Summary:

- Roku faces significant headwinds resulting from operational headwinds, international expansion, and a challenging macroeconomic environment.

- Expansion into the EU Bloc may face ARPU headwinds related to data privacy laws, leading to lower quality ad targeting which may dilute advertising revenue.

- I believe that the firm’s cost-cutting measures in FY23 and the lack of guidance for eFY24 are signals from management that eFY24 may bring significant challenges to Roku’s operations.

simonkr

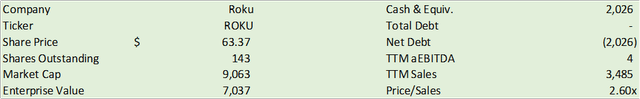

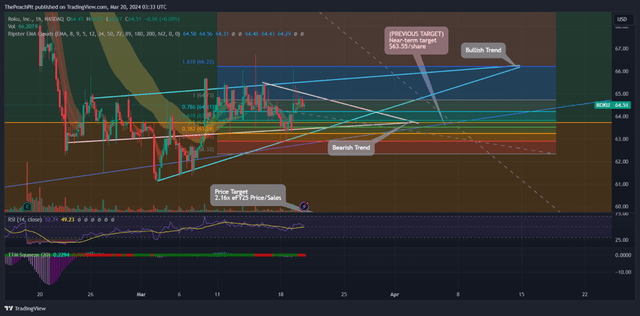

Roku (NASDAQ:ROKU) has found itself in a challenging position going into eFY24. On the back of a major cost-cutting year, management denoted eFY24 as a year of scaling and growth as the firm expands their presence internationally. I believe that Roku will face significant economic headwinds as the firm attempts to scale their device presence in the midst of challenging macroeconomic headwinds. I believe that management electing to not provide guidance for eFY24 on the back of their cost-cutting year was a signal to the market for more challenging times to come. I maintain my SELL recommendation with a price target of $58.79/share at 2.16x eFY25 net sales. My gray sky scenario calls for a target price of $50.35/share, which will be explained in the Valuation & Shareholder Value section of this report.

Operations

Roku may be faced with significant headwinds as they navigate a challenging FY24. As Roku expands their reach across the EU Bloc, ARPU has and may continue to face significant headwinds resulting from diluting their advertising book. I believe that one of the biggest risks Roku faces as the firm navigates through the growing foreign market pertains mostly to data privacy laws and how companies can utilize customer data. Given how much more stringent GDPR is when compared to US regulation, I believe Roku may face challenges in upselling their targeted advertisement platform if advertisers are limited to what data can be utilized when designing their breadth.

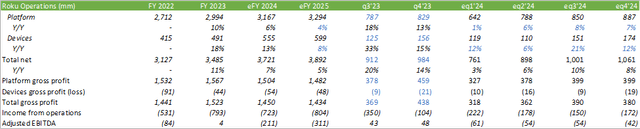

In addition to challenges on the software side, Roku may face significant near-term headwinds resulting from their expansion plan as the firm is at a gross loss of -13% for their devices sold. As Roku scales their presence at negative gross margins, I expect this growth to be paired with challenging ARPU growth which may result in deteriorating platform margins.

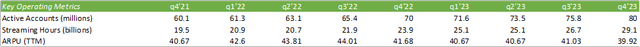

Corporate Reports

One point worth mentioning was that aEBITDA for q4’23 swung to a positive figure as the firm adjusted for the one-time impairment charge of $42mm relating to lease impairments and workforce reductions. Looking through Roku’s reported financials, R&D was cut by -17%, S&M cut by -11%, and G&A cut by -2% for an overall cut to opex of -12% on a y/y basis in q4’23. Considering how deep these cuts were across S&M and R&D, I have reason to believe that Roku is attempting to right-size the firm for a further slowdown in revenue growth rather than just trimming around the edges. Whether it is due to a cloudy view of the challenging macroeconomic environment or internal profitability challenges, I believe that the cuts to these two areas will be the result of slower topline growth that may trickle down into challenging operating and aEBITDA margins. Management did discern that they reached positive aEBITDA a year earlier than anticipated; however, I anticipate that this will not be repeatable in the near-term. Considering Roku’s cost-cutting measures followed up by their aim for expansion, I find it challenging for Roku to reach sustainable, profitable growth.

Another risk I find puzzling is Roku’s expansion into branded TVs, which I briefly discussed in my previous report covering Roku. Considering Roku’s new cost-cutting direction, I believe adding their own branded TVs into the mix adds an extra layer of risk as the firm now has direct ties to operational leverage to which they were not initially exposed. Given Roku’s inability to sell devices at a gross profit, I cannot fathom a scenario that doesn’t result in cutting this segment before turning a profit. I believe that adding their own branded hardware into the mix will only add to the negative pressure despite having more control over the cost structure. I found it exceptionally interesting that Roku reported that consumers were driven to purchase based on value in 2023 followed by the announcement of the release of their pro series 4K QLED TV “with retail prices under $1,500.”

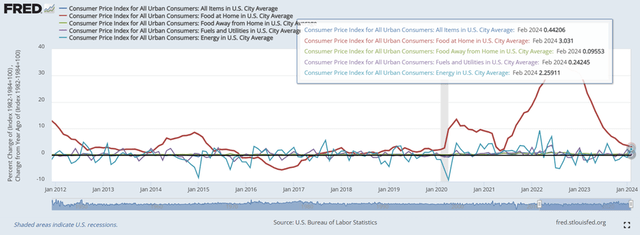

Bank of America reported that consumer spending is soft but stable with signs of lower-income households’ spending growth slowing. Looking at CPI for some additional guidance, daily costs such as energy, utilities, and food continue to drive inflationary pressures on consumers.

FRED CPI

According to EY, 94% of US citizens are concerned about the rising cost of living associated with groceries and household essentials with 57% surveyed expecting rising living costs to worsen in the next 6 months. 41% of those surveyed suggested that rising costs have made affording things more challenging with 26% suggesting challenges paying for the essentials. Economic challenges aren’t isolated to the US either. Japan, the United Kingdom, Finland, Ireland, China, and Germany are each facing significant economic headwinds and/or recessionary pressures. More often than not, marketing budgets are the first costs for firms to cut when going through economic hardship. Accordingly, CNBC reported that 2024 will be a year for cost-cutting to counter inflationary pressures. I believe that if marketing budgets are reduced this year, Roku may be forced to reprice ad space, which will in turn pressure ARPU and operating margins.

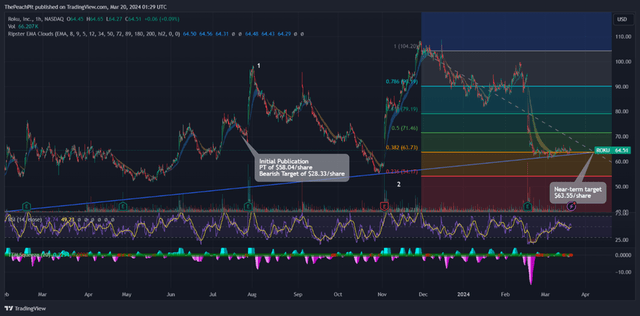

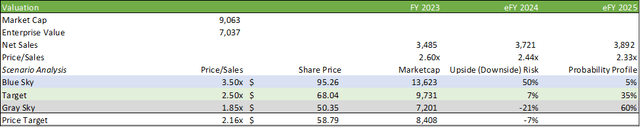

Considering my previous publication covering Roku, I was arguably early in releasing my previous report as shares climbed 40% literally the day after my bearish publication. With a base case price target of $58.04/share and a bear case of $28.33/share at the time, it has become clear that despite being early, my thesis has played out as described. For reference, I have included my original chart below.

TradingView

TradingView

To be clear about my investment thesis, I do not doubt Roku will fail at scaling the business internationally in the long-term. I personally use their product and have used competing platforms, such as Samsung (OTCPK:SSNLF), Google Chromecast (GOOG) (GOOGL), and VIZIO (VZIO), and I do believe Roku has the superior OS on the market. The challenges I see with the business include scaling devices faster than their ability to grow advertisement sales, leading to tighter margins and lower ARPU, and the firm’s ability to generate a sustainable positive adjusted EBITDA. Despite the firm’s cost-cutting efforts in FY23, I believe that the rate of growth is slowing faster than management is leading onto and that market saturation domestically is nearing its peak. In addition to this, I believe that consumers will focus their spending on household necessities over buying a new TV or streaming service in the near-term as they face inflationary pressures as denoted above.

Corporate Reports

Modeling out eFY24, I believe Roku will be heavily pressured resulting from poor business economics across their devices and the challenging platform resiliency. I believe the firm will face pressure at the margins as a result of this, which may lead to either further cost reductions or acceleration in deteriorating margins. I do not anticipate Roku to repeat positive aEBITDA for eFY24 & eFY25 as a result of a more challenging macro environment; however, the firm may experience tailwinds coming out on the other side if their scaling initiative succeeds.

One final thought before moving into Valuation & Shareholder Value. Walmart (WMT) announced their intent to acquire VIZIO Holding (VZIO) towards the end of February 2024, which has led analysts to cut ROKU’s ratings or drop the stock from their focus lists. Though this may have some impact to placement prioritization in stores and on Walmart’s website, I do not believe this will significantly impact Roku’s growth going forward. Walmart may also run the risk of anticompetitive behavior if undergoing these anticompetitive behaviors, similar to Amazon back in 2020.

Valuation & Shareholder Value

Corporate Reports

Valuing ROKU shares, I will reiterate my SELL recommendation with a price target of $58.79/share. I believe that the firm faces significant exogenous economic risk that may have a cascading effect across device sales and in turn, result in platform sales underperforming expectations. I believe that the cost-cutting measures Roku took in FY23 were a precursor to what they expected for eFY24 as discerned in their q4’23 earnings call. I believe management not providing guidance was a signal to the market that economic conditions will impact Roku’s growth and margins.

Corporate Reports

Considering the various scenarios laid out, I believe the blue-sky scenario is a longshot, but will be achieved if the macroeconomic headwinds were to resolve sooner than expected and if companies were to bolster their marketing budgets. I do not believe this is a likely scenario and provided this a 5% probability. My target case will be aligned with my growth forecast for the firm. Investors will value Roku more towards my most bearish scenario and price the firm closer to $50.35/share as denoted in my gray-sky scenario.

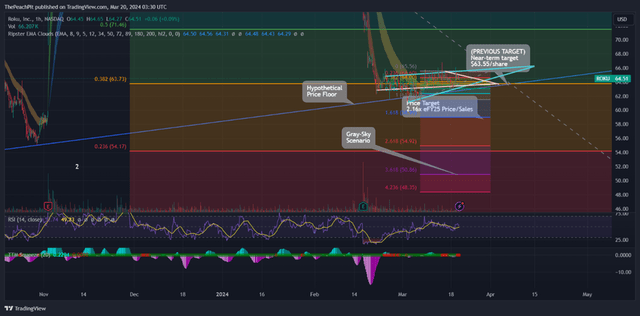

TradingView

Looking at ROKU from a tactical perspective, shares appear to be reaching for two separate inflection points, one at the long-term 0.382 retracement point and the other signaling the beginning of a bullish trend.

TradingView

I believe that either point will determine the direction investors take the stock. I remain in the bearish camp given my fundamental analysis; however, one must not discount the forces of Mr. Market.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.