Summary:

- Nvidia Corporation stock has seen significant growth due to increased demand for its AI chips, and there is potential for further growth.

- The company’s Q4 earnings exceeded expectations, indicating that the demand for its chips has not peaked yet.

- Nvidia has no major competitors in the generative AI chip market and has revealed the world’s most powerful AI chip, solidifying its dominance.

Justin Sullivan/Getty Images News

Nvidia Corporation (NASDAQ:NVDA) has been one of the best-performing major stocks in the last year as the increased demand for its artificial intelligence (“AI”) chips has exceeded all the macroeconomic and geopolitical risks that were threatening to undermine the company’s growth story. Even though Nvidia’s market cap in recent weeks has increased by an additional $1 trillion and the business is now worth over $2 trillion, there are reasons to believe that the company’s growth story is far from over and its stock has an additional room for growth. Therefore, I continue to hold a long position in the company at a hefty unrealized profit since I believe that Nvidia is not in bubble territory yet despite the aggressive growth in recent weeks.

The Rally Continues

Last May I wrote an article titled “Nvidia: I Was Wrong,” in which I outlined the reasons why it makes sense to believe that generative AI is not another fad like the metaverse. I came to that conclusion after I integrated several generative AI tools into my daily workflow which helped me improve my overall efficiency. In September, I initiated the first BUY rating for Nvidia’s stock, which at that time was trading at around $400 per share, after realizing that the AI rally appeared to be far from over.

Then in November, I published another article titled “Nvidia: The Market Is Wrong” after the company reported its Q3 earnings results which at first didn’t impress the market and led to the slight depreciation of the business’s shares. In that article, I argued that the market is underestimating Nvidia’s potential and the fact that the demand for its AI chips is likely to increase in the following months. Since the publication of the latest article on Nvidia in November, the company’s shares have appreciated by over 80%, added more than $1 trillion in additional market cap, and there are reasons to believe that the growth story is still not over yet.

If we look at Nvidia’s latest earnings results for Q4, which were released last month, we’ll see that the company managed to exceed expectations once again as it increased its revenues by 265.3% Y/Y to $22.1 billion, above the estimates by $1.55 billion. The Non-GAAP EPS of $5.16 was also above the expectations by $0.52.

Such an exceptional performance indicates that the demand for its chips has not peaked yet and there are reasons to believe that we could see another earnings beat in the next few quarters. This is due to the fact that the shortages for its flagship AI chips are expected to remain for a while as a result of the increased demand across the globe. What’s more is that as the sovereign nations begin to allocate capital into the AI infrastructure to build their own large-language models and become a part of the generative AI revolution, the demand for Nvidia’s chips is likely to continue to rise in the foreseeable future.

Another thing that the company has going for it is the fact that it doesn’t have any major competitor that could’ve taken a significant market share and posed a threat to Nvidia’s dominance in the field of generative AI chips. In my latest article on Advanced Micro Devices, Inc. (AMD) that was published last month, I noted that the company expects to sell only $3.5 billion worth of AI chips in 2024 at lower prices than Nvidia. As such, it’s safe to say that Nvidia has no competition on the horizon. Add to all of this the fact that Nvidia revealed the world’s most powerful AI chip earlier this week and it becomes obvious that almost nothing could undermine the company’s growth story for now.

Considering all of those catalysts, it’s safe to say that Nvidia’s growth story is far from over. After the exceptional performance in FY24, the company is expected to continue to grow its top line at an impressive rate of ~80% in FY25 while its earnings are expected to grow at an aggressive rate as well.

What’s more is that there’s always a possibility that the outlook will be improved as the year goes by, which could once again lead to upward revisions in the following months. This was already the case for a few quarters in a row, and in recent months as well when the management’s revenue outlook for Q1 of $24 billion was above the Street consensus of $22.03 billion.

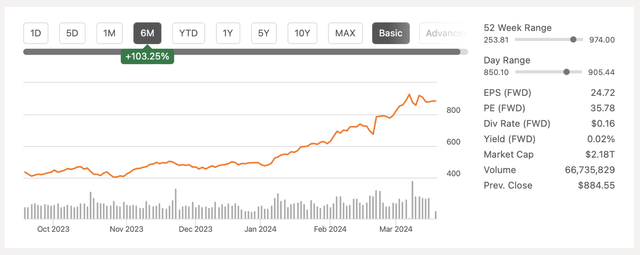

As a result of this, there are reasons to believe that Nvidia’s stock could have additional room for growth in the following quarters. By trading at a forward P/E of ~36x, Nvidia is undervalued against its closest rival AMD which trades at ~50 times its forward earnings. At the same time, at such a multiple it’s hard to consider Nvidia to be in a bubble territory especially since the current average P/E ratio of the broad market is ~28x, which is not that far away from the chipmaker’s multiple.

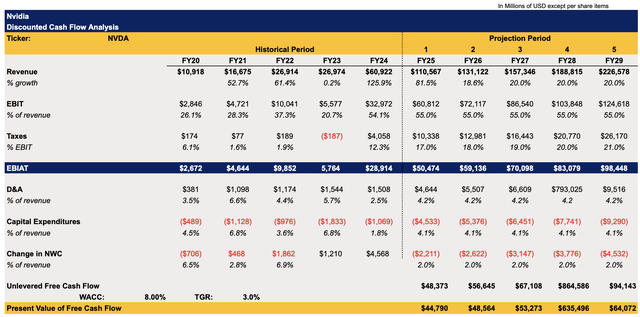

On top of all of that, even with the current growth expectations Nvidia’s shares appear to be trading close to their fair value at the current price. In my discounted cash flow (“DCF”) model below the revenue and earnings assumptions are mostly in line with the Street expectations, while the assumptions for all other metrics are close to the historical levels. The WACC in the model is 8%, while the terminal growth rate is 3%.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

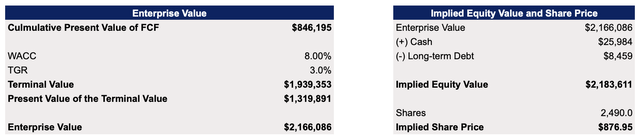

The model shows that Nvidia’s enterprise value is $2.16 trillion, while its fair price is $876.95 per share, which is close to the current market price at the time of this writing.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

However, there’s a possibility that the outlook could once again be raised in the following quarters, which would prompt upward revisions of the assumptions in the model and lead to a greater fair value. Add to all of this the fact that Nvidia’s shares seem to have found a solid technical support level above $850 per share, there’s a possibility that we could see another price breakthrough to new all-time highs in light of the latest developments.

Nvidia’s Stock Price (Seeking Alpha)

Major Risks To Consider

It would be foolish in my view to assume that Nvidia Corporation stock has no downside risk even if the momentum is currently on its side. While there’s no denying that the rising demand for the company’s chips will likely lead to better-than-expected business performance in the following quarters, there’s nevertheless going to be a time when Nvidia won’t be able to constantly exceed expectations anymore. When such a thing happens, we’ll likely conclude that the demand has peaked, and the aggressive returns will become a thing of the past. Under such a scenario, Nvidia will likely continue to grow its business, but the upside for its shares would become limited.

We shouldn’t forget that despite an impressive performance in recent quarters, Nvidia’s sales in China have significantly declined due to the latest export restrictions that were imposed by the United States. While the company managed to mitigate this decline thanks to the exceeding demand in other markets, there’s a risk that once the demand in other markets stabilizes, Nvidia won’t be able to find new growth catalysts to continue to exceed expectations. The good news, though, is that it could take years before such a thing happens, given the latest developments.

The Bottom Line

Considering everything stated above, I decided not to sell my long position in Nvidia Corporation stock and continue to stick with the BUY rating since it appears that Nvidia’s growth opportunities continue to outweigh major risks at this stage. Even though it might become harder for Nvidia to constantly exceed expectations in the future and there will come a time when the growth rate normalizes and the shares will lose momentum, it appears that we’re not at that stage just yet.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.