Summary:

- Abercrombie & Fitch’s stock has rallied over 600% despite declining sales, elevated costs, and declining demand for the Hollister brand, since our first article in September 2022.

- Sales have been relatively stagnant over the past five years, and recent upticks are likely due to seasonality rather than sustained growth.

- The company’s valuation is significantly higher than its peers, and its profitability has not shown significant improvement.

- For these reasons, we believe that the current share price is not justified.

Tim Boyle

Abercrombie & Fitch Co. (NYSE:ANF), through its subsidiaries, operates as a specialty retailer. The company operates in two segments, Hollister and Abercrombie.

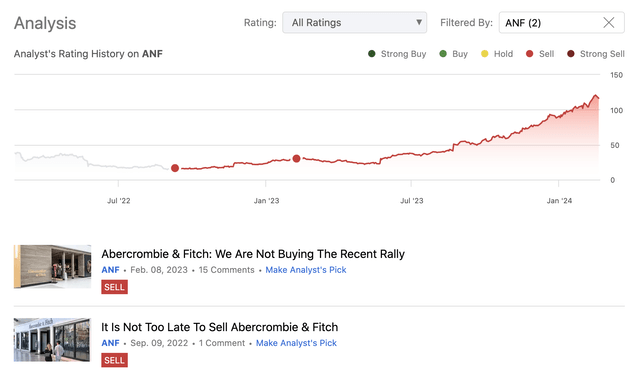

We have started covering the firm in September 2022, and we have published two bearish articles in total. In both of these writings we have argued that declining sales, elevated freight and raw material costs, increasing inventory, declining demand for the Hollister brand and capital allocation decisions are all negatively impacting the financial performance.

Despite these headwinds, ANF’s stock rallied more than 600% since our first article.

Today, we are revisiting ANF and discussing, whether this stellar stock price performance is justifiable and sustainable. We are going to be looking at the dynamics of the sales, inventories, profit margins and valuation over the past year to support our discussion.

Sales

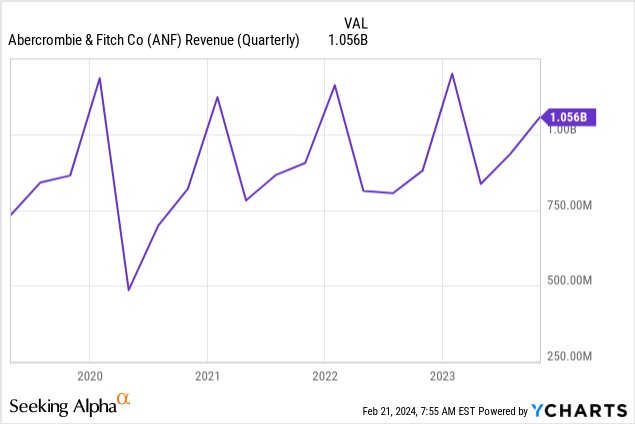

To start our analysis, we will first look at the top line of the income statement, the revenue. The following chart depicts, how the revenue has been changing over the past 5 years.

While there has been an uptick in the past quarter, we believe that this is nothing more than seasonality playing a role. If we look at the past five years, ANF’s revenue has been fluctuating in a relatively stable range of $0.75 billion to $1.2 billion. In this time frame, there has been only one occasion when the revenue went out of this range, and that was in early 2020, as a result of the pandemic.

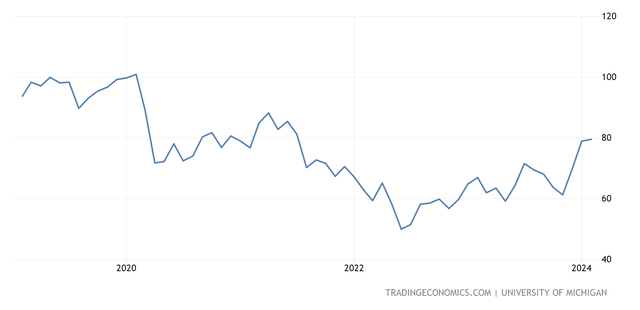

Although consumer confidence in the United States has started improving in the recent months and ANF has announced an official partnership with McLaren Racing, we do not believe that any of these will have a material positive impact on the sales volumes, which would result in the revenue breaking out of the above mentioned range.

U.S. Consumer confidence (tradingeconomics.com)

From this perspective, we believe that the recent rally in the share price is not justified from a sales point of view.

Inventory

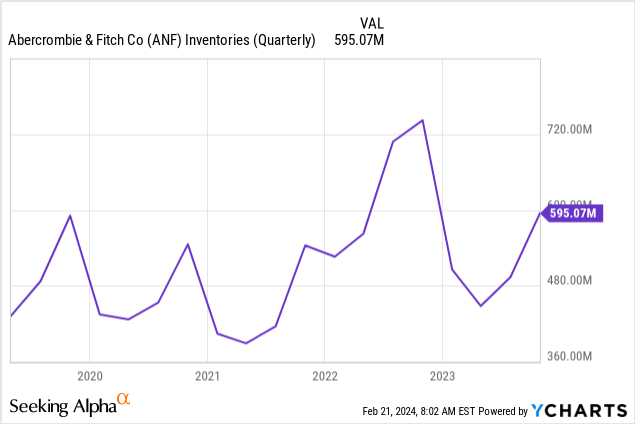

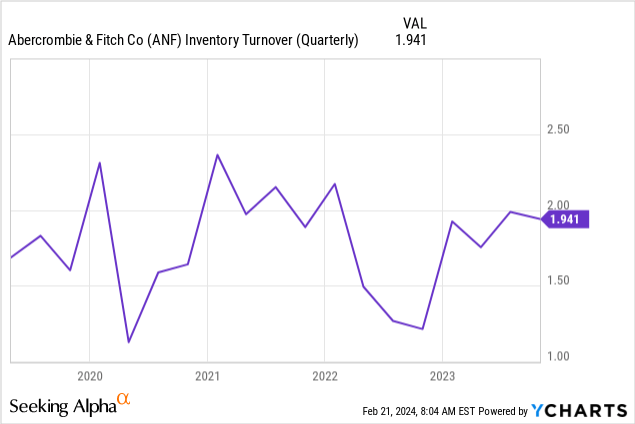

While the company has managed to significantly reduce its inventory levels by the beginning of 2023, its level is trending upwards once again. In our opinion, this upward trend is not justified by the current level of sales/sales growth.

As a result, the improvement of the inventory turnover has come to an end after the rapid increase in the beginning of 2023.

Looking forward, we would like to see the company improve its inventory turnover at least to the level, where it was in 2021.

Profitability

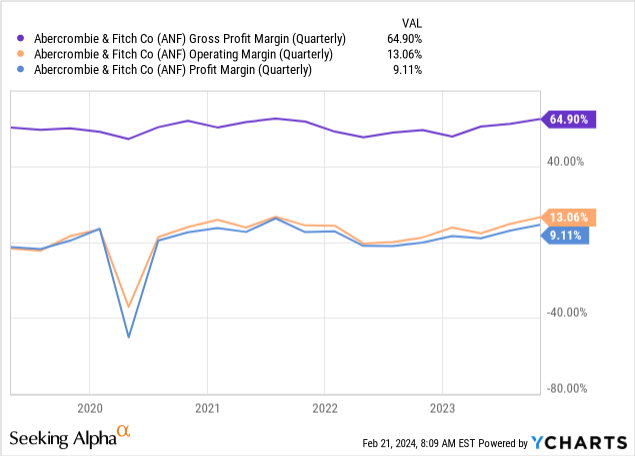

To assess the profitability of the company and its change over the past year, we are going to be looking at the gross profit margin, the operating margin and the net profit margin. The following chart shows these three metrics.

While the downward trend observed in 2022 has come to a stop, the profitability of the firm has shown minor signs of significant improvements compared to the 2021 figures. Neither of the metrics are showing that the improving macroeconomic environment, including moderating inflation or stabilizing commodity prices, has had a positive impact on ANF’s financial performance.

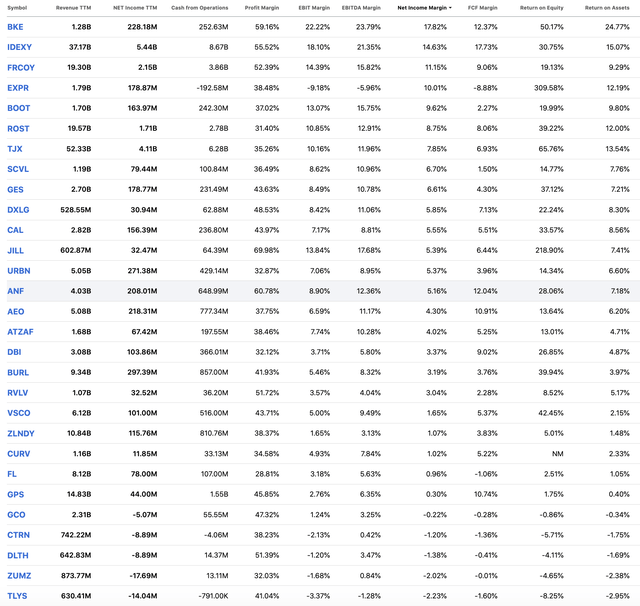

When comparing these figures to those of other players in the apparel retail industry, they do not appear to be outstanding in any way that could justify a 600% share price increase over the course of the past roughly 2 years.

Comparison of profitability (Seeking Alpha)

Valuation

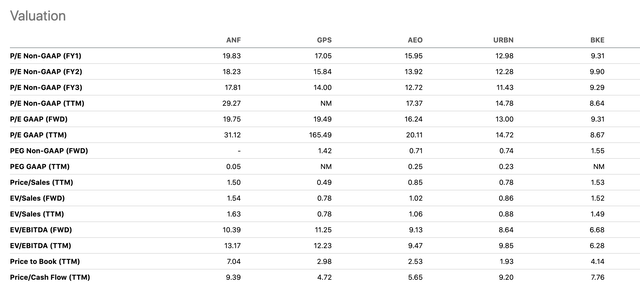

To determine the fair value of the company, we are going to be looking at a set of traditional price multiples.

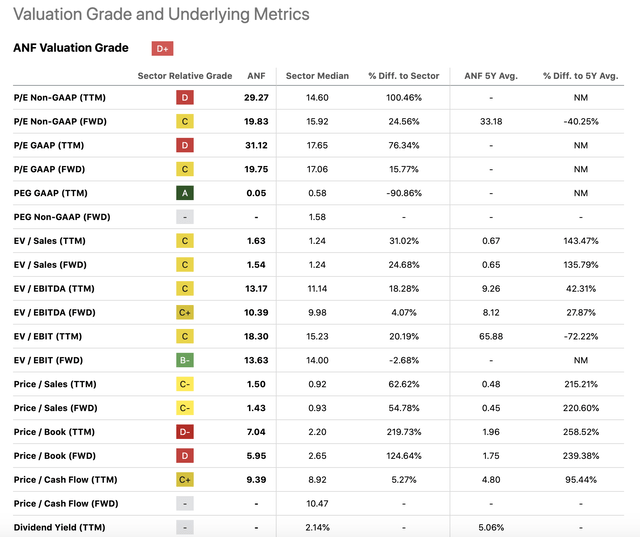

According to the majority of these metrics, ANF is selling at a substantial premium compared to the rest of the consumer discretionary sector.

P/E non-GAAP (FWD) and forward EV to sales indicate a roughly 25% premium, at the same time, forward price to sales indicates a more than 50% premium, while forward price to book value shows a more than 120% premium.

When we narrow the peer group to some of ANF’s closest peers, we can also see that ANF’s stock still appears to be trading at a premium compared to theirs even though ANF’s business does not appear to be significantly better fundamentally.

Also interesting to see that insiders have been selling the stock towards the end of last year. While it is not a guarantee that they believe the stock is overvalued, it can well be a warning sign. The firm has also stopped repurchasing its stock in 2023 (although its free cash flow has improved compared to 2022), which may also be an indication that the shares are currently overvalued.

For these reasons, we do not currently find ANF’s business attractive from a valuation point of view.

What do we like about the business?

Before concluding the article, we would like to highlight a few things that we like about ANF, in order to give a balanced view of the firm.

1.) Boosted sales outlook

The company has just recently boosted its sales outlook for the full year of fiscal 2023. Management has cited the positive response to the company’s marketing efforts and product lines.

Consistent with the first three quarters of 2023, our customers responded positively to compelling product assortments and engaging marketing, leading us to increase our fourth quarter and full year net sales and operating margin outlook. We expect to deliver fourth quarter net sales growth across regions, led by continued strength in the Americas.

2.) Return to shareholders

First of all, it is a positive sign that ANF has stopped paying dividends, when they were no longer sustainable based on their free cash flows. It is always good to see that management is able to take such steps in order to improve the financial flexibility of the firm during times of market stress.

Second, while they have stopped the dividends, they have kept on repurchasing their own shares throughout 2021 and 2022. This way, they still returned value to their shareholders in a more flexible, and likely a more tax-efficient way.

Looking forward, we believe that both dividends and share repurchase programs may be restarted in the near future, due to the substantial improvement of the company’s free cash flow in the recent quarters and its boosted sales outlook.

Conclusions

Over the past year, ANF’s share price has increased by more than 300%, significantly outperforming the broader market and its peers. We believe, however, that the fundamentals of the firm have not improved so much that they could justify this stellar rally.

Sales and profitability have remained relatively stagnant, while the valuation has gone well above the sector medians. Although the firm has boosted its sales outlook and its free cash flow has also improved meaningfully in the past quarters, we do not expect this extraordinary share price performance to continue. We believe that at this price point, there is more downside risk than upside potential.

For these reasons, we maintain our “sell” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.