Summary:

- I believe Airbnb’s current valuation reflects its slower growth trajectory and underestimates its potential upside.

- The company’s emphasis on generating robust free cash flows, coupled with its strong balance sheet, makes it an attractive investment opportunity.

- Navigating obstacles while capitalizing on growth opportunities will be key for Airbnb to unlock its full potential and deliver value to investors.

AleksandarNakic/E+ via Getty Images

Investment Thesis

Airbnb (NASDAQ:ABNB) is cheaply valued for the size of its opportunity. Admittedly, Airbnb is no longer delivering premium growth (meaning stable, consistent, and predictable growth of about 20% per year).

But what it lacks in topline growth, it more than makes up with its very strong free cash flows.

In fact, I argue that paying 21x this year’s free cash flow for Airbnb already prices in its lackluster growth. And this valuation does not appear to factor in its very strong balance sheet.

All in all, I remain bullish on this opportunity.

Rapid Recap

Back in December, in a bullish article, I wrote,

Airbnb is not a blemish-free investment, but investors’ expectations have moderated significantly, allowing the stock to be a compelling investment.

Ultimately, I make the case that paying approximately 17x forward free cash flow for Airbnb is a very compelling entry point.

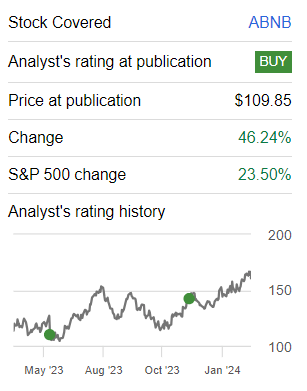

Author’s work on ABNB

Indeed, it’s been about a year since I wrote I Am Not Throwing In The Towel. Since that time, Airbnb is up 46%, beating the S&P 500 which delivered 24% (about half of the return). While today’s valuation is slightly more stretched, the outlook is less murky. Hence, here’s why I’m bullish on ABNB.

Airbnb’s Near-Term Prospects

Airbnb is a platform that allows people to rent out their homes, apartments, or other properties to travelers looking for accommodations. It connects hosts, who list their properties for rent, with guests who want to book a place to stay for short-term stays.

Throughout 2023, Airbnb demonstrated impressive performance, boasting its highest fourth-quarter metrics to date. With 99 million Nights and Experiences Booked in Q4 Airbnb is showing adaptability in the face of an evolving market.

Moreover, Airbnb’s emphasis on three strategic priorities-making hosting mainstream, perfecting its core service, and expanding beyond the core-positions it well for future success.

The company’s focus on scaling its host community, enhancing the guest experience, and venturing into underpenetrated international markets underlines its future potential opportunities.

Further, Airbnb’s expansion into new markets, coupled with innovative product offerings, could bode well for its upside potential.

And yet, despite this upside potential, Airbnb faces some challenges that are difficult to quantify. I’ll run through a few headwinds that come to mind. For one, as the global economy grapples with inflationary pressures and geopolitical uncertainties, Airbnb faces headwinds.

On top of that, Airbnb faces competitive pressures in various markets, which continue to impede its expansion efforts. For instance, Airbnb’s expansion into underpenetrated markets faces competition from entrenched players, including hotel booking platforms such as Booking.com (BKNG), Expedia (EXPE), and Hotels.com which also compete with Airbnb for travelers’ accommodation bookings. On top of all that, Airbnb faces short-term rental regulations that pose barriers to Airbnb in certain markets and its ability to grow in those markets.

Given this context, let’s discuss its fundamentals.

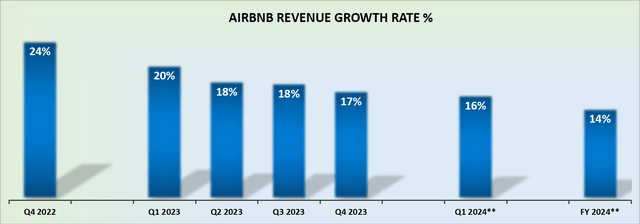

Revenue Growth Rates Point to 14%

Airbnb openly discusses that Q1 is more likely than not to end up as its strongest quarter of 2024. This is for the most part due to the timing of Easter falling into Q1 this year.

Consequently, this implies that Q2 2024 will not benefit from the Easter weekend this year and will therefore be a weak Q2 quarter. Nevertheless, I believe that if we start with the presumption that Q1 is likely to be as good as it gets for 2024, this should mean that an approximately 14% increase in y/y revenue growth rates could be on the cards for Airbnb in 2024.

This is not overly exciting. And puts Airbnb on a path towards it delivering its weakest year in the past 3 years. And to further complicate matters, it’s not exactly the case that 2023 delivered particularly strong comparables.

Luckily, I make the case that this slow pace of growth is already thoroughly priced into its stock.

ABNB Stock Valuation — 21x 2024 Free Cash Flow

According to my estimates, Airbnb will see $11.3 billion in revenues this year, given that Airbnb delivered 37% EBITDA margins in 2023, together with the contention that Airbnb guides that in 2024 there will be at least 35% EBITDA margins. Therefore, I’ve presumed that there’s potential for a further 200 basis points EBITDA margin expansion relative to 2024.

This means that, all in all, Airbnb should see about 39% EBITDA margins. Straight away this implies there’s about $4.4 billion of EBITDA on the cards this year.

However, since Airbnb gets cash upfront in the first instance for bookings to be realized in time, I believe that Airbnb could in actuality report $4.7 billion of free cash flow in 2024. A figure that is slightly higher than its EBITDA figure, and speaks of the strong free cash flow premise of the business.

On top of that, keep in mind that Airbnb has approximately $6 billion of net cash on its balance sheet (a figure that already accounts for its long-term debt). In other words, approximately 6% of Airbnb’s market cap is made up of cash.

Accordingly, having to pay 21x this year’s free cash flow for a business that is growing in the mid-teens strikes me as a perfectly fair price to pay for Airbnb.

The Bottom Line

In conclusion, while acknowledging that Airbnb’s premium growth phase may be behind us, I remain bullish on the company’s prospects. Despite its slower growth trajectory, Airbnb continues to generate robust free cash flows, which, coupled with its strong balance sheet, make it an attractive investment opportunity.

Paying 21 times this year’s free cash flow for Airbnb already accounts for its lackluster growth, and this valuation does not fully reflect its potential upside.

The company’s strategic focus on making hosting mainstream, perfecting its core service, and expanding into new markets positions it well for future success.

In sum, with its solid fundamentals and compelling valuation, I believe Airbnb presents a promising investment opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.