Summary:

- Airbnb is a fantastic long-term buy with deep potential, despite a gain of 20% year to date.

- The company is noting a rebound in travel originating from China, as well as strong performance in Latin America.

- Recent user experience improvements including total price displays have addressed many common user concerns.

- The company should benefit from continued strong travel spending in 2024 as well as a flashy Paris Olympics cycle.

Goodboy Picture Company/E+ via Getty Images

So far in 2024, investors have re-adopted their long-term mindsets, investing heavily in tech stocks that have wide-open futures. AI (and in particular, Nvidia (NVDA)) have been among the biggest beneficiaries of this long-term thinking, but these are not the only plays that have room to expand.

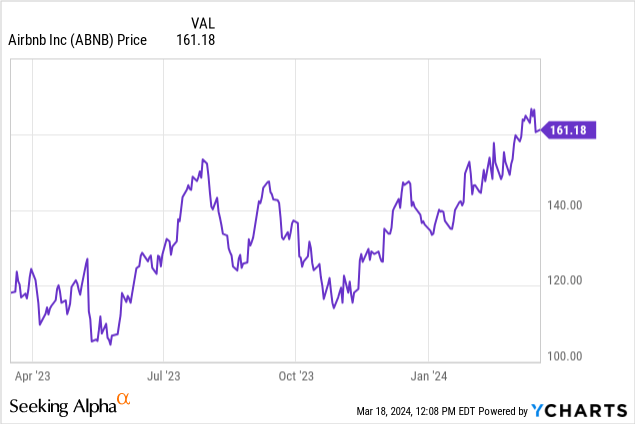

Look no further than Airbnb (NASDAQ:ABNB) for another long-term buy with deep potential. This travel platform has already seen its share price rise ~20% year to date, with gains picking up after the company’s mid-February earnings release. In spite of this, I continue to think Airbnb will enjoy further upside through the end of the year.

Constant platform improvements underpin longer-term growth catalysts

I last wrote a bullish opinion on Airbnb in December, when the stock was trading closer to $140 per share. I’ve enjoyed meaningful gains since then, but I remain bullish on this stock and am quite content to hold on for more upside.

In the few years since it emerged on the scene, Airbnb has gone from being a disruptor in the travel industry to truly mainstream. The world seems to have adjusted to Airbnb co-existing peacefully alongside hotels; with the latter emphasizing luxury, service, and amenities, while Airbnb caters more toward authentic, neighborhood-oriented, and budget-oriented travelers.

At the same time, Airbnb also continues to make tweaks to its platform in response to user feedback. For example, a lot of the traveler community had been fed up with exorbitant cleaning fees on the Airbnb platform, which many hosts had used as a more invisible pricing lever. Airbnb has since adopted a “total price” option that displays post-tax, post-fee prices, which many users have appreciated.

The company has also made doing business easier for hosts as well. It rolled out a “Similar Listings” tool to help its hosts compare their homes versus other listings in their area and price appropriately. This has improved pricing efficiency on the Airbnb platform, benefiting both hosts and customers.

And, though not a lever currently on the table: I’d argue that Airbnb still has more room to experiment with its own pricing. The company currently earns 17% of gross bookings (3% from hosts and 14% from guests). Though relatively high, given the lack of true competitors that have Airbnb’s scale and brand recognition, the company could probably still squeeze in several percentage points to boost its take rates without meaningfully alienating much of its customer base.

Here are the longer-term reasons to be bullish on Airbnb:

- Airbnb’s portfolio of offerings continues to expand, pushing it beyond being just a lodging platform. Airbnb continues to fuel innovation to drive additional monetization opportunities. Examples of these include “Experiences” (which offer local activities with local guides), and “Airbnb Rooms”, which offers lower-priced rooms in homes in alignment with the company’s original couch-surfing ethos.

-

Picking up share of both travel spend as well as rent spend with longer-term stays. With so many companies announcing permanent remote or hybrid work structures, many workers have leaped at the chance to become digital nomads and work from anywhere. More and more Airbnb bookings come from longer-term stays of 28 days or more. This trend may see Airbnb picking up not just travel demand, but essentially “rent” budgets from digital nomads as well. As a result of this trend, average trip lengths are increasing quite substantially.

-

Travel demand remains red-hot post-COVID. Travelers are still catching up on lost vacations post-pandemic, and while consumers seem to have curbed spending in many categories, the desire to spend on experiences has not slowed down.

-

Opportunity to compete with OTA giants in offering hotels a new listing platform. Hotels have always been under pressure by Expedia (EXPE) and Booking (BKNG), which are necessary marketing outlets but charge a giant fee. Airbnb already allows boutique hotels to list on its platform for a fee; over time, Airbnb could compete in this more minor segment of its business to take more share from OTAs.

-

Profitability in mind. During the immediate aftermath of the pandemic, Airbnb laid off about 20% of its staff. While it is now continuing to hire, this profit-centric mindset and the fact that Airbnb is structurally leaner than it was pre-pandemic has allowed the company to make sizable profitability gains.

Stay long here: Airbnb’s Q4 results demonstrated the resiliency of the company’s growth trajectory, and it remains a great buy for the remainder of 2024.

Q4 download

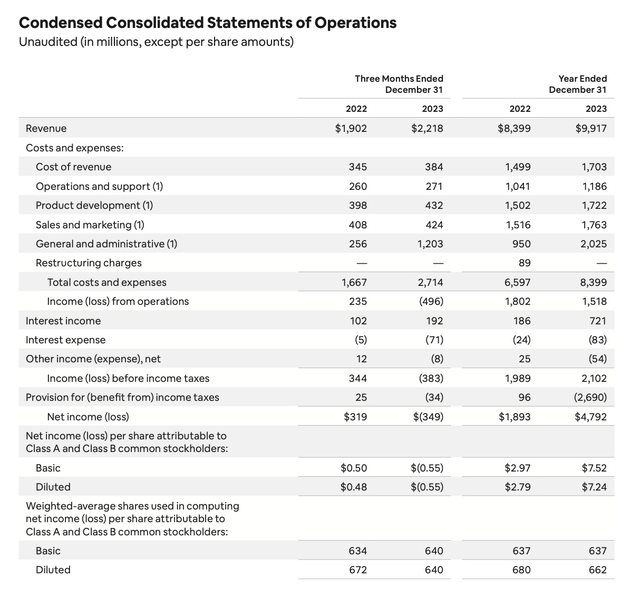

Let’s now go through Airbnb’s latest quarterly results in greater detail. The Q4 earnings summary is shown below:

Airbnb Q4 results (Airbnb Q4 shareholder letter)

Airbnb’s revenue grew 17% y/y to $2.22 billion, well ahead of Wall Street’s expectations of $2.16 billion (+13% y/y). Note that on a constant currency basis, Airbnb’s revenue would have been lower at 14% y/y, as Airbnb has benefited from a stronger dollar.

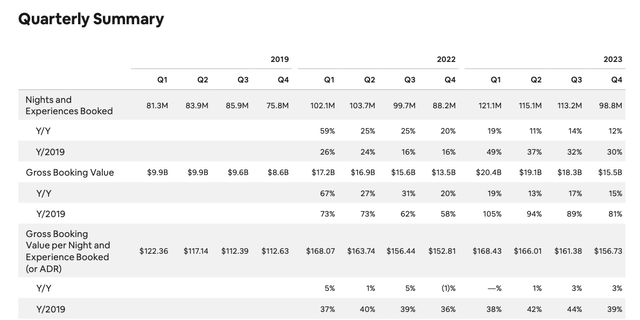

Booking nights grew 12% y/y, and remain up 30% versus the pre-pandemic quarters. At the same time, ADRs – or average daily rates – also continued to rise to $156.73, a Q4 record for the company.

Airbnb trended metrics (Airbnb Q4 shareholder letter)

In terms of regional trends, Airbnb noted importantly that travel to and from Asia continues to rebound. Nights and experiences booked in Asia rose 22% y/y in the fourth quarter. At the same time, economic recovery continues to mount in China, and Airbnb bookings originating in the world’s most populous country grew 90% y/y.

Latin America continues to be another growth star as well, with bookings also up 22% y/y. The company is also picking up with travelers from this area, with bookings originating from Chile, Peru and Ecuador more than doubling versus the pre-pandemic period.

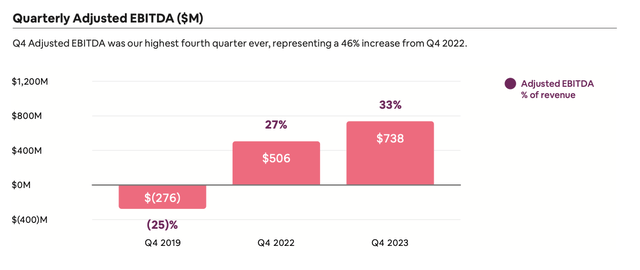

We also like the fact that Airbnb continues to drive massive profitability expansion. Adjusted EBITDA jumped 46% y/y to $738 million, representing an impressive 33% margin.

Airbnb adjusted EBITDA (Airbnb Q4 shareholder letter)

Risks and key takeaways

Of course, Airbnb is not without its risks, and the main one is its ever-evolving dance with local regulations. We do take comfort in the fact, however, that Airbnb notes that no single city represents more than 2% of its overall gross bookings.

All in all, I continue to see a company with substantial tailwinds. We look ahead to the 2024 Paris Olympics as another major driver of growth (the Olympics have always driven a squeeze in hotel availability, and the influx of Airbnb supply is a perfect sponge for this demand) and continued margin gains. Stay long here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.