Summary:

- PENN Entertainment recently partnered with ESPN to launch ESPN Bet, expanding its sports betting and iCasino businesses.

- The company’s profitability has been impacted by its efforts to gain market share in the sports betting market, resulting in losses and lower margins.

- The company’s valuation is currently low, with a P/S multiple near its historical bottom, and the potential for revenue growth through ESPN Bet could drive stock price elevation.

Leland Bobbe/DigitalVision via Getty Images

Thesis

PENN Entertainment (NASDAQ:PENN) is a regional casino operator in the United States. The company recently partnered with ESPN by launching ESPN Bet to expand its sports betting and iCasino businesses. In my perspective, it is worth for investors to monitor the company for at least six months as I believe the current market valuation of PENN Entertainment is undervalued, and ESPN Bet could trigger momentum for the elevation of the stock price.

Overview of the business

PENN Entertainment is a casino operator that concentrates on the U.S. market. Through its casino operating segments (Northeast, South, West, Midwest), the company generates most of its profits through land-based and dockside gaming, with a number of brands including Hollywood Gaming, L’Auberge, and Boomtown. Unlike its competitors such as Wynn Resorts (WYNN) or MGM Resorts (MGM), PENN Entertainment does not have a five-star landmark casino; instead, it operates four or three-star regional casinos across the United States. In my opinion, focusing solely on the U.S. market would likely generate stable profits even during economic downturns, however, the potential for revenue growth may be limited compared to the competitors expanding their business internationally.

Through Interactive segment, the company is trying to promote sports betting and online casino businesses. Before partnering with ESPN, it formerly launched Barstool sportsbook with Barstool, which has ended unsuccessfully with huge losses. ESPN bet was launched in November 2023, and the company is investing heavily in promotions to gain a share in a market that is already dominated by DraftKings and FanDuel. According to the recent 4Q earning call, ESPN BET appears to have approximately a 7% market share.

Profitability

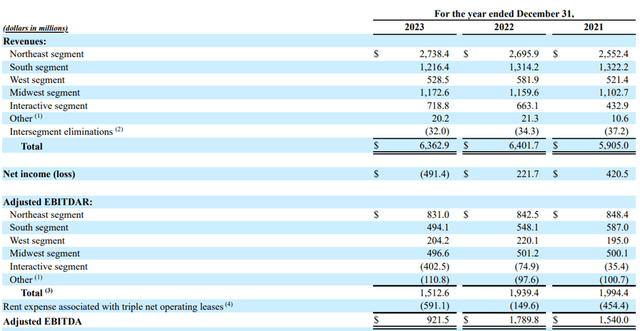

Before investing heavily in the interactive segment, the company maintained decent gross margins, recording 47.8%, 49.7% respectively in 2020 and 2021. However, after the company has strived to gain a market share in the sports betting market, the gross margins deteriorated to 47.6%, 43.5% respectively in 2022 and 2023. To dive more deeply into the margin side, the operating margin dipped from 18.2% in 2022 to 6.3% in 2023. The interactive segment recorded $400 million in losses in adjusted EBITDAR in 2023 due mostly to promotional spending. When taking roughly $900 million in losses on the disposal of Barstool into account, I believe the company’s efforts to gain market share in the sports betting market are becoming a burden to profitability. Moreover, inflation and tightening labor market had impacts on the company as food, beverage and other expenses for the year increased by $244.2 million and gaming expenses including payroll costs increased by $125.0 million when compared to 2022.

Fourth Quarter Earnings

When focusing on the fourth-quarter earnings, it is understandable why the stock price dropped significantly after the announcement due to doubts about the company’s ability to control costs. Revenue for the quarter was $1,395.4 million, which is roughly $190 million lower than the comparable quarter last year. The main reason for the decline is the poor performance of the interactive segment, which recorded only $31.5 million for the quarter due to high user acquisition costs. This represents a drop in revenue of more than $170 million compared to the fourth quarter of 2022. The company operates a casino business, which requires sufficient revenue to cover fixed costs. As a result, the company recorded more than $350 million in losses in net income.

Financial Soundness

On the balance sheet, I believe it is highly unlikely that the company would go through serious credit events over the next few years. Even though the company’s profitability has dropped significantly, it still generated more than $800 million in EBITDA in 2023, which is enough to cover the interest expenses. Excluding capital leases, long-term debt, and cash & cash equivalents, the figures were $2,718 million and $1,071.8 million respectively in 2023, leading to roughly $1.6 billion in net debt. In my opinion, considering the cash-generating capability of the company, the net debt would not be a serious burden in the short term.

Valuation

I believe the purpose of doing valuation of a company is not to calculate the exact future stock price, but to check whether the probability to earn money is higher than losing when investing in the stock. For this purpose, I would use the P/S multiple method to find out whether PENN is expensive or not.

This chart shows the history of the P/S multiple of the company. Due to the recent decline in the stock price, the multiple is hovering around 0.44, which is near its historical bottom of roughly 0.3. When taking into account the revenue guidance that the company provided during the recent earnings call, the multiple drops to roughly 0.4.

However, investors should be aware that the P/S multiple is a function of net income. In corporate finance, the intrinsic value of a company can be calculated by discounting the future cash flow.

• Value = Dividend / (Discount rate – Growth Rate)

If we divide this formula by revenue, we could find out that P/S (or value/revenue) is derived from (Net income Margin) * (Payout Ratio) * (1 + Growth rate) divided by (Discount rate – Growth rate).

• P/S = (NI Margin) * (Payout Ratio) * (1 + Growth Rate) / (Discount Rate – Growth Rate) Therefore, the crucial aspect of using the P/S multiple is the net income margin of the company.

To dive more deeply into the company’s history, the P/S multiple decreased to about 0.3 in 2014 when the net income margin was -7.1%. From this point, the performance improved, causing the ratio to increase to roughly 0.5 by October 2015. Even though the multiple dropped again to 0.3 in 2016, with better profitability, the stock price increased dramatically, and the multiple reached roughly 1.0 by January 2018.

In my opinion, it is highly likely that the valuation is nearing the bottom. Based on the company’s guidance that EBITDA losses from the interactive segment would be around $400 million, similar to 2023, and excluding one-time earnings from gains on REIT transactions and losses from the disposal of Barstool in 2023, which are $500 million and $900 million respectively, the company’s net income margin would likely improve with high probabilities in 2024. As we have observed from the history of the company’s stock performance, if the margin improves after the P/S multiple reaches the level of 0.3, the stock price shows good performance.

Moreover, ESPN Bet momentum may trigger such a reassessment of stock value. According to the recent earnings call, the management expects the interactive segment to generate revenues between $1.905 billion to $2.02 billion in 2024. This is more than double compared to 2023, which is a huge boost to revenue. However, in my perspective, the market is currently placing a discount on the interactive segment due to suspicion over the company’s capabilities of controlling costs. If the company is able to meet the guidance provided during the earnings call, which is increasing revenue with fewer losses, the market would start to reevaluate the stock valuation higher.

Risk

- Attractiveness of ESPN Bet application

Maintaining a retention rate of new incoming users, thanks to a splurge of promotional spending, would be another challenge for the company. With the ESPN brand and a huge amount of money to attract users, ESPN Bet achieved a higher market share than the previous Barstool Bet. However, ESPN Bet is just a rebranding of Barstool Bet, which, in my opinion, didn’t offer a good user experience when compared to competitors. If ESPN Bet cannot figure out how to create attraction points for users to keep using the application, the company may not be able to reach double-digit market share in the near future.

- Decline in retail segment

The base scenario of my investment thesis is the maintenance of retail casino business. For the company to boost ESPN Bet, cash flow from the retail business is essential. However, if the casino business shows a decline in revenue due to various reasons such as an economic downturn, investors may have to impose greater discounts on the company’s stock valuation.

- No more losses

I think many investors have lost faith in the current management, as the company recorded huge losses due to the failure in the Barstool deal, which occurred within a year. If the management were to make a similar mistake and encounter further losses, the stock price may drop significantly.

Conclusion

For the market to reevaluate the current valuation, it would take at least half a year, as investors want to check whether the company can control its costs related to ESPN Bet and whether the company can maintain its market share in the sports betting market. However, with an attractive valuation and momentum in ESPN Bet, I believe it is worth it for investors to monitor PENN.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PENN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may have a biased opinion as I hold this stock.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.