Summary:

- Qualcomm experienced strength in Q1’24 earnings with a turnaround in top-line growth rate and strong margin expansion. Forward growth may face headwinds depending on consumer strength.

- Qualcomm may experience some tailwinds as it rolls out its high-value mobile GenAI chipsets across major OEMs, offset by flat growth in handhelds.

- CTAs forecast 230mm AI-enabled smartphones and PC to ship in 2024, suggesting strong tailwinds for consumer devices.

NguyenDucQuang/iStock Editorial via Getty Images

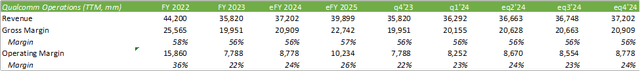

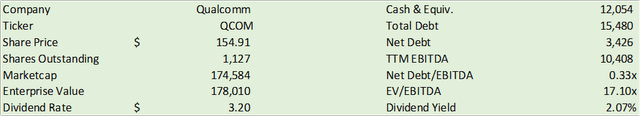

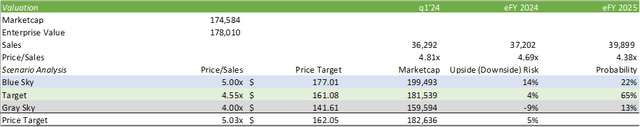

QUALCOMM (NASDAQ:QCOM) experienced strength in their q1’24 earnings with a turnaround in their top-line growth rate and strong margin expansion. Despite this strength, I anticipate eFY24 to be another challenging year despite the rollout of AI-enabling chipsets for handhelds. With an anticipated flat market for handhelds and a modestly soft automotive market, management anticipates strength in industrial IoT. I anticipate eFY24 & eFY25 to experience growth at the top line and margins, but expect a narrower performance when compared to consensus estimates as I anticipate the strength of the consumer to be softening due to persistent inflationary pressures. I provide QCOM a HOLD recommendation with a price target of $162/share based on 5.03x eFY25 sales.

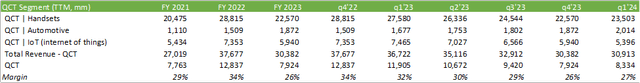

Operations

Q1’24 appears to have been a turning point for Qualcomm’s growth trajectory, with trailing sales turning to growth at 1.32% on a TTM basis. This may be a pivotal time for Qualcomm as the firm releases its next generation of chips in mobile devices. As the focus on AI-enabled devices becomes the main theme for 2024, Qualcomm may be able to ride the wave. Though much of the interest appears to be at the hyperscaler and corporate levels, as seen by Nvidia’s (NVDA), Advanced Micro Devices (AMD), and Intel’s (INTC) growth expectations, there may be considerable growth at the consumer level. A January report in Barron’s suggested that consumer spending for technology is expected to grow 2.8% in 2024. Though the report doesn’t segment out handhelds specifically, the report does suggest that over 230mm AI-enabled smartphones and PCs are expected to ship this year.

Qualcomm reported significant strength in their premium tier chipset as handset OEMs implement on-device GenAI features. As the next generation of handset devices adopt GenAI technology, Qualcomm should realize significant value from Apple, Samsung, and Google. In addition to this, Apple extended their licensing agreement with Qualcomm, pushing out the term date to March 2027. I believe that Qualcomm’s partnership with Apple will continue to be focused on as Apple continues to develop their own mobile chips internally that can potentially compete with Qualcomm’s chipset. Qualcomm is also in the process of negotiating two agreements or renewals with other key licensees and OEMs in China, which are currently set to expire in 2025.

As management had alluded to in their q1’24 earnings call, handsets are expected to be flat in 2024 with some growth in 5G-enabled handsets in the range of high-single to low-double-digit growth. I believe this may play strongly to Qualcomm’s margins as higher tier chips will be required for this shift in handset demand.

Qualcomm may experience strength as they deploy their mobile GenAI chips into the next-generation Samsung Galaxy S24. The chips will enable features such as live translate, interpreter, chat assist, and nightography, amongst other features. The new Galaxy S24 device launched on January 17, 2024 and should start showing results in eq2’24.

Corporate Reports

This next class of Snapdragon chipsets can reinvigorate Qualcomm’s growth in eFY24 as the firm navigates a flat market. The higher-value content added can bring a higher dollar value per content to this segment as well as the ability to strengthen margins going forward.

Similar to handsets, automotive is expected to have a relatively flat year for FY24 with some tailwinds to more content per vehicle. As vehicles include more sophisticated ADAS and infotainment systems, more chips will be required to properly function. This can lead to significant tailwinds for Qualcomm in a flat-to-down market and somewhat balance out through volumes of chips on a smaller number of vehicles.

Considering trailing margins, QCT has been experiencing tighter margins. Management mentioned their headcount reduction to reel in costs, which should somewhat bolster margins going forward. The degree of the impact may not be significant enough to turn the ship around per se; however, q1’24 did show some improvement in margins when compared to the previous quarter.

Management does anticipate some strength in industrial IoT coming off of a downtrend from consumer IoT. There can be a strong case for industrial automation and devices as companies seek to automate more operations and manage costs as nearshoring/onshoring occurs. There could be some strength as a result of expected funding through the IRA and infrastructure bills as modern technologies will need to be deployed for various aspects to segments like grid modernization. Exactly when this impact occurs is to be seen; however, there have been hints at money being deployed this year, as it is an election year, after all.

Corporate Reports

Looking to financials, I anticipate a softer growth rate when compared to consensus estimates. Though the firm will be at the epicenter of consumer AI-enabled technologies, I believe that the consumer strength isn’t as strong as the broader market anticipates. One example that I will credit Mike Green of Simplify with is the factor of available drivers on Lyft (LYFT) and Uber (UBER) platforms offsetting the unemployment rate. I believe that consumers will be more cautious in their spending and focus less dollars on consumer electronics in favor of spending impacted by inflation, such as consumables. As a result, I don’t believe the January smartphone sales slump is the end to the trend. My expectation is that Qualcomm’s eFY24 & eFY25 growth will be derived from higher-value content in handhelds and vehicles as well as from industrial IoT.

Valuation & Shareholder Value

Corporate Reports

Qualcomm offers significant shareholder value in the form of buybacks and dividends. As of q1’24, Qualcomm has $4.4b remaining under their share repurchase program, offering significant flexibility for the firm to opportunistically repurchase shares. At the current share price, Qualcomm has roughly 28mm shares they can take off the float. Given my expectations for a relatively soft growth rate for eFY24 & eFY25, I do not anticipate Qualcomm to emphasize their share buybacks unless there is a significant pullback in the price per share. The firm has historically increased the dividend rate annually, so we may be able to model in some growth in the dividend rate for eFY24.

Valuing QCOM shares, I anticipate 5% growth for my terminal share value of $162/share based on my eFY25 sales estimate. I provide QCOM shares a HOLD recommendation.

Corporate Reports

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.