Summary:

- WMT remains a Buy, thanks to the robust growth observed in its membership incomes and advertising segment, with these typically being directly accretive to bottom lines.

- The stock remains shareholder friendly as well, as seen in its consistent share repurchases, dividend raises, and recent stock split.

- Combined with the inherent market leadership in the US retail market, we maintain our conviction surrounding WMT’s ability to deliver profitable growth ahead, naturally explaining the embedded premium valuations.

shutter_m

We previously covered Walmart (NYSE:WMT) in September 2023, discussing its robust investment thesis, attributed to the market leading dollar share and growing comparable sales, despite the rising inflation and elevated interest rate environment.

Combined with its well-diversified offerings across retail/e-commerce and advertising segments, we had it rated as a Buy, with the stock also generating a total return of over 15% since then.

In this article, we shall discuss why we are maintaining our Buy rating for the WMT stock, thanks to the robust growth observed in its membership incomes and advertising segment, with these typically being directly accretive to bottom lines.

The stock remains shareholder friendly as well, as seen in its consistent share repurchases, dividend raises, and recent stock split.

Combined with the inherent market leadership in the US retail market, we maintain our conviction surrounding WMT’s ability to deliver profitable growth ahead, naturally explaining the embedded premium valuations.

The WMT Investment Thesis Remains Robust, Despite The Premium Valuations

WMT recently reported a double beat on its FQ4’24 earnings call, with revenues of $173.38B (+7.8% QoQ/ +5.7% YoY), operating incomes of $7.25B (+16.9% QoQ/ +14% YoY), and adj EPS of $0.60 (+17.6% QoQ/ +5.2% YoY).

Otherwise, FY2024 (CY2023) also brought forth exemplary numbers of $648.18B (+6% YoY), $27.01B (+10.1% YoY), and $2.22 (+5.7% YoY), respectively.

It is apparent that WMT’s advertising and membership growth have greatly contributed to its excellent top/ bottom line growths in FY2024.

For example, its global advertising business has expanded by +28% YoY to $3.4B as with the membership (and other) incomes by +1.4% to $5.48B in FY2024, with these typically boasting higher profit margins compared to commerce.

Anyone concerned about the supposed deceleration in its comparable sales at 3.9% in FQ4’24 (-0.8 points QoQ/ -4.9 YoY) must also note the impact of deflation in its top-line, as the CPI peaks with a prospective rate cut already priced in by H2’24, if not Q2’24.

For now, the robust profitability has directly contributed to WMT’s moderating leverage with debt-to-EBITDA ratio of 0.97x in FQ4’24, compared to the 1.03x reported in FQ4’23 and 1.36x in FQ4’20.

As a result, WMT has offered a promising FY2025 (CY2024) guidance, with approximate revenues of $670.86B (+3.5% YoY), operating incomes of $28.36B (+5% YoY), and adj EPS of $2.30 (+3.6% YoY post-split) at the midpoint.

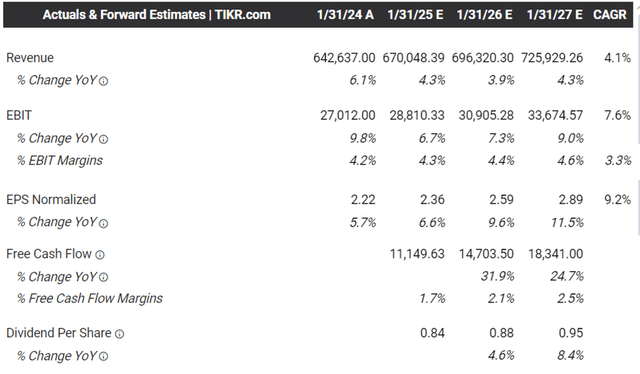

The Consensus Forward Estimates

With excellent operating margins of 4.16% in FY2024 (+0.16 points YoY) and the projected expansion to 4.22% in FY2025 (+0.06 points YoY), compared to 3.90% in FY2020, it is unsurprising that the consensus have also moderately raised their estimates, further aided by the reduced float from share repurchases.

For now, WMT is expected to report an accelerated top/ bottom line growth at a CAGR of +4.1% and +9.2% through FY2027, compared to the previous estimates of +2.9%/ +6% and historical growth at +4.2%/ +6.4% between FY2017 and FY2024, respectively.

The projected profitable growth trend is very promising indeed, especially since we may see its Cash Flow generation expand moving forward, further sustaining its capex growth and shareholder returns.

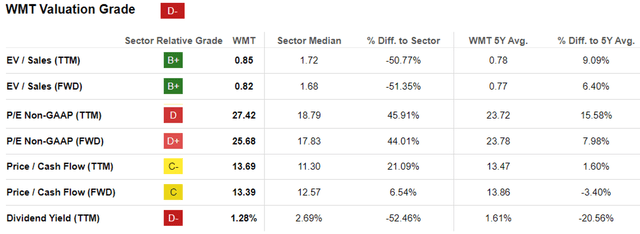

WMT Valuations

As a result of the profitable growth trend, we can understand why WMT has been awarded with the premium FWD P/E valuations of 25.68x and FWD Price/ Cash Flow valuations of 13.39x.

This is compared to its 1Y mean of 24.08x/ 12.66x, 3Y pre-pandemic mean of 19.73x/ 9.40x, and sector median of 17.83x/ 12.57x, respectively.

The same premium is also observed in its commerce peers, such as Costco (COST) at 45.65x/ 31.06x and Amazon (AMZN) at 41.47x/ 15.81x, attributed to their growing membership base, profitable growth trend, and robust shareholder returns thus far.

As a result, we believe that WMT does not appear to be expensive here, especially since it remains the largest US retailer as of January 2024 with $376.41B in brick-and-mortar sales (+2.5% YoY) and $65.4B in ecommerce sales (+22.4% YoY) over the last twelve months.

This is compared to COST at an overall sum of $180.12B in the US over the last twelve months and Target (TGT) at $107.41B in 2023 (with nearly all of its revenues are generated in the US), while nearing the king of ecommerce, AMZN, at $352.82B in North American sales in 2023.

In addition, WMT is not sitting on its laurels, with the management already offering an annual membership plan, Walmart+, with value-added free deliveries and returns, fuel savings, and video streaming with Paramount+, amongst others, in an attempt to boost ecommerce sales.

At the same time, the retailer also offers new same-day delivery services from March 2024 onwards, with Walmart+ consumers typically “shopping more frequently and spending more money” at approximately “+31% more in-store and +206% more at walmart.com.”

With massive opportunities in the ecommerce market and growing TAM from $4.93T in 2022 to potentially $5.45T in 2027 in the US, we believe that WMT remains well positioned for consistent growth and shareholder returns ahead.

So, Is WMT Stock A Buy, Sell, or Hold?

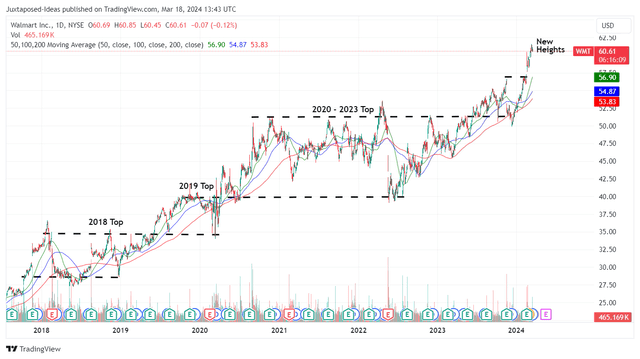

WMT 5Y Stock Price

Combined with the tailwinds from the stock split announced in early 2024, it is unsurprising why WMT has rallied as it has while breaking out of its 50/ 100/ 200 day moving averages.

With the stock charting new heights at the time of writing, it can be said that market momentum is extremely bullish, further aided by the promising FY2025 (CY2024) guidance.

Based on the FY2024 adj EPS of $2.22 and the FWD P/E of 25.68x, WMT appears to be trading near our fair value estimate of $57, with a minimal premium of +6.7% at current levels.

Based on the FY2027 adj EPS estimates of $2.89, there seems to be an excellent upside potential of +21.9% to our long-term price target of $74.20 as well.

Readers must also note that WMT has recent announced a +9% hike to its dividend per share to $0.83 (post-split), implying an acceleration in its dividend growth compared to the historical 3Y Dividend Per Share growth at +2.44%.

Seeking Alpha Quant also grades its Dividend Safety at B-, as its Interest Coverage Ratio of 10.07x and Dividend Coverage Ratio of 2.82x remain stable, compared to the 5Y averages of 10.91x and 2.60x, respectively.

Much of the retailer’s cash flow tailwinds have been put to good use as well, with 94M or the equivalent 1.1% of its float (post-split) already retired over the last twelve months, and 496M/ 5.7% since FY2020 (CY2019).

As a result of the (prospective) dual pronged returns through capital appreciation and dividend payouts, we are maintaining our Buy rating for the WMT stock, especially on all dips.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COST, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.