Summary:

- Verizon’s stock has seen a total return of 21.45% since my first “Buy” call last year, outperforming the broad market.

- Q4 FY2023 results show revenue growth exceeding expectations, driven by wireless service revenue and postpaid phone net additions.

- I think VZ’s free cash flow will remain stable over the next 2 years. I explain why.

- The VZ stock is undervalued by 23.8% today according to my conservative DCF model.

- I reiterated my previous “Buy” rating for Verizon stock today.

Mike Coppola

Intro & Thesis

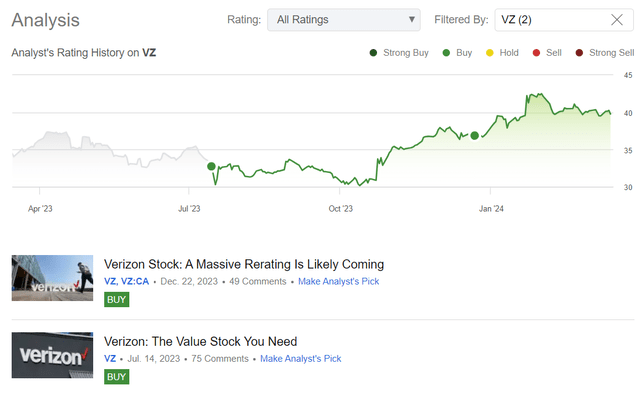

In the middle of last year, I initiated my coverage of Verizon Communications (NYSE:VZ) stock with a ‘Buy’ rating at $34 per share. The stock’s total return since then went up to 21.45%, outperforming the broader market.

Seeking Alpha, author’s coverage of VZ stock

But how much potential for further recovery growth remains in VZ today? Enough time has passed for me to take another look at my thesis and try to answer this question based on new data and industry conditions. Throughout today’s discussion, I conclude that the recovery we’ve seen in VZ stock over the past few months may only be the beginning of a longer uptrend.

Why Do I Think So?

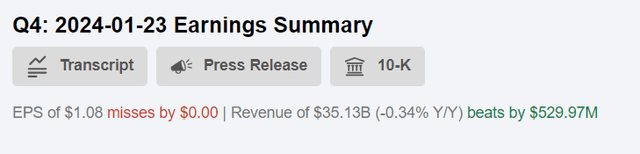

The company’s results for Q4 FY2023 were roughly in line with expectations in terms of EPS but exceeded analysts’ expectations in terms of revenue growth by ~$530 million – a positive surprise of 1.53%:

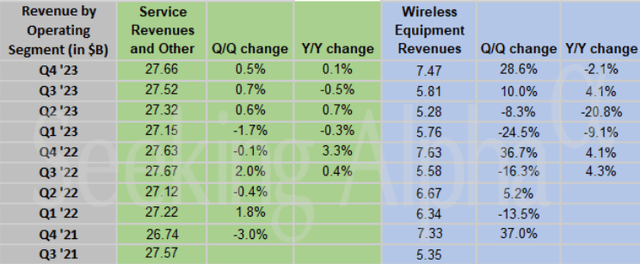

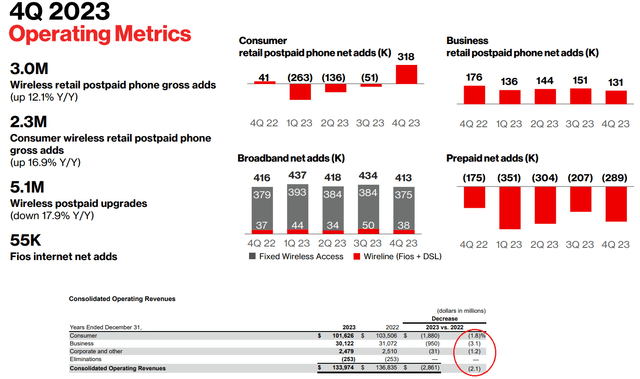

Looking at Verizon’s numbers in more detail, we see that its wireless service revenue for the full year 2023 reached $76.7 billion, representing a 3.2% YoY increase. Q4 FY2023 revenue was essentially flat at $35.1 billion, impacted by a 2.1% YoY decline in wireless equipment revenue due to postpaid subscriber upgrades decline.

In Q4 2023, Verizon added 318 thousand postpaid phone customers. However, there was a loss of 289 thousand prepaid subscribers during the same period. Consumer churn was 1.08%, moving higher sequentially from 1.04% in 3Q FY2023 and 1.06% in 4Q FY2022. VZ’s Consumer Group, which accounted for 75.8% of total revenue in FY2023, benefited from price increases, more customers opting for premium unlimited plans, and higher contributions from the launch of the company’s fixed-line access.

VZ’s Business Group segment added 131,000 in Q4 FY2023, marking the 10th consecutive quarter of postpaid phone net adds exceeding 125,000, according to the management commentary. Unfortunately, sales in this segment fell by 3.1 % for the year as a whole due to the typical headwind caused by declines in legacy wireline voice and data systems.

VZ’s 10-K and latest IR presentation, author’s notes

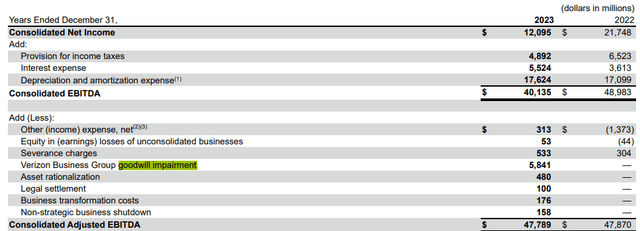

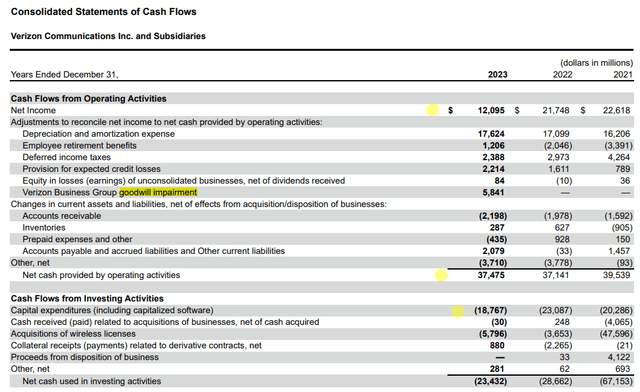

Moving further on the income statement and also having a cash flow statement opened in another tab, we see that Verizon’s FY2023 adjusted EBITDA amounted to $47.8 billion (slightly down YoY), while the free cash flow of ~$18.7 billion showed a whopping growth of over 33% YoY. Why is there such a discrepancy in these metrics?

If we do not adjust the EBITDA figure, it will be 18% lower than in FY2022, as net profit fell by -44.4% year-on-year. The main reason why the adjusted EBITDA was much higher is due to the goodwill impairment of the Verizon Business Group of ~$5.8 billion.

However, this goodwill impairment was an integral part of the company’s operating expenses for the reporting period and thus reduced net profit, but was not an actual cash expense. Therefore, cash flow from operations was not affected after the adjustment – hence we received a rapid increase in FCF due to an 18.7% decrease in CAPEX volume in FY2023.

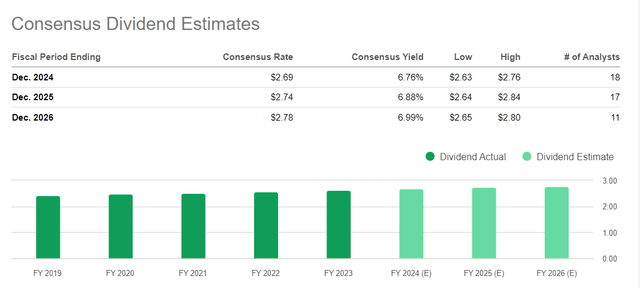

According to the company’s management, Verizon anticipates strong wireless service revenue growth of 2% to 3.5% (2.75% in the middle) in FY2024, driven by “positive postpaid phone net additions, continued fixed wireless access expansion, and premium plan adoption.” The adjusted EBITDA is estimated to rise by 1-3% for the full year, while capital spending is expected to range between $17-17.5 billion – even lower, than last year. We can therefore assume that the guidance – all other things being equal – will result in the implied FY2024 FCF being slightly higher than in FY2023. As we know from financial theory, “free cash flow represents the cash flow that is available to all investors before cash is paid out to make debt payments, dividends or share repurchases.” Therefore, I suggest comparing the FCF-to-dividends ratio to answer the question of the stability of Verizon’s dividend yield going forward. In 2023, this ratio was ~1.7, i.e. the FCF Verizon generated was 70% higher than required to pay dividends to shareholders (even after the dividend increase). In 2022, this ratio was 1.3, so there was an improvement of about 30% compared to what we can call “dividend safety” (according to this particular ratio, of course).

Management plans to use the surplus FCF (after dividend payouts) to reduce debt:

We remain laser-focused on growing wireless service revenue and expanding our adjusted EBITDA and free cash flow to allow for a meaningful debt reduction in the year ahead. This is what our whole team is working towards and what you, our shareholders, and our Board want us to focus on.

Source: Earnings call, author’s emphasis added

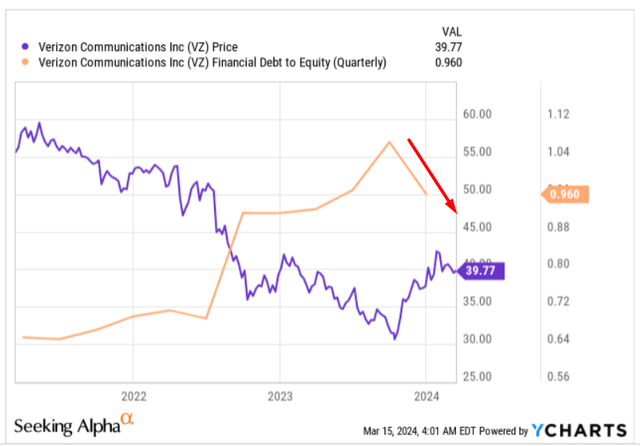

In my opinion, this is one of the most important things for Verizon today. In the fourth quarter, according to Ycharts data, the leverage ratio fell slightly, and the stock price reacted inversely to that, i.e. it started to rise. I think some of the value investors have decided that VZ is no longer a value trap for them and have decided to open a long position or add to an existing one.

Looking at VZ’s potential in terms of FCF generation, I think debt reduction is the most logical place for the money to go after the dividend payout to investors. Considering how highly leveraged it is today (still), I think VZ has a much longer road of deleveraging ahead of it – and thus the room for the stock to recover.

Given my assumption about the stability of dividend payments in the foreseeable future – even if the top-line stagnates or gradually declines slightly. With that in mind, I believe the current FWD dividend yield of 6.69% makes VZ a tasty morsel for value investors looking for undervalued opportunities in today’s market. And most importantly, these yields are expected to rise if the price does not go higher.

Let’s try to value the company through a simple DCF model to check how close my thesis of Verizon’s undervaluation is to the truth. Right now, the market expects VZ’s sales to grow at a CAGR of about 0.65% over the next 6 years. I expect VZ’s EBIT margin to gradually decline from FY 2025 and reach 21.5% in the last forecast year. The company has a very high average effective tax rate, which I will leave unchanged – as well as the rest of the driving metrics, as I don’t see strong deviations in the last 3 years. Is it possible that CAPEX as a % of sales, as it seems to me, will decrease slightly in 2024 and 2025 (I draw this conclusion based on management’s forecast) and then increase again. This is what I got after adjusting FinChat’s template:

FinChat, VZ stock, author’s notes

Now a word about Verizon’s cost of capital. Debt is a significant part of the company’s enterprise value, so it’s very important to decide what cost of debt we use. I think that given the relatively high risk-free interest rate today, if VZ wants to raise additional debt, the funding rate could reach 8%. That sounds like a pretty big number, but I would rather plan for more to be on the safe side and stay conservative. This results in a WACC of only 6.2%:

FinChat, VZ stock, author’s notes

Assuming a terminal growth rate of only 0.5%, the undervaluation I’m getting seems to be more than enough to give the VZ stock another “Buy” rating today:

FinChat, VZ stock, author’s notes

Where Can I Be Wrong?

As Argus Research analysts wrote a few weeks ago (proprietary source), while AT&T (T) and Verizon have long dominated the wireless telecom landscape, resembling a duopoly akin to Coke and Pepsi, the rise of T-Mobile (TMUS) and the merger with Sprint have given it the scale and spectrum to challenge Verizon’s dominance in the industry. Indeed, it is hard to disagree here.

Verizon’s sales have been declining for a long time, and the market in which the company is trying to compete is already quite saturated. It will be difficult for VZ to grow its EPS going forward; the entire focus should be on the sustainability of margins. If it turns out that the company can no longer maintain margins, the dividend is likely to be cut quickly, and the stock price could test its recent lows again.

My DCF model assumes growth in the terminal phase of 0.5% – which is not much more than in the forecast period for the company’s revenues. If we reduce the growth forecast for the post- forecast period to 0.1%, we get a much less attractive undervaluation upside, which for me would mean “Hold” rather than “Buy”.

FinChat, VZ stock, author’s notes

The Verdict

Despite the abundance of risks, I think VZ’s free cash flow will remain stable over the next 2 years. Once this becomes clear to a large number of investors, the level of uncertainty surrounding the company and its dividend stability today should fade – that theoretically may lead to a re-rating in light of the upcoming change in monetary policy in the US and the world (high-yielding stocks will be back in high favor).

So I reiterated my previous “Buy” rating for Verizon stock today.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!