Summary:

- Meta’s extraordinary execution continues to be underestimated by the market, even after a huge surge in price.

- I estimate the company will handily beat expectations, and find Meta undervalued at these levels.

- Meta is probably the biggest beneficiary of a TikTok ban if one were to happen.

- With all the noise floating around the Chinese company, even if nothing materializes, advertisers might allocate more budgets to Meta due to better certainty and less noise.

- I reiterate Meta as a Buy.

grinvalds

Meta Platforms (NASDAQ:META), the largest operator of social media platforms in the world, has been one of the best investments in the market since the beginning of 2023.

Led by Mark Zuckerberg, the owner of Facebook, Instagram, and WhatsApp, it is the embodiment of a company that has learned the 2022 lesson. No more reckless spending, no more overhiring, the name of the game is profitable growth.

After the 441% surge from the November 2022 lows, investors wonder whether Meta remains an attractive investment.

I argue, that with the company’s extraordinary execution, and a TikTok ban that’s floating around, there’s still ample upside.

Let’s dive in.

Background

I’ve been covering Meta on Seeking Alpha since July of last year. While Meta was already in the midst of an extraordinary turnaround story, I claimed that the company’s ‘Year of Efficiency’ story was only beginning.

I followed up with an article quantifying the burden of the Reality Labs segment on the company’s valuation and an additional one, showing why I think the market is extremely underestimating the company’s prospects for 2024.

Now, let’s dive into what we’re here for today, and that’s discussing future upside amid a potential TikTok ban.

Meta Is No Longer The Cheapest Stock Among Big Tech, But Rightfully So

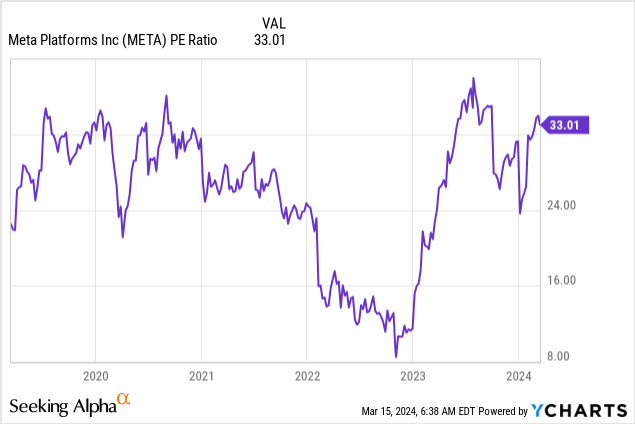

It’s always fun (or not) to look back in time and see the cheap valuations stocks get to sometimes. And while some investors could argue buying Meta at the low-teens P/E was as easy as taking candy from a baby, I’d argue that it was only around the Q2’23 release that it became certain Meta is officially turning things around.

As we can see, for the better part of 2022, Meta was trading at a commodity-like valuation. In hindsight, this seems like a bargain, but let me remind you that during this time, Meta saw three consecutive quarters of declining revenues, and its operating margins dipped below 20%.

The company’s struggles were a result of a terrible mix of declining ad spending amid rising interest rates, Apple’s ATT changes which hurt the company’s ad-targeting capabilities, and huge investments in the company’s losing Reality Labs arm.

Those very headwinds became a blessing because they forced Meta to (a) become much more efficient and cut costs, and (b), much more importantly, the company invested heavily in AI-driven targeting capabilities, which no longer relied on third parties.

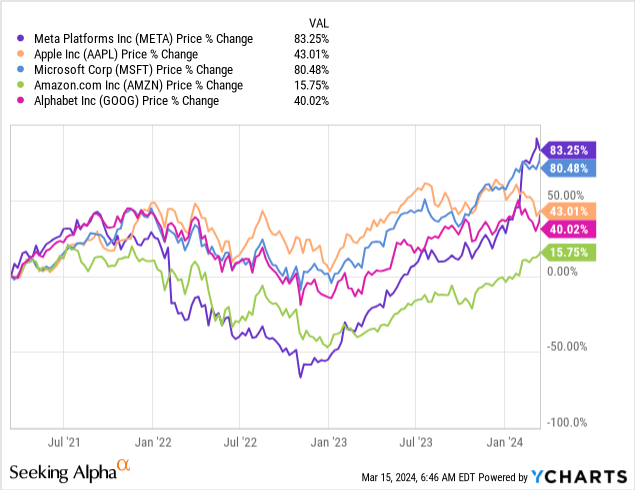

To say Meta succeeded in turning things around will be an understatement. You can see in the purple line how the company went from being the worst among big techs to capturing the first place over the last three years.

With that background in mind, we can get to discussing Meta’s future.

Potential TikTok Ban In The U.S. (And Europe?)

For those who have been living under a rock for the last eight years, TikTok is one of the fastest-growing social media platforms in the world, with more than 1.2 billion users worldwide, and about 170 million users in the United States.

TikTok is owned by a Chinese parent company in ByteDance, which politicians believe has ties with the Chinese Government. Legislators are seeing potential harm from the app on two fronts.

One, they are concerned that the vast amount of data collected by TikTok is used for surveillance and espionage. Specifically, according to Senator Cruz, the Chinese government allegedly monitors what Americans are saying, their physical location, and what are their interests, search queries, etc.

Another big concern is that the way the app works is through a proprietary and non-transparent recommendation algorithm, which TikTok can influence to generate propaganda in its interest (as well as possibly influence the upcoming elections, hence the timing of the bill). According to the Senator, hashtags like Tibet, Uyghur, Tiananmen Square, and Hong Kong protests, all of which are topics the Chinese government supposedly does not want people to talk about, are overwhelmingly more common on Instagram.

In the U.S., TikTok is primarily used by people between the ages of 18-29. According to Sen. Cruz, it is no coincidence that this specific cohort is the only one that’s not overwhelmingly in support of Israel and the most pro-Hamas.

While legislators are worried about data collection by all social media platforms, they believe that in TikTok’s case, that’s a matter of national security, rather than a mere question of privacy rights.

That has led to a rare agreement between U.S. parties, which passed a bipartisan bill in the House of Representatives that, if approved by the Senate, could force ByteDance to sell its U.S. operations or face a nationwide ban.

Such action was sought after by former President Donald Trump back in 2020 and almost went through, but ended up being blocked by a federal judge.

Enough politics, let’s talk business.

Meta Is Probably The Biggest Beneficiary Of A Potential TikTok Ban

In general, I rarely base my investment theses on a major regulatory change or a long shot, which is what we’re talking about here. Nobody knows if and when a ban will take place, and there are multiple significant hurdles to cross.

Even if a ban does occur, it will probably result in a sale rather than an outright shutdown, which means TikTok can be in the hands of a different strong competitor.

As we’ll discuss later in the article, I believe Meta still has significant upside without TikTok being banned. However, it’s worth diving into the potential implications of such a ban, and why Meta is the likely biggest beneficiary.

Significant Users Overlap & A Natural Transition

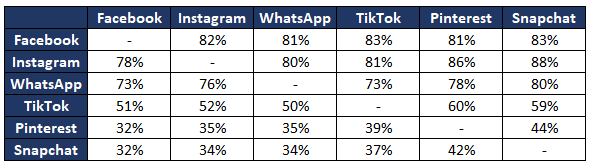

Let’s take a look at the following user overlap matrix, according to GWI:

Created by the author based on Global Web Index Social Media Report (2024)

Of the people who use TikTok, 83%, 81%, and 73%, also use Facebook, Instagram, and WhatsApp, respectively. From the opposite angle, 51%, 52%, and 50% of people who use Facebook, Instagram, and WhatsApp, are also on TikTok.

We don’t have recent data on YouTube (GOOG), but according to a January 2021 report, TikTok users who also used YouTube were 93.3%, and people who used YouTube who were also on TikTok were 34.6%.

What do we make of it? In my view, this means that in the case of a TikTok ban, time spent by overlappers on Meta’s platforms will increase meaningfully.

Most of TikTok’s users are already signed in to platforms like Instagram, which will make for a smooth transition. Additionally, they can get a very similar experience with Instagram Reels.

That being said, we can see that there’s significant user overlap with Snapchat and YouTube as well, so this doesn’t seal the argument on Meta being the biggest beneficiary. Which leads me to the next section.

Advertisers Overlap

Reliable data is hard to find on this matter, but we know that generally, YouTube advertisers tend to lean more towards larger enterprises, whereas Instagram and Facebook are more relevant for small and medium businesses, especially online stores.

Furthermore, the Instagram Reels experience resembles that of TikTok a bit more than YouTube Shorts, especially because YouTube users typically follow channels and content creators, whereas TikTok and Instagram include way more interaction with real-life connections and friends.

Therefore, I estimate that in the case of a TikTok ban, more advertisers will allocate their budgets to Instagram, rather than YouTube.

Monetization Of Short-Form Video

Lastly, we get to the number one reason Meta is the major beneficiary. It is simply way ahead in terms of monetizing short-form video. While Google isn’t as transparent and doesn’t provide too much clarity on the subject, YouTube shorts have a much lower ad load and are way less monetized.

On the contrary, Instagram Reels reached monetization neutrality in Q4, according to Meta’s management, meaning they are now indifferent between a user who scrolls the legacy feed, and a user who spends time watching Reels.

This is a crucial subject.

Even if YouTube Shorts receive a similar bump from TikTok transitioners like Instagram Reels, the latter will see a much bigger financial impact.

TikTok Ban Aside, Meta’s Extraordinary Execution Will Continue

So, we understand why a TikTok ban could be a big tailwind for Meta. However, it’s not a crucial part of my investment thesis in the company.

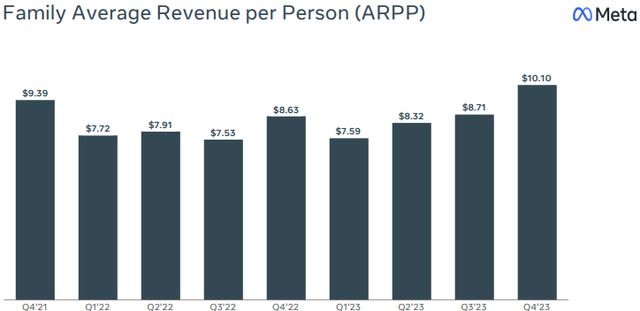

Meta Q4’23 Slides

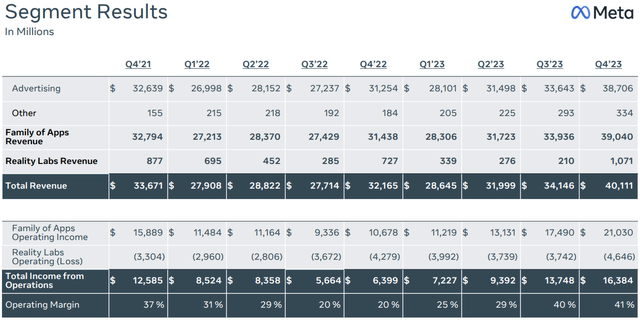

In Q4’23, Meta generated revenues of $40.1 billion, driven by an all-time high across every line of business. While operating margins did not fully recover to 2020 records, Family of Apps margin came close, at 53.9%, and should surpass the 54.4% peak this year. Reality Labs’ losses continued to weigh down on consolidated results, but they are more than offset by the other segments.

Meta Q4’23 Slides

Family ARPP reached an all-time high as well, driven by improved monetization of Reels, and strong AI-driven targeting. Unlike what many people thought, including myself, the post-ATT business is as profitable as the pre-ATT, despite the huge costs associated with AI targeting.

Looking ahead to 2024, Meta expects to grow expenses by less than 10%, while revenues are expected to increase materially, reflecting continued margin expansion and significant top-line growth.

Valuation

One of the biggest problems investors have, in my view, is recency bias. What I mean by that is investors seem to think that if a stock surges up, it can’t go up much further.

Well, Meta clearly taught investors that isn’t the case. Those who said back in the $200s, or $300s that Meta is no longer attractive, missed a clearly undervalued high-teens EPS growth story. To emphasize, I’m not talking about Meta in 2022, which I already said was struggling. I’m talking about Meta in Q2’23 onwards.

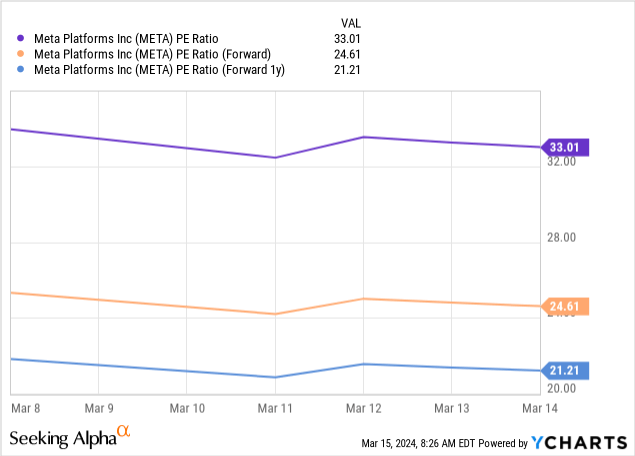

Today, Meta trades on a 33x P/E over 2023 earnings, but a much lower 24.6x and 21.2x on 2024 and 2025, respectively. This reflects growth expectations of 34.4% in 2024, and 16.0% in 2025. In other words, Meta is trading at 0.7x and 1.3x PEGs.

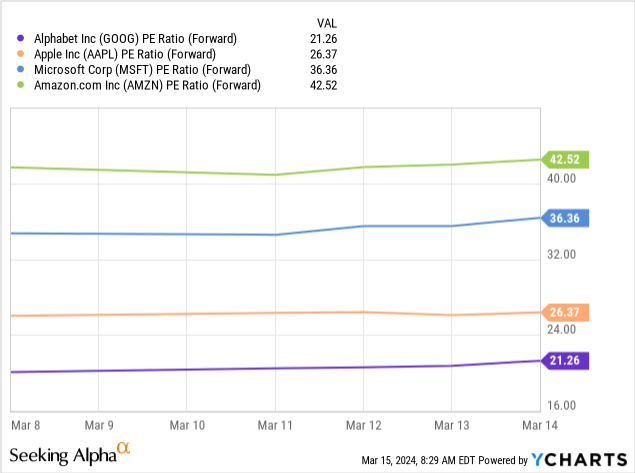

Among big tech, the only company that’s cheaper than Meta on an absolute P/E basis is Google, at 21.3x P/E over 2024. However, adjusting for growth, Google is more expensive at a 2024 PEG of 1.3x.

On a PEG basis, Amazon is the only other company that’s trading below a PEG of 1x, but is still more expensive than Meta on the surface, with a 2024 PEG of 0.9x.

Conclusion

With Meta’s extraordinary execution, a TikTok ban is not necessary but can add meaning upside to the story if one were to happen. Even in case of a sale or no change at all, advertisers could reallocate more budget to Meta, as it will provide better certainty, at least in the near term.

In my view, Meta remains very attractively valued considering its growth prospects. As I wrote in a previous article, I expect the company will handily beat somewhat low expectations for 2024, and continue to provide market-beating returns, even from current levels.

As such, I reiterate a Buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.