Summary:

- Adobe’s growth rates are tepid, making it difficult to support its valuation of approximately 27x forward EPS.

- The company’s near-term prospects are promising, but it faces competition in the digital software market and pricing challenges.

- ADBE’s revenue growth rates are expected to decelerate in the coming quarters, raising concerns about its future trajectory.

hapabapa

Investment Thesis

Adobe (NASDAQ:ADBE) falls on the back of its fiscal Q2 2024 guidance. Investors’ natural reaction is to say buy the dip, as management is being conservative with its guidance.

And yet, for my part, I don’t believe management is being conservative. And what’s more critical here is that Adobe’s growth rates are so tepid that they struggle to support its valuation of approximately 27x forward EPS (including the pre-market drop).

All in all, I’m finding so many bargains elsewhere, that I cannot bring myself to be bullish on this stock.

Rapid Recap

Back in December, I concluded my neutral analysis by saying:

The overarching concern lies in Adobe’s valuation at 31x forward non-GAAP EPS, which, considering the modest growth and evolving tech landscape, prompts a reevaluation against potentially more appealing investment opportunities, particularly in small and medium-sized tech companies with far superior valuations.

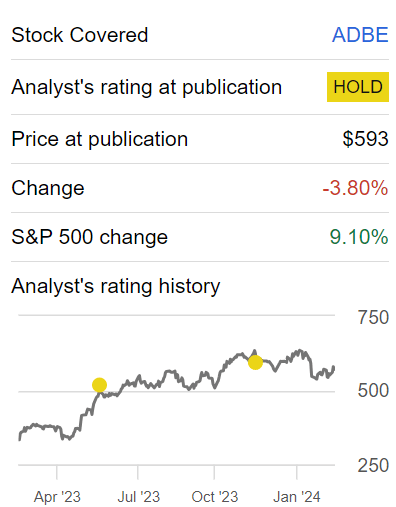

Author’s work on Adobe

Since I penned those words questioning Adobe’s valuation, Adobe’s share price has significantly lagged behind the S&P 500 which is up more than 9%, in what has been a very strong bull market lifting nearly all boats. Simply put, I find it challenging to recommend this stock.

Adobe’s Near-Term Prospects

Adobe creates software tools to help people work more creatively and efficiently in the digital world. They offer a range of products like Adobe Creative Cloud for designing and editing, Document Cloud for managing documents, and Experience Cloud for digital marketing and customer experience management. Their products use advanced technologies like generative AI to empower users to create and engage with their content across various channels, whether it’s designing graphics, editing documents, or crafting personalized marketing campaigns. Adobe’s goal is to make digital experiences seamless and impactful for individuals, businesses, and organizations of all sizes.

Adobe’s near-term prospects appear promising, with several key initiatives poised to drive growth across its Digital Media, Digital Experience, and Document Cloud segments.

With innovations such as the AI Assistant in Acrobat and the integration of Firefly across its Creative Cloud applications, Adobe strives to unlock productivity for its users.

However, Adobe faces headwinds too in the competitive landscape. There are now so many emerging competitors in the digital software market that are eager to take market share away from Adobe. On top of that, factors such as the lapping of pricing are also playing a role in Adobe’s guidance.

Given this backdrop, let’s now turn to discussing its fundamentals.

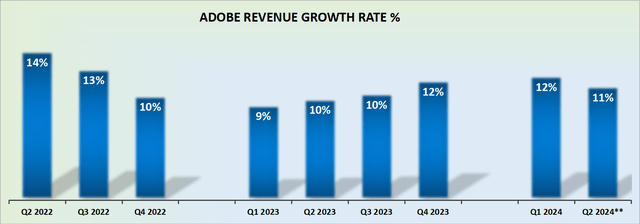

Revenue Growth Rates Now Headed Towards Low Teens

Fiscal Q1 2024 was up against the easiest hurdle of this fiscal year, and Adobe’s digital media revenue grew by 12% y/y. This means that this is likely as good as it’s going to get for the next year. As the comparables start to become more challenging, Adobe’s revenue growth rates will decelerate with each passing quarter.

On the one hand, that was to be expected. On the other hand, given that Adobe had consistently accelerated its revenue growth rates over the past four consecutive quarters, investors were hoping that Adobe had once again found its stride.

Now, once again, all the concerns investors have had about whether or not AI is capable of disrupting large swathes of what Adobe delivers will suddenly come to the fray, yet again.

And then, to complicate matters further still, this slow growth has to be taken on board, given its price stock price.

ADBE Stock Valuation – 27x Forward EPS

Adobe’s fiscal Q1 2024 saw its non-GAAP EPS figures increase by 18% y/y. That’s a solid performance on the bottom line, and investors should be fairly content.

That being said, the problem with investing is never about the quarter just reported, it’s always about the guidance. And the guidance here points to Adobe’s EPS being up 14% y/y if we presume that Adobe beats the high of its guidance.

However, recall that this includes approximately 1% of Adobe’s share count being bought back. Accordingly, this means that its EPS excluding buybacks is only up somewhere between 12% to 13% y/y for the quarter ahead.

Given that consideration, I believe that Adobe could be on a forward run-rate of approximately $19 of EPS at some point in the next twelve months. Consequently, the stock is priced at 27x forward EPS.

The Bottom Line

In conclusion, Adobe’s growth rates appear to be slowing down, making it challenging to justify its current valuation of approximately 27x forward EPS.

Despite solid performance in fiscal Q1 2024, the tepid revenue growth outlook and modest EPS projections for the upcoming quarter underscore concerns about the company’s future trajectory.

Given these factors, coupled with the availability of more attractively valued investment opportunities in small and medium-sized tech companies, it’s difficult to maintain a bullish stance on Adobe’s stock.

With growth rates now headed toward the low teens and uncertainties surrounding its ability to navigate evolving market dynamics, investors may find better bargains elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.