Summary:

- Advanced Micro Devices, Inc. stock has doubled since October 2023.

- The company’s stock has experienced significant growth.

- AMD’s performance has been strong in recent months.

Jerod Harris

Advanced Micro Devices, Inc. (NASDAQ:AMD) has doubled since lows hit late October 2023. The company has a market capitalization of more than $300 billion as it strives to be more competitive with Nvidia (NVDA), working to build its own competitive GPUs. Despite being dramatically smaller, as we’ll see throughout this article, even with the market position, the company is heavily overvalued.

We last recommended against investing in AMD in a prior November article. However, we failed to foresee the exuberance artificial intelligence (“AI”) stocks would see going into 2024. Still, we see AMD as clearly overvalued.

AMD Market Positioning

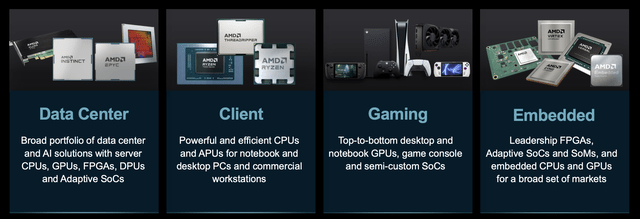

AMD has worked to improve its market positioning, supported by its recent acquisition of Xilinx and strong datacenter demand. The company also maintains its gaming GPU business and CPU business direct to consumers.

The company’s data center portfolio is among its strongest, and the company is working to expand it. Here with its Xbox and other segments, we think the company might be uniquely positioned to help customers make custom silicon. For clients, the company has become increasingly competitive with Intel, which is exciting to see.

However, in gaming GPUs the company still lags behind Nvidia, which continues to dominate high end GPUs. This indicates that its gaming segment will face continued headwinds given desktop GPU demand declines.

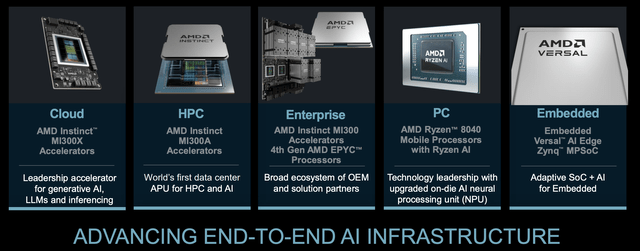

The above section shows the company’s focus on positioning itself in AI, especially with its new MI300X accelerator. To provide brief background, originally GPUs were created to excel at simple parallel compute, taking advantage of sending numerous pixels to a display. It turns out, a multi-billion parameter neural network does the same thing.

That has led to GPUs (first Nvidia) being at the forefront of AI, until the market has become large enough that companies are building dedicated silicon for these tasks. AMD’s MI300X is its example of an accelerator for a market that’s potentially worth $10s of billions.

In major, potentially relevant benchmark workloads, such as the Llama 2 (a large language model, or LLM), the company sees 1.2x performance versus the H100. Of course, the MI300X will compete more against the H200, but it still shows the GPU can hold its ground. With continued shortages, this shows the MI300X’ strength. With the MI300X seeing additional SW support, this is key to increased adoption and future revenue from the product.

However, it’s also worth noting that the company is playing second fiddle to the clear market leader Nvidia. Demand for the company’s GPUs comes from shortages and higher prices for Nvidia’s GPUs.

AMD Financial Performance

The company’s financial performance in 4Q 2023 (released Jan 2024) declined YoY, despite strong revenue, as its core segments outperformed.

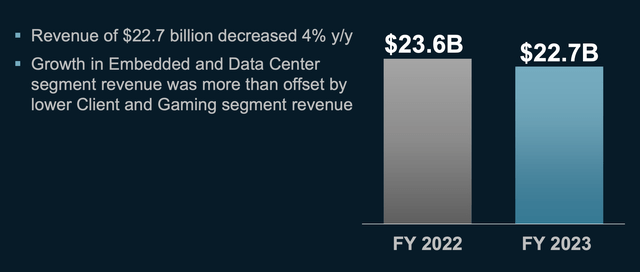

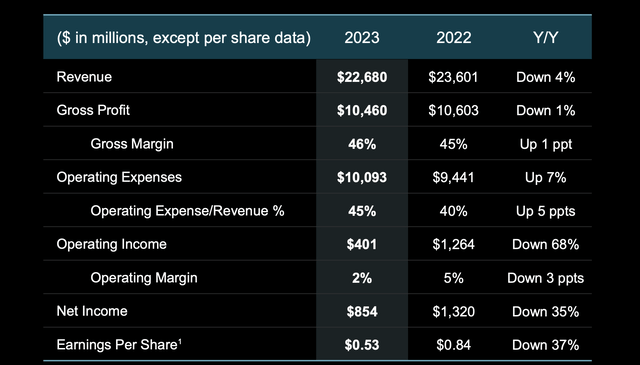

The company saw its revenue decline by 4% YoY after it took a noticeable hit from weakness in the client and gaming segments. Versus a company with a market capitalization of more than $300 billion, that’s a price to sales of almost 15x. It indicates how expensive the company is and how much growth it needs in order to justify its valuation.

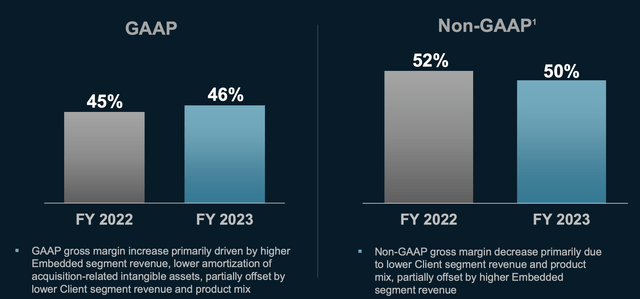

The company did manage to improve its GAAP margins, which is impressive in a tough market where revenue declined. There was a GAAP margin improvement from 45% to 46%, showing this strength. The company’s non-GAAP margins did decline by 2%, but we feel that GAAP margins are much more important than Non-GAAP.

The above shows the breakdown of the company’s YoY comparisons. Operating expenses did go up substantially, which took away the impact of gross margins. That’s not too surprising given the company’s newfound focus on building out AI accelerators. The company did have more than $850 million in net income, and a P/E of almost 400 for the year.

We expect the company’s 2024 to improve financially, as it sells more accelerators, but the company’s relatively stagnant YoY financials are clear. The company needs profits to increase dramatically to justify its valuation.

Long term, the S&P 500 (SP500) returns are around 10%. Obviously not every growth stock needs that, however, at some point in the future AMD needs the shareholder returns to justify an almost $300 billion market capitalization. If it takes 10 years to hit that, it needs to get even higher returns to justify the valuation.

With current net income at less than $1 billion annually, we don’t see the company as having a path to getting to the $30+ billion it needs to be long term.

AMD Outlook

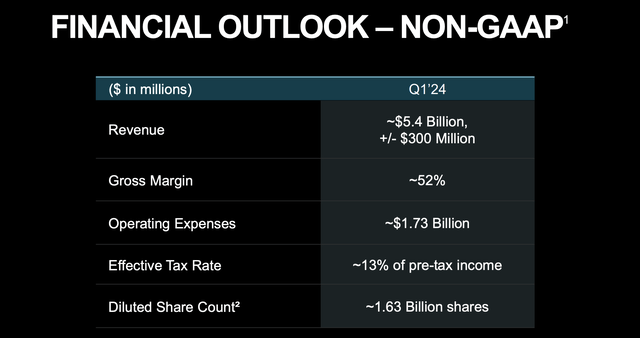

The company’s outlook shows strong improvement in the financial picture, but again not the positioning to justify its valuation.

The company has $5.5 billion in cash and cash equivalents and just under $3 billion in debt. The company’s share count is still reeling from the impacts of the Xilinx acquisition. That increased its share count by 35%, in an all-stock acquisition completed when its share price was at half its current level. We’re almost never a fan of a major dilutive acquisition, unless you’re in an industry like banking with minimal alternatives.

The company’s forecast is for roughly $5.4 billion in revenue, an annualized decline, but with a wide range showing a varying market for artificial intelligence. Expenses are to remain high, but the company does expect a higher gross margin, likely supported by higher margin data center GPUs it’ll be selling.

Still there’s nothing in the company’s guidance to show it has a growth path to justify its valuation.

Thesis Risk

The largest risk to our thesis is the size of the market and the AMD’s position as it strives to compete with Nvidia. If the company can build a GPU that’s ahead of Nvidia’s, or Nvidia has a continued shortage, it could quickly capture a larger portion of the market.

Conclusion

AMD represents what was once primarily a gaming GPU company, but is now a company using its technology to position itself in the race for AI accelerators. The company has some impressive technology and products that it’s built up. Despite that, the company actually saw its revenue decline YoY despite incredibly strong performance in its share price, especially YTD, backed by AI exuberance. The company has a strong portfolio of assets and is working to become more competitive with Nvidia for its latest AI accelerators.

Despite all of that, Advanced Micro Devices, Inc. is still heavily overvalued. The company’s guidance suggests virtually no revenue growth and profits are still extremely low versus its valuation. Despite the long-term potential of the market, we don’t view the company’s potential as being unique enough to justify investing at the current share price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.