Summary:

- Adobe Inc. in fiscal Q1 reported record revenue of $5.18 billion, with a 12% growth rate translating to over half a billion in extra sales.

- The creative media industry is difficult to track, making it hard to determine if Adobe is gaining or losing market share.

- Adobe plans to buy back $25 billion of its shares over five years, in line with previous share repurchase programs.

Justin Sullivan/Getty Images News

Investment Thesis

Adobe Inc. (NASDAQ:ADBE) just reported its earnings for the first fiscal quarter (three months ended March 1st), and I think they did well. Revenue stood at a record of $5.18 billion. That’s pretty impressive. Now, a 12% growth rate (13% constant currency) might not sound a lot, but that translates to over a half billion in extra sales, which is no small feat.

Here is why. Adobe generates about 85% of its sales from the U.S. and Europe. Macroeconomic figures in these regions point to about 3% inflation and, say, 1.5% GDP growth (2.1% in the U.S. and 0.6% in Europe.) Adobe has been talking about raising prices for some time now. Now, they haven’t provided many details during the quarter, so we’ll have to speculate a lot. Say Adobe raised its prices in line with inflation for all its products. When you pair that with a general 1.5% GDP growth, you find that more than half of the 12% growth reported by Adobe is essentially “organic” and outperforming the broader economy. Now, isn’t that something to rely on to generate Alpha in the stock market?

As always, there is a risk. Figuring out whether Adobe is gaining market share or not is not easy. The creative media industry is hard to track because a lot of the players competing with Adobe are private companies and don’t publish their financials. One market report estimates the Global Digital Content Creation market size at $27 billion as of 2023, growing at about 13% going into 2024. If this is true, then Adobe grew along with the market, neither expanding nor losing market share.

Market dynamics are more important now than ever, with all the talk about disruptive tech like Sora and DALL-E, which can generate creative content that rivals those made by Adobe’s products like Photoshop, Illustrator, Lightroom, and others, which together contribute to roughly 60% of total sales in FY 2023. But it’s important to remember that the driver of Adobe’s stock performance over the past twelve months is still in play. Today’s price drop is about fear brought by “disappointing” guidance, but the ticker’s rally over the past twelve months is grounded on resilient performance and a successful launch of Firefly in September 2023, a very important product that injects generative AI elements into Adobe’s ecosystem.

Overall, I’m with fellow analysts that think there are better deals than Adobe on the stock market. The company is going for 31x forward P/E. Even if the whole generative AI wave doesn’t mess with their sales, it’s not exactly cheap. On the contrary. The current price kind of bets on AI being a win for Adobe, which, sure could happen. But then again, it might not.

Share Repurchase Program

During yesterday’s earnings call, Adobe dropped the news that they’re planning to buy back $25 billion of their shares. That’s a big figure when stacked against their $220 billion market cap (including today’s 15% drop). But before we get excited with the headline, which Adobe made sure was the first thing you saw, it is important to clarify that this figure is spread over five years. So, it’s more like $5 billion per year, which isn’t that far off what they’ve been doing lately anyway.

Ignoring the issuance of new stock tied to employee benefits, $5 billion would buy about 10 million shares. So, it’s like they’re adding $180 million to this year’s net income just by doing this buyback. I’m not complaining, but part of the EPS estimated 12% YoY growth in 2024 is because of this share buyback program.

Speaking of EPS, it’s kind of interesting to see the absence of economies of scale in Wall Street’s forecasts. Wall Street expects revenue to grow by 11% this year. But then, the EPS forecast also implies a 12% growth. For a software company, with little variable costs, that’s a bit unusual.

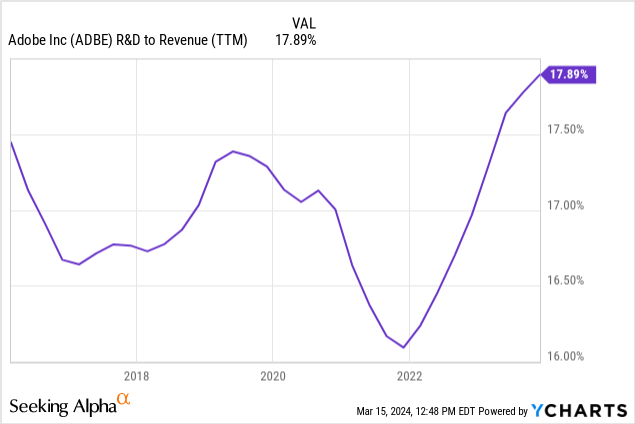

Maybe they’re expecting R&D as a percentage of revenue to keep going up as competition intensifies. It has been increasing for the past few quarters. R&D spending is the highest it’s been since 2016. But then, if that’s the case, then they’re really expecting some serious R&D growth. I mean, gross margins are ~90% for Adobe. So, Wall Street is forecasting a meaningful increase in operating costs.

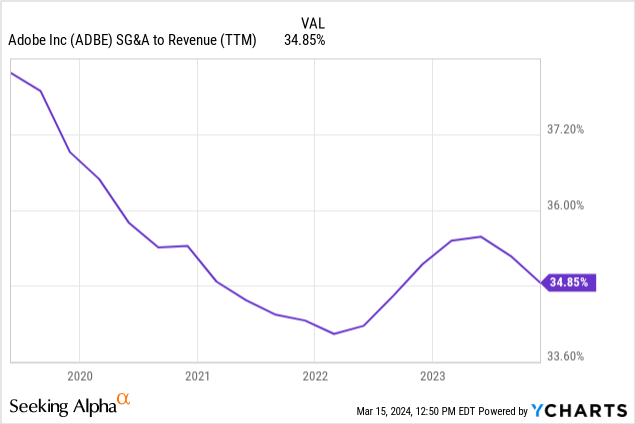

Now, when it comes to SG&A, things are even more interesting. Every time I hit the play button on a YouTube video by Adobe, I see ads for a competing or a similar product. But it’s rare to see Adobe’s own ads. For now, it seems that management is confident that its product portfolio is strong enough to stand out in the market on its own. And to give them credit, they’re not doing too bad, as the latest quarterly results tell us. But then again, today’s drop isn’t really about their past performance, is it?

Market Position and Q4 Performance Overview

With Adobe showing solid growth, the competition heating up, more cash flow flowing into R&D, and management showing confidence in their product mix, where does that leave Adobe in the grand scheme of things?

One thing is clear. Adobe has taken a unique path in the world of generative AI. They have their own Trademarked library of images that they use to train their own generative AI algorithms. This means their corporate clients won’t have to worry about using images their competitors used in their ads. Also, Adobe isn’t just about making pictures look cool. When you watch the YouTube videos of how marketing teams use their software, you quickly see that Adobe is an ecosystem that extends beyond photo editing. Different apps integrate seamlessly to build, organize, and control marketing campaigns. In many ways, the value of generative AI is multiplied by Adobe’s product suite. Isn’t this Sam Alman and Microsoft Corporation’s (MSFT) vision when they opened OpenAI to the public at extraordinarily affordable prices?

Now, when looking at Q1 performance, it is not surprising that Adobe ended the quarter with $17.6 billion in Remaining Performance Obligations – the money that Adobe’s customers subscribed to pay. Most of Adobe’s sales are from subscriptions, and looking at the RPO figure compared to annual sales, it seems most customers are on an annual subscription, which shows how dependent they are on the company’s services. It is also interesting that the company added $432 million of annualized recurring revenue in the Digital Media segment alone. Since the company’s total growth was 543 million, it’s clear that many paying customers have committed to longer subscriptions.

Gross margins improved a bit, from 88% to 89%. It makes you wonder how much did they really increase prices. Operating costs skyrocketed to $3.6 billion, but that’s because of Figma’s $1 billion merger breakup fees. Excluding this one-time payment, operating income would have been $1.9 billion, up 20% YoY. EPS would have been $3.55, up 31% YoY. That’s more like it for a software company, which then also cast some shadow over Wall Street’s estimates.

Summary

So, is Adobe Inc. stock a good investment? Well, it’s a solid company with great products, that’s for sure. They are growing their sales, and their new product, Firefly, looks promising. But the Adobe Inc. stock price is already betting on all of that going perfectly, so it’s a bit of a gamble.

With all the buzz of generative AI, it’s hard to be sure that Adobe can keep its edge. Personally, I think there are safer bets out there, but if you’re okay with a little risk, you could do worse than Adobe.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.