Summary:

- Home Depot has rallied over optimistically by +22% compared to the wider market at +13% over the past few months, pulling forward most, if not, all of its upside potential.

- This is despite the yet-to-be successful Complex Pro monetization, with the transition still in the early days and the macroeconomic outlook still uncertain.

- Readers must also note HD’s less-than-impressive dividend hike, as its balance sheet further deteriorates with growing net debts and impacted bottom line.

- We maintain our stance that the stock’s inflated prices offer interested income investors with relatively underwhelming dividend yields.

koyu/iStock via Getty Images

We previously covered The Home Depot, Inc. (NYSE:HD) in October 2023, discussing the sustained decline in its comparable sales in FQ2’23, with H2’23 likely to bring forth further headwinds as the macroeconomic outlook remained pessimistic.

With the stock still trading at a premium compared to Lowe’s Companies, Inc. (LOW) and the sector median, we believed that there was a minimal margin of safety then, resulting in our reiterated Hold rating.

In this article, we shall discuss why we are maintaining a Hold rating, with the HD stock rallying over optimistically by +22% compared to the wider market at +13% over the past few months, pulling forward all of its upside potential.

While we applaud the management’s attempt to diversify its sales through improved Pro penetration, these are still early days, with the stock’s inflated prices offering interested income investors relatively underwhelming dividend yields.

The HD Investment Thesis Remains Overly Optimistic Here

For now, HD has reported a double beat FQ4’23 earnings call, with revenues of $34.78B (-7.7% QoQ/ -2.9% YoY) and GAAP EPS of $2.82 (-25.9% QoQ/ -14.5% YoY), with FY2023 bringing forth revenues of $152.66B (-3% YoY) and GAAP EPS of $15.11 (-9.4% YoY).

While its top/ bottom lines have been impacted on a QoQ/ YoY basis, it is apparent that there is no escaping the demand destruction, with the housing borrowing costs still elevated at 6.77% by February 15, 2024 (+0.17 points MoM/ +0.45 YoY/ +2.97 from 2019 averages of 3.8%) and the market still experiencing “record low market supply.“

The same has been observed in HD’s reduced customer transactions at 372M (-27.8M QoQ/ -6.5M YoY), declining average ticket of $88.87 (-0.5% QoQ/ -1.3% YoY), and impacted sales of $550.50 per retail square foot (-7.5% QoQ/ -3.6% YoY) in FQ4’23.

However, we believe that readers must note that these numbers are still improved compared to FQ4’19 levels of 369.6M (-25.2M YoY), $68.29 (+4.1% YoY), and $425.70 (+2.8% YoY), respectively, implying a sustained growth in its performance metrics over the past few years.

At the same time, HD has offered a relatively decent FY2024 guidance, with revenue growth of +1% YoY and adj EPS growth of +1% YoY, despite the projected decline in its comparable sales by -1% YoY. With the housing market recovery still uncertain, we believe that the management’s guidance has been better than expected.

At the same time, readers must also note that despite the demand headwinds and bloated inventories of $20.97B (-15.7% YoY/ +44.3% from FY2019 levels of $14.53B), HD has yet to embark on drastic price markdowns.

This is observed in its relatively stable FY2023 gross margins of 33.4% (-0.1 points YoY, compared to FY2019 levels of 34.1% (-0.2 points YoY).

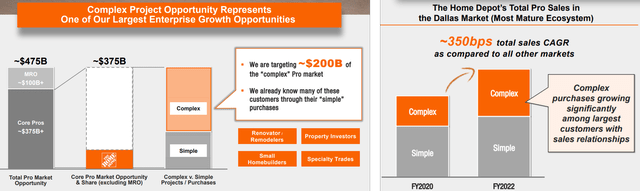

Much of HD’s DIY headwinds are also well-balanced by the management’s strategic push into the Complex Pro segment, with it comprising 50% of the projected $950B in TAM.

While the company does not specifically break down their sales by DIY/ Pro segments, with the last commentary in the Goldman Sachs 30th Annual Global Retailing Conference indicating a 50%/ 50% split, it is apparent that there are massive untapped opportunities in the Pro segment.

HD’s Pro Opportunities

For example, with a $475B in Pro TAM, it appears that HD’s penetration remains low at approximately 16%, based on an estimated 50% in weightage/ $76.33B in sales on its FY2023 net sales of $152.66B.

With the management already embarking on various partnerships/ infrastructure upgrades/ acquisitions to improve its B2B offerings, while guiding 12 new Pro-oriented stores and improved Pro experience in its existing stores in FY2024, we may see the home improvement company eventually grow its Pro sales to $200B indeed.

This success has already been observed in HD’s Dallas market, with the Complex Pro sales growth accelerating by +350 bps compared to other markets, with Pro sales also boasting up to 11x in average spend upon improved engagements.

The Consensus Forward Estimates

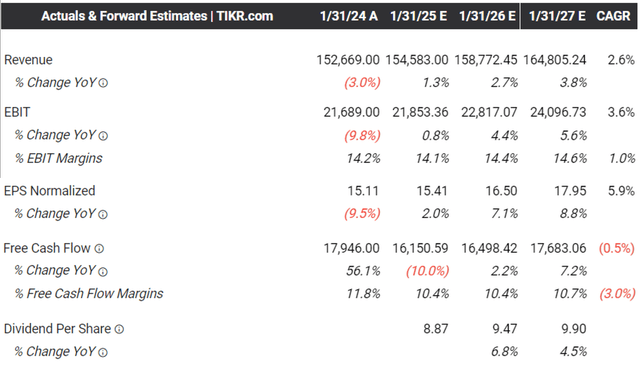

At the same time, the consensus forward estimates remain somewhat decent, with HD expected to generate a stable top/ bottom line at a CAGR of +2.6% and +5.9% through FY2026.

While moderate compared to the previous estimates of +4.3%/ +11.8% and historical growth at +7.1%/ +12.9% between FY2016 and FY2023, respectively, we are not overly concerned indeed.

These numbers remain a win for HD, especially since they have been able to maintain their hyper-pandemic sales/ profit margins thus far, with the consensus also estimating a similar trend ahead as the company monetizes the Pro market.

HD Valuations

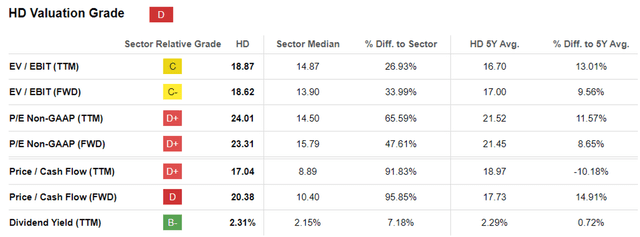

Perhaps the above reasons are why HD has been temporarily awarded the premium growth valuations, with FWD P/E valuations of 23.31x and FWD Price/ Cash Flow valuations of 20.38x.

This is compared to its 1Y mean of 20.36x/ 17.30x, 3Y pre-pandemic mean of 20.17x/ 17.30x, and sector median of 15.79x/ 10.40x, respectively.

Readers must also note that HD trades at a relatively higher valuation than its direct peer, LOW at 17.32x/ 10.10x, despite the latter being expected to generate a slightly improved top/ bottom line growth at +2.2%/ +7.2%, respectively.

Perhaps part of the optimism is attributed to HD’s sustained share repurchases, with 24M already retired over the LTM, and 103M since FY2019, further demonstrating its shareholder-friendly policies.

This is on top of HD’s strategically raised annualized dividends by +7.7% from $8.36 to $9.00, compared to LOW’s last hike by +4.7%.

Then again, readers must also note that the dividend per share increase is notably lower than the CAGR of +25.38% reported between FY2016/ FY2019, +11.34% between FY2019/ FY2023, and the last increase of +10% in FY2023.

At the same time, HD’s balance sheet has been deteriorating with a growing net debt of $38.98B (+9.8% QoQ/ +7.8% YoY/ +53.1% from FY2019 levels of $25.45B) by the latest quarter.

It is unsurprising that this also results in an elevated annualized interest expense of $2.05B (+5.3% QoQ/ +13.7% YoY/ +70.8% from FY2019 levels of $1.2B) and impacted net income margins of 8.1% (-2 points QoQ/ -1.3 YoY/ -2.1 from FY2019 levels of 10.2%).

While HD’s Free Cash Flow generation remains robust with things likely to remain stable ahead, readers must note that its Interest Coverage Ratio and Dividend Coverage Ratio have moderately deteriorated to 11.16x/ 1.72x as well. This is compared to its 5Y average of 14.81x/ 1.97x and sector median of 7.30x/ 3.03x, respectively.

As a result, while its dividends remain safe with forward yields of 2.48%, we are uncertain if it is wise to chase its income investment thesis here, with the US Treasury Yields still offering improved returns of between 4.28% and 5.38%.

So, Is HD Stock A Buy, Sell, or Hold?

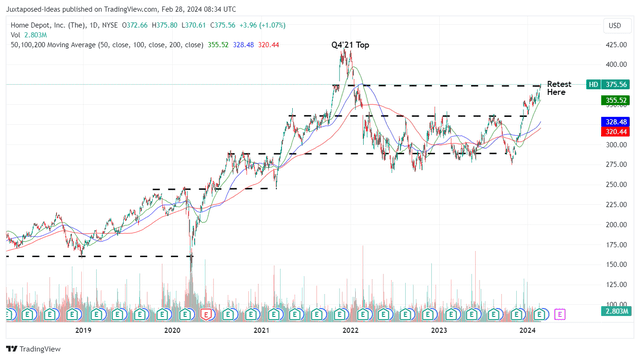

HD 5Y Stock Price

For now, HD has rallied optimistically since the October 2023 bottom, while appearing to retest its previous resistance levels of $370s.

The exuberance embedded in the stock valuations and prices are surprising indeed, if we are to take into account the mixed FQ4’23 earnings call, declining performance metrics, and underwhelming forward guidance.

Based on HD’s normalized 1Y P/E of 20.36x and its FY2023 adj EPS of $15.11, it is also apparent that the stock is trading above our fair value estimate of $307.60, with a notable +20.9% premium.

Even based on the consensus FY2026 adj EPS estimates of $17.95, there is a minimal margin of safety to our long-term price target of $365.40, with the stock already pulling forward all of its upside potential.

As a result of the potential underperformance over the next two years, we prefer to maintain our Hold (Neutral) rating on the HD stock here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.