Pfizer: Attractive Valuation And A Strong Pipeline Mitigate Patent Cliff Concerns

Summary:

- Pfizer’s stock has dropped over the last year+ due to declines in revenue and profit from Covid-related products.

- The company’s non-Covid products have shown growth, indicating potential for continued future success.

- While the upcoming patent cliff looks concerning, PFE’s pipeline is well stocked with potential Phase-3 winners.

- Trading at a significant discount vs. historical measures and industry peers, PFE looks like a compelling opportunity, with a double-digit upside to our estimated ‘Fair Value’ range.

- We rate PFE a ‘Strong Buy’.

Angelo D’Amico/iStock via Getty Images

Pfizer (NYSE:PFE) has had a rough few quarters.

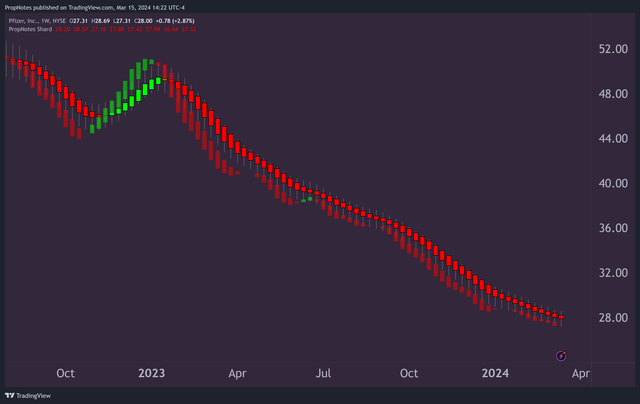

Following a massive boom in revenue and profits that was the direct result of the company’s prominent Covid products – including the vaccine (Comirnaty) and Paxlovid – shares have plunged as the pandemic has broadly receded as a global threat:

TradingView

However, as Covid-based revenue and profit has moved from a big chunk of PFE’s revenue to a comparably smaller piece of the pie, PFE’s stock, at this point, has once again become about the balance between the company’s expiring patents and the new drug pipeline, something which we are ultimately bullish on.

Plus, as shares trade at multi-year lows, and as the valuation has come into attractive looking territory, PFE stock has begun to look rather compelling as a potential investment, both for value seekers as well as yield investors.

Today, we’ll break down PFE’s prospects, valuation, and momentum in order to explain why we rate the stock a “Strong Buy”. Sound good?

Let’s dive in.

Financials

As we just mentioned, PFE’s financials have been suffering lately, largely as a result of a post-pandemic comedown on key Covid-related products.

Comirnaty and Paxlovid previously acted as a ‘sugar rush’ to PFE’s top and bottom-line results, but it’s clear now that the company is coming down off of this high.

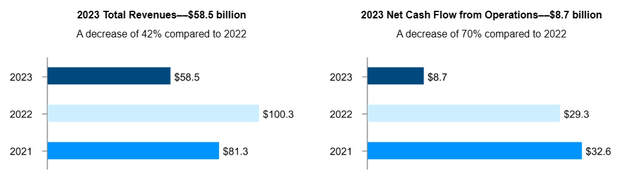

Revenue and cash flow are down 42% and 70% respectively from 2022 to 2023, which is largely due to the negative impact of Covid related products:

10-K

10-K

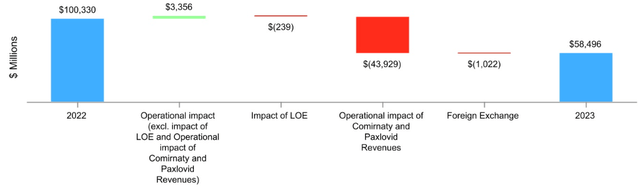

However, if you strip out the Covid impact, PFE’s other revenue was actually up 7%, which might be surprising to some readers:

Excluding contributions from Comirnaty and Paxlovid, Total revenues increased 7% operationally, reflecting an increase in revenues from Nurtec ODT/Vydura and Oxbryta; revenues from Abrysvo, primarily driven by the launch of the older adult indication in the U.S.; as well as continued growth from the Vyndaqel family and Eliquis; partially offset by a decline in Ibrance.

This is actually rather bullish, as it proves that PFE’s ‘core’, non-Covid products have been holding their own while the pandemic-related products have gone through their full cycle. Considering that these other drugs and therapies should drive the huge majority of PFE’s results going forward, it makes sense to start by looking here.

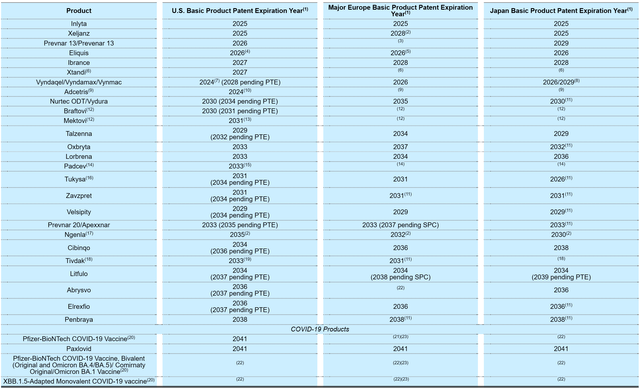

Many have recently made hay about PFE’s ‘Patent Cliff’, and it’s true that a number of PFE’s drug patents are expiring in the next few years. This includes a number of important drugs, including Eliquis, Prevnar 13, and Ibrance:

10-K

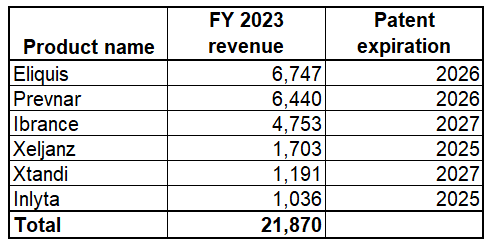

Fellow SA analyst KM Capital calculated the impact over the next three years on PFE’s revenue in a recent article, and it’s significant:

KM Capital

Fortunately, not all of the Prevnar family patents are expiring soon, so the total figure is a little lower than $21.8 billion annually.

That said, with potentially $19-20 billion in annual top line sales essentially set to expire over the next few years, these expirations could have a large impact on PFE’s stock.

Between the patent cliff impact, as well as the likely continued decay of Covid products, it appears that potentially ~$32 billion of PFE’s $58.8 billion in annual sales could be at risk in the coming years:

Now, it’s not all bad news for investors.

While PFE’s patent issues and the Covid hangover appear to be significant, PFE’s pipeline is also strong, and has been further fortified by the recent SGEN acquisition which closed in December.

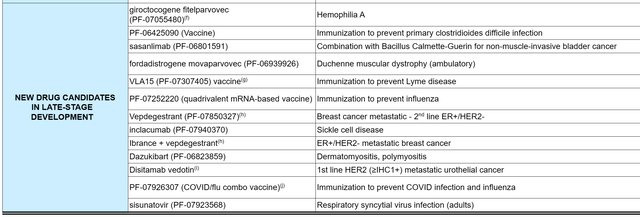

Organically, the number of New Drugs in late-stage development continues to grow:

10-K

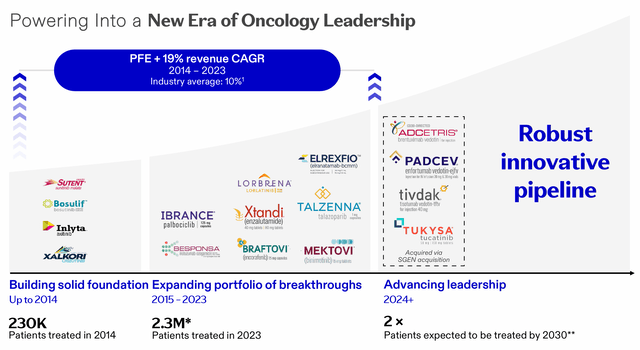

Additionally, with the acquisition of SGEN, PFE’s focus on oncology (cancer) products could also drive a few potential blockbuster results in the future:

Investor Presentation

Altogether, with 31 total projects at stage 3 in the in the PFE pipeline, there’s significant chance that a number of them will grow into products that can shoulder the revenue burden of the products whose patents are coming off, and potentially even grow cash flows further.

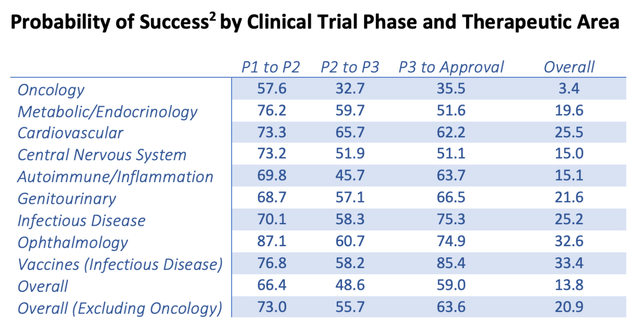

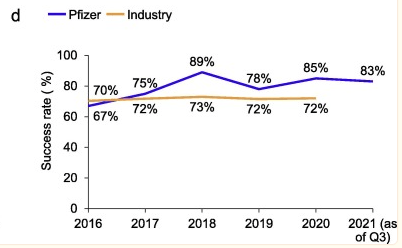

The stats show that a considerable number of drugs in P3 make it all the way to approval, between 60%-70% on average:

acsh

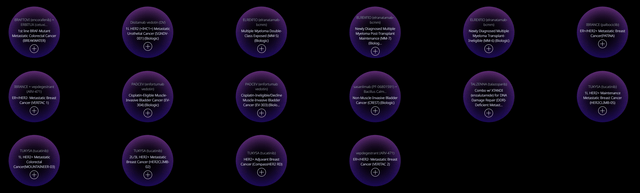

Expectations should be tempered a bit, as 16 of PFE’s 31 P3 projects are in the field of oncology, which has a lower historical rate of approval:

pfizer.com

That said, with reduced competition in the oncology space, if a drug gets through, there’s a higher chance of it being a blockbuster.

Plus, with PFE’s better-than-average P3 success rate, we see serious potential here:

NIH

Overall, we’re excited about the pipeline’s prospects.

There’s also proof that this strategy is working.

Recently, Adcetris, a newly acquired project from SGEN, completed a primary endpoint trial, which sets the stage for monetization and productization:

Pfizer (NYSE:PFE) announced Tuesday that a Phase 3 trial for its antibody-drug conjugate Adcetris developed with Takeda (NYSE:TAK) generated positive results in a new lymphoma condition, potentially supporting a future regulatory filing.

According to the company, its ongoing ECHELON-3 trial showed a statistically significant and clinically meaningful improvement for Adcetris as a combination therapy in terms of overall survival, the trial’s primary endpoint.

The nominal amount of revenue that could be produced from such a product isn’t substantial to PFE, but it’s a step in the right direction, and proof that PFE’s combined pipeline still has some juice in it.

Overall, we believe that Covid and patent cliff declines should be more than made up for by PFE’s solid looking pipeline and growth strategy centering on oncology. Management may have to thread the needle as revenue drivers drop off, but managing these risks is something the company is now adept at, given its long track record of success.

Value

But what is the company worth?

Analysts, for their part, expect that PFE’s EPS will actually grow in coming years as management balances patent run-downs with new products, and the company’s recently announced cost-cutting program improves OM% and net margins significantly:

FAST Graphs

Projections are for EPS to grow into the upper ~$2 region by the end of 2025, which seems reasonable to us.

The key here is how this plays out in terms of PFE’s valuation.

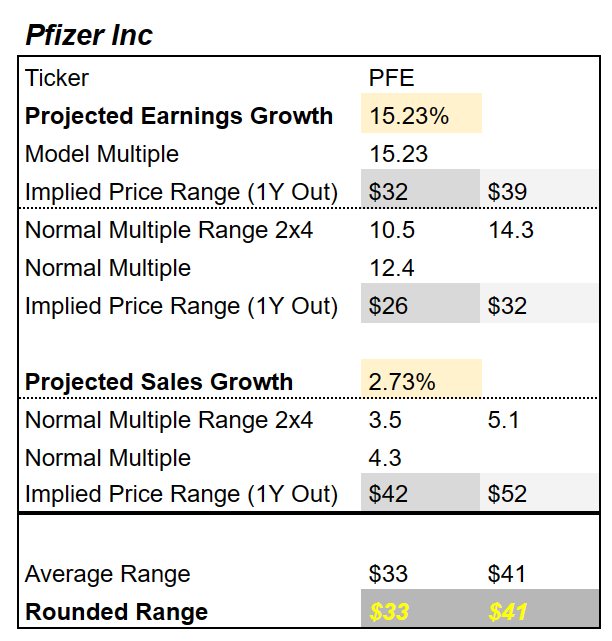

Right now, we currently place PFE’s ‘Fair Value’ range at somewhere between $33 and $41, which is significantly higher than where shares are currently trading:

www.propnotes.co

By averaging out model and historical multiples, we believe that PFE is has about 18% upside to its ‘Fair Value’ zone.

In this model, we use 12.4x EPS and 4.3x sales as a benchmark for ‘historical’ multiple, because that is where the stock has traded as a rough blended average of the last 5 years.

Plus, with an EPS growth rate of 15.23% projected, we’re applying a PEG of 1, suggesting that PE=G, which is a highly accepted model for companies growing at a faster rate than 15%.

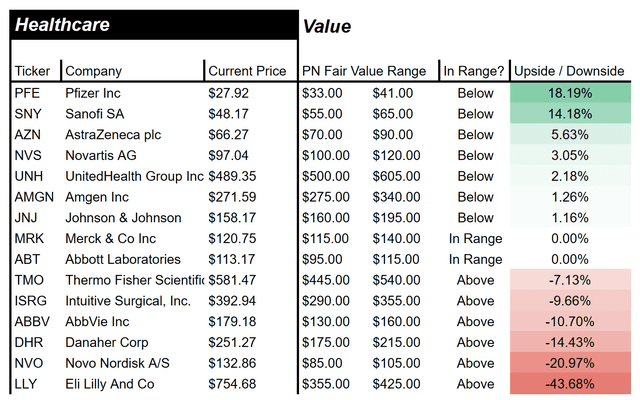

This makes it the most highly discounted healthcare company we currently cover:

www.propnotes.co

All in all, with a strong pipeline and an attractive valuation that includes potential upside to a zone where investors can then participate fully in the company’s growth, PFE looks like an attractive investment candidate at the present juncture.

Plus, with a well covered 6% dividend, you get paid handsomely to wait for the thesis to play out.

Risks

That said, there are some risks.

First off, as is the case with almost all major pharma companies, the pipeline is a key risk. Revenue generators are almost always dying off, and so the strength of the pipeline is crucial.

Right now, with 31 projects in the pipeline, we believe there’s a high chance that management will be able to produce more blockbuster products that better people’s lives and improve health outcomes. However, with an increased focus on oncology, and with only 35% of P3 oncology drugs / treatments making it to approval historically across the industry, there’s increased risk in this dimension.

Additionally, PFE’s stock has terrible momentum:

TradingView

Since its peak during the pandemic, shares have been dropping like a rock, and seemingly nobody wants to buy them.

We think that the value is now compelling, but it might take some time for the market to agree, and so buying in now could be too ‘early’, and investors could suffer at the hands of the momentum factor for some time, even if things get better fundamentally.

It’s a risk worth considering.

Summary

On balance, though, PFE looks like a ‘Strong Buy’.

Shares look historically cheap, the pipeline looks healthy, and while there have been issues with Covid and the patent cliff shaking investor confidence, we ultimately think that the risk is now skewed to the upside.

Good luck out there!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.