Summary:

- Qualcomm stock has performed relatively well and exceeded expectations in its fiscal first-quarter earnings release.

- The worst headwinds are expected to be over, further bolstered by the recent AI hype.

- Qualcomm is still mainly a smartphone chipset maker, so investors must be careful in chasing the narrative in a more robust valuation re-rating.

- I explain why I maintain my Hold thesis and point out the appropriate levels to consider adding more exposure.

Sundry Photography

Qualcomm Incorporated (NASDAQ:QCOM) stock has continued to perform well since my previous update, as I downgraded it to a Hold. While I didn’t assess a need to be bearish, I expected a more pronounced pullback, helping to open up more attractive opportunities to get on board. However, the AI-driven hype has also bolstered buying sentiments in QCOM, as investors anticipate Qualcomm to benefit from the AI smartphone and PC refresh moving ahead.

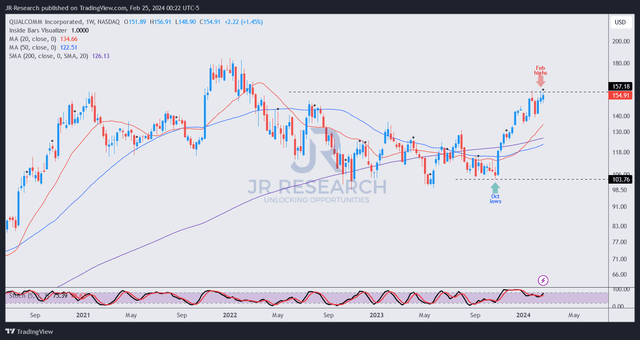

Qualcomm posted its fiscal first quarter earnings (FQ1’24) release at the end of January 2024. It was a solid release as Qualcomm exceeded its internal guidance and surpassed Wall Street’s estimates. Given QCOM’s pre-earnings recovery from its 2023 lows, I believe the market has gotten QCOM’s recovery on point. Accordingly, QCOM re-tested the $158 level in January 2024 (last seen in early 2022), although its upward momentum has since stalled.

Consequently, given its robust recovery, I gleaned that QCOM could move into a consolidation phase as the market reassesses the company’s opportunities moving ahead.

Qualcomm’s guidance suggests a sequentially weaker quarter for FQ2, although it isn’t unexpected, in line with typical seasonality factors. Notably, Qualcomm noted more robust smartphone demand dynamics in China, auguring well for a stronger Android 5G performance in 2024. The Chinese economy is still recovering from its property-driven malaise. However, more robust momentum driven by Chinese consumers’ interest in Huawei’s 5G offerings could also expand adoption in other smartphone makers. As a result, Qualcomm believes that the TAM for premium handsets in China “has expanded,” which is expected to bolster “continued strong demand from Qualcomm’s customers post that launch.”

Moreover, Qualcomm also underscored that the IoT revenue decline could bottom out in the first half, leading to a growth inflection in the second half. The company indicated that the inventory dynamics have improved. As a result, investors should anticipate stronger performance from all of Qualcomm’s revenue segments in fiscal 2024. In addition, Qualcomm expects its licensing revenue to trend according to normalized expectations, lending further clarity to its revenue stability.

Moreover, Qualcomm highlighted the significant growth inflection on AI PCs and smartphones, which could result in a stronger-than-anticipated refresh cycle. Samsung is going all out in its bid to outmaneuver Apple (AAPL) in introducing generative AI on the smartphone. However, Apple’s recent earnings suggest we should expect a significant gen AI launch from Apple management at this year’s WWDC. Given how much interest generative AI has driven, leading to a significant expansion in earnings estimates for Nvidia (NVDA) over the past year, I assessed the market as getting increasingly optimistic about the smartphone chipset makers. Apple’s ability to further encroach against Android’s market share shouldn’t be underestimated. Furthermore, Qualcomm’s entry into the automotive and AI PC segments is still nascent and not expected to be deserving of an economic moat currently. Hence, I assessed that the market will likely value QCOM as a smartphone SoC maker until investors have confidence in Qualcomm’s ability to move deeper into Intel’s (INTC) and AMD’s (AMD) market segments with its AI PCs.

Notwithstanding my caution, QCOM’s valuation isn’t expensive, rated “C-” by Seeking Alpha Quant. Therefore, the market seems to have priced in these uncertainties, bolstering its buying sentiments.

QCOM price chart (weekly, medium-term) (TradingView)

I’ve not gleaned red flags on QCOM’s price action, suggesting investors can consider holding on unless they expect to reallocate their exposure. However, an extended consolidation at the current levels should be expected, as buying momentum has stalled. I still expect a pullback on QCOM, although the recent AI fervor seems to have delayed that. Investors keen on a more attractive risk/reward profile can consider potential opportunities closer to the low- to mid-$130 levels.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!