Summary:

- The Boeing Company is facing a wave of negative headlines and safety issues, causing investors to question the company’s safety and reliability.

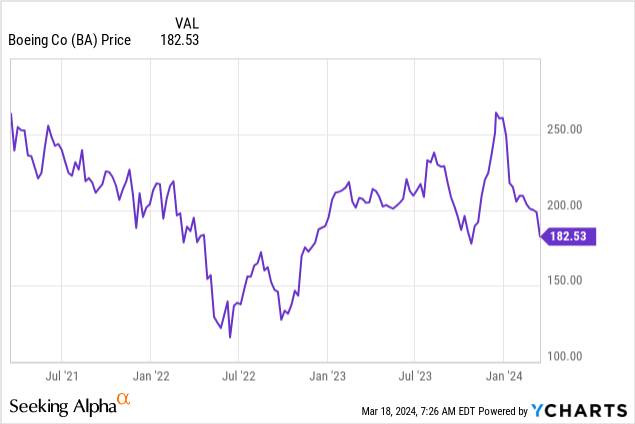

- The stock has underperformed the market, down 17% since June, while Airbus has seen strong returns.

- Despite the challenges, Boeing still has potential for long-term growth, with strategic initiatives and an attractive valuation.

Aeon Aviation Photography

Introduction

By now, I doubt it may come as a surprise when I say that I’m a fan of the aerospace (& defense) industry. Roughly a quarter of my entire net worth is invested in this area, and I frequently cover aerospace stocks.

One of the stocks I have owned in the past is The Boeing Company (NYSE:BA), a company that may be considered to be America’s industrial crown jewel.

However, that title is starting to see some cracks, as investors are being buried under a wave of negative headlines about incidents involving Boeing aircraft.

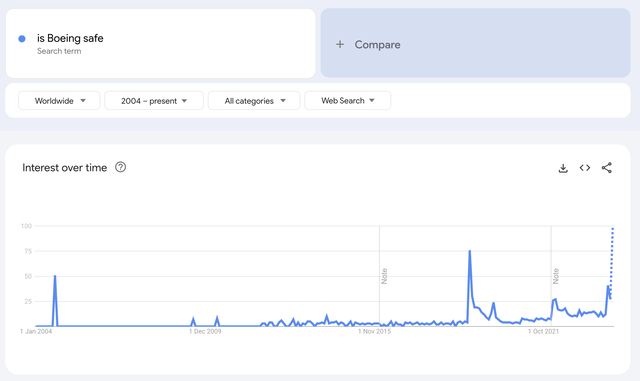

In fact, Google searches for “Is Boeing safe?” are expected to reach an all-time high in March, according to Google Trends.

My most recent article on the stock was written on June 19. Back then, I went with the title “Boeing: Impressive Turnaround.”

Since then, shares are down 17%. The S&P 500 (SP500), on the other hand, is up 17% during this period.

In Q4, I briefly looked really smart when the stock crossed $250.

Now, it’s time to reassess the situation, including the longer-term risk/reward, as we are, once again, dealing with quality issues that have caused investors to jump ship.

So, let’s get to it!

Serious Safety Issues

Boeing has some major issues. We are not dealing with a single incident but a series of problems that have buried Boeing under a load of negative headlines.

As reported by Al Jazeera:

- John Barnett, a former quality manager at Boeing for more than three decades, was found dead at his home with an apparently self-inflicted wound. He has been a key source of evidence in a lawsuit against the company. Please note that I’m NOT implying that Boeing is going after whistleblowers. My only point here is that this adds to the negative headlines and to the perception some people may have when they read about Boeing.

- A Chilean LATAM Boeing 787 suddenly lost altitude. This caused 12 people to be taken to the hospital.

- In January, an Alaskan Airlines (ALK) 737 MAX 9 lost a door panel.

- In Portland, a 737-800 had to make an emergency landing due to fumes in the cabin.

- A Boeing 777-200 lost a tire after taking off in San Francisco.

Again, I’m NOT making accusations.

All I’m saying is that Boeing is having some major headline issues that Airbus (OTCPK:EADSF) is not dealing with.

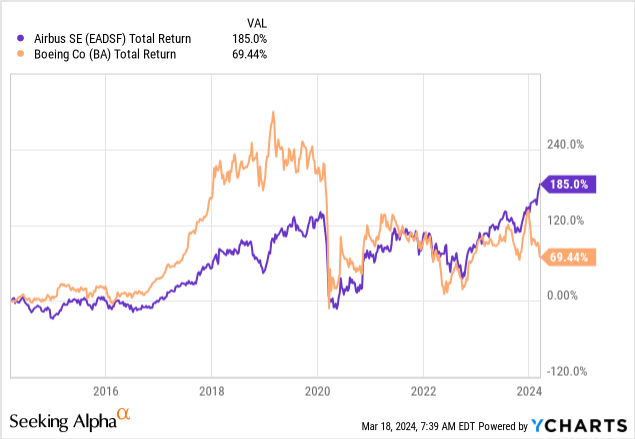

As a result, we are seeing a major divergence between the stock prices of the two giants. Boeing has returned just 70% over the past ten years. Airbus has returned 185%. These numbers include dividends.

Even worse, on top of negative headlines, Bloomberg reported that Boeing may have neglected safety, according to a report from the FAA (emphasis added):

The planemaker was faulted for ineffective procedures and a breakdown in communications between senior management and other members of staff, a panel of experts convened by the Federal Aviation Administration said in a report released Monday. Constant changes to complex procedures and trainings led to confusion, while other shortcomings hindered the average employee’s understanding of their role in how Boeing manages safety, according to the report, which was mandated by US lawmakers. – Bloomberg (emphasis added)

Moreover:

The 50-page report highlights the work still to be done at Boeing despite efforts to overhaul its culture and bolster safety practices after two fatal 737 Max crashes in 2018 and 2019 killed 346 people.

According to the article, there are two major issues:

- Bad news from the factory floors often does not reach the right executives who can mitigate these risks.

- (Some) employees are not qualified enough to flag certain issues.

Surveys showed that many Boeing employees didn’t know how to flag potential safety issues or didn’t trust the “Speak Up” program the company put in place following a 2019 grounding of the 737 Max aircraft prompted by two fatal crashes.

This is based on more than 250 interviews and more than 4,000 pages of documents.

As a result, airlines are increasingly careful when dealing with Boeing.

According to the Wall Street Journal, major airlines have to adjust their operations, as Boeing is dealing with delays and lower output.

For example, Southwest Airlines (LUV), a major Boeing customer that exclusively uses 737 aircraft (!), recently announced plans to reduce its flight capacity and reevaluate its financial outlook due to lower-than-expected deliveries of Boeing planes.

Moreover, United Airlines (UAL) has halted pilot hiring for two months and is looking for options to acquire planes from Airbus to fill the void left by delayed Boeing deliveries.

However, it’s not all bad.

Greenshoots & Growth Opportunities

The same Wall Street Journal article I mentioned above also noted that despite setbacks, some airlines, including American Airlines (AAL), are still optimistic about the future of Boeing.

For example, AAL recently placed an order for 85 new Boeing MAX 10 planes.

However, if Boeing does not deliver, its competitor Airbus will benefit.

American said it expects Boeing will be able to deliver the new MAX 10s by 2028, but just in case, it has negotiated protections, including options to take more Airbus planes and to switch to another type of MAX. – Wall Street Journal

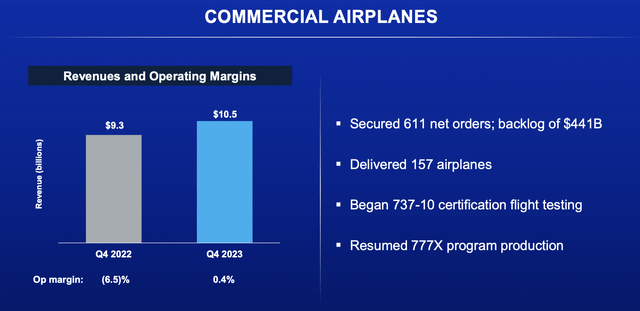

Moreover, during its Q4 2023 earnings call, the company noted that its 737 program delivered 110 airplanes in the fourth quarter, with ongoing FAA certification flight testing for the 737-10 model.

Boeing aims to maintain production at 38 per month and collaborate transparently with the FAA while prioritizing the master schedule to prevent further supply chain disruptions.

Regarding the 787, 23 airplanes were delivered in the quarter, with plans to transition production to 10 per month by 2025-2026.

This helped the company to grow revenues by 10% to $22 billion. Roughly half of this came from the commercial segment.

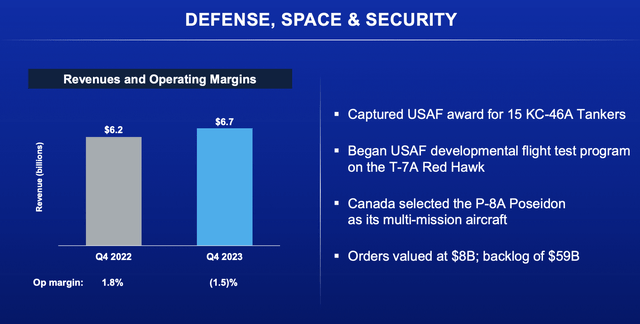

Its defense segment also did very well, as it secured roughly $8 billion in orders in 4Q23 alone.

This was driven by the Lot 10 award for 15 KC-46A tankers.

However, while revenue rose to $6.7 billion, the operating margin dropped to a negative 1.5%, driven by ongoing challenges due to cost true-ups on fixed-price development programs.

The good news is that the core business, which represents 60% of revenue, maintained mid-to-high single-digit margins, with positive expectations for the years ahead.

It also saw stabilization in the fighter and satellite programs, which is very important going forward.

On the 25% of the portfolio primarily comprised of fighter and satellite programs, operational performance stabilized as we exit the year. And as a result, the fourth quarter saw improved margin trends, although still negative. We still expect to return to the strong historical performance levels as we roll in our new contracts with tighter underwriting disciplines as we move into the ’25, ’26 time frame. – Boeing 4Q23 Earnings Call (emphasis added).

The company is also in the process of exploring a potential takeover of its fuselage supplier Spirit AeroSystems (SPR), a company that has been dealing with quality issues for a while.

Although nothing has been decided yet, I believe that if Boeing decides to work on a complete safety overhaul, it may benefit from owning SPR. It would have much more control over the supply chain.

In fact, I think benefits could go well beyond a combined safety overhaul, as a takeover could allow Boeing to benefit from major defense programs as a supplier through Spirit.

“As the DOD starts to shrink down the number of mainline manned aircraft programs … that means fewer and fewer opportunities for Boeing, Lockheed and Northrop to become the prime,” Clark said. “This way Boeing could be … through Spirit, a contributor to programs that they otherwise could have been locked out of.”

In the near term, Callan said, acquiring Spirit would give Boeing a piece of programs that company works on, such as the B-21 Raider stealth bomber — which Boeing lost to Northrop Grumman in 2015 — and the Bell V-280 Valor, the Army’s Future Long-Range Assault Aircraft. – Defense News.

Adding to that, during last month’s TD Cowen Annual Aerospace and Defense Conference, the company noted it aims to gradually ramp up production, focusing on quality over speed.

Boeing’s management expects stable production rates for the 737 and 787 models, supported by efficient supply chain management and customer demand.

Moreover, the company is expected to lower net debt from $36.3 billion in 2023 to $18.4 billion by 2026. This would imply a return to a sub-1.5x leverage ratio.

By then, it could generate north of $10 billion in annual free cash flow, which is 9.6% of its current market cap.

Hence, over the next 2-3 years, I expect a return to potentially aggressive buybacks and a dividend.

Needless to say, economic developments or failure to improve product quality could negatively impact this outlook.

Valuation

In general, the company remains attractively valued.

Unless Boeing is unable to control current headwinds, its valuation is looking very good at current levels.

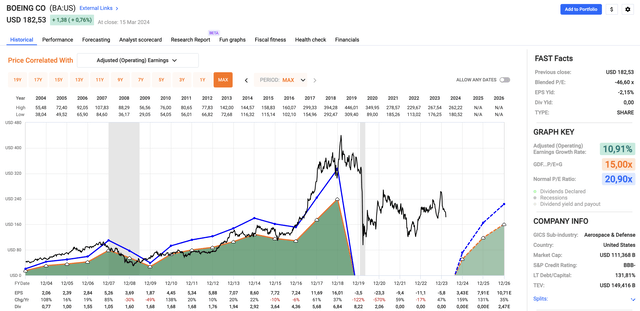

As we can see below, the company is expected to turn profitable in 2024, generating $3.43 in EPS. In 2025, that number is expected to grow by 131% to $7.91, potentially followed by a 35% surge to $10.71 in 2026.

Over the past 20 years, the company had a normalized P/E ratio of 20.9x.

If we keep that number, it has room to rise to roughly $224 per share. That’s 23% above its current price.

I believe that would be a very conservative estimate, as the company would likely maintain elevated double-digit growth after 2026.

The current consensus target is $261.

While these numbers come with a load of uncertainty, I have started to really like Boeing stock at these levels. While I dislike what is currently going on at the company, a lot of weakness has been priced in.

If the company is able to give its entire operations/safety department an overhaul and potentially buy SPR, I have little doubt that this giant can emerge stronger from this crisis.

Hence, I’m considering buying Boeing despite my elevated aerospace exposure and the fact that a big part of my money has been earmarked for unexpected tax expenses.

For now, it may feel like catching a falling knife, with further momentum from negative headlines. However, I believe we’re likely dealing with a $260-$300 stock over the next two years.

Takeaway

Despite facing what seems like a nonstop stream of negative headlines, Boeing remains a compelling investment opportunity for the long term – I think.

While safety issues and production delays have damaged investor confidence in the company, its resilience, combined with strategic initiatives like potential M&A and a focus on quality, could pave the way for a stronger future.

With an attractively valued stock and an optimistic outlook on profitability, investing in The Boeing Company at current levels could offer substantial returns over the next few years.

Pros & Cons

Pros:

- Long-Term Potential: Despite recent setbacks, Boeing has a strong history and brand recognition in the aerospace industry.

- Attractive Valuation: With the stock trading at a discount due to current challenges, there’s an opportunity for value investors.

- Strategic Initiatives: Boeing’s efforts to address safety concerns and explore acquisitions, like the potential takeover of Spirit AeroSystems, could improve its competitive position and drive future profitability and growth.

Cons:

- Safety Concerns: Ongoing safety issues, production delays, and negative headlines pose significant risks to investor confidence and could prolong the company’s recovery.

- Market Uncertainty: Economic downturns or further disruptions in the aerospace industry could delay the EPS recovery.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.