Summary:

- Qualcomm’s FY1Q24 top and bottom lines beat consensus estimates as the handset and automotive business exceeded expectations.

- Qualcomm announced multiple key license agreement extensions, including a 2-year extension with Apple, taking the agreement to March 2027.

- The Snapdragon 8 Gen 3 mobile platform is expected to enable on-device generative AI features on smartphones, and Samsung is the first to adopt this.

- In 2023, management shared that 75 new models were launched commercially with the Snapdragon Digital Chassis Solution.

- The recent stabilization of demand led to more optimistic handset guidance and an expectation of flat to slightly up handset unit growth in 2024.

AutumnSkyPhotography

QUALCOMM (NASDAQ:QCOM) has rallied 21% since the last article was published (which can be found here).

The company has published their FY1Q24 results, and this article will cover my thoughts on the earnings.

This was a strong print as top and bottom-line exceeded the high end of the guidance and expectations.

The strong results showed an improvement in the handset cycle, with demand stabilizing and the company being more optimistic about where we are at in the handset cycle.

Apart from the handset segment, automotive also was strong, while management expects this FY1Q24 quarter to be the bottom for revenues for the IoT segment.

Last but not the least, Qualcomm is showing its upside in generative AI as AI pushes to the edge to enable on-device AI, and there is also a PC opportunity that could be big a few years from today.

FY1Q24

Qualcomm generated $9.92 billion in revenues for FY1Q24, up 15% sequentially. This was 4 percentage points higher than consensus.

The beat was a result of the higher handset and automotive chip sales.

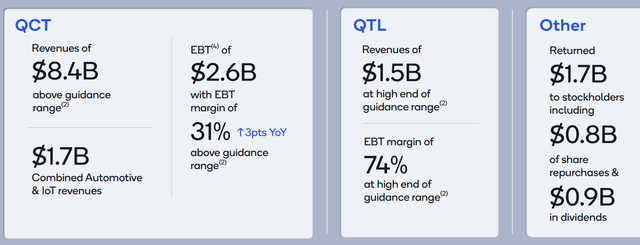

I will first touch on the QCT segment before delving into the QTL segment below. QCT revenues came in at $8.4 billion and EBT margin of 31% was delivered. Both came in above the high end of the guidance range, again due to strength in both handsets and automotive revenues.

QCT margin was a result of improvement in revenue scale, better product mix and continued operating discipline.

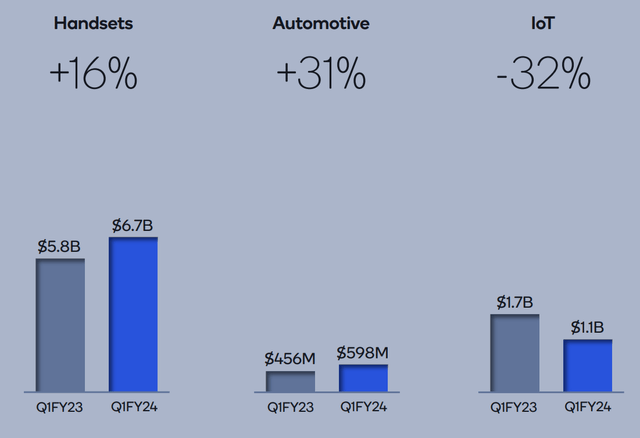

Handset revenues grew 16% from the prior year to $6.7 billion. This was higher than management’s own expectations as a result of higher demand due to the acceleration of Android flagship launches with the Snapdragon 8 Gen 3 mobile platform. In particular, Android handset revenues from Chinese OEMs exceeded management’s expectations, growing more than 35% from the prior quarter.

Automotive revenues were also strong, growing 12% sequentially to $598 million, which was a result of increased content in new vehicle launches with the Snapdragon digital chassis platform. IoT revenues of $1.1 billion reflect the industry-wide challenges we’ve previously outlined. We achieved record automotive revenues of $598 million, which grew by 12% sequentially,

Breakdown of QCT revenues (Qualcomm)

QTL revenues came in at $1.5 billion and EBT margin of 74% was at the high end of guidance. Again, this reflected the slightly higher handset units.

For the QTL business, Qualcomm also announced multiple key license agreements extensions.

Firstly, Apple exercised its 2-year extension on its licensing agreement due to its extended reliance on Qualcomm modems. This takes the licensing agreement with Apple to march of 2027.

In addition, management shared that Qualcomm also extended long-term agreements with two significant Chinese smartphone OEMs.

Qualcomm continues to negotiate new agreements and renewals with new or existing customers, with some expiring in early fiscal 2025.

QCT and QTL revenue breakdown (Qualcomm)

Gross margins came in at 56.9%,up 139 basis points sequentially. This was 1 whole percentage point higher than consensus estimates.

EPS came in at $2.33, 19% higher than market consensus, as a result of the beat in gross margins and lower taxes.

However, guidance came in lighter than expected.

For FY2Q24, Qualcomm guided for revenues to be at $9.3 billion, which is down 6% sequentially, as a result of share loss at Samsung. This was about 2% below consensus.

FY2Q24 EPS was guided to $1.79, 10% below market consensus, as a result of lower licensing revenue.

During the quarter, Qualcomm continued returning value to shareholders, $1.7 billion was returned to shareholders, $895 million in the form of dividends and $784 million in the form of share repurchases.

Samsung and generative AI

In FY1Q24, Qualcomm also announced the Snapdragon 8 Gen 3 mobile platform, which brings generative AI capabilities to the top-tier Android smartphones and the performance and experiences it brings puts the Snapdragon 8 Gen 3 mobile platform a category leader.

Importantly, the Snapdragon 8 Gen 3 mobile platform for Galaxy was featured in the Samsung Galaxy S24 Ultra, which was recently announced, along with the Galaxy S24 and S24 Plus.

This enables the Galaxy S24 Series to enable on-device AI features like live translate, chat assist and more.

I think the adoption by Samsung of the Snapdragon 8 Gen 3 mobile platform for generative AI opportunities could lead other smartphone players to start incorporating it into their smartphones as well to match the user experience and performance of the Galaxy S24 Series.

Qualcomm announced that it has extended a multi-year agreement with Samsung. This agreement relates to Snapdragon platforms for flagship Galaxy smartphone launches from 2024.

With this extension of a multi-year agreement with Samsung, I think this shows the strong technological leadership of Qualcomm’s Snapdragon 8 and the value of a long-term strategic partnership with Samsung.

With this agreement, Qualcomm continues to have a majority share position with Samsung, which is somewhere in the 80% range, down from the earlier 100%.

Guidance for global handset units

Qualcomm commented that they expect global handset units to fall mid-single digit percentage in the 2023 calendar year, on a year-on-year basis. Again, this is an improvement from the earlier down mid-to-high single-digit percentage relative to 2022 in the prior quarter.

This is a result of the recent stabilization of demand.

For the 2024 calendar year, management expects global handset units will be flat to slightly up from 2023. Of which, 5G handsets are expected to grow high-single digit to low double-digit percentage.

For the June quarter, while Qualcomm is not yet guiding that far ahead, management suggests nothing out of the ordinary.

Diversification thesis continues

One of the key pillars to the investment thesis surrounding Qualcomm is the generation of new sources of revenues from automotive and IoT.

Automotive is an important growth pillar and has done well yet again this quarter.

In 2023, management shared that 75 new models were launched commercially with the Snapdragon Digital Chassis Solution.

This is a substantial number of models for an emerging and growing business and thus, further validates my thesis that Qualcomm continues to be growing in scale in the automotive segment and management is executing the design wins well.

Qualcomm also announced that it is collaborating with Bosch, for Bosch to use the Snapdragon Ride Flex system-on-chip (“SoC”) to power their new central vehicle computer.

Qualcomm’s Snapdragon Ride Flex SoC allows for the combining of infotainment in ADAS functionalities on a single SoC.

Lastly, Qualcomm shared that it demonstrated digital cockpits connected services and advanced driver systems enabled by generative AI models running locally on the Snapdragon platform. This can simply be enabled through a software upgrade and presents new opportunities for Qualcomm.

Within the IoT segment, the consumer part of it is seeing some form of stabilization after Qualcomm called out the weakness earlier in 2023. That said, it is seeing weakness in industrial and edge networking side as well.

That said, management is of the view that FY1Q24 was the bottom for its IoT revenues, with the guidance for the segment in the next quarter being a growth of mid to high-single digits.

With the second half of FY2024, management expects that the inventory channel to normalize and a great product portfolio to lift things up then.

Qualcomm is looking to launch the Snapdragon X Elite in the middle of 2024 for PCs, and the company has seen traction in design wins in this area since it was announced in October last year. The Snapdragon X Elite will be the industry benchmark for on-device generative AI and co-pilot experiences for the next-generation Windows PCs, along with leading performance and battery life.

Within Qualcomm’s mixed reality business, it recently announced the Snapdragon XR2+ Gen 2, brings about very high quality and immersive mixed reality and virtual reality experiences.

Qualcomm did partner with Samsung and Google to bring about XR experiences for Galaxy end users using the Snapdragon XR2+ Gen 2.

Lastly, within edge networking, Qualcomm announced the Snapdragon X35 5G Modern-RF system, which is the 1st 5G NR light Modem RF system in the world, which will bring a unified 5G platform for IoT devices.

Valuation

In my earlier Seeking Alpha article on Qualcomm, I raised my 1-year price target to $159, as the improving market environment for handset, along with the continued improvement in fundamentals led to revisions in my near-term financial forecasts.

In this article, I am reiterating my earlier 1-year price target of $159, given that there are no material changes after the FY1Q24 results.

With that, I would reiterate my Buy rating for Qualcomm given that there is considerable conservatism embedded in my 1-year price target, with just a 15x 2024 P/E multiple applied to the 2024 EPS estimate to derive the 1-year price target.

Of course, this conservatism is to ensure a sufficient margin of safety and I do think that when the cycle turns and recovery strengths, I can increase the multiple further given this will likely result in a multiple expansion.

For now, the 15x 2024 P/E I applied for Qualcomm is still rather conservative in my view given the strong technological and competitive leadership of the company.

Conclusion

I think Qualcomm’s FY1Q24 results showed the strength in the handset and automotive segment.

The handset segment continues to show growing demand and signs of a bottom, while the automotive segment remains in the early days and shows strong momentum.

Qualcomm also showed that it has opportunities in the form of the generative AI upside, and an exciting new opportunity in PCs that could be huge few years from now. The fact that the Snapdragon 8 Gen 3 mobile platform is used in the Galaxy S24 Series to enable on-device AI features shows that Qualcomm is indeed winning in on-device generative AI.

The company is one to watch given that we are seeing a transformation in the company. While handset revenues are likely to decrease in the revenue mix, we will start to see more IoT and automotive revenues offset that. PCs are definitely an area of opportunity that I can see Qualcomm winning in as well, which will further provide another pillar of growth and further diversification to revenues.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 50% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!