Summary:

- The author has owned Starbucks stock for a decade and has seen significant returns, with dividends pushing total returns above 200%.

- The narrative surrounding Starbucks has changed, with concerns about rising worker costs, unionization threats, and geopolitical tension with China affecting the stock.

- Despite these concerns, the author believes the recent sell-off has made Starbucks shares attractively valued and has recently added to their position.

Nadya So

I’ve owned Starbucks (NASDAQ:SBUX) as a core component of my dividend growth portfolio for years.

I began purchasing the stock back in March of 2014. My earliest shares came with a cost basis of $35.26. Today, even with shares down more than 20% from their all-time highs, I’m up more than 164%.

Since 2014, Starbucks has paid me roughly $13.50/share in dividends.

Those dividends push my total returns up above the 200% threshold.

Throughout the last decade, I’ve added to the position many times and today my overall cost basis sits at $51.21.

Without a doubt, SBUX has been a big winner for me, yet the narrative surrounding this stock has changed quite a bit since I first began buying it.

A decade ago, SBUX was a can’t-miss DGI stalwart. This founder-led company was posting very reliable growth in the 20% area annually. It was still expanding rapidly and hoped for international dominance similar to the success that it had experienced in the United States was driving the bulls into a fever pitch. Really, the only strike against SBUX back in the mid-2010’s was valuation. The stock was typically trading with a 30x P/E multiple attached, which made some value investors anxious.

Well, today there are still valuation concerns (although SBUX is cheaper now, with a ~25x blended P/E attached, it’s still trading at a premium to the broader market). But, those are the least of the bull’s worries.

Today, investors have to worry about rising worker costs and unionization threats eroding margins and efficiency. Also, rising geopolitical tension between the US and China is cause for concern due to Starbuck’s reliance on the Chinese market, not only as a growth vehicle, but also, as a large piece of the company’s existing revenue pie.

And yet, despite these potential headwinds, I added to my SBUX stake last week.

This was the first time that I’ve bought SBUX in years; however, I think the recent sell-off has pushed shares down to a level where the risk/reward can no longer be ignored.

I bought shares at $93.21 on February 15th, 2024, maintaining my portfolio weighting in the 1.5% range after the stock’s recent sell-off.

Currently, SBUX is my 12th largest holding, showing the conviction that I have long-term.

I believe that SBUX is attractively valued here in the low $90’s and the stock remains near the top of my personal watch list due to its safe/reliably increasing dividend and strong forward-looking fundamental growth prospects.

In this report I’ll highlight the company’s recent earnings results, break down SBUX’s valuation, and put a spotlight on my forward-looking expectations with regard to share price appreciation and ongoing dividend growth.

Fiscal 2024 First Quarter Results

Starbucks has been on a negative trend for about a year now and their first quarter results didn’t do anything to change that.

During the trailing 12 months, SBUX shares are down by 13.33%. They’re down about 1% since the 1/30/2024 earnings report. And yet, I didn’t think the results were all that bad.

SBUX Q1 ER “At A Glance”

Yes, SBUX missed Wall Street’s expectations on both the top and bottom lines.

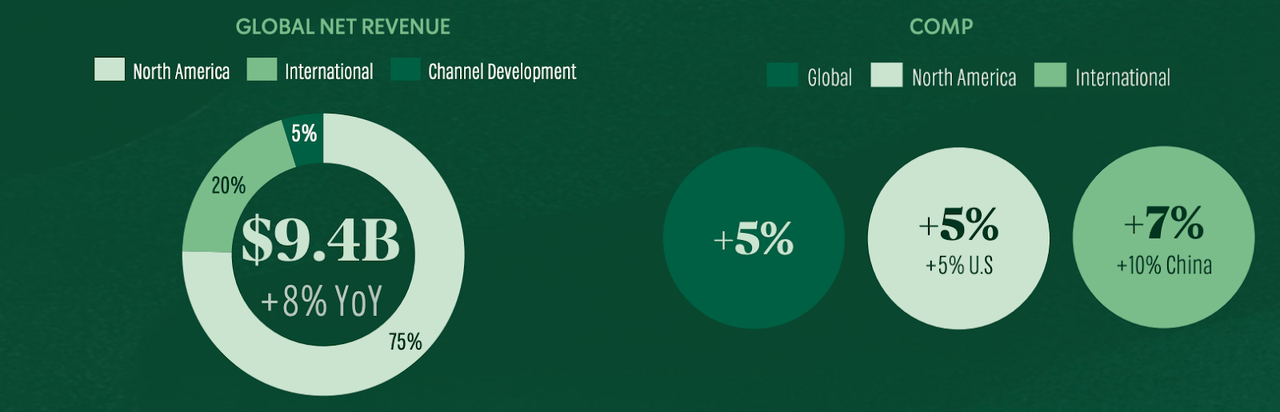

They posted $9.4 billion in sales, which was $230m short of consensus. However, this $9.4b sales figure represented 7.9% y/y growth and in today’s macro environment, that’s a fine figure.

For instance, McDonald’s most recent quarterly revenue growth came in at 8.1%.

I think high single digit growth is acceptable for a mature company like this. These companies can turn high single digit sales growth into solid, double digit earnings growth by managing operational leverage and financial engineering (using buybacks to enhance earnings-per-share).

What’s more, $9.4 billion was a Q1 record for the company. Who am I to argue against all-time records?

SBUX’s Q1 non-GAAP EPS came in at $0.90/share. That missed expectations by $0.04/share; however, $0.90/share still represented 21.4% y/y growth.

SBUX’s Q1 global same-store sales were up 5% (3% being driven by transactional volumes and 2% driven by average ticket size).

It was nice to see a blend here of volumes and pricing, especially after consumer staples like PepsiCo (PEP) and Coca-Cola (KO) in the non-alcoholic beverage space just posted quarters that were driven entirely by price increases.

This was especially the case in SBUX’s international segment, which was 7% y/y same-store sales growth, driven by 11% transaction volume alongside a 3% average decline in ticket size.

I think the declining ticket size here was concerning because it points towards a lack of pricing power in the face of rising competition (and therefore, margin compression). However, at the end of the day, double digit transaction growth clearly points towards strong demand for Starbucks’ offerings.

Pricing power is great, but I also want to see growing demand for products.

I think SBUX strikes a nice balance in this regard.

In terms of brand equity, it appears that SBUX remains hot. During the Q1 report the company noted that its holiday gift card sales totaled $3.6b, another new record high.

SBUX Q1 ER “At A Glance”

The company continues to capitalize on this trend by growing its digital rewards program, which saw a 13% y/y membership increase during Q1, up to 34.3 million customers (who are likely to provide stickier, more predictable sales moving forward).

Over the years this company has proven its ability to steadily increase gross margins over time and I suspect that it will continue to execute moving forward. Obviously, that’s a speculative statement, but when I invest in companies I’m essentially putting my faith in their management team’s ability to execute and despise negative sentiment surrounding shares, I haven’t lost that trust.

I think it’s also important to note that SBUX continues to expand its footprint. The company opened up 549 new stores during Q1, pushing its global store count up to 38,587.

Increasing the global footprint is an easy way to increase sales/cash flows over time and looking at the company’s updated guidance figures for 2024, it appears that this is exactly what SBUX aims to achieve.

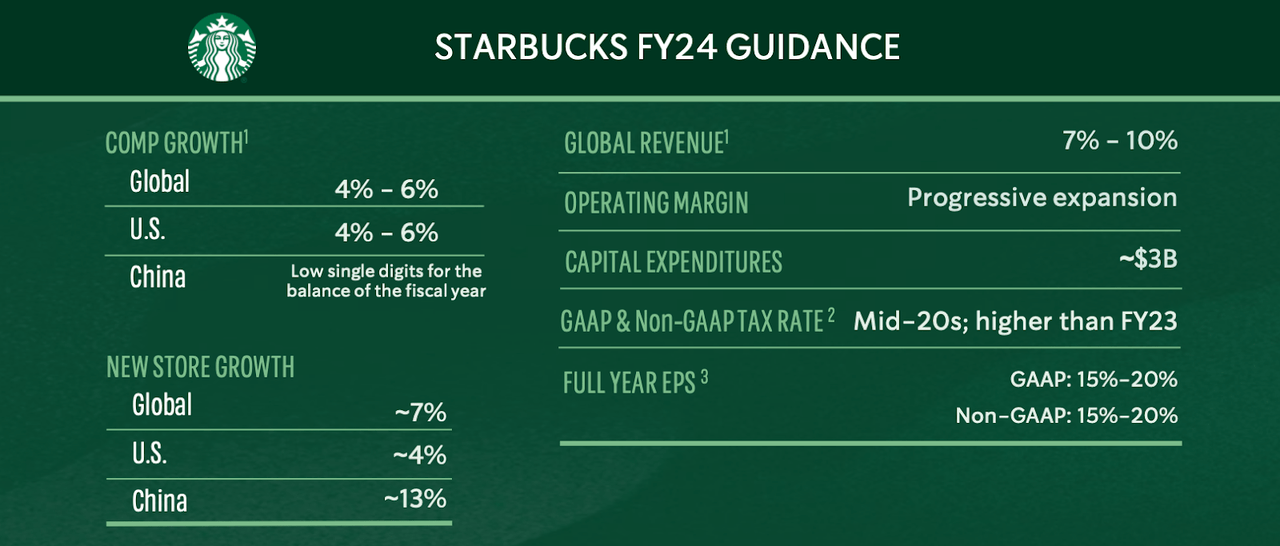

As you can see below, SBUX expects to continue to increase its store count and produce mid-single digit same-store sales comps, ultimately resulting in 7-10% revenue growth and 15-20% EPS growth.

SBUX Q1 ER “At A Glance”

You’re never going to hear me complain about a company growing its earnings at a 15%+ rate.

I’m not a coffee drinker. Honestly, I can’t remember ever spending a dime in one of Starbucks’ locations. This certainly isn’t a “buy what you know” situation. But, that doesn’t matter. All that matters to me is reliable bottom-line growth and generous shareholder returns. SBUX provides both in spades.

Companies that can do this consistently are the types of compounders that I want to own and looking at SBUX’s long-term results and forward-looking consensus estimates, it appears that the company has moved past the COVID-19 disruptions and is now back to normal (in terms of realistic, reliable double digit annual growth potential).

Valuation

Not only do I want to own reliable compounders, I’m willing to pay a premium for shares.

As my introduction shows, buying and holding blue chips over the long-term…even if the initial premium is high, can result in very strong returns.

Now, there are limits to this strategy.

Actually, prior to my purchase last week, my most recent SBUX trade was a sale.

In August of 2019 I trimmed my position at $93.76, locking in gains of 64%.

At the time I was concerned with the stock’s ~35x P/E ratio and rising PEG ratio. I was also worried about the ongoing impact of Trump’s trade war with China and potential retaliatory measures being taken against big US multinationals, like SBUX, which had tied their growth wagons to the Chinese market.

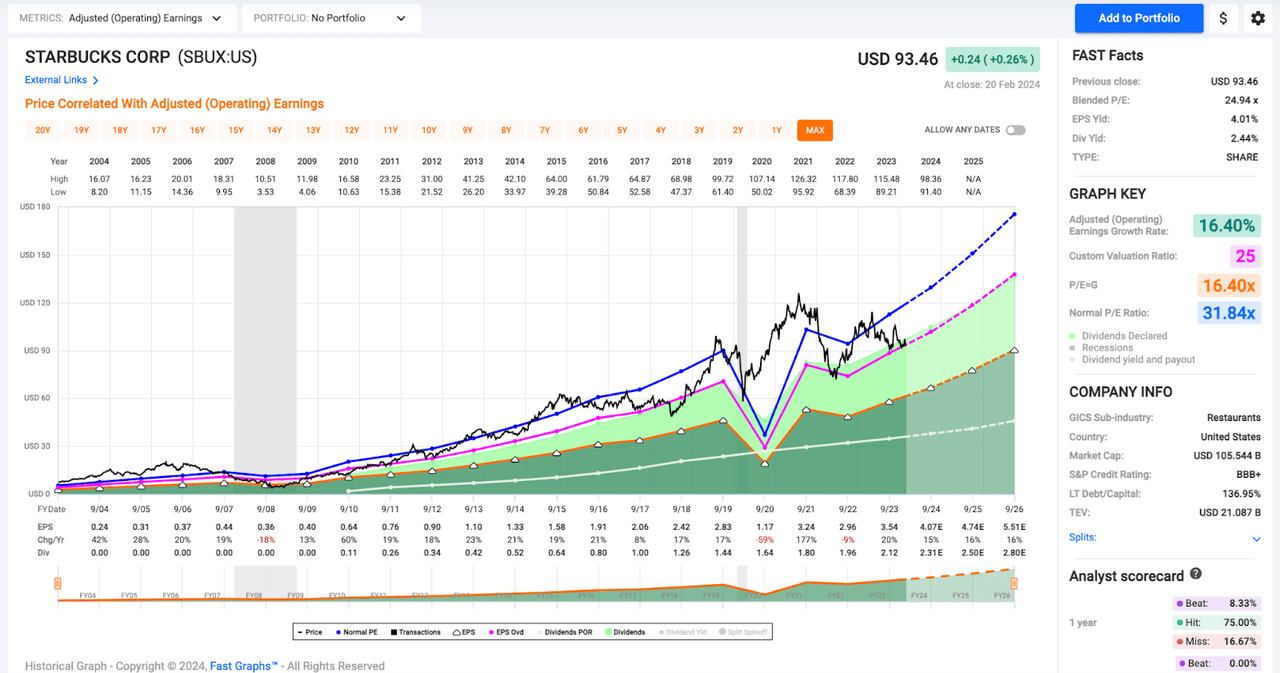

In 2019, SBUX generated $2.83/share in earnings. By 2023 the company’s EPS rose to $3.54. And, on a forward-looking basis, 2024 consensus currently sits at $4.07.

Since SBUX shares are trading at basically the same prices that I previously sold at, with a bottom-line that is significantly higher, shares are notably cheaper.

The combination of rising earnings and share price stagnation has resulted in multiple compression from 35x to 25x.

What’s more, looking at 2024 earnings growth potential, SBUX’s forward P/E ratio is just 22.9x.

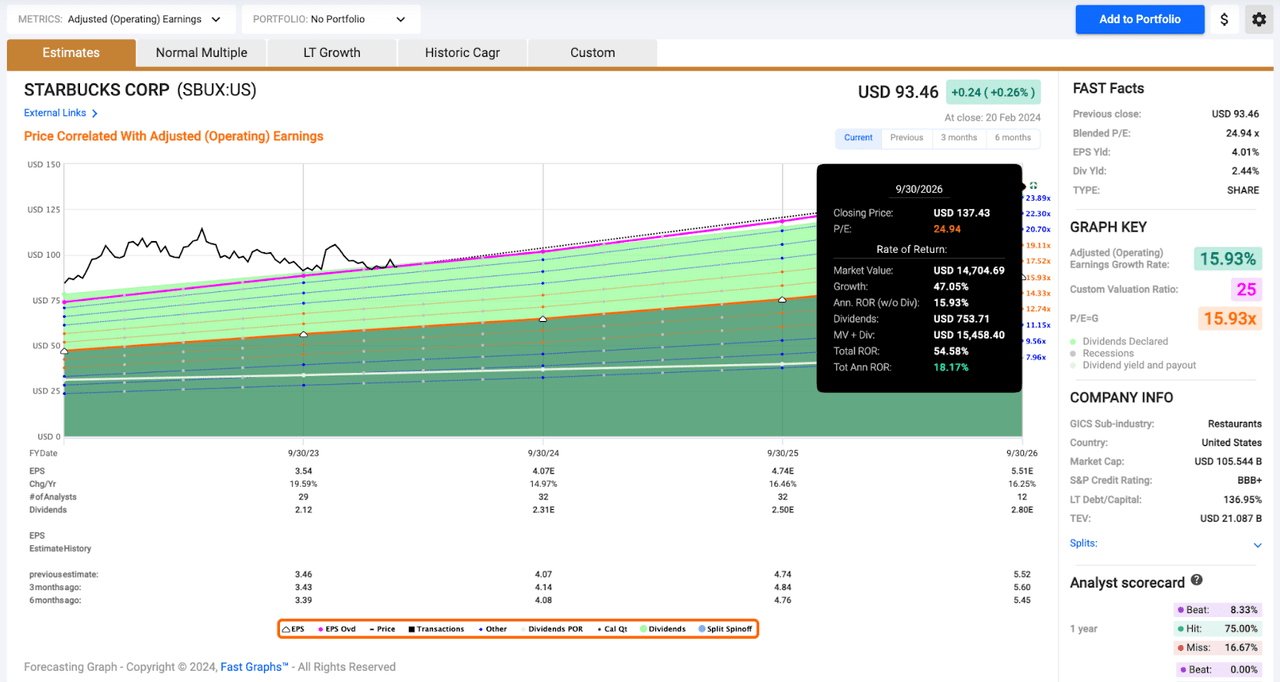

FAST Graphs

Has the Chinese regulatory threat disappeared? No. But, the risk/reward proposition attached to SBUX shares is now much more attractive and therefore, I’m looking to buy back those shares that I sold a few years ago.

I believe that 25x forward is where fair value lies…which translates to a ~$102/share fair value estimate (pointing towards a ~6.3% margin of safety today).

That’s not a steep discount, but anytime a wonderful company trades at a fair price, I’m happy to buy.

And that’s especially the case when those wonderful companies have double digit bottom-line growth prospects because over time, rising cash flows will inevitably lift my FV estimate and ultimately, the company’s share price.

The Dividend

Not only is Starbucks’ earnings much higher than they were pre-pandemic…their dividends are as well.

When I trimmed SBUX in August of 2019 its quarterly dividend was $0.36/share.

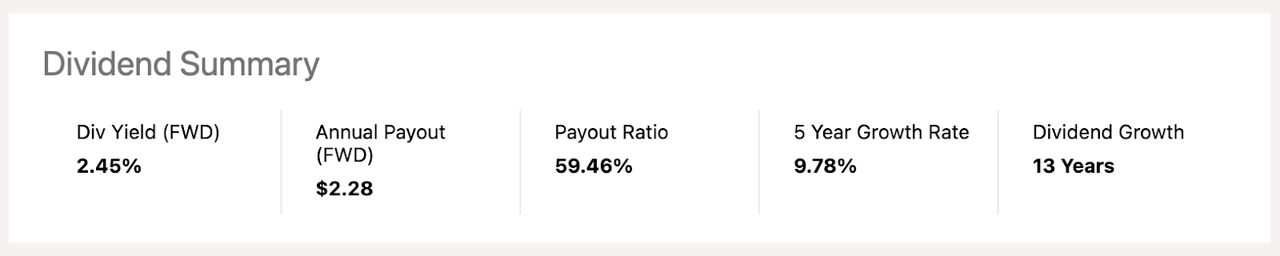

Today, SBUX’s quarterly dividend is 58% higher at $0.57/share.

Seeking Alpha

SBUX is on a 13-year annual dividend increase streak.

Its dividend growth rate is slowing, but that’s to be expected as the company matures.

As you can see above, SBUX’s 5-year DGR is 9.78%.

The company’s more recent raise was just 7.5%.

That’s a far cry from the 20%+ raises that it was known for prior to 2019. But, over the last decade or so we’ve seen SBUX’s EPS payout ratio rise from ~40% to ~60% and therefore, moving forward, I expect to see more conservative raises as management takes steps to reduce the burden of its dividend on its cash flows.

Even though SBUX isn’t the high dividend growth stock that it was when I originally bought it, I’m still happy to own a ~2.5% yield compounding at a high single digit rate.

What’s more, I don’t necessarily think that double digit raises are going to be a thing of the past here.

If SBUX meets its own EPS guidance, then 10%+ raises will be safe and sustainable.

For 2024, I expect to see an 8-11% raise.

Moving forward, I expect to see the passive income that my SBUX shares provide more than double over the next decade.

When you’re someone like me who is basing his financial freedom plans around safe and reliably growing passive income, expectations like that are what allow me to sleep well at night owning SBUX shares.

Total Return Expectations

But, this isn’t just an income play.

SBUX’s growing dividend is what makes it easy for me to hold this stock over the long-term; however, it’s really just the icing on the cake compared to the stock’s total return potential.

Due to its combination of historically low multiples and ongoing double digit fundamental growth prospects, I believe that SBUX offers strong upside potential.

I don’t think that mean reversion back up to the 30x+ range makes sense here since SBUX’s growth trajectory has slowed (now, I think 10-15% growth is more likely over the long-term than the ~20% levels that SBUX was known for pre-pandemic).

But, I think the ~25x range is fair for a company growing at such a high, reliable rate (while also providing shareholders a solid, growing dividend).

As you can see here, if SBUX maintains its current ~25x multiple moving forward and meets Wall Street’s consensus estimates with regard to its EPS growth and dividend payments, then investors buying here are looking at an roughly 18% total return CAGR over the next 2-3 years.

FAST Graphs

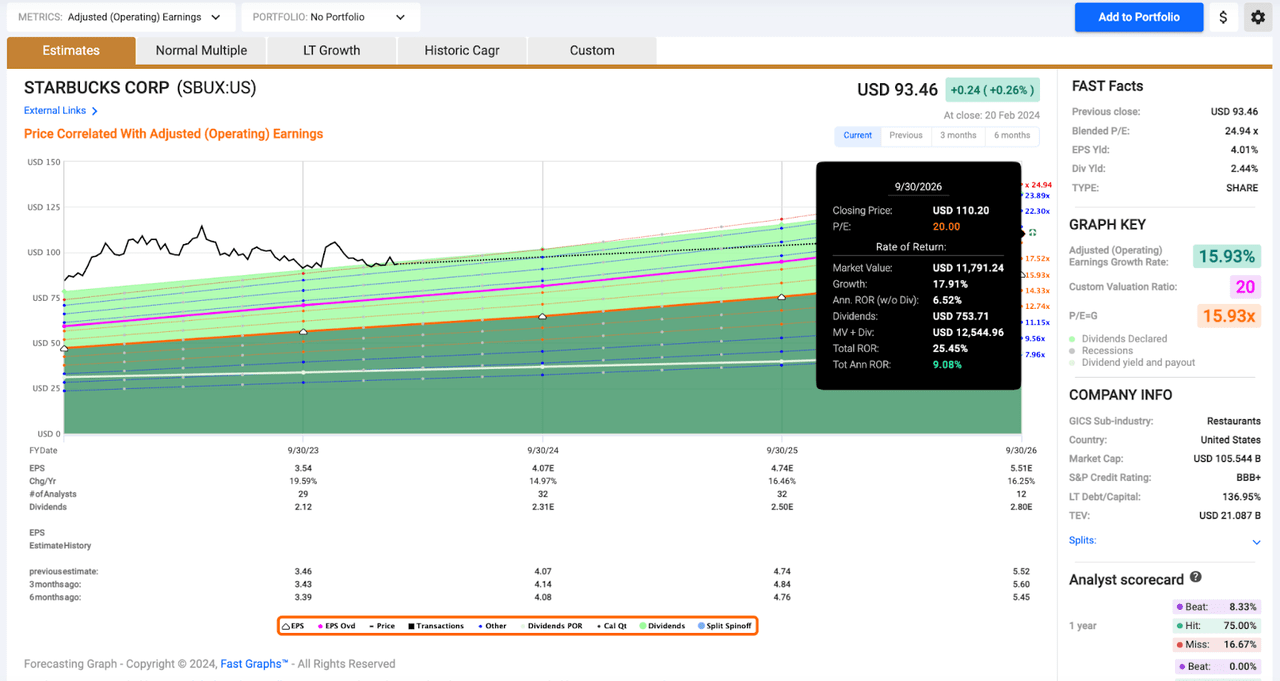

If SBUX continues to see multiple contraction and only trades for 20x by the end of its fiscal 2026, then we’re still looking at 9% annual returns (a level that should be at least in-line with the boarder market’s results).

Given that none of the blue chips in the consumer discretionary space trade with a 20x multiple, I don’t think this is a very likely scenario. But, when I look at the numbers and see a total return floor in the ~10% area, I get excited.

FAST Graphs

To lose money here I think we’d have to see a major shift in consumer tastes (which is also unlikely, especially given the addictive nature of caffeine which has driven SBUX’s sales for decades) or a black swan event (likely something having to do with geopolitical strife between the US/China which would really hurt SBUX’s sales in that region).

The sad reality is, an armed conflict between China and Taiwan is going to disrupt the entire market and lead to massive losses across most sectors. With that said, I’m not making investment decisions (in the current geopolitical environment, anyway) based upon that event occurring. Maybe one day, I’ll change that tune a bit (I track military-related news in the Pacific closely). But, in general, I don’t think it makes sense to take risk off of the table because of an event that may never occur.

Conclusion

Starbucks’ forward-looking fundamental growth outlook leads me to believe that this stock is undervalued.

I love the stock’s nearly 2.5% yield with high single digit/low double digit dividend growth potential.

Looking out over the next couple of years, I believe that SBUX is likely to generate a total return CAGR in the 15-20% area.

All in all, I’m a buyer on this 20%+ dip and if the sell-off continues, I will happily continue to add to my already large SBUX position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of A, AAPL, ABBV, ACN, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, BAH, BAM, BEPC, BIPC, BIL, BLK, BN, BR, BTI, BX, CME, CNI, CP, CPT, CRM, CSL, DE, DHR, ECL, ELV, ENB, ESS, SPAXX, GOOGL, HON, HSY, ICE, ITW, JNJ, KO, LHX, LMT, MA, MAIN, MCD, MCO, META, MKC, MO, MRK, MSCI, MSFT, NKE, NNN, NOC, NVDA, O, ORCC, OTIS, PEP, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, SBUX, SHW, SPGI, TMO, TD, TXN, USFR, UNH, V, VLTO, WM, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

divi Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our "Learn How To Invest Better" Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.