Summary:

- Snap stock dropped over 35% after missing revenue estimates by 1.5%, resulting in a market cap plunge of nearly $10 billion.

- Despite the revenue miss, Snap remains one of the significant social media companies outside of Meta’s control and has shown solid growth potential.

- Snap’s augmented reality and AI initiatives, along with improved monetization, are expected to contribute to better-than-expected growth and a higher stock price in the future.

Vertigo3d

Snap Inc. (NYSE:SNAP) stock recently cratered by over 35% after reporting Q4 earnings, briefly dipping below $11 as it missed revenue estimates by $20 million. The 1.5% revenue miss cost the company a market cap plunge of nearly $10 billion. I understand that expectations are sky-high during the AI era, but is the market overreacting here?

After all, Snap remains one of the only significant social media companies outside of Meta Platforms’ (META) social networking monopoly control. Snap has a staggering number of daily active users, or DAUs (414 million at the end of 2023). Moreover, DAUs expanded by 10% YoY, illustrating solid growth potential for Snap moving forward.

Also, Snap should continue benefiting from its augmented reality (“AR”) and AI initiatives. Snap faces transitory increases in costs and margin compression associated with R&D and the rollout of new products and services, which should pay off in the long term.

Additionally, the soft economic environment continues to weigh on ad revenue income, limiting revenue growth and profitability in the near term. However, Snap can grow its user base and monetize it better, leading to better-than-expected growth and a much higher stock price in future years.

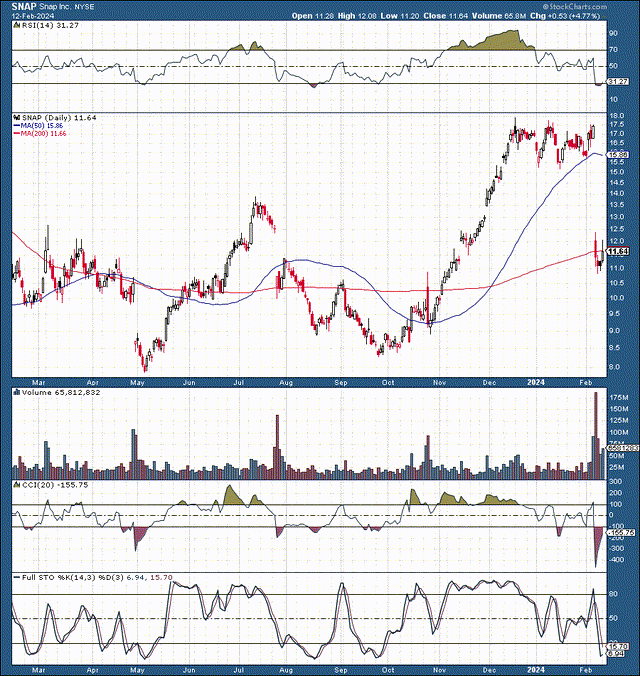

Snap – Technically, Buy The Dip

I don’t often buy Snap, but I follow the company. I bought the dip when I saw shares drop by 35% on massive volume because of a minor revenue miss. Snap’s drop filled two gaps (one at $13 and one at $11). The RSI crashed below 30, and the CCI hit nearly -500, illustrating massively oversold technical conditions. Snap is also around a critical support level of $12-10, and the downside is likely minimal from here.

Also, let’s put things into perspective. Snap became massively overbought going into year-end. The stock consolidated for two months but did not achieve the stellar results for which it was priced. Now, Snap’s market cap is below $20 billion again, exceptionally cheap for a company in Snap’s lucrative position.

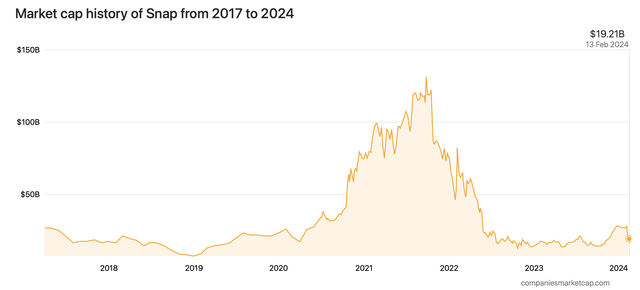

From $130 Billion to Below $20 Billion

Snap market cap (companiesmarketcap.com)

Snap’s market cap collapsed after the tech market peaked in 2021 and has yet to recover. Meanwhile, Snap’s stock trades around 3.2 times forward (2025) sales (consensus estimates) and has a 30-forward P/E ratio. Also, due to improved monetization, Snap’s earnings should continue increasing.

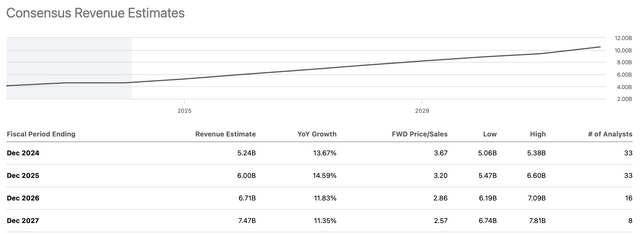

Revenues To Increase Considerably

Revenue estimates (SeekingAlpha.com)

Snap is much smaller than Meta. Therefore, its ad slowdown is taking longer to improve during this slow economic phase. Also, Snapchat+, Snap’s subscription service, has already reached over 7 million people and should continue to ramp up, leading to considerable revenue growth in the coming years. Consensus estimates are for $6 billion in sales next year, but Snap could surpass the forecast as more accessible monetary policy, increased growth, and improved monetization propel revenues and profitability higher.

Therefore, we may see 12-15% revenue growth or higher as we advance. Also, even with these modest sales estimates, Snap trades at only 3.2x 2025 $6 billion sales expectation. 3.2 times sales is relatively inexpensive for Snap, as Meta trades at over 6x sales, and many small and mid-cap tech firms trade at 7-10 times sales or higher.

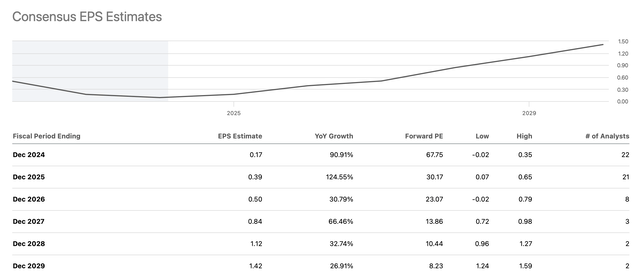

Earnings Should Improve Substantially

EPS estimates (SeekingAlpha.com )

Snap’s earnings should improve substantially, and it has a high probability of outperforming consensus figures. Snap has only missed EPS estimates once in the last twenty quarters. That’s going back five years. Snap’s 2025 Consensus EPS estimate is $0.39, implying that Snap trades at just 30 times forward EPS estimates. Moreover, Snap could outperform the forecast, and earning 50 cents next year puts Snap’s forward P/E ratio at just 22, which is dirt cheap for a company in Snap’s growing position.

The Bottom Line: A Jump In Profitability Is Likely

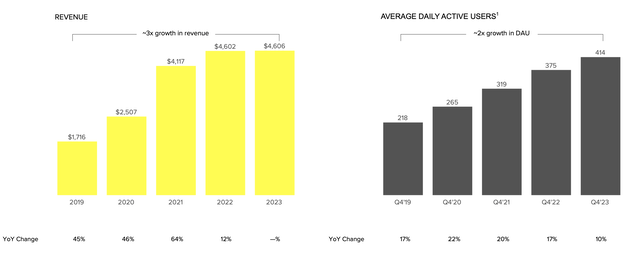

Snap growth (static.seekingalpha.com )

Snap’s DAUs increased by 10% YoY and have roughly doubled since Q4 2019. While revenue growth slowed recently, it is likely a transitory slowdown. We also see that revenues have tripled since Q4 2019. Snap’s advancements in AI, Snap AR, Snapchat+, and other ventures could produce a surge in sales in the coming years. Snap should also continue benefiting from user growth and improving monetization, leading to higher average revenue per user, or ARPU, and a considerably higher stock price.

Where Snap’s stock could be in the future:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $5.3 | $6.3 | $7 | $8 | $8.9 | $9.9 | $11 |

| Revenue growth | 15% | 19% | 11% | 12% | 12% | 11% | 10% |

| EPS | $0.22 | $0.50 | $0.70 | $0.93 | $1.16 | $1.40 | $1.65 |

| EPS growth | 144% | 127% | 40% | 33% | 25% | 20% | 18% |

| Forward P/E | 30 | 31 | 32 | 33 | 32 | 31 | 30 |

| Stock price | $15 | $22 | $30 | $38 | $45 | $51 | $58 |

Source: The Financial Prophet.

Risks to Snap

Despite my bullish outlook, Snap faces risks on several fronts. First, we must consider the economic slowdown and its impact on ad spending and Snap’s bottom line if the sluggish economy persists. Also, Snap faces competition from Meta, TikTok, and other social platforms. Snap also needs to maintain user growth and should expand ARPUs. Otherwise, its stock could head in reverse. There is also the risk of worse or slower than expected profitability and worse than anticipated revenue growth. Investors should examine these and other risks before investing in Snap.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNAP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!