Summary:

- Nvidia Corporation stock has seen significant growth due to high demand for its AI chips, which remain supply constrained.

- Although concerns over the sustainability of Nvidia’s valuation and growth expectations have recently increase, industry capex allocation to AI-related infrastructure remains on the rise within the foreseeable future.

- Nvidia remains well-positioned for further fundamental outperformance, which is supportive of a similar extent of valuation multiple expansion as previously observed leading up to its next earnings release.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) has maintained a relentless upsurge since the debut of OpenAI’s ChatGPT catapulted mainstream interest in generative AI. The stock has increased five-fold since, underpinned by hot demand for Nvidia’s AI chips that serve as the backbone to an ongoing tech revolution. Not only is Nvidia’s outsized revenue growth over the past year commendable, but its phenomenal pace of simultaneous margin expansion is also impressive. The combination continues to highlight the execution capabilities of Nvidia’s visionary management team, and the value attributable to their commitment to innovation.

Yet, the stock’s biggest intraday drop since May 2023 at the close of last week has dialed up the volume on concerns over whether Nvidia’s currently lofty valuation and growth expectations are sustainable. Admittedly, demand for AI chips will eventually normalize as the build-out phase of related compute capacity and infrastructure progresses to scale phase. But demand moderation is unlikely within the near-term, as industry remains in the early stages of its transition from training to inferencing – which is where the bulk of compute demand will stem from. In other words, if humanity is really embarking on an AI transformation that will revolutionize technology like the advent of IoT, then existing compute infrastructure is likely only addressing the tip of an iceberg of demand.

This accordingly underscores further expansion in the market for AI accelerators and GPUs, which Nvidia thrives in. And continued resilience in Nvidia’s core demand environment is corroborated by the elevated level of ongoing and impending investments into the nascent technology. For instance, OpenAI’s Sam Altman has been pursuing an ambitious plan to build a $7 trillion venture for the development of artificial general intelligence that will outsmart humans. Said investment plans are similarly echoed by SoftBank’s Masayoshi Son’s consideration of a $100 billion AI chip venture. Paired with near-term prioritization of capex spend towards the build-out of AI infrastructure across hyperscalers and enterprise server providers, there remains far greater demand for GPUs than what is currently available (or will soon be available) in the market.

And market’s steadfast confidence in Nvidia’s widening lead in the heated AI race is evident in the stock’s swift recovery this week. Our analysis shows that Nvidia is currently trading exactly at where it should be. Based on historical observations, Nvidia should experience some renewed volatility through next week as its annual GTC keynote progresses. But momentum is expected to pick up gradually post-GTC, and more prominently approaching the F1Q25 period-end and on the heels of said earnings release.

Nvidia Is Right Where It Should Be

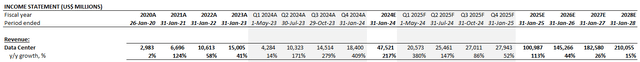

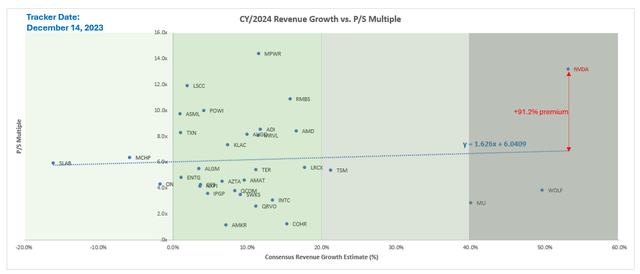

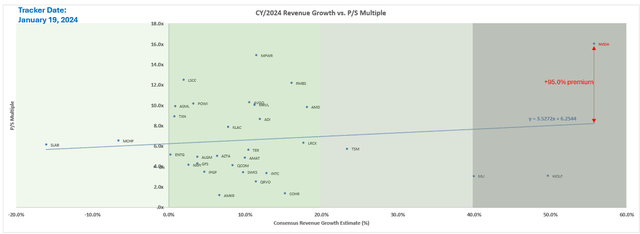

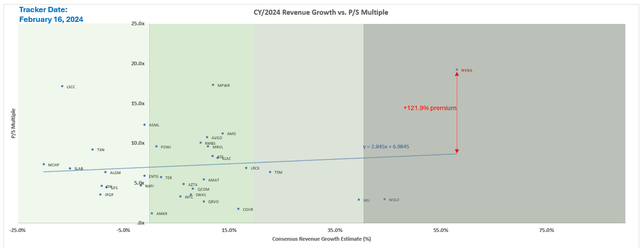

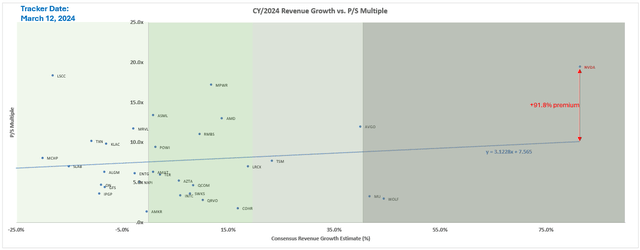

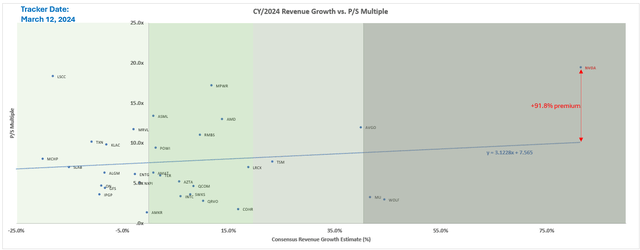

Nvidia is trading right where it should be right now after normalizing for market’s favorable pricing of its F4Q24 outperformance and solid F1Q25 guidance. We have been tracking Nvidia’s valuation multiple on a relative basis to the broader semiconductor peer group over the past quarter. And Nvidia has consistently demonstrated a ~90% premium to the peer group trendline on a relative basis to its consensus growth estimate.

Data from Seeking Alpha; Tracked by Author Data from Seeking Alpha; Tracked by Author Data from Seeking Alpha; Tracked by Author Data from Seeking Alpha; Tracked by Author

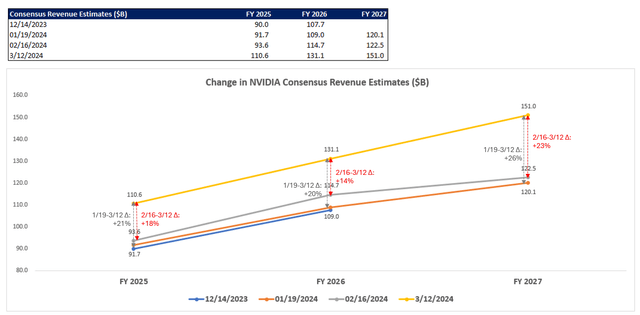

An exception was observed in February, shortly after Nvidia finished the fiscal fourth quarter. Our February tracker showed a sharp jump in Nvidia’s premium to the peer group trendline to 122%, deviating from the consistent preceding average premium of ~93% by almost 30 percentage points. We believe this jump was to account for market’s front-running in anticipation of a strong F4Q24 report and F1Q25 guidance. And this materialized, with consensus growth estimates for Nvidia through FY 2027 increasing by 19% on average post F4Q24 earnings, compared to estimates for the same period observed prior.

Data from Seeking Alpha; Tracked by Author

And following Nvidia’s sharp drop on Friday (March 8), which likely drove a similar decline in the broader Philadelphia Semiconductor Index (SOX), Nvidia now trades at a 92% premium to the peer group trend line, normalizing towards the preceding trend. This is exactly where Nvidia should be trading at right now, in our opinion.

Data from Seeking Alpha; Tracked by Author

Specifically, we believe the stock is likely in a rinse and repeat cycle of what was observed in the months leading up to its F4Q24 earnings release, given no material changes to underlying AI momentum and GPU demand environment. Specifically, our thesis is that given AI momentum remains intact in the near-term, Nvidia is expected to exhibit an outsized jump in its multiple premium to peers after F1Q25 close, similar to what was observed in February. This is further complemented by Nvidia-specific growth tailwinds in the current quarter, which includes improvements to H100 supply, the start of H200 shipments, and accelerating inference demand from hyperscalers and enterprise spending segments.

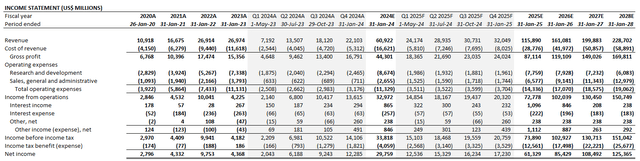

Our updated fundamental forecast for Nvidia, taking into consideration its actual F4Q24 performance and F1Q25 guidance, expects revenue growth of 90% to $115.9 billion in FY 2025. This will be primarily led by consistent sequential expansion in data center sales.

As mentioned earlier, Nvidia exhibits company-specific tailwinds that corroborate continued growth outperformance in the near-term. They include improvements to GPU supply to fill backlogged demand and favorable H200 pricing with shipment ramp-up. Nvidia’s key customers across the cloud computing and enterprise segments have also echoed resilient capex and R&D prioritization within the foreseeable future for AI developments during the latest earnings season. This will inadvertently reinforce demand for supporting infrastructure, which includes AI chips for accelerated computing data centers and full stack Nvidia software.

The anticipated acceleration in inferencing workloads, as recently developed AI solutions go to market, is also expected to complement Nvidia’s data center sales. Inferencing refers to the process of generating output from AI solutions deployed, such as responses on ChatGPT queries. Current industry forecasts expect inferencing activity to soon overtake training workloads as the key source of demand for compute power, and represent “2x the number of cycles and spend as training by mid-2025.” Nvidia has recently disclosed that only 40% of its current data center revenue was attributable to AI inference. And this number is likely to expand through FY 2025 and beyond, as CPU-based data centers transition to accelerated computing for improved efficiency and TCO in handling increasingly complex inferencing workloads. This will inadvertently reinforce demand for all of Nvidia’s data center solutions tailored for the AI revolution, spanning GPUs, accelerators, networking solutions to enable scalability, and full stack software.

While we expect steepening deceleration in core data center growth through fiscal 2025 and towards fiscal 2028 before segment demand normalizes, they are unlikely to preclude further valuation appreciation over the near- to medium-term. Specifically, our forecast expects annual data center revenue growth to be halved through FY 2028. This is consistent with previously observed cloud momentum, which grew sharply during the pandemic and through FY 2022, accompanied by an adjacent valuation upsurge in the Nvidia stock. Anticipated momentum in higher-margin data center sales will also reinforce the sustainability of Nvidia’s gross margin in the mid-70% range as guided by management. This accordingly provides incremental durability to its valuation premium to peers over the next year.

Pricing Considerations

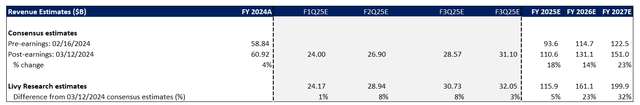

Our current revenue growth estimates for FY 2025 through FY 2027 outperforms consensus expectations by a similar extent to what was observed post-F4Q24 earnings release. This accordingly corroborates the potential for another upward deviation in Nvidia’s valuation multiple premium to the broader semiconductor peer group leading up to its next earnings, which we expect to be another upside surprise.

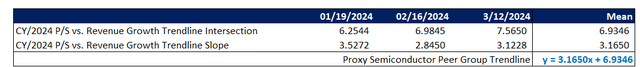

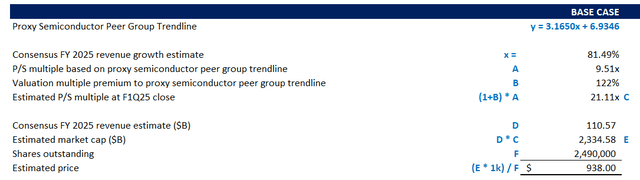

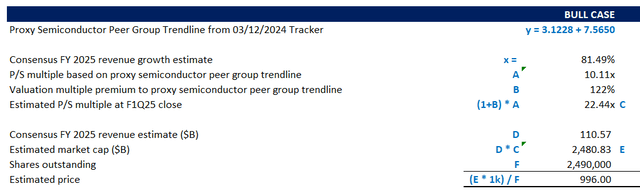

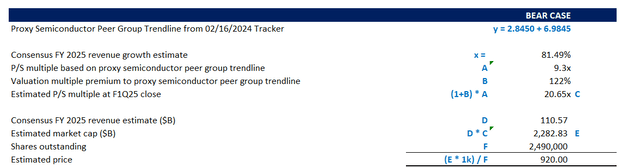

The big questions is where the broader semiconductor peer group multiple trendline will be – i.e., what is the base to Nvidia’s anticipated valuation premium leading up to its F1Q25 earnings. Admittedly, there are uncertainties to predicting this base, given the combination of company-specific and broader external influences, such as macroeconomic conditions and market risk appetite. In order to normalize for these unpredictable factors, we take the average sector trendline slope and intersection observed over the past three months as a proxy for the baseline to which Nvidia’s pre-earnings valuation multiple premium will be launched from.

Considering the consensus growth estimate of 81.5% for Nvidia’s FY 2025 revenue, the stock should trade at about 9.5x on the proxy trendline. And applying the 122% pre-earnings multiple premium to the proxy trendline result would yield an estimated P/S multiple of 21.1x for Nvidia expected F1Q25 close. By applying 21.1x to Nvidia’s current consensus FY 2025 revenue estimate of $110.6 billion, the stock should trade at about $938 apiece.

This represents modest upside from the stock’s current levels, despite expectations for another leg up in Nvidia’s forward estimates post-F1Q25 earnings release. However, if a 122% multiple premium is applied to the semiconductor peer group’s current multiple trendline, the resulting P/S ratio of 22.4x would yield an estimated price of close to $1,000 apiece. There remains potential for a further upsurge of this extent approaching Nvidia’s next earnings release. Specifically, the higher baseline at current levels could remain sustainable, as it already reflects the broader peer group’s recent pullback to normalize for any previous upward market mispricing on the stronger-than-expected Q4 earnings season.

Alternatively, a flatter peer group trendline like that observed in mid-February could mark a fair industry bear case in the near-term. Based on the foregoing analysis, we believe AI momentum should remain intact and resilient in the near-term. Thus, any prolonged moderation should not fall far from the bottom observed in recent months. By applying a 122% multiple premium to this baseline, the resulting P/S ratio is at about 9.3x, which would yield an estimated price of about $920.

Taken together, we believe any dips below the $900-level for Nvidia leading up to its next earnings release would represent a buy opportunity for further upside potential in the near-term. We view the upcoming GTC keynote event as a potential opportunity. The annual keynote is typically accompanied by volatility in the stock. Nvidia has posted a 5% on average over the course of the four-day event, followed by an immediate, yet brief, pullback, which could mark an opportunity for upside potential leading up to its next earnings release.

Conclusion

Despite Nvidia Corporation’s lofty premium at current levels, we remain bullish on the stock considering its relative trend to the broader peer group. There is also resilient AI momentum in the near term, where demand for supporting processors remains a function of supply availability. This accordingly bodes favorably with Nvidia’s market leadership, and provides further fuel for a potential upsurge towards the $1,000 threshold in the coming months.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!