Summary:

- United Airlines Holdings, Inc. beats revenue estimates by $80 million and core earnings per share by $0.29 in Q4 and full-year earnings.

- The grounding of the Boeing 737 MAX 9 has implications for United Airlines.

- United Airlines showed strong Q4 revenues and ended the year on a positive note.

Boarding1Now

United Airlines Holdings, Inc. (NASDAQ:UAL) reported its fourth quarter and full year earnings on the 22nd of January, beating revenue estimates by $80 million and core earnings per share of $2.00 beat expectations by $0.29. Since my last report covering United Airlines, the stock has climbed 14.5 percent in line with the market performance. In this report, I will be discussing the full-year results with special attention for the impact that The Boeing Company (BA) 737 MAX 9 might have for United Airlines not only in the near future, but also over the longer term.

Boeing 737 MAX 9 Issues Could Have Big Implications For United Airlines

I recently provided an update on the implications that the Boeing 737 MAX 9 crisis has produced, explaining that these implications stretch beyond the MAX 9. That holds true for United Airlines more than many other airlines, it seems. United Airlines has a fleet of 79 airplanes. So far, the company has not publicly discussed customer compensation patterns. The general compensation calculations we see from analysts is in line with the lease rates, which would bring compensation in the $21 million to $25 million per month range. Though I could also see it happening that United Airlines will look for more elaborate compensation schemes that more closely resemble missed profits.

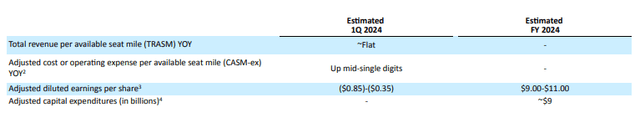

The reality is that the MAX 9 represents roughly 8% of the Q1 2024 capacity, and so removing the MAX 9 from the schedule has an impact on CASM. Q1 2024 CASM excluding fuel is expected to be up mid-single digits, which includes a three-point pressure from the MAX 9 grounding.

The bigger implications are for United’s longer-term plans. United Airlines has 107 deliveries scheduled for 2024, including 31 Boeing 737 MAX 9, but the company does not expect that all those airplanes will be delivered. Moreover, United Airlines has 277 MAX 10 airplanes on order, with options for an additional 200, and the company is now planning for a future without those airplanes at the intended delivery dates presorting for another slip in certification for the biggest member of the MAX family. Important to keep in mind is that United Airlines is still very much interested in operating that airplane, but its certification timeline has become even more uncertain since the MAX 9 accident and United Airlines has to de-risk its business where possible. The big question is how much flex the U.S. airline has in planning for a future without the MAX 10, since competitor Airbus (OTCPK:EADSF) is fully sold out on the A321neo program for years to come.

United Airlines Ends Year On A Strong Note

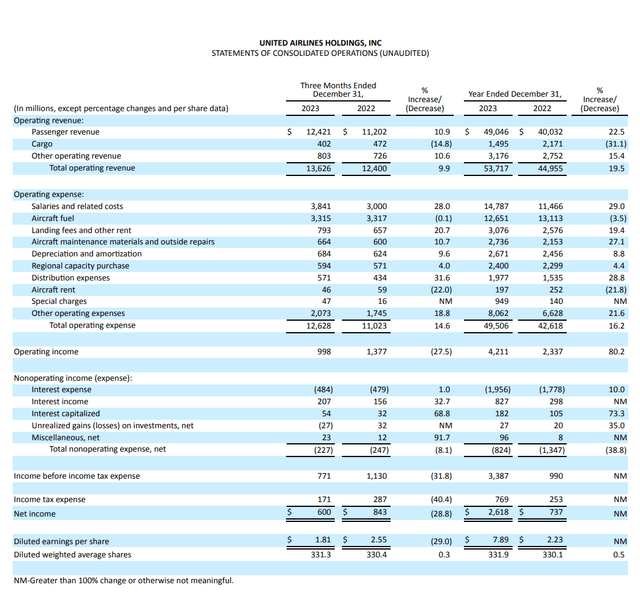

United’s Q4 revenues grew nearly 10% and 19.5% for the year on a 14.7% increase in capacity for Q4 and 17.5% for the year, with quarterly cost increasing in line with the capacity expansion and slightly more favorable cost absorption for the full year. I would say that the fourth quarter can best be described as a quarter where United Airlines managed yields quite well, keeping them stable year-over-year, while total revenue per available seat mile declined 4.2%. Unit costs excluding fuel were up 4.9% for the quarter and 2.6% for the year, and while I would like to see an aggressive reduction in the unit costs in line with capacity expansions, the reality is that airline cost structures have significantly changed in the past year and that impacts the unit cost balances. That is a reality that is unlikely to change until we will see a major demand reset, and for the time being there is no strong indication that such a reset is imminent.

United Airlines Guidance Lacks Color

The guidance that United Airlines provided did not contain a lot of information. For the full year, the company expects adjusted earnings of $9 to $11 per share, which compares to $9.59 per share in expected earnings by analysts. The CapEx figure of $9 billion likely is a bit on the high side as Boeing deliveries will likely be lower than expected and that was already the case before the problems with the MAX 9 while Airbus is also facing challenges globally to deliver airplanes in line with initial agreed on delivery schedules. I would say that all of that provides another year for airlines where the ability to carry demand is somewhat limited.

United Airlines Stock Has Significant Upside

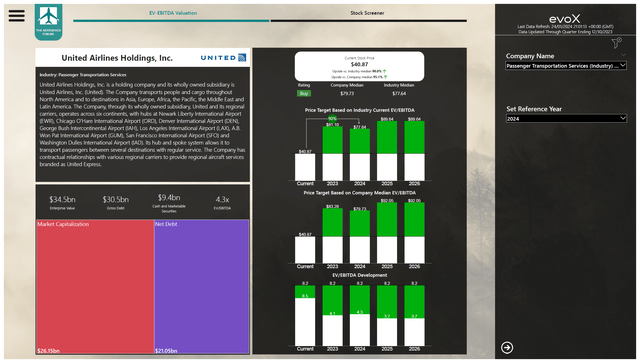

I have processed the balance sheet data for United Airlines as well as the forward projections for EBITDA and cash flows and based on those projections, I do believe that United Airlines stock has significant upside. Valuing the airline stock in line with peers, we would get to a $77.64 price target representing 90% upside, which is significantly higher than $61.25 price target that Wall Street analysts have for the stock. However, the significant upside gives me a comfortable feeling that even if we take the execution risk to be half of the upside, a $59 price target should be in reach rather easily.

Conclusion: United Airlines Faces Challenges But Is Executing Well

I do believe that, in 2024, the industry will remain constrained from a supply side perspective. While I do think that unit revenues might be more challenged, there still is plenty of space for successful execution for United Airlines Holdings, Inc. In my view, the biggest risk is the uncertainty regarding the delivery schedules for commercial airplanes which will affect both the fresh deliveries from Boeing as well as Airbus, where obviously the U.S. jet maker faces the bigger challenges to live up to expectations. For United Airlines, that could provide a longer-term challenge, but given that the challenges are felt throughout the industry, it does provide support to ticket prices to some extent and limits the CapEx.

Having reviewed the earnings and analyst projections, I continue to believe United Airlines stock is a buy as its current valuation does not describe a reasonable valuation compared to industry peers or to United’s own median EV/EBITDA.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA, EADSF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.