Summary:

- Adobe has fallen into the commodity status of AI products, facing the same pitfalls as other AI tech giants.

- The combination of common flawed generative AI with its slow rollout and execution puts it doubly behind.

- While management says it’s internally on track with its AI tools and integration, guidance isn’t proving it’s enough.

- Underwhelming guidance and the bearish stock chart likely mark a top in the stock, forcing me to a sell rating instead of a hold.

Tero Vesalainen/iStock via Getty Images

The AI (artificial intelligence) landscape has many facets and variables, and they’re each reaching the forefront as the AI world evolves. One of the higher level facets is the positioning of businesses in the AI world – is a company a producer of the hardware needed to run AI models, is it a consumer of AI to generate business returns, or is it a retailer of sorts where it produces an AI product meant to be directly consumed by end users? It’s quickly becoming apparent the commodity status is encroaching on the last scenario. Unfortunately for Adobe (NASDAQ:ADBE), it has fallen into this category, along with the pitfalls associated with the commodity status.

But it should be noted this commodity status isn’t by nature, necessarily. The AI landscape on this level could have gone in a different direction, one where the product served a unique purpose and avoided the mistakes of a rushed product. But unfortunately, Alphabet (GOOG)(GOOGL), Microsoft (MSFT), and, as I’ll get into, others have succumbed to this.

What am I talking about? Falsehood generative AI.

It’s happened many times: a prompt is submitted, and verifiably wrong information or an off-base answer is given, seemingly rooted in poor information sourcing or some similar reasoning. One of the most recent incidents was from Google’s Gemini, which depicted the founding fathers as black and Nazi soldiers as darker-skinned. It was enough for Alphabet’s CEO to send a memo saying its Gemini launch was unacceptable.

This is, of course, the bumps in the road in perfecting a new technology, especially one moving as fast as AI.

All the major tech companies are in an AI arms race to have the “best generative AI” and for internet users to flock to it and become the “Google” of the AI era. After all, this is a revolutionary technology in which a narrow timeframe exists to unseat the internet incumbents of years past. Perhaps the incumbents will retain the leadership title, but perhaps they won’t. Regardless, to maintain leadership or take leadership, speed and execution are of the utmost importance.

Right now, the tech leaders of the early 2000s are struggling to remain relevant, and that’s sort of the idea in this article.

Adobe has been around as long or longer than the many tech companies vying for AI leadership. However, one of the best has been around the shortest amount of time out of the majors: Meta Platforms (META). It has used AI to strengthen its internal business with content recommendations and ad targeting, which has paid dividends – quite literally now. But it also has had trouble with its outward, user-facing creative AI, causing small stirs. But due to how close it was to the Google incident, it softened the blow as the outrage was already letting off steam.

The problem is Adobe has fallen into the same situation and is thus unable to maintain its “commercially safe” differentiated business proposition. This is especially unfortunate since the company staked its claim on ethically sourced images using data and images from its own Adobe Stock and copyright-free content. Unfortunately, this has also caused a stir as the company allegedly didn’t get users’ consent to use their stock photos for generative AI purposes. The fine print might reveal otherwise, but the optics aren’t helpful.

Nevertheless, the company had an opportunity to stand out but has fallen into the same pitfalls as its big tech brethren. But, again, I go back to this being a very formative time for AI and generative AI specifically, so I don’t necessarily expect perfection at this stage. It’s just as likely much of this can be chalked up to growing pains as much as it is to inherent biases from a system dependent upon humans, as all software engineering is.

The fallout from this is Adobe loses any edge and advantage, which has begun to show up in guidance. There were many questions on its Q1 call about the lack of updated full year guidance and the lower-than-consensus guide for Q2, which wasn’t huge but quite meaningful in the current AI environment needed more and more growth.

…there was roughly half the absolute beat you’ve had in past quarters and then the guide obviously, lower for next quarter. I think everyone is asking is this some type of AI headwind? Is this macro? Is this execution?

– Brent Thill, Jeffries Analyst, Adobe’s FQ1 ’24 Earnings Call Q&A

What followed was an answer with a confident tone regarding putting a plan into action, but in between the lines was a slower rollout than the market expected.

…given the desktop products are still in beta, and there we look at value and there we look at utilization. And so I think we gave you some numbers on the $6.5 billion generations that we’re seeing, the really positive feedback that we’re getting in Acrobat that continue to give us optimism associated with how that is. I think where there’s tremendous interest and where if you look at it from an AI monetization, the two places that we’re monetizing extremely in line with our expectations.

– Shantanu Narayen, CEO, Adobe’s FQ1 ’24 Earnings Call Q&A

Products are still in beta, and monetization is in line with internal expectations. While I fully expect Adobe to come out on top in terms of quality with AI-generative creative content and the integration into professional and enthusiast workflows, the market is not in the mood for “it’s coming” plans, slow rollouts, or merely inline results.

Additionally, management touched on containing costs and being particular about providing access to GPUs for its AI researchers. While I can respect not going hog wild on capital expenses, this isn’t the type of technological revolution to wait and hold the door open. Adobe needs to be more aggressive in its AI integration, as spending money now will provide greater medium and long-term returns.

And here’s my entire point: the company is taking the “ethical” approach and taking its time to source its training data ethically to create infringement-free content – which is good and responsible – but it results in the same error-ridden image generation as Microsoft, Google, and Meta.

So, where’s Adobe’s advantage in the market?

It has tried to do AI “the right way,” but the results are the same inaccurate output plus at a slower pace. It’d be one thing if management were at the cutting edge and operating on a schedule ahead of competitors but had errors in its AI output – at least then I could argue this is the cost of being cutting edge – but without that tact, it looks like it’s taking two Ls.

Adobe isn’t going to fail overall, but the market is looking for results today, given the growth found elsewhere in the AI market, like Nvidia (NVDA) and Meta Platforms. When beats become smaller and guidance misses the mark, it spells trouble for a company touting AI as its next big thing.

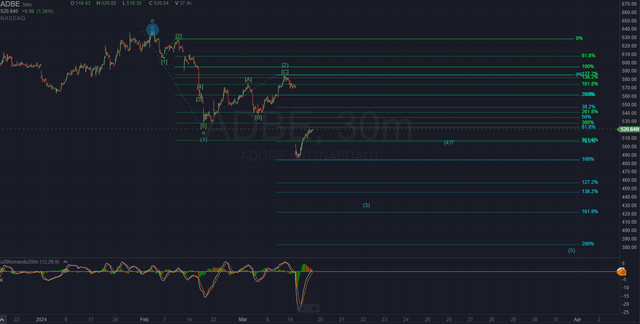

And where this all matters, this lack of growth isn’t enough to push the stock higher. In fact, the way it fell after earnings may mark a top in the stock in the medium term, as in several months to a year out. The stock completed five waves down in mid-February, where it then proceeded to form three waves up in a corrective bounce. This bounce ended on March 13th, just ahead of earnings, but was confirmed with the lower low after earnings. This five-down, three-up pattern signals a reversal in the trend (noted by waves (1) and (2)).

Author’s chart workup

An early confirmation comes on a lower low below $490. If it doesn’t break this level, it’s possible this entire move off the high has been corrective, and the stock will see new highs. This is the risk to the downside setup, but it also lets you know where I’m wrong. Should the $490 level break, further confirmation comes on a completed higher degree five-down with wave (5) completing in the coming weeks and months. This final confirmation aside, the initial five down and three up means the stock likely won’t return to the highs it made a month ago for the foreseeable future. In fact, the next immediate target is near $430, and after one more corrective bounce in wave (4), the stock may end up in the high $300s in a few months as wave (5) currently targets.

While I’ve been bullish on Adobe in the past, the combination of its inability to complete the acquisition of Figma – which keeps competition on some levels alive and well – the slower rollout with the same generative AI gotchas as its peers, and its underwhelming guidance in the face of many opportunities in the market means I can’t continue to be bullish. At best, I rate it as a hold, but when I look at the chart, it’s difficult not to rate it as a sell.

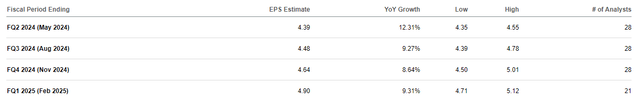

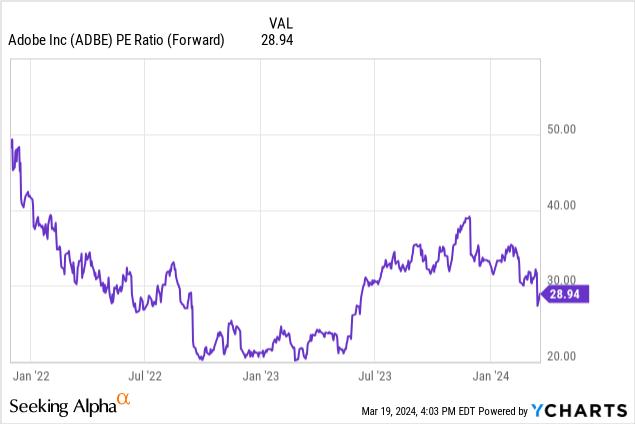

This becomes more unavoidable when estimates for very low double-digit EPS growth are combined with a forward P/E ratio in the high-20s.

Seeking Alpha

With all these factors considered, Adobe looks like one to let go of while it sorts out its AI monetization path and can produce growth reflective of a company leading the charge in “retail AI.” Moreover, with the targets on the chart showing much more to fall ($380, or 27% downside), there’s no reason to buy on this dip as the dip is set to extend further. And once that occurs, a somewhat significant bounce will give way to the low $300s.

I still like Adobe’s business model and cash cow attributes, which is why it isn’t easy to give it a sell rating. But I have to assess the situation for what it is and what’s been given. Unless the company begins reporting major beats and raises its guidance meaningfully next quarter forward, there’s no reason to catch the falling knife. I’ll wait for a better entry to add to the position I recently trimmed in mid-to-late February.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE, NVDA, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join The Top AI And Tech Investing Group

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Then sign up to be a free member of my investing group Tech Cache. You’ll get more free content from me, no paywall, and no credit card. If you want the trading strategy and on-going technical chart analysis of Adobe, step up to being a paid subscriber with a two-week free trial and read it immediately.