Summary:

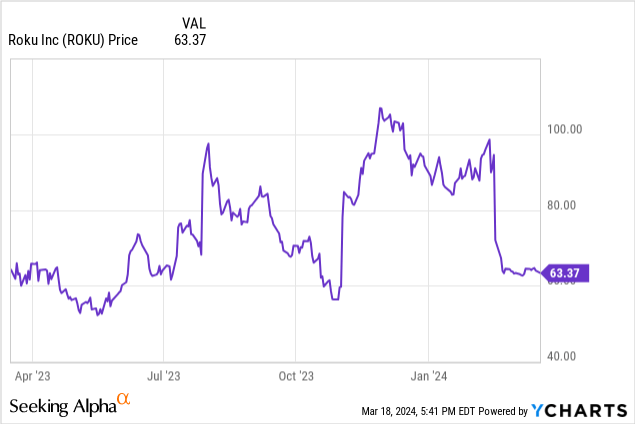

- Roku stock has fallen 30% this year despite a strong Q4 earnings print.

- The company continues to enjoy double-digit growth in users, streaming hours, and platform revenue, while profitability has surged above breakeven.

- Management continues to cite more and more ad spend shifting away from linear TV and toward streaming.

- The company’s investments into content plus its overseas expansion plans should continue to serve as key growth catalysts for the company going forward.

- Roku also has more than $2 billion in net cash, a substantial chunk of its ~$9 billion market cap.

Monica Schipper

Understandably, investors have demanded sheer perfection out of earnings season this quarter. With stock markets so high, only the best performers have been allowed to continue rallying. In some cases, however, post-earnings negative reactions have created buying opportunities in stocks that were otherwise expensive, creating perfect contrarian plays in a frothy environment.

Roku (NASDAQ:ROKU) is a perfect example here. The streaming company has lost roughly 30% of its market value this year, dramatically underperforming the broader markets with losses picking up after the company’s recent Q4 earnings release. Despite a beat to quarterly expectations and a robust outlook for the current quarter, Roku still sunk – which to me forms a perfect buying opportunity.

I last wrote a bullish note on Roku in December, when the stock was trading closer to $100 per share. Though I’ve suffered painful losses in this position while the rest of the broader market has rallied, my conviction in Roku remains unchanged. I’m unruffled by common market sentiment of the moment and am still a strong believer in Roku’s long-term appeal.

Investors should focus on two things here: first, the company continues to build up its large platform audience and grab share away from traditional TV ad spend; second, Roku’s focus on profitability and increased pricing on its hardware sales has led to a major turnaround in both adjusted EBITDA and free cash flow. While execution may be lumpy from quarter to quarter, I still see a future that is dominated by streaming, and the Roku Channel and Roku hardware devices continue to be dominant names in this arena.

For investors who are newer to Roku, here is my refreshed long-term bull case for this stock:

-

Roku’s shift toward a platform-first model has dramatically improved its margins and revenue stability. At one time, Roku’s revenue split between its low-margin hardware players and its platform revenue was closer to 50/50; now, hardware is less than 20% of Roku’s overall revenue. Not only has this improved profitability, but this also means Roku’s revenue is more stable from quarter to quarter and isn’t heavily reliant on the seasonality of device sales.

- Advertising spend continues to shift toward streaming, as cord-cutting continues. Advertisers have been slower to move off of “linear” TV and onto streaming than consumers have. Roku notes that while 45% of U.S. adults’ entertainment is provided by streaming services, U.S. companies only spend 18% of their ad budgets on streaming. Roku’s ability to grow in 2023 amid tougher trends for advertising as a whole demonstrates that it’s going to continue benefiting from secular shifts away from traditional TV and into streaming.

-

The company continues to drive growth via the Roku Channel and is also a leader in original programming. The company’s platform is now one of the leading streaming offerings in the U.S. This channel is also now producing original content, including a new documentary in partnership with the NFL that became one of the most popular shows on Roku.

-

Active accounts and streaming hours continue to grow. Though growth rates have certainly slowed from the immediate boost that the pandemic delivered, Roku is still delivering constant growth in both active accounts and streaming hours, boosting its monetization capabilities.

-

Ambitions to expand overseas- Roku has recently set its sights on expanding aggressively overseas, with recent overtures in the UK, Canada, and Mexico – representing the next leg of growth for the company. Though this has dented the company’s ARPU (international markets generate less ad dollars than in the U.S.), we should focus on drawing in eyeballs first and worrying about revenue contribution later.

We should note as well that Roku has amassed a sizable balance sheet, especially since TTM free cash flows turned positive in mid-2023. The company has over $2.0 billion of net cash on its books (no debt at all), which represents a big chunk of its ~$9 billion current market cap. This gives Roku plenty of financial firepower to invest in growth initiatives such as its international push as well as content growth.

All considered, I remain quite bullish on Roku’s prospects for the remainder of the year, and I think even a slight whiff of positive news can push the stock into rebound mode.

Q4 download: widely panned despite strong results

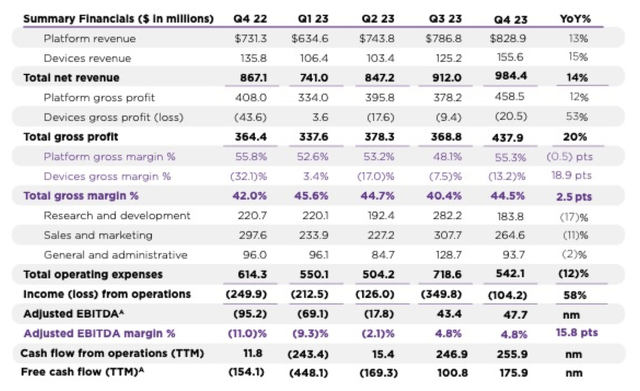

Let’s now go through Roku’s latest quarterly results in greater detail. The Q4 earnings highlights are shown below:

Roku Q4 trended highlights (Roku Q4 shareholder letter)

Roku’s revenue grew 14% y/y to $984.4 million, well ahead of Wall Street’s expectations of $968.1 million (+12% y/y). So we have to ask ourselves: what gives, and why did the stock fall so much post-earnings?

There are two main drivers that investors panned.

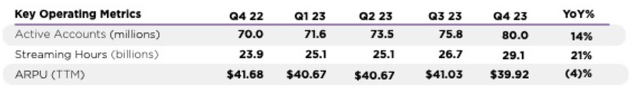

Roku key metrics (Roku Q4 shareholder letter)

First: as shown in the chart above, after several quarters of expansion, Roku reported a y/y decline in ARPU, down 4% y/y to $39.92. However, we have to understand the context behind this decline: this isn’t due to weakness in ad spending or a reduction in users consuming content. In fact, active accounts grew 14% y/y to a record 80 million users; while streaming hours grew faster at 21% y/y to 29.1 billion hours – also a record, and implying that average viewership per user rose.

Instead, the reason ARPU declined was because Roku experienced user growth in international markets. This is a common theme among companies that rely on internet advertising for revenue (particularly social media companies): international users generate far less in ad dollars than their U.S. counterparts, so at least early on, these users will represent a drag to ARPU metrics: while still contributing to the revenue pool overall.

Overall ad engagement remained quite healthy, and Roku continues to take share from TV incumbents. Writing in its Q4 shareholder letter, Roku management noted as follows:

While the U.S. ad market recovery is uneven, the decline in traditional linear TV and the shift of advertising from traditional TV to streaming is consistent. In Q4, ad spending on traditional TV decreased 11% YoY, and traditional ad scatter decreased 9% YoY (according to SMI). Conversely, Roku saw continued signs of rebound. In Q4, the YoY growth of video advertising across the Roku platform outperformed both the overall ad market and the traditional linear TV ad market in the U.S. In Q4, Consumer Packaged Goods, Health and Wellness, and Telecom grew, while Media & Entertainment, Financial Services, and Insurance remain challenged.

In 2023, we made strong progress expanding our relationships with third-party platforms, including retail media networks, DSPs (demand side platforms), and other strategic partners. As a result, we have increased our new and existing advertisers, programmatic ad spend, and ad spend through third-party DSPs.”

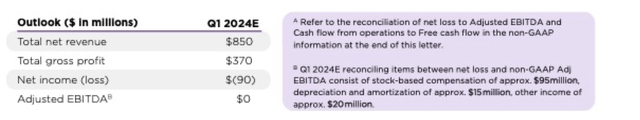

The second piece that investors panned was Roku’s guidance for breakeven adjusted EBITDA in Q1, after scoring two consecutive quarters of EBITDA profits.

Roku Q1 outlook (Roku Q4 shareholder letter)

However, we note that the company is still planning for revenue growth (+15% y/y) in Q1. Given the recent trend in sharply improved hardware/device margins, I think there’s plenty of conservatism in this forecast. The company has also been reducing opex y/y across all components of operating spend, which should help provide additional opportunity to the bottom line.

Key takeaways

In my view, there is no need to turn bearish on Roku after the company’s Q4 results or its Q1 outlook release. The company still enjoys a long tail of positive catalysts to drive a rebound, including international growth, rising margins, tremendous gains in both users and streaming hours, and ad dollars pouring in away from traditional TV and toward streaming. Stay long here and buy the dip.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.