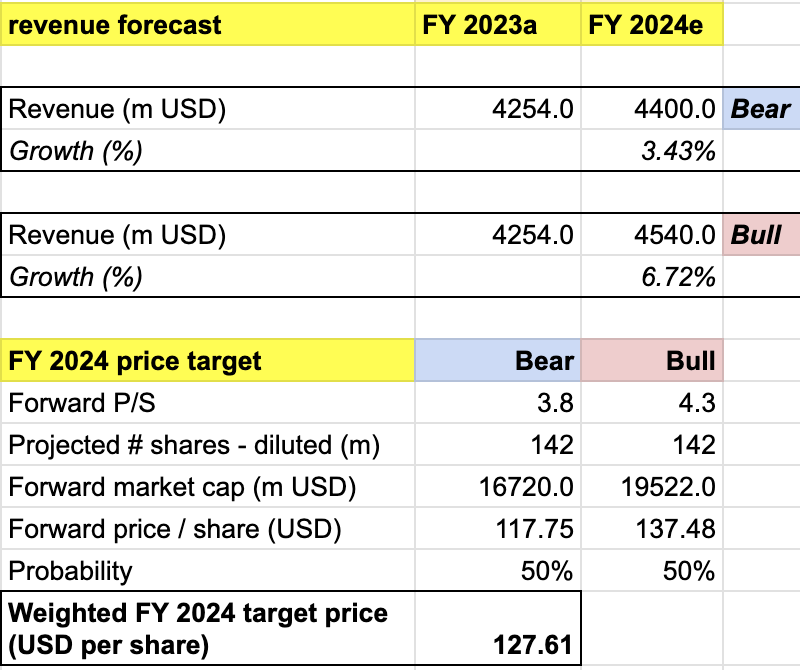

My target price for GDDY is driven by the following assumptions for the bull vs bear scenarios of the FY 2024 projection:

-

Bull scenario (50% probability) assumptions – GDDY to achieve FY 2024 revenue of $4.54 billion, a 6.7% growth, at the high end of the market’s estimate. I assign GDDY a forward P/S of 4.3x, an expansion from the current level. In this scenario, I expect GDDY to continue seeing an increasing share of higher-margin revenue from A&C, driven by Airo uptake and attach rates.

-

Bear scenario (50% probability) assumptions – GDDY to deliver FY 2024 revenue of $4.4 billion, a 3.4% growth, missing the market’s estimate. In this scenario, I would expect intense competition in other geographies limiting Airo’s upside potentials. I expect its P/S to contract to 4x, implying a relatively subdued share performance from the current level.

target price (own analysis)

Consolidating all the information above into my model, I arrived at an FY 2024 weighted target price of $128 per share, presenting a potential upside of 13% from the current level. I give the stock a buy rating.

Conclusion

Despite its recent surge, GDDY already boasts a long history of growth, with a 327% return on investment since its IPO. Their strategic focus on high-margin segments and the promising Airo platform position them well in the booming e-commerce landscape. While competition remains a challenge, GDDY’s commitment to AI-based innovation offers attractive potential. I initiate coverage with a buy rating and a 1-year price target of $128, representing a compelling 13% potential return.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GDDY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.