Summary:

- CZR’s strong post-covid recovery and improving earnings make it a cheap stock with potential for growth.

- CZR’s 65 million rewards customer base sets up a successful marketing cycle.

- Despite its debt profile, CZR’s massive footprint and strong gaming brands make it a valuable investment.

Caesars Palace Hotel & Casino a world wide mecca since the 1960s and still the most recognizable brand in gaming. RudyBalasko

Stipulation

As readers of this space may know, I am a c-suite Caesars (NASDAQ:CZR) alumni from back in the day. Much has changed since I moved through the halls of the executive offices, but the core ethos management culture – the good part – remains in place according to friends in and out of the company. The CEO Gary Loveman era had a dark ages cast to them with some good, but mostly punctuated by colossal blunders. The decision to bypass a Macau footprint in the early 2000s when the CZR brand was golden in Asia goes down as a B-School case history of incomprehensible incompetence. And later, in 2008, we witnessed the playing of the Greed Bowl when the company was sold to private equity giant Apollo Global who hung a $17.5b debt burden on CZR that took it into bankruptcy in 2015. Surprise, surprise, Loveman and friends cashed out big time, though Apollo later admitted it had made a bad deal.

The new El Dorado management team led by the ever savvy Tom Reeg has moved the company through and into a post-covid path to a growth arc in revenues and ROE of 15% we like a lot considering their aggressive asset allocation strategy. The key here is sales growth and lower debt to come.

I follow the stock closely on the lookout for catalysts or headwinds I see coming. Up until recently I have seen a notable neutral sentiment haunting the stock. It’s clearly in a what have you got in mind next Caesars phase investors are asking. After all, in the highly visible gaming sector, investors tend to view its stocks as giant piñatas ready to be struck at any moment with a blow either causing a massive shower of goodies or torrents of coal.

We’ve seen wide swings in valuations many times. The covid disaster blitzed the sector. The post covid period rained candy and coins down on key stocks as investors were blown away by the exponential bursting of Vegas revenue. Sold out weekends, high REVPARs, inflationary dining prices phasing no one. Record gaming revenue gains. The town has been on a tear and to a great extent is still on one.

The top operators in the space all had solid buy stories amplified by their scope. Some were also fueled either by the great leap forward in their Asia footprint business or pure tech stock gambling plays like DraftKings with a great sales growth story. With no Asian or meaningful global initiatives to capture the imagination, CZR has kind of dead pooled since its really impressive 3Q23 earnings gave it a bit of a boost.

CZR 3Q23 delivered revenues of ~$3b, a beat by $58. Earnings were $0.31, a 4c beat. Analysts are looking for 4Q23 to produce $0.28. Earnings from continuing operations came in at $722m. Net income was ($899m). CZR is rapidly earning its way out of the aftermath residual damage of post-covid, and a heavy debt burden looking for an EBITDA for the year at $3.8b.

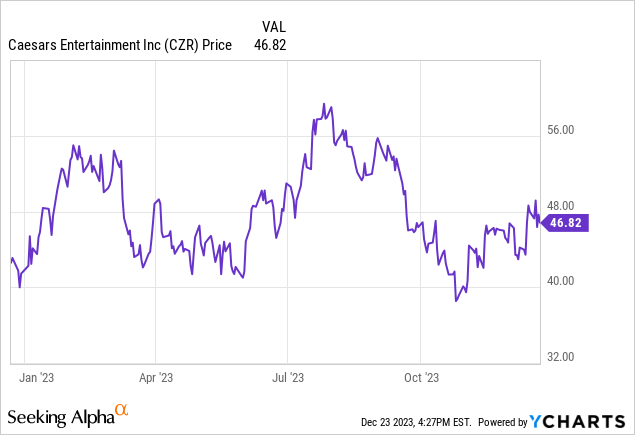

Above: Looks like a buy point to us.

A key metric in our view is revenue growth yoy of 8.81% vs the sector median of 5.24% TTM revenue $11.5b. For context, the AGA reported that 2022 saw a record breaking $60b in commercial gaming revenue growing at a 10% pace. By the end of 3Q23, commercial gaming revenues hit $49b headed for another record year that could reach $68b.

As a US only (except one property in Canada) operator, CZR holds ~a 20% share of the US commercial gaming market. That’s without an Asian footprint in contrast to peers Wynn Resorts Ltd., MGM Resorts International, and Las Vegas Sands. Yet CZR’s valuation to date has lagged the S&P 500 +6.15% vs. +22.3%. Yet at mid-year 2023, CZR traded at +28.70% vs. the S&P at 16.99%. So the pointed question here is: What has happened since last July that may have triggered the decline?

It may first appear as over simplistic to suggest that CZR shares have gone south since summer because of just slipping below the bull scenario radar of the investing public. But the reality is that the catalysts that have driven the sector post covid have become old news to Mr. Market.

In fact there has been growing sentiment that the momentum has slowed (it has not) and that regional casinos have likewise entered a cycle of late recovery as well. Add to that ongoing concerns about the debt profile of CZR and you have what I think is the core reasons the stock has dead pooled. We think it’s time to wake it up.

In brief I believe the company, one of the pinnacle stocks of US gaming, has sort of settled into a what-have-you-done-for-me-lately sentiment among investors looking for rocket ride yield stories.

In truth, CZR is as formidable a global brand as any of its peers-even though it has no presence in Asia. It has been and continues to meet the ultimate definition of what constitutes real fame. And that is when you mention a brand name and then don’t have to say what it is or who it is, people know. Caesars was that brand when I was there and still is globally recognized, though no longer alone in its fame.

CZR’s 600lb debt gorilla is on a diet: pay attention, it counts

El Dorado Resorts’ $17.3b acquisition of CZR in covid plagued 2020 and CZR’s subsequent buy of the UK online gaming giant William Hill, put its balance sheet tilted heavily into numbers the market didn’t find very encouraging. Add to that the siege of covid between 2020 and 2021 pressuring FCF, burning cash in a sector wide bonfire, and you have a stock buried in questions. Lease adjusted net leverage ratio is now 4.7X.

Investors who bypass the shares at its current price worried about the CZR debt profile needn’t bake that into a decision to pass. What counts now is this: CZR given its momentum, its scale, its strong gaming brands household names: Caesars Palace flagship, Horseshoe, Harrah’s El Dorado, Slivery Legacy, Circus Circus Reno, Tropicana -covers the entire gamut of customer segments from upscale to budget.

Clearly the lease obligations are long term debt but they do exist under contingencies that are different than regular bank and bond debt. Casinos are single use reality assets and have little or no conversion value should their operators fail. There have been scattered efforts to convert dying casinos into non-gaming hotels that have failed. That means the REITs that own casino realty must respond to their tenants in extremis, should they face draconian forces that necessitate either moderating leases, moratoriums, or exchanges in equity.

In regular debt, default is default plain and simple and either a pre-packaged deal with creditors emerges or a fire sale to a competitor — but the operator is gone. This is not the case here so we think that investors need to look at CZR debt as the net $11.6b vs the $13b for the 12 months of 2022.

YTD the company has repaid $600m. Knowing management as we do at all levels, our expectation is that, assuming the sales growth we anticipate for 2024 continues in the low double digits, CZR will hack away aggressively at its debt profile going forward. Management realizing it is a priority for overall corporate health going forward is proven.

The value story should be obvious at $48 a share

We believe the CZR story which since 2022 and up to its 3Q23 earnings release is a really solid value given the massive footprint of the company’s brands in every key gaming market in the US. With 51 properties in 16 states, CZR is biggest and most geographically diverse US casino operator in the sector.

Above all, mix in what is really the secret sauce of CZR value equation bar none, is its 65m Caesars Rewards members, by far the biggest in the industry.

The marketing strategy is elegant marketing math. It may be former CEO Loveman’s only positive legacy. Patrons of CZR regional casinos build up points based on play, then use those points toward reducing the net cost of special visits to CZR Vegas flagships like Caesars Palace. When there, they play and compile points again to be used in the nearest to home CZR property. It is a pure circulatory system that keeps the revenue blood moving through a single body.

That is part of the legacy CZR marketing rationale even when I was in senior management at the AC property. One of our best marketing tools was Caesars Palace. Our most valued players whether in table games or slots, consistently used their status with us to request reservations, comps or seats to the big fights at the Palace. It was a marketing moat at the time.

The palace has near 4,000 rooms that can accommodate its rewards members from all over the country regularly in addition to the usual feed from conventions and tour groups. While the property once stood alone as the citadel of Vegas class and excitement and now has lots of competitive company, the worldwide lure of the Caesars Palace brand remains high to both tourists and premium players.

Caesars Online sports book has a small market share but benefits from its large footprint in all US sports betting states

A breakdown of CZR revenue for 3Q23 is revealing:

Las Vegas properties: $3. 3b

Regional properties: 4.4b

Digital revenue: 669m*

Caesars sports book has an estimated 6% share of the US sports betting market YTD. We are forecasting it to reach ~$920 to $1b in 2023 revenue and, like its peers, will show losses slowly coming down. Caesars sports book emerges from its $4b acquisition of the UK sports betting giant William Hill which had an existing wide footprint in US brick and mortar casinos. It kept the US business and sold off the international piece to 888gaming. Net proceeds were ~$600m thus CZR got Hill’s US piece for $3.3b net.

The strategic key of the CZR digital entry like its brick and mortar peers, one of the collateral benefits of live sports books is their effectiveness in generating visitation of millennial players. They have migrated onto the casino floors when on property to bet on big games. This and the expanded night club scene has solved the age problem casinos have faced since the baby boomer generation began to age out.

For CZR there is particular resonance because it has hosted so many globally famous special events over time, that its cache remains even for younger players. Brand segmentation assures the birds of a feather reality of how players view various properties. CZR has dined on this reality for decades.

Conclusion

It may not appear a compelling case for a stock when one concludes that its price has fallen for no other big reason than its simply lack of favor because it is less visible than it had been. We disagree. We think in the case of CZR at its current trade it is one of the best values in the sector. It has not benefitted from the surging momentum of Asian gaming. Nor has it dented player awareness as a core online sports book when sector leaders like DKNG and PDYPY attract most investor interest. If you look at its large but certainly manageable debt, its massive US scale, its improving earnings profile against its price compared to peers, you should see real value.

Compared with sector peers with large US asset bases, we think CZR has been overlooked as a strong story at its price. We recognize why investors have not bid up the stock to a higher valuation since its 3Q23 results were released, but we believe its core story needs telling at its current price.

We’re calling it a BUY at equal weight with a revised PT of $66.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.