Summary:

- Acadia’s DAYBUE drug to treat Rett Syndrome has disappointed recently.

- DAYBUE patients suffer from side effects that make the drug difficult to continue using.

- Several senior insiders have left the company recently, and remaining insiders have continued to exercise options and sell their shares.

- I’m taking a negative view of the company’s stock price going forward until DAYBUE can prove it’s a viable and growing drug.

ZeynepKaya/E+ via Getty Images

Introduction

ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) is a biotech company currently selling two drugs: NUPLAZID, which treats Parkinson’s Disease, and the recently launched DAYBUE, which treats the extremely rare Rett Syndrome. ACAD has at least 5 other drugs currently in the pipeline at various stages of development.

The company just reported Q4 2023 and Full Year 2023 results after the close on February 27, 2024. Although reported revenue and guidance were good, I believe there is reason to be concerned about DAYBUE, and the possibility it might not meet street expectations should be considered.

DAYBUE Users Slowing

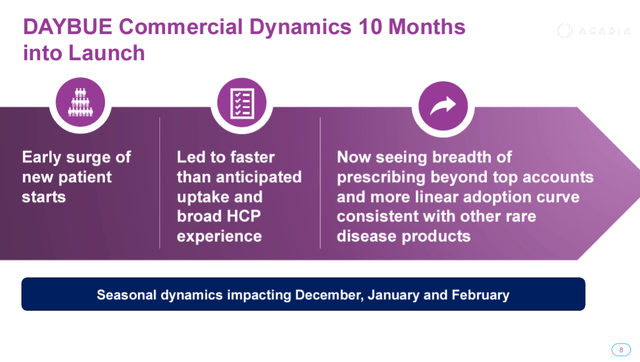

DAYBUE launched in April 2023 with significant anticipation and enthusiasm among potential patients. This resulted in an immediate interest and uptake above expectations. Since then, however, the number of patients using DAYBUE has slowed and even begun to decline in 2024.

Acadia Q4 2023 Investor Presentation Acadia Q4 2023 Investor Presentation

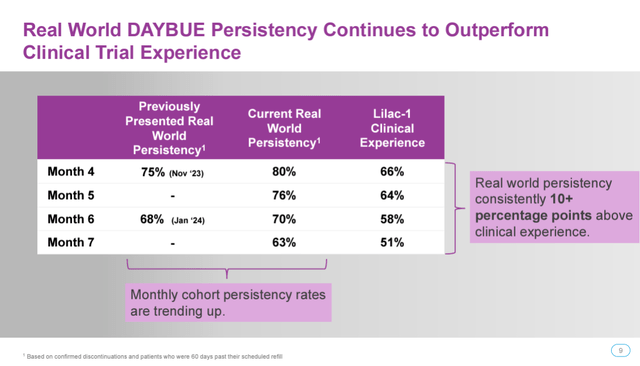

Acadia has blamed seasonal weakness for DAYBUE seeing a slowdown in December through February. The persistency chart showing a decline is expected given the clinical experience. Also, real-world persistency remains well above clinical trial levels in terms of patients remaining on DAYBUE after several months.

However, we don’t have all the data yet. Most DAYBUE prescription refills occur at the 6-month mark. This is when we’d likely start to see patients begin to drop off. Acadia’s persistency chart already begins to show this, with 70% of patients continuing the drug by month 6, dropping 7 percentage points further to 63% by month 7, an acceleration in the rate of decline from months 4 to 5 and 5 to 6. Furthermore, this only includes confirmed cancellations and prescriptions that are 60 days past their scheduled refill. Thus, if patients decide not to refill their prescription and stop using the drug at the 6-month mark, it may take another 2 months before Acadia is aware they’ve stopped using it. Thus, we need data out to 8 or even 9 months to really see how many patients are continuing usage.

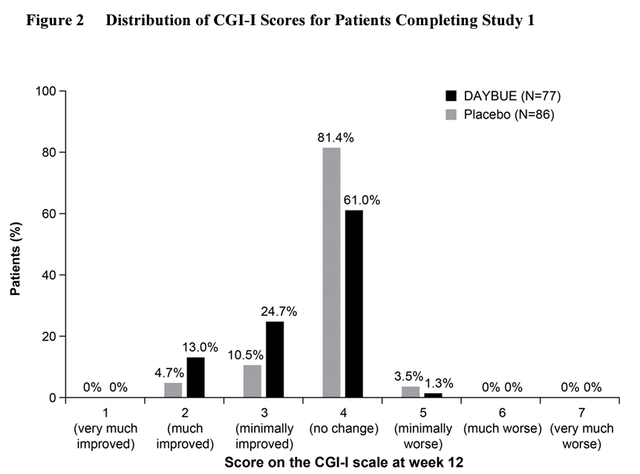

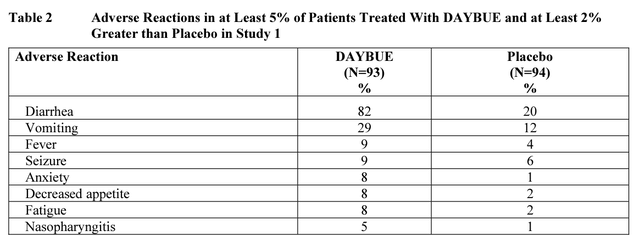

The decline appears to be due to considerable side effects and relatively little effectiveness for most patients. Acadia’s clinical studies suggested that over 60% of patients see no improvement from taking DAYBUE, and the vast majority experience either no improvement or minimally improved symptoms at best. With mild to moderately severe side effects including vomiting, diarrhea, and weight loss affecting as much as 80%+ patients.

DAYBUE CGI-I Scores (Acadia Clinical Studies) DAYBUE Adverse Reactions (Acadia Clinical Studies)

On the earnings call when asked by an analyst, management suggested their target after 12 months would be 50% of patients continuing to use the drug.

And I think for long term, I think if you think more like 50% plus over a 12-month and beyond period, that’s a good early sign. Obviously, I’ll point out we don’t have patients out that far in the commercial setting. So that’s data that we’ll evaluate. But I think that’s a good reasonable ballpark assumption to take at this time.

– Mark Schneyer, CFO

We’ll have to wait to see the 12-month data.

As for seasonality, when analysts asked how many patients are currently on the drug, and how the seasonality impacted this, management was sure to emphasize a rebound in February.

I think as you recall, we had just over 800 patients at the end of the third quarter. When we closed in 2023, we had close to 900 patients on therapy. And just to give a little further context, as we described, we had a seasonal decline in January and as a consequence, fewer patients initiated therapy. And then in February, we saw a significant rebound in new patient starts and together with improvements in conversion and refill rates. And today, we have — taking that all together, we have approximately 860 patients on therapy.

Mark Schneyer, CFO

Although patient adds may have bounced back slightly in February, the fact that it’s still down from 900 at the end of 2023 to 860 just 2 months later suggests uptake of the drug has continued to be weak and that the drug has not yet fully recovered to its 2023 year-end levels.

Insiders Selling And Resigning

Another concern has been insiders leaving the company recently. One can only speculate as to the reasons for their departure.

Doug Williamson, M.D., Head of Research and Development, left in November 2023.

On January 30, 2024, Acadia put out a press release announcing two new additions to the executive team. A more careful reading though reveals that Austin D. Kim, Executive Vice President, General Counsel and Secretary, has decided to leave the company.

Insiders have also been exercising options and selling shares. While this isn’t entirely unusual, it could raise some speculative questions in my opinion.

Acadia Insider Sales (Open Insider)

Cash Burn Will Remain Significant If DAYBUE Disappoints

Acadia finally managed to report a profit in Q4 2023, with EPS coming in at $0.28, just below analyst estimates of $0.29. The only other time Acadia has reported a profit was in Q2 2023 when they did just enough to report $0.01 of EPS. The company has consistently been unprofitable and cash flow negative for much of its life, although that is perhaps not surprising for a biotech in the process of developing several drugs.

Operating cash flow for the 2023 year came in at a just barely positive $16.7M. The company had burned nearly $70M in the first 9 months of 2023, so Q4 actually generated over $86M of positive operating cash flow. DAYBUE is critical to Acadia’s cash flow going forward. If DAYBUE disappoints, then we could see Acadia return to a negative operating cash flow position. This is perhaps mitigated by the substantial cushion of $439M of cash and investment securities on the balance sheet.

Risks To The Short Thesis

The biggest risk to the short side is twofold. One, Acadia’s pipeline of new drugs having great success, and two, DAYBUE outperforming expectations and successfully expanding globally.

Given Acadia currently only sells 2 drugs, a highly successful third drug could make a meaningful impact on the company. If they can succeed with multiple drugs in the pipeline, then they could see very rapid growth.

If management is correct that the slowdown in DAYBUE is merely seasonal, then the numbers should rebound over the next few quarters. Management has clearly stated that they want to see 50% of patients remain on the drug at the 1-year mark. We’ll have to wait a couple more quarters to see. Furthermore, successful launches in Canada and Europe for DAYBUE could provide further short-term growth for the drug.

Conclusion

Investors may want to be cautious with Acadia going forward. There are still some questions about the company and their DAYBUE drug that treats Rett Syndrome. In time, the company will either prove this is a successful drug, or more recent trends continue, and we see limited uptake of DAYBUE going forward.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of ACAD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am short shares and have options positions with an overall negative delta that will profit in the event of a decline in the stock price.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.