Summary:

- Novo Nordisk’s Wegovy represents a significant advancement in obesity treatment, demonstrating a more profound weight-loss effect compared to its predecessor, Saxenda.

- Eli Lilly’s entry with Zepbound, targeting both GLP-1 and GIP, signifies a competitive market landscape, potentially outperforming Wegovy in efficacy.

- The race to redefine obesity treatment is heating up, with several other pharmaceutical companies developing GLP-1 agonists and exploring alternative targets.

Halfpoint/iStock via Getty Images

The Evolution of Obesity Pharmacotherapy: From Phentermine to Wegovy

The 2021 approval of Novo Nordisk’s (NVO) Wegovy (semaglutide) marked a new era in obesity treatment. Obesity has been targeted for decades. Phentermine was a stimulant approved in the 1950s and was popularly combined in the 1990s with fenfluramine (fen-phen). It was soon discovered that fenfluramine causes heart valve issues and pulmonary hypertension. The crazed combination was then withdrawn from the market and phentermine lost its appeal, but, as of 2012, it was available in combination with topiramate (an anticonvulsant) as Qsymia. Also approved in 2012 for obesity, lorcaserin activates serotonin receptors to induce feelings of satiety, but was withdrawn from the market in 2020 due to an increased risk of cancer that was observed in long-term studies. In 2014, Contrave, a clever combination of naltrexone (long used for addiction) and bupropion (an antidepressant), achieved approval but never caught on due to side effects like increased blood pressure and modest weight loss.

Novo Nordisk’s Strategic Shift from Saxenda to Wegovy in Obesity

Interestingly, Novo’s Wegovy wasn’t their first shot at obesity. Saxenda (liraglutide), better known as “Victoza” for type 2 diabetes, achieved approval in 2014 for obesity. Saxenda is a glucagon-like peptide-1 (GLP-1) agonist that mimics the action of GLP-1, an incretin hormone that is naturally produced after eating. This class of medicine also enhances glucose-dependent insulin secretion and slows gastric emptying. Moreover, GLP-1 receptor agonists have been discovered to act on the brain to decrease appetite. So, unlike past attempts at obesity, GLP-1 agonism appears to be a more sophisticated and multifactorial approach. Saxenda had the typical GI side effects associated with GLP-1 agonism, like nausea, vomiting, and diarrhea. Compared to Wegovy, its weight-loss effect was modest. In Study 1, Saxenda procured a weight loss of 7.4% after 56 weeks, which was a 4.5% difference from placebo. On the other hand, in a similar type of study, Wegovy caused a mean weight loss of 14.9%, which was a 12.4% improvement relative to placebo after 68 weeks. Granted, the side effect profile of Wegovy took a hit, as nausea and vomiting incidences saw marginal increases. Wegovy’s robust efficacy caught the attention of the public. Although Saxenda seems like an afterthought now and many have likely never heard of it, Novo currently has an apology on the medication’s website, noting, “Significant demand for weight-management medicines has impacted the availability of Novo Nordisk obesity medications, including Saxenda.” This is probably more of a testament to Wegovy than anything (patients are likely directed to Saxenda when the demand of Wegovy outpaces supply).

Eli Lilly Tipping the Scales in Obesity Battle with Zepbound

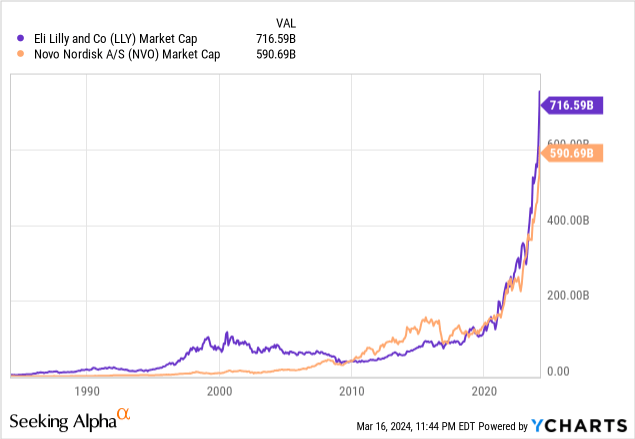

Two years after Novo’s popular GLP-1 agonist, Eli Lilly (NYSE:LLY) entered the obesity market with Zepbound (tirzepatide), targeting GLP-1 and GIP (which offers additional metabolic benefits). Although Zepbound may appear slightly more effective than Wegovy, as its high dose (15 mg) produced a weight loss of 20.9% (besting placebo by 17.8% after 72 weeks), the two are widely considered equal in treatment recommendations. Both Zepbound and Wegovy are blockbuster drugs that are likely to generate tens of billions of dollars over the next decade. Despite being approved in November, Eli Lilly already reported $175.8 million in worldwide Zepbound revenue for Q4 2023. In the same quarter, Wegovy produced $1.4 billion, which fell below consensus estimates but only because of supply bottlenecks. As a result of this massive opportunity (the obesity market is anticipated to grow to $38 billion in 2032), Novo and Eli Lilly investors have seen considerable returns and many believe one or both of them are bound to be the first trillion-dollar pharmaceutical company.

The Race to Redefine Obesity Treatment

The competition for obesity is quite robust in the clinic and neither Eli Lilly nor Novo are sitting on their hands. Starting with Phase 3 candidates, Eli Lilly is testing a daily oral GLP-1 agonist, orforglipron, with the trial expected to complete in 2027. Meanwhile, Novo is working on CagriSema, which is a combination of semaglutide and cagrilintide (an amylin receptor agonist). So far, the combination appears to be more effective than either drug alone in treating obesity and diabetes. The Phase 3 study of 3400 participants is expected to be completed in 2026. Both Boehringer Ingelheim and Innovent Biologics are developing GLP-1/GCG (glucagon receptor agonists), with Innovent anticipating a regulatory submission in China later this year after positive Phase 3 data.

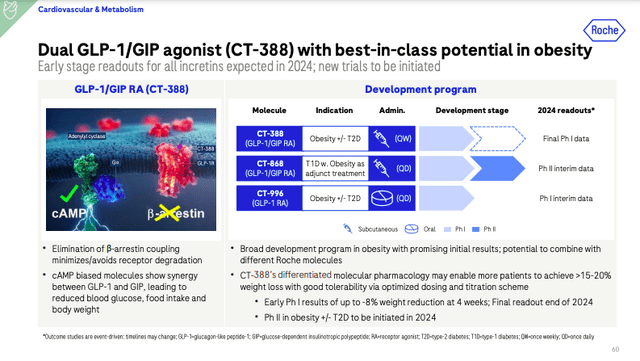

Novo has a few Phase 2 candidates as well. They are targeting amylin (cagrilintide), PYY (PYY 1875), and GLP-1/PYY. Amgen (AMGN) and Pfizer (PFE) enter the picture with twice-daily danuflipron and AMG 133, respectively. Danuflipron is an oral GLP-1 receptor agonist. Pfizer revealed Phase 2 data in December. Weight loss ranged from 8 to 13% at 32 weeks, but the company announced its intention to bail on the twice-daily formulation due to high rates of GI adverse events. They have a once-daily formulation they may proceed with. In December, Roche (OTCQX:RHHBY) acquired Carmot Therapeutics for $2.7 billion upfront for their oral GLP-1 agonist, CT-996, and CT-388, a subcutaneous, Phase 2 drug targeting GLP-1/GIP. Roche is hoping these assets will provide differentiation to drugs like Zepbound.

Roche

Viking Therapeutics (NASDAQ:VKTX) is also targeting GLP-1 and GIP both orally and subcutaneously (VK2735). Recently, Viking announced Phase 2 data for their subcutaneous drug. After just 13 weeks, 35 patients titrated up to 15 mg of once-weekly VK2735 lost 14.7% of their baseline weight, a 13.1% improvement over placebo. Discontinuation rates were high (20%) in this cohort, so it may be wise to proceed with 10 mg (14% discontinuation rate/12.9% placebo-adjusted weight loss). Altimmune (ALT) and South Korea-based Hanmi Pharmaceutical, like Innovent and Boehringer, are developing GLP-1/GCG agonists of their own. I wrote about Altimmune’s recent obesity data and briefly touched on Boehringer’s in a recent writeup.

Eli Lilly, Zealand Pharma, and AstraZeneca (AZN) are testing amylin agonism in Phase 1 trials. The first amylin agonist, pramlintide, was approved in 2005 for diabetes treatment. Pramlintide also caused relevant weight loss, although it does not appear to be as robust as GLP-1 agonists.

GDF15 analogs are being pursued in humans after beating GLP-1 analog dulaglutide in body weight loss in nonhuman primates. So, this will be an interesting target to watch moving forward. Novo and CinRx Pharma are in Phase 1.

There are a few others (companies and targets) that I did not cover.

Shaping the Future: Leaders Emerge in Obesity Drug Race

As I was writing and researching the content above, three things stuck out to me.

- Novo Nordisk is in it for the long haul. I am impressed by the depth and strategy of their obesity pipeline. Wegovy figures to be a clear leader for the next few years. CagriSema is their answer to many of the co-agonists in development. Beyond these two drugs, Novo is researching other interesting targets like GDF15 analogs and PYY, leaving no stone unturned.

- Following the timely acquisition of Carmot, Roche became a serious contender in obesity. Recall that Viking and Carmot are both developing GLP-1/GIP agonists. Viking’s Phase 2 data temporarily catapulted their market capitalization to over $8 billion. With this in mind, Roche’s $2.7 billion investment seems like it’s already paying off.

- It’s difficult to envision Viking Therapeutics remaining independent for long. After the failure of their twice-daily oral GLP-1 receptor agonist, Pfizer is an obvious potential acquirer, among many others.

The Next Decade in Pharma: Incretin Hormones Leading the Way

No one knows what the future holds (the next decade or two), but it’s likely full of GLP-1 and GIP. There’s potentially another incretin hormone breakthrough on deck as well. For historical reference, I think it’s appropriate to look back at how the statin market evolved. Statins emerged in the late 20th century for their ability to reduce LDL [bad] cholesterol and cardiovascular risk. The first-to-market was Merck’s (MRK) lovastatin, which was approved in 1987 and, as of 2021, was the 100th most prescribed medicine in the US with over 6,000,000 total prescriptions. Sitting at the very top of the list is actually atorvastatin (Lipitor), with an astonishing 116 million total prescriptions. This is despite the many statins preceding Lipitor’s (e.g., Zocor, Pravachol, and Lescol) 1996 approval. Noteworthy: A few statins were well-established and blockbusters by the time Lipitor came to market. Lipitor was developed by Waner-Lambert (who also came up with the idea for sugarcoat drug tablets) and later acquired by Pfizer in 2000 for a hefty $90 billion. Many believe Lipitor became the preferred option due to its robust LDL-lowering abilities (perceived to be superior to other statins), dosing flexibility (once-daily, various doses), and an innovative marketing strategy that targeted the public. Anyway, I point all this out to stress that this market is still evolving and that while Eli Lilly and Novo have head starts, there will likely be others. Even within the GLP-1/GIP pathway, there are signs of efficacy beyond just weight loss. In August, Novo revealed cardiovascular risk reduction data for Wegovy. Its drug reduced major events (e.g., heart attacks and strokes) by 20%. GLP-1/GIPs are also being explored in liver disease (MASH), sleep apnea, and even Alzheimer’s.

Moving forward, drug developers will be focused on alternative administrations like oral, which could improve patient adherence and quality of life. Combination therapies (dual agonism) may result in greater efficacy and tolerability. Advancements in genomics could shed light on a more tailored treatment of obesity. For example, some patients may be more appropriate for different incretin targets.

To summarize, the development of GLP-1/GIP and subsequent research into other incretin hormones represents a significant shift in the pharmaceutical industry. The implications for investors are critical, and most investors moving forward should have a basic understanding of this landscape. Indiana-based Eli Lilly appears to have an edge in the US market with Zepbound. Amazingly, Zepbound prescriptions have already reportedly outnumbered Wegovy’s. This isn’t a slight to Wegovy, though. Wegovy will continue to be a behemoth of its own. However, Novo’s CagriSema appears primed to disrupt the industry in a few years. Moreover, Novo’s younger projects provide some optionality in the future in case Wegovy is challenged. It’ll be interesting to see what other large pharmaceutical companies will enter the picture here. Roche and AstraZeneca may be on the verge of some major tailwinds in the coming years. Lastly, smaller, differentiated players, like Viking Therapeutics, are, in my view, more likely to be acquired for large premiums before reaching the market and could become major footnotes in the history of medicine. All in all, I think it’s worth keeping a few of these names in a well-diversified portfolio to secure some alpha in the next decade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.