Summary:

- Advanced Micro Devices and Intel compete fiercely in CPU market for PCs and servers, with Intel leading desktops and AMD leading servers.

- AMD has gained market share in desktop and server CPUs, but has struggled in the laptop market.

- Intel maintains a performance advantage, backed by innovative architectures and broader patents, with a pricing edge due to manufacturing capabilities.

- AMD’s strategies position the company as a significant player in AI, but Intel, and more so Nvidia also have strengths in the AI chip market, further intensifying competition.

JHVEPhoto

In our previous analysis of Advanced Micro Devices, Inc. (NASDAQ:AMD), we believed AMD’s strategies, comprising a diverse AI product portfolio, an open AI software platform, and established partnerships, positioned the company as a significant player in AI. The importance of high-performance chips, especially in data-intensive tasks like machine learning, is evident. While AMD emphasizes GPU technology superiority, our analysis acknowledges strengths in Nvidia (NVDA) and Intel (INTC) as well. The competitive landscape is dynamic, with all three contributing significantly to the AI chip market. Despite differences, we anticipate a balanced market share for AMD, Nvidia, and Intel in the server GPU market.

In this analysis, we covered AMD again to determine if AMD is becoming more competitive in the CPU market. This is as compared to our previous forecast where we expected AMD to lose share in the PC (desktop and laptop) segment but gain share in server CPUs, AMD had actually performed better in some areas such as Desktop and Servers, gaining market share but continued to falter in the laptop market share. Therefore, we update its comparison featuring its latest CPUs to determine the net effects on its competitiveness.

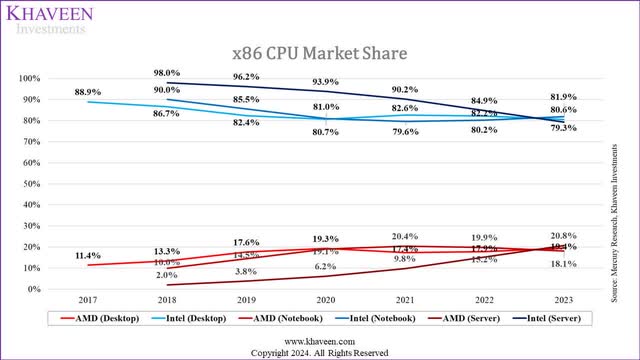

Based on the chart below, AMD’s desktop x86 CPU market share has been rising since 2017 but fell in 2021 to 17.4% from 19.3% in the previous year. However, in 2022, AMD’s market share rebounded and increased to 19.4% in 2023, the highest in the period at Intel’s expense. In the Laptop CPU category, AMD’s market share had been rising until 2021 when it peaked at 20.4% and fell in 2022 and 2023 as Intel clawed back some market share from AMD. In the Server CPU market, AMD’s market share has continuously increased over the past 6 years against Intel with the highest in 2023 at 20.8%.

Mercury Research, Khaveen Investments

CPU Performance Comparison

Firstly, we examined whether AMD is maintaining its performance advantage over Intel with its CPUs. In PC, AMD recently introduced its new Ryzen 8000 series with a few chips after expanding its Ryzen 7000 series product line throughout 2023 for PCs. Furthermore, in server, the company highlighted that its 4th Gen EPYC Processor revenue experienced “significant double-digit percentage growth.” Additionally, management highlighted that they believe “Zen 4 is extremely competitive right now with Genoa, Bergamo, Siena.”

On the other hand, Intel had launched its 14th generation CPUs for desktops and laptops codenamed Raptor Lake S Refresh following its 13th generation Raptor Lake. In server, Intel had launched its 5th generation Xeon processors.

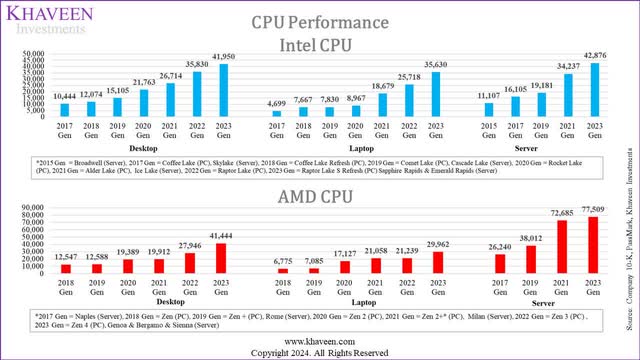

We updated our performance comparison of the desktop, laptop and server CPUs between Intel and AMD with the 2022 and 2023 generations. For AMD’s desktop CPUs, we omitted its Threadripper CPUs as it caters to workstations which represent a very small portion of the PC market of less than 3%.

Company Data, PassMark, Khaveen Investments

Desktop

|

CPU Benchmarks |

2018 Gen |

2019 Gen |

2020 Gen |

2021 Gen |

2022 Gen |

2023 Gen |

Average |

|

Intel Desktop Growth % |

15.6% |

25.1% |

44.1% |

22.7% |

34.1% |

17.1% |

26.5% |

|

AMD Desktop Growth % |

0.3% |

54.0% |

2.7% |

40.3% |

48.3% |

29.1% |

Source: Company Data, PassMark, Khaveen Investments.

In Desktop CPU, based on the chart of the benchmark scores between AMD and Intel, AMD had a slightly higher average performance compared to Intel in the 2018 gen. However, Intel had pulled ahead with the 2019 gen offering a 25% performance improvement compared to AMD. In 2020, AMD, with the launch of its new Zen 2 architecture, introduced the Ryzen 4000 series and had the highest performance growth in the past 6 years at 54% but Intel’s performance growth was also impressive at 44%. Intel continued to maintain a performance advantage against AMD with its subsequent new CPU generations. In 2021, Intel’s performance gap, the difference between the average benchmark score with AMD, increased to 6,803 from 2,374 with its Alder Lake. In 2021, AMD’s market share fell for the first time after rising since 2017. In 2022, Intel further widened the performance gap with AMD (7,884), however, AMD actually gained some minor market share (0.5%) from Intel despite the large performance gap. In 2023, however, with the Ryzen 7000 series introduced, AMD had almost closed the performance gap with Intel’s new 14th gen Raptor Lake Refresh CPUs, with a minor difference of only 506, due to AMD’s impressive 48% performance growth compared to its 2022 gen (Ryzen 6000 series). This corresponded with AMD regaining some market share (1.6%) from Intel in 2023 despite Intel still having the higher average benchmark score performance. Overall, our desktop CPU performance comparison analysis indicates a fierce rivalry between Intel and AMD as the performance difference has narrowed between the 2 companies with Intel still maintaining a slight performance advantage.

Laptop

|

CPU Benchmarks |

2018 Gen |

2019 Gen |

2020 Gen |

2021 Gen |

2022 Gen |

2023 Gen |

Average |

|

Intel Laptop Growth % |

63.2% |

2.1% |

14.5% |

108.3% |

37.7% |

38.5% |

44.1% |

|

AMD Laptop Growth % |

4.6% |

141.8% |

22.9% |

0.9% |

41.1% |

42.2% |

Source: Company Data, PassMark, Khaveen Investments.

Whereas in the Laptop segment, Intel’s average benchmark scores had been slightly higher than AMD in its 2019 and 2020 generations. However, in 2021, AMD’s Zen 3-based Ryzen 5000 series CPUs showed massive performance growth, the highest in the past 5 years, resulting in AMD overtaking Intel with a wide performance advantage with a significant difference of 8,160. By the end of 2021, Intel responded with the launch of its Alder Lake CPUs with a significant 108% performance improvement, allowing Intel to narrow the gap with AMD. AMD’s laptop CPU market share peaked in 2021, corresponding to the last time its performance was higher than Intel’s. In 2022, Intel launched its new Raptor Lake and Raptor Lake Refresh in 2023, both offering strong performance gains.

Despite AMD’s better performance growth in 2023 with the Ryzen 7000 Zen 4-based CPUs, AMD was still behind Intel while the performance gap between Intel and AMD widened in 2023 (5,669), highlighting Intel’s solid performance advantage in Laptop CPUs, thus we believe could explain the decline of AMD’s laptop market share in 2022 and 2023.

Server

|

CPU Benchmarks |

2017 Gen |

2019 Gen |

2021 Gen |

2023 Gen |

Average |

|

Intel Server Growth % |

45.0% |

19.1% |

78.5% |

25.2% |

42.0% |

|

AMD Server Growth % |

44.9% |

91.2% |

6.6% |

47.6% |

Source: Company Data, PassMark, Khaveen Investments.

In the Server segment, AMD’s performance contrasts with its Desktop and Laptop segments as this segment shows AMD having a clear performance advantage over Intel in every one of the past 4 CPU generations as AMD’s average benchmark had been higher than Intel in the past 4 generations. Not only that, but AMD’s performance advantage also solidified as its performance gap with Intel widened with its 2019 (Rome) and 2021 (Milan) generations having higher performance growth compared to Intel.

However, in the latest product gen, Intel’s Sapphire Rapids & Emerald Rapids-based CPUs had better performance growth than AMD for the first time in the past 4 generations, indicating increasing competitiveness from Intel. Whereas AMD’s performance growth was underwhelming at only a 6.6% increase, well below its 47.6% average. However, despite Intel’s better growth in 2023, AMD still maintains a large performance score gap with Intel (average benchmark difference of 34,632) in 2023. Overall, the rapid rise in AMD’s server market share corresponded with the surge in its massive performance growth in the past 4 generations, while it has slowed with its latest 2023 gen, it still has a large lead over Intel in terms of performance.

Outlook

Overall, in the desktop market, the competition between Intel and AMD is very fierce, with Intel overtaking the performance advantage with a higher average since its 2022 gen and maintaining its lead in its 2023 gen to AMD. However, AMD’s desktop CPU performance growth had been higher than Intel’s growth closing the gap with Intel while gaining market share in 2023. However, in the laptop segment, Intel’s CPU performance advantage is more evident as the difference between its 2023 gen is large compared to AMD as Intel’s CPU performance improvement had been better than AMD in the past 2 gens, solidifying Intel’s performance advantage in the laptop segment. In contrast, the server segment has AMD as the leading company with a much higher average performance compared to Intel despite Intel’s better performance growth for its 2023 gen.

Looking ahead, AMD’s next Zen 5 architecture is reported to offer a 20% performance improvement compared to Zen 4 while Intel’s next Arrow Lake architecture was reported to have a “25% to 35% performance boost” compared to Meteor Lake, which indicates strong potential performance growth for Intel.

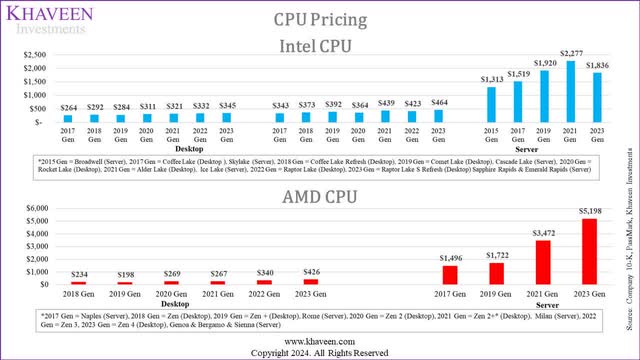

CPU Pricing Comparison

Furthermore, at this point, we compared the pricing comparison of AMD and Intel CPUs in desktop and server. We updated our comparison from our previous analysis with the 2022 and 2023 product generations. Furthermore, we also compiled Intel’s laptop CPU pricing based on its recommended selling price from its website. However, we could obtain data from AMD for its laptop CPUs.

Company Data, PassMark, Khaveen Investments

Desktop

|

CPU Pricing |

2018 Gen |

2019 Gen |

2020 Gen |

2021 Gen |

2022 Gen |

2023 Gen |

Average |

|

Intel Desktop Growth % |

10.5% |

-2.8% |

9.7% |

3.2% |

3.6% |

3.9% |

4.7% |

|

AMD Desktop Growth % |

-15.2% |

35.4% |

-0.7% |

27.6% |

25.1% |

14.4% |

Source: Company Data, PassMark, Khaveen Investments.

In terms of pricing for the Desktop segment, Intel’s pricing has generally been higher than AMD’ between the 2018 to 2021 product generations. In 2019, both AMD and Intel’s average pricing growth was negative, indicating aggressive pricing competition between both companies. However, beyond that, AMD’s average prices have risen at a faster pace compared to Intel, apart from 2021 when AMD’s pricing growth was flattish. In the 2022 product gen, AMD’s Zen 2 Ryzen 5000 series average prices were higher than Intel for the first time in the past 6 generations as its average prices were 27.6% higher than the previous gen (Ryzen 4000). Despite AMD’s higher pricing for its 2022 gen, it still managed to retake some market share from Intel.

Also, in 2023, AMD’s average pricing growth for its new gen (Ryzen 7000) was also higher than Intel at 25% compared to Intel’s 3.9% increase, thus AMD’s average prices for its 2023 gen were much higher than Intel’s. Still, AMD managed to continue taking market share from Intel in 2023.

Laptop

|

CPU Pricing |

2018 Gen |

2019 Gen |

2020 Gen |

2021 Gen |

2022 Gen |

2023 Gen |

Average |

|

Intel Laptop Growth % |

9.0% |

5.0% |

-7.1% |

20.4% |

-3.7% |

9.8% |

5.6% |

|

AMD Laptop Growth % |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A |

Source: Company Data, PassMark, Khaveen Investments.

Furthermore, in the Laptop segment, we only analyzed Intel’s laptop CPU pricing as AMD does not disclose information on pricing for its laptop CPUs. Based on the table above, Intel’s server CPU pricing growth has an average of 5.6% in the past 6 generations. The highest was in 2021 with the launch of its Alder Lake CPUs, however, as analyzed above, AMD’s Alder Lake CPUs had a massive performance improvement compared to its predecessor with a 108% performance improvement.

Server

|

CPU Benchmarks |

2017 Gen |

2019 Gen |

2021 Gen |

2023 Gen |

Average |

|

Intel Server Growth % |

15.7% |

26.5% |

18.6% |

-19.4% |

10.3% |

|

AMD Server Growth % |

15.2% |

101.6% |

49.7% |

55.5% |

Source: Company Data, PassMark, Khaveen Investments.

In the Server segment, AMD’s average pricing for its 2017 and 2019 gen CPUs was lower than Intel’s despite its performance advantage. Moreover, Intel’s average pricing growth for its 2019 gen was also higher than AMD’s. However, since the 2021 gen, AMD’s pricing growth has been significantly higher than its previous gen with 101.6% higher pricing, overtaking Intel with higher average pricing. For the 2023 gen, Intel’s average prices decreased by 19% despite its strong performance improvement, on the other hand, AMD increased by 49.7%. This could indicate Intel trying to compete more aggressively with AMD with its new server CPUs. However, despite that, in 2023, AMD’s market share still increased at Intel’s expense, highlighting AMD’s pricing power supported by its massive performance advantage compared to Intel as explained in the first point above.

Outlook

Overall, in terms of pricing, in the desktop segment, AMD’s average pricing was lower than Intel but its 2022 gen and 2023 gen are higher compared to Intel’s as its pricing growth in the past 2 generations was higher, thus highlighting Intel’s lower pricing advantage in desktop. Still, AMD’s market share in desktop continued to rise in 2022 and 2023. In server, AMD’s pricing growth for its new 2023 gen was much higher than Intel’s but lower than its previous gen, while Intel’s new 2023 gen average pricing growth was -19.4% but still managed to gain market share while we believe was supported by its performance advantage as mentioned in the first point.

Overall, AMD generally had higher pricing growth compared to Intel in Desktop and Server despite the stronger performance growth by Intel in the past 2 gens in Desktop and 2023 gen server, thus highlighting Intel’s pricing advantage due to its lower pricing in Desktop and Server compared to AMD. However, in the laptop segment, only Intel disclosed its pricing, which grew by an average of 5.6% whereas AMD did not disclose.

One difference is Intel produces its chips internally while AMD’s production is outsourced to the Taiwan Semiconductor (TSM) aka TSMC foundry which has raised its wafer pricing in the past as previously analyzed. Furthermore, in 2024, TSMC is reportedly planning further price hikes to between 3% to 6% according to DigiTimes, which would be passed through in AMD’s pricing growth unless AMD absorbs the price hike which would impact profitability margins.

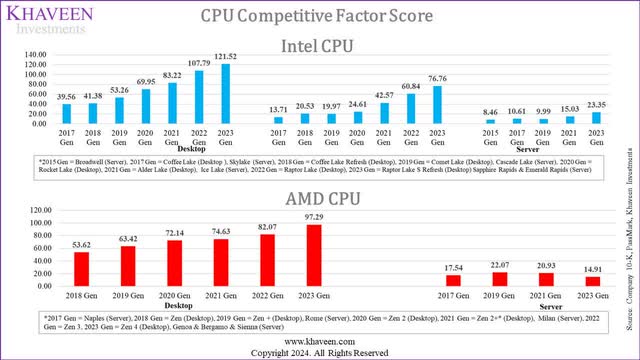

CPU Competitive Factors

In this point, we examined our derived competitive factor score of AMD vs. Intel CPUs based on its performance over its pricing for each product generation.

Competitive Factor Score Comparison

Company Data, PassMark, Khaveen Investments

Desktop

|

CPU Competitive Factor Score |

2018 Gen |

2019 Gen |

2020 Gen |

2021 Gen |

2022 Gen |

2023 Gen |

Average |

|

Intel Desktop Growth % |

4.6% |

28.7% |

31.3% |

19.0% |

29.5% |

12.7% |

21.0% |

|

AMD Desktop Growth % |

18.3% |

13.8% |

3.5% |

10.0% |

18.5% |

12.8% |

|

|

Intel Laptop Growth % |

49.7% |

-2.7% |

23.2% |

73.0% |

42.9% |

26.2% |

35.4% |

|

AMD Laptop Growth % |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A |

Source: Company Data, PassMark, Khaveen Investments.

Server

|

CPU Competitive Factor Score |

2017 Gen |

2019 Gen |

2021 Gen |

2023 Gen |

Average |

|

Intel Server Growth % |

25.3% |

-5.8% |

50.5% |

55.3% |

31.3% |

|

AMD Server Growth % |

25.8% |

-5.2% |

-28.8% |

-2.7% |

Source: Company Data, PassMark, Khaveen Investments.

In the chart above, we derived our competitive factor score based on performance over pricing for AMD and Intel and the growth in the table above. For the Desktop segment, AMD had a higher competitive factor score between the 2018 and 2020 product generations. However, from 2021 onwards, Intel had higher competitive factor scores than AMD, indicating better value for Intel CPUs. In 2021, as Intel overtook AMD with a higher competitive factor score, Intel’s market share rebounded by 1.9%.

However, while Intel maintained a higher competitive factor score in 2022, AMD retook some market share from Intel (0.5%) and in 2023, AMD also gained market share from Intel (1.6%) as its competitive factor score growth was higher than Intel. Thus, we believe this highlights the value advantage as the main factor driving the Desktop CPU market share.

In the Laptop segment, although we could not derive a competitive factor score for AMD due to a lack of pricing data for its laptop CPUs, we analyzed Intel’s competitive factor growth which has an average of 35.4%, higher than its average growth for Desktop and Laptop, indicating Intel laptop CPU value has grown strongly over the period.

In the Server segment, AMD has higher competitive factor scores than Intel between 2017 to 2021 product gens. However, in 2023, Intel’s competitive score overtook AMD and was higher than AMD’s. Notwithstanding, AMD’s market share continued to rise strongly in 2023. We believe this highlights the performance advantage of AMD, being a more important factor driving its market share.

Furthermore, we examined factors that support the company’s performance capability factors including the ability to execute on their process roadmap, architecture and IP/patent portfolio as well as and pricing capability factors such as capabilities manufacturing capabilities, distribution network and Backend Manufacturing Capabilities.

Performance

Process Roadmap

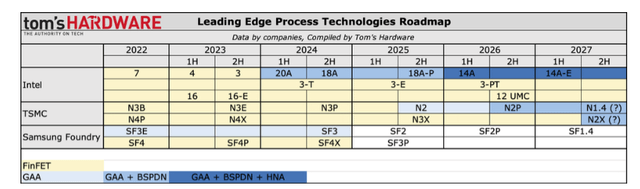

AMD depends on TSMC to produce its chips while Intel produces its chips in-house, thus we compared the process roadmap between TSMC and Intel by Tom’s Hardware. Intel had set a goal of “five nodes in four years” as it tried to catch up with TSMC. Intel had faced delays previously for the past for Intel 7 Sapphire Rapids which launched in early 2023 instead of 2022, however, Intel currently has caught up with TSMC with a 3nm process with its Sierra Forest products based on Intel 3 sampling with its customers.

Based on the roadmap, Intel plans to launch 2nm and 1.8nm process nodes (20A and 18A) before TSMC and unveil 1.4nm (14A) in 2026 based on advanced high-NA EUV lithography. According to Intel, management expects to “achieve manufacturing readiness” and launch its 2nm and 1.8nm products this year. On the other hand, for TSMC, the company is not expected to release a 2nm process node (N2) until late 2025, around 1-1.5 years behind Intel, whereas the extension line of N2P would only start mass production in H2 2026.

However, TSMC highlighted its claim that its N3P (3nm) node can be comparable to Intel’s 18A (1.8nm), while its N2 could even beat the 1.8nm process node performance. For their 4nm process, TSMC’s N4 process has a 16% higher transistor density compared to Intel 4. Thus, indicating TSMC’s process technology to be superior to Intel. Therefore, while Intel appears to be on track after catching up with TSMC and is expected to launch its future nodes, TSMC’s superior transistor density makes it uncertain whether Intel would likely have a performance advantage over TSMC and thus AMD. Therefore, in terms of the process technology roadmap, we believe there is no clear advantage between Intel and AMD and Intel’s upcoming new process may be on par with TSMC.

Architecture

Following Intel’s launch of 5 nodes in 4 years, Intel has designed and introduced new and different architectures over the period such as Rocket Lake, Alder Lake, Raptor Lake and Raptor Lake Refresh. Rocket Lake (11th Gen), marked the introduction of DDR4-3200 memory support. Alder Lake, the (12th Gen), brought a significant evolution with its hybrid architecture featuring both Performance (P) and Efficient (E) cores while embracing DDR5 memory for desktop PCs and LPDDR5 for laptops, exemplified by the flagship model Intel Core i9-12900K, boasting 16 cores and 24 threads. Raptor Lake (13th Gen) built on the same Intel 7 process as Alder Lake, enhanced performance and efficiency by increasing the core count delivering performance boosts of up to 40%.

AMD’s Zen 3 architecture, featured in the Ryzen 5000 series CPUs, brought notable advancements over its predecessor (Zen 2) with a redesigned layout and enhanced overall performance and was manufactured using a 7nm process. Zen 3+, a subsequent minor update, introduced some performance enhancements but AMD highlighted “no fundamental IPC improvements”. Following that Zen 4, delivered performance gains of more than 35% according to AMD.

As highlighted above, AMD’s next Zen 5 architecture is reported to offer a 20% performance improvement compared to Zen 4 while Intel’s next Arrow Lake architecture was reported to have a “25% to 35% performance boost” compared to Meteor Lake, which indicates strong potential performance growth for Intel. Overall, in terms of architecture, Intel’s new architectures had been superior compared to AMD due to the higher performance boost compared to its previous architecture and is also reportedly expected to have a higher performance boost for its upcoming Arrow Lake architecture in 2024 as well.

IP/Patent Portfolio

According to GreyB, AMD has a total of 11,492 patents globally while Intel has 214,150 total and 102,821 active patents, highlighting Intel’s larger patent portfolio breadth. Moreover, we compiled the total publications, filings and grants from Global Data below to compare AMD and Intel’s patent growth. As seen below, Intel has higher patent publications, filings and grants each year over the period. While the average growth in the total period is similar, Intel’s patent growth has been declining since 2018 while AMD generally had positive growth during the period except in 2022. Overall, we believe that Intel’s superior patent portfolio indicates its IP advantage against AMD which supports its chip performance capabilities.

|

AMD |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

Average |

|

Total Publications |

1470 |

1415 |

1247 |

1065 |

1044 |

1271 |

1598 |

1795 |

1803 |

1363 |

|

|

Growth % |

-3.7% |

-11.9% |

-14.6% |

-2.0% |

21.7% |

25.7% |

12.3% |

0.4% |

-24.4% |

0.4% |

|

|

Filings |

795 |

743 |

659 |

613 |

528 |

726 |

934 |

978 |

1069 |

831 |

|

|

Growth % |

-6.5% |

-11.3% |

-7.0% |

-13.9% |

37.5% |

28.7% |

4.7% |

9.3% |

-22.3% |

2.1% |

|

|

Grants |

652 |

657 |

565 |

437 |

503 |

530 |

637 |

776 |

688 |

482 |

|

|

Growth % |

0.8% |

-14.0% |

-22.7% |

15.1% |

5.4% |

20.2% |

21.8% |

-11.3% |

-29.9% |

-1.6% |

|

|

Intel |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

Average |

|

Total Publications |

8837 |

12667 |

13713 |

17566 |

20380 |

18809 |

16567 |

13064 |

11693 |

8156 |

|

|

Growth % |

43.3% |

8.3% |

28.1% |

16.0% |

-7.7% |

-11.9% |

-21.1% |

-10.5% |

-30.2% |

1.6% |

|

|

Filings |

6005 |

9549 |

8956 |

10791 |

12252 |

10927 |

9858 |

7165 |

6243 |

4987 |

|

|

Growth % |

59.0% |

-6.2% |

20.5% |

13.5% |

-10.8% |

-9.8% |

-27.3% |

-12.9% |

-20.1% |

0.7% |

|

|

Grants |

2613 |

2797 |

3867 |

5724 |

7091 |

6843 |

6151 |

5623 |

5165 |

3005 |

|

|

Growth % |

7.0% |

38.3% |

48.0% |

23.9% |

-3.5% |

-10.1% |

-8.6% |

-8.1% |

-41.8% |

5.0% |

Source: Global Data, Khaveen Investments.

Pricing

Manufacturing Capabilities

As mentioned, AMD depends on TSMC’s foundry to produce its chips while Intel produces most of its own chips in-house including CPUs as an IDM but contracts TSMC to produce its GPUs. IDMs, encompassing design and fabrication may benefit from vertical integration but have high capital expenditure for in-house fabrication facilities. The total cost, however, may be influenced by factors like yield and production volume. TSMC is the world’s largest foundry with around 60% market share and highlights its massive scale whereas Intel is one of the top IDMs. TSMC also benefits from geographical advantage in terms of labor costs in Taiwan and lower effective tax rates compared to Intel-based in the US. TSMC’s production yield is also high with its 4nm between 70% to 80% while Intel’s yield had been unsatisfactory according to the company in the past which resulted in delays. That said, we believe Intel’s yield rate may have improved as its product launches were mostly on track and also “Intel announced that its Intel 3 technology has met its yield rate and performance goals”.

Furthermore, TSMC has a history of increasing its wafer pricing for its customers as previously analyzed. Furthermore, in 2024, TSMC is reportedly planning further price hikes to between 3% to 6% according to DigiTimes, which would be passed through in AMD’s pricing growth unless AMD absorbs the price hike which would impact profitability margins.

Overall, we believe Intel’s manufacturing capabilities could provide it with an advantage over AMD due to its internal manufacturing which has shown signs of improvement in its production yield as it launched most of its products as scheduled. While TSMC benefits from geographic advantages with lower labor costs and tax rates in Taiwan, it has been raising its wafer prices on its customers which is negative for AMD as it passes through the price hikes to customers, which could explain the higher average pricing growth for AMD’s Desktop and Server CPUs compared to Intel from the previous point.

Distribution Network

Both AMD and Intel have extensive distribution networks and collaborate with their partners to deliver their products. AMD operates a global network of 314 authorized distributors, offering a variety of products such as processors, graphics cards, and PC systems. On the other hand, Intel manages a Partner Alliance program to support its distribution network and has 170 total distributor partners. While AMD has more partners, both AMD and Intel have the top distributors including Arrow Electronics (ARW), Avnet (AVT), WPG Holdings (OTC:WPGHF) and WT Microelectronics. Furthermore, in terms of selling and marketing expenses, both companies have a similar average SG&A % of revenue with Intel at 11.16% and AMD at 10.27%. Therefore, we believe this indicates both companies have extensive distribution network capabilities with similar expenses as a % of revenue, thus it is inconclusive whether one company has a clear advantage over the other.

Backend Manufacturing Capabilities

Both AMD and Intel utilize OSAT services. AMD utilizes OSAT services from TSMC, SPIL and TMFE. In contrast, Intel outsources its chip packaging to various OSATs for assembly and test services to companies such as Powertech Technology. Overall, both companies rely on OSATs to meet their semiconductor assembly, packaging, and testing requirements. As the OSAT market is fragmented in terms of market share with relatively low differentiation as the companies compete mainly based on low labor costs with their facilities across Asia, we believe it is unlikely AMD or Intel has a distinct advantage to support their pricing competitiveness.

Outlook

Overall, we believe that Intel has the overall advantage in terms of performance capabilities, mainly due to its ability to increase its performance through new architectures such as the upcoming launch of its next Arrow Lake which reportedly could deliver a higher performance boost to its previous architecture (Meteor Lake) compared to AMD. Additionally, we believe Intel’s broader patent portfolio highlights its IP advantage over AMD which could support its chip development.

Additionally, we also believe Intel has an advantage in terms of pricing capabilities as we believe it has stronger manufacturing capabilities as its production yields are indicated to have improved following its successes in launching new product generations as scheduled and catching up with a 3nm process which management highlighted satisfactory yields, whereas AMD outsources production to TSMC and faces price hikes, which could pressure it to pass the price hikes through higher prices to its customers.

We updated our projection for the CPU market share for desktop and server based on our derived competitive factor score. In the Desktop market, we derived a weighted average based on its past 6 generations at 0.92x for AMD, which indicates we expect AMD to face increasing competition from Intel due to its innovation with new architectures and patent portfolio advantages as well as strong manufacturing capabilities supporting its pricing competitiveness. Furthermore, in server, we derived a weighted average of 1.01x, which reflects our view that we expect AMD to still gain some market share, due to its existing current performance advantage which far exceeds Intel, but at a slower pace compared to previously as we believe Intel is becoming increasingly competitive with better performance growth and lower pricing as seen with its latest 5th Gen Xeon chips, delivering a higher factor score compared to AMD.

|

Desktop CPU Competitive Factor Score |

2018 Gen |

2019 Gen |

2020 Gen |

2021 Gen |

2022 Gen |

2023 Gen |

Average |

|

Intel Desktop |

41.4 |

53.3 |

69.9 |

83.2 |

107.8 |

121.5 |

|

|

Growth % |

4.6% |

28.7% |

31.3% |

19.0% |

29.5% |

12.7% |

21.0% |

|

AMD Desktop |

53.6 |

63.4 |

72.1 |

74.6 |

82.1 |

97.3 |

|

|

Growth % |

18.3% |

13.8% |

3.5% |

10.0% |

18.5% |

12.8% |

|

|

Average |

48 |

58 |

71 |

79 |

95 |

109 |

|

|

Intel Difference from average |

0.871 |

0.913 |

0.985 |

1.054 |

1.135 |

1.111 |

1.08 |

|

Weight |

2.5% |

7.5% |

10.0% |

15.0% |

25.0% |

40.0% |

|

|

AMD Difference from average |

1.129 |

1.087 |

1.015 |

0.946 |

0.865 |

0.889 |

0.92 |

|

Weight |

2.5% |

7.5% |

10.0% |

15.0% |

25.0% |

40.0% |

Source: Khaveen Investments.

|

Server CPU Competitive Factor Score |

2017 Gen |

2019 Gen |

2021 Gen |

2023 Gen |

Average |

|

Intel Server |

10.6 |

10.0 |

15.0 |

23.4 |

|

|

Growth % |

25.3% |

-5.8% |

50.5% |

55.3% |

31.3% |

|

AMD Server |

17.5 |

22.1 |

20.9 |

14.9 |

|

|

Growth % |

25.8% |

-5.2% |

-28.8% |

-2.7% |

|

|

Average |

14.1 |

16.0 |

18.0 |

19.1 |

|

|

Intel Difference from average |

0.754 |

0.623 |

0.836 |

1.221 |

0.99 |

|

Weight |

10.0% |

15.0% |

25.0% |

50.0% |

|

|

AMD Difference from average |

1.246 |

1.377 |

1.164 |

0.779 |

1.01 |

|

Weight |

10.0% |

15.0% |

25.0% |

50.0% |

Source: Khaveen Investments.

Risk: Arm-based CPUs

In our previous analysis of Microsoft, we highlighted the development of custom Arm server CPUs by Microsoft (MSFT). Furthermore, other cloud service providers such as AWS (AMZN), Google (GOOG) and Alibaba (BABA) had also previously developed their own Arm-based chips for their own cloud. In the PC market, we highlighted that Qualcomm (QCOM) is also developing Arm-based CPUs for the PC market similar to Apple Silicon chips (AAPL). According to DigiTimes, the share of Arm-based server CPUs had increased to 8.1% in 2023 from 2.6% in 2020. Whereas in the PC market, the share of Arm CPUs had increased to 10% in 2023 Q3 from less than 2% in 2020. Therefore, the rise of Arm-based CPUs in PCs and servers may affect AMD’s CPU shipment growth outlook.

Valuation

|

AMD Revenue Forecast ($ mln) |

2024F |

2025F |

2026F |

|

Client (PC CPU) |

5,887 |

7,381 |

8,307 |

|

Growth % |

26.57% |

25.37% |

12.55% |

|

Gaming Console Estimate |

6,007 |

6,548 |

7,072 |

|

Growth % |

9.90% |

9.01% |

8.01% |

|

Gaming (PC GPU) Estimate |

1,085 |

1,531 |

1,746 |

|

Growth % |

45.3% |

41.2% |

14.0% |

|

Data Center CPU Estimate |

5,127 |

6,551 |

8,031 |

|

Growth % |

32.99% |

27.79% |

22.58% |

|

Data Center GPU Estimate |

3,500 |

5,367 |

8,230 |

|

Growth % |

118.8% |

53.3% |

53.3% |

|

Data Center DPU Estimate |

344 |

423 |

511 |

|

Growth % |

24.9% |

22.9% |

20.9% |

|

Data Center FPGA Estimate |

878 |

1,006 |

1,153 |

|

Growth % |

14.60% |

14.60% |

14.60% |

|

Embedded |

6,098 |

6,988 |

8,008 |

|

Growth % |

14.60% |

14.60% |

14.60% |

|

Total |

28,924 |

35,795 |

43,057 |

|

Growth % |

27.5% |

23.8% |

20.3% |

Source: Company Data, Khaveen Investments.

We updated our revenue projections from our previous analysis with our updated PC CPU and Data Center CPU projections. We projected its CPU revenue growth based on shipments and pricing growth. For shipments, we based the desktop and laptop growth on our previous PC market shipment growth model and server market on the server market 10-year average, adjusted by our factor scores of 0.92x (Desktop) and 1.01x (Server). Whereas for pricing, we based its growth on our analysis of AMD’s past generations for desktop and server, tapered down beyond 2024.

Furthermore, we also accounted for AMD’s guidance for its data center GPU revenue guidance to surge to $3.5 bln in 2024 from its earnings briefing. In total, we projected a forward average of 23.9% for AMD over the next 3 years.

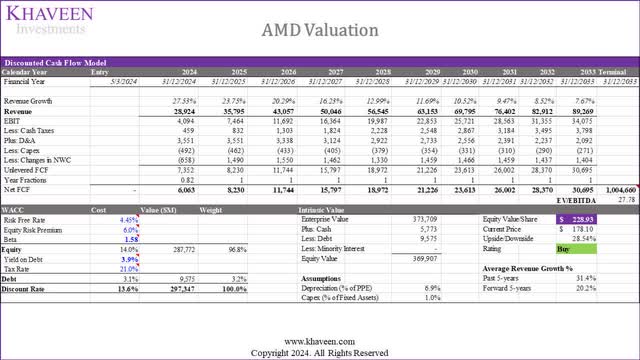

Based on a discount rate of 13.6% (company’s WACC), and a 5-year average EV/EBITDA based on U.S.-only chipmakers of 27.78x, our model shows 28.54%.

Verdict

Overall, we believe the competition between AMD and Intel in the CPU market remains aggressive across both PCs and servers. In the desktop market, Intel has consistently outperformed AMD since 2022, maintaining its lead through 2023.

However, AMD’s desktop CPU performance has seen higher growth, resulting in a narrowing gap and increased market share. While Intel dominates the laptop segment, AMD leads in servers despite Intel’s improved performance growth in 2023.

Looking ahead, we anticipate further performance gains from both companies with Intel expected to continue its strong performance trajectory against AMD. In terms of pricing, we believe Intel generally enjoys a pricing advantage in desktops, while AMD has experienced higher pricing growth in both desktops and servers. This discrepancy may be attributed to differences in their manufacturing models; Intel operates as an IDM while AMD relies on TSMC, making it susceptible to wafer price hikes. This could potentially erode AMD’s CPU pricing value going forward.

Overall, we believe Intel maintains an advantage in performance over AMD, driven by innovative architectures and a broader patent portfolio. Additionally, its stronger manufacturing capabilities and improved yields contribute to its pricing edge. Our projections indicate increased competition in desktops, favoring Intel, while AMD is expected to maintain its lead in servers gaining market share but at a slower pace due to Intel’s threat of its growing competitiveness. Overall, we updated our projections at a forward average of 23.9%, reflecting a growing threat for AMD in the CPU market but factoring in its continued robust pricing growth and growth opportunities in other segments based on its latest data center GPU guidance.

Our updated discounted cash flow (“DCF”) valuation calculates a price target of $228.93 for AMD, which is higher compared to our previous analysis of $160.20, due to a higher EV/EBITDA average (27.78x vs 23.59x), but with a lower upside following a 42% surge in the company’s stock price since our previous analysis. Thus, we rate AMD stock as a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No information in this publication is intended as investment, tax, accounting, or legal advice, or as an offer/solicitation to sell or buy. Material provided in this publication is for educational purposes only, and was prepared from sources and data believed to be reliable, but we do not guarantee its accuracy or completeness.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.